Professional Hair Care Market Size, Share, Growth & Industry Analysis, By Product Type (Hair Coloring, Shampoos, Conditioners, Styling Products, Hair Treatments) By Application (Salons, Spas, Personal/Home Use) By End-User (Men, Women, Unisex), and Regional Analysis, 2024-2031

Professional Hair Care Market: Global Share and Growth Trajectory

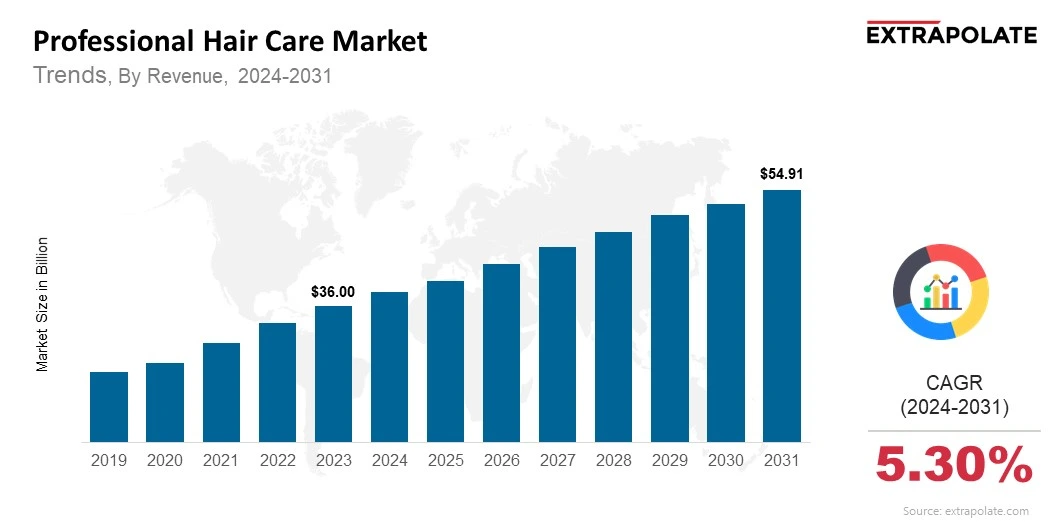

The global Professional Hair Care Market size was valued at USD 36.00 billion in 2023 and is projected to grow from USD 38.24 billion in 2024 to USD 54.91 billion by 2031, exhibiting a CAGR of 5.30% during the forecast period.

The global professional hair care market is growing quickly. This growth comes from rising consumer awareness about grooming, digital media effects, and the expanding salon industry. Professional products, once only in high-end salons, are now easy to find online and in specialty stores. This change allows for wider market access across different regions.

As cities grow and incomes rise, people are more willing to spend on premium hair care. They want products that deliver visible results and last over time. There’s a rising demand for salon-quality items, from hair coloring to scalp treatments. Consumers now prefer personalized regimens that fit their hair type and lifestyle. This trend encourages brands to create tailored products with advanced ingredients and clean beauty standards.

Asia-Pacific is a major player in this market and is expected to grow the fastest. This growth is driven by changing beauty standards, a young population, and rapid salon growth in India, China, and South Korea. North America and Europe also have strong positions. Their mature salon systems, high brand recognition, and steady demand for premium services keep them competitive.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several key trends are shaping consumer preferences and boosting demand for professional hair care solutions:

Clean and Sustainable Beauty Movement

More consumers want products free from sulfates, parabens, and synthetic fragrances. Clean beauty has become a core value that drives product reformulation and branding. Brands now prioritize transparency, sustainable sourcing, and eco-friendly packaging. This shift has pushed manufacturers to innovate with natural and organic hair care solutions while maintaining performance.

Surge in Demand for Hair Color Services

The hair color category is one of the most profitable segments in professional hair care. Fashion trends, social media, and a wish for self-expression drive both men and women to salons for vibrant, customized hair color. DIY kits have boosted retail demand, but professional salons still lead with precise application, lasting effects, and safety.

