mHealth Market Size, Share, Growth & Industry Analysis, By Product Type (mHealth Apps, Wearable Devices, Telemedicine Platforms, Remote Monitoring Devices, Others), By Application (Chronic Disease Management, General Wellness, Diagnostic Services, Remote Consultations, Others), By End-User (Patients, Healthcare Providers, Payers, Employers), and Regional Analysis, 2024-2031

mHealth Market: Global Share and Growth Trajectory