Men’s Grooming is Rising

Men’s grooming, once seen as secondary, is now a key market growth driver. Professional hair care products for men—like scalp treatments and styling gels—are gaining popularity. Barbershops and salons are expanding services to meet the growing demand for premium grooming experiences.

Influence of Social Media and Beauty Influencers

Platforms like Instagram, TikTok, and YouTube have changed how consumers find and engage with hair care products. Beauty influencers and hairstylists with large followings show product results in real time, boosting brand visibility and driving sales. Social media trends encourage consumers to try new hairstyles, textures, and colors, increasing product demand.

Major Players and Their Competitive Positioning

The professional hair care market is highly competitive. Major players focus on innovation, brand positioning, and expanding distribution. Several multinational giants and regional specialists lead the industry. L'Oréal Professional, Wella Professionals, Kao Corporation, Henkel AG & Co. KGaA (Schwarzkopf Professional), Coty Inc., Aveda Corporation (Estée Lauder), Matrix (L'Oréal), Kevin Murphy, Revlon Professional, Davines Group.

These companies are investing heavily in product development, salon partnerships, and influencer marketing. They use strategic acquisitions, R&D investments, and sustainability initiatives to stand out and keep their competitive edge in a crowded market.

Consumer Behavior Analysis

Understanding consumer behavior is crucial for predicting growth in the professional hair care market.

Premiumization and Personalization

Today’s consumers want products tailored to their hair types and concerns. They are willing to pay more for professional-grade shampoos, conditioners, and treatments that deliver salon-like results at home. Brands providing customized solutions based on scalp condition, hair texture, and color history are gaining popularity.

Trust in Professional Recommendations

Salons are key for product education and recommendations. Consumers trust hairstylists’ suggestions, often buying directly from salon shelves or linked online stores. This relationship strengthens salons' roles in influencing purchases.

Conscious Consumerism

Ethical issues like cruelty-free testing, vegan formulas, and eco-friendly packaging shape buyer preferences. Brands that align with these values resonate with Gen Z and millennials, leading to brand loyalty and advocacy.

Shift Toward At-Home Treatments

While salons thrive, demand for at-home care kits and treatments is rising. From keratin treatments to deep-conditioning masks, consumers seek convenience and professional results without salon visits. Salons selling home-use products effectively meet this need.

Pricing Trends

Professional hair care products are priced higher than mass-market options. Pricing varies based on product type, brand, ingredient quality, and packaging. For example:

- Premium hair color kits are pricier due to exclusive formulas and lasting results.

- Salon-only products may include additional costs for stylist application or training.

- Clean and organic lines often cost more because of sourcing and sustainability certifications.

Consumers view these products as investments in appearance and wellness, leading to high brand loyalty. Subscription models, bundled kits, and discounts help make premium products accessible while maintaining value.

Growth Factors

Several strong factors are driving the global growth of the professional hair care market.

Urbanization and Lifestyle Changes

Urban populations are leading fast-paced, appearance-focused lives. This results in more salon visits, grooming routines, and demand for effective hair products. Better access to salons and online platforms reaches second-tier cities and rural areas.

Growth of the Salon Industry

The global salon industry is growing, with franchises and independent salons partnering with professional brands. In emerging markets, economic growth and beauty awareness boost salon chain expansions, increasing demand for professional hair care.

Technological Advancements in Formulation

Brands are using biotechnology and dermatological science to create advanced formulas. Innovations like micro-encapsulation and heat-activated protection enhance product effectiveness and credibility, attracting professionals and consumers seeking real results.

Increased Hair Concerns Due to Pollution and Stress

Pollution, climate change, and stress harm hair health. Consumers are turning to scientifically backed solutions from professional brands. Demand for scalp treatments, hair serums, and repair systems is rising.

Regulatory Landscape

The professional hair care market follows regulations to ensure safety and consumer protection:

- In the U.S., the FDA oversees hair care products under the Federal Food, Drug, and Cosmetic Act, monitoring claims like “treats hair loss.”

- In the EU, hair care products must comply with the Cosmetic Products Regulation (EC) No 1223/2009.

- In regions like Asia-Pacific, compliance with local health and trade authorities is necessary, including licensing and labeling regulations.

- Sustainability and cruelty-free certifications are becoming informal standards, shaping brand development and consumer choices.

Recent Developments

Several recent changes are reshaping the professional hair care landscape:

- L’Oréal launched Water Saver technology, a sustainable hair-washing system that cuts water use by 80%, showing a commitment to eco-friendly salon innovation.

- Henkel partnered with Plastic Bank, reinforcing its sustainability efforts through recyclable packaging for Schwarzkopf Professional products.

- Digital salons and AI hair diagnostics now offer personalized product and service suggestions.

- Aveda expanded its Botanical Repair™ line, focusing on plant-based ingredients that repair damage for all hair types.

- The rise of K-beauty and J-beauty hair products brings Asian botanical ingredients and traditional practices into mainstream professional hair care.

These changes show a market evolving with consumer values while using science and sustainability for innovation.

Current and Potential Growth Implications

Demand-Supply Analysis

Demand for professional hair care exceeds supply in some areas, especially in emerging markets with developing salon infrastructure. Brands are increasing production and improving distribution to satisfy global demand for salon-quality products.

Gap Analysis

Despite strong growth, challenges remain in product accessibility, particularly in low-income and rural regions. Limited awareness among some demographics also restricts adoption. Market players are addressing these gaps with smaller product versions, mobile salons, and regional influencer partnerships.

Top Companies in the Professional Hair Care Market

- L'Oréal Professional

- Wella Professionals

- Schwarzkopf Professional (Henkel)

- Aveda (Estée Lauder)

- Matrix (L’Oréal)

- Revlon Professional

- Kevin Murphy

- Davines

- Paul Mitchell

- R+Co

These companies offer comprehensive portfolios including coloring agents, treatments, conditioners, and styling products tailored to various hair types and consumer demographics.

Professional Hair Care Market: Report Snapshot

Segmentation | Details |

By Product Type | Hair Coloring, Shampoos, Conditioners, Styling Products, Hair Treatments |

By Application | Salons, Spas, Personal/Home Use |

By End-User | Men, Women, Unisex |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Professional Hair Care Market: High-Growth Segments Hair Coloring

Hair color remains a top segment due to frequent product updates and strong consumer interest. Innovations like ammonia-free, permanent, and semi-permanent colors will keep this segment in the lead.

Hair Treatments

This category includes serums, scalp rejuvenators, and repair products. Due to increased environmental and styling damage, it is one of the fastest-growing segments, especially in cities.

Major Innovations

Key innovation drivers include:

- Botanical and Ayurvedic Formulations: Merging traditional methods with modern science for overall hair health.

- Scalp Health Products: Focusing on hair health's roots with exfoliants, oils, and probiotic treatments.

- Smart Hair Devices: Tools like hair analyzers and custom applicators are changing professional hair care.

Professional Hair Care Market: Potential Growth Opportunities Expansion into Emerging Markets

Countries in Asia-Pacific, Latin America, and Africa have growing middle classes and changing beauty standards. Brands that adjust to local tastes will thrive in these fast-growing markets.

Integration with Digital and Subscription Models

E-commerce and subscription services are reshaping how consumers buy professional products. Features like online consultations, virtual hairstyling previews, and automatic reordering are creating new revenue streams.

Kings Research says:

The professional hair care market is set for significant growth in the coming years. As beauty standards shift and consumer awareness increases, the demand for high-quality, salon-grade products will rise. The mix of scientific advancements, natural ingredients, and personalized experiences will boost market expansion.

From hair coloring and treatments to sustainable innovations, the market is undergoing a major transformation. Companies that prioritize quality, ethics, and accessibility will lead the way. With digital tools improving customer interaction and salon growth worldwide, the future of professional hair care looks bright and robust.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Professional Hair Care Market Size

- June-2025

- 148

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021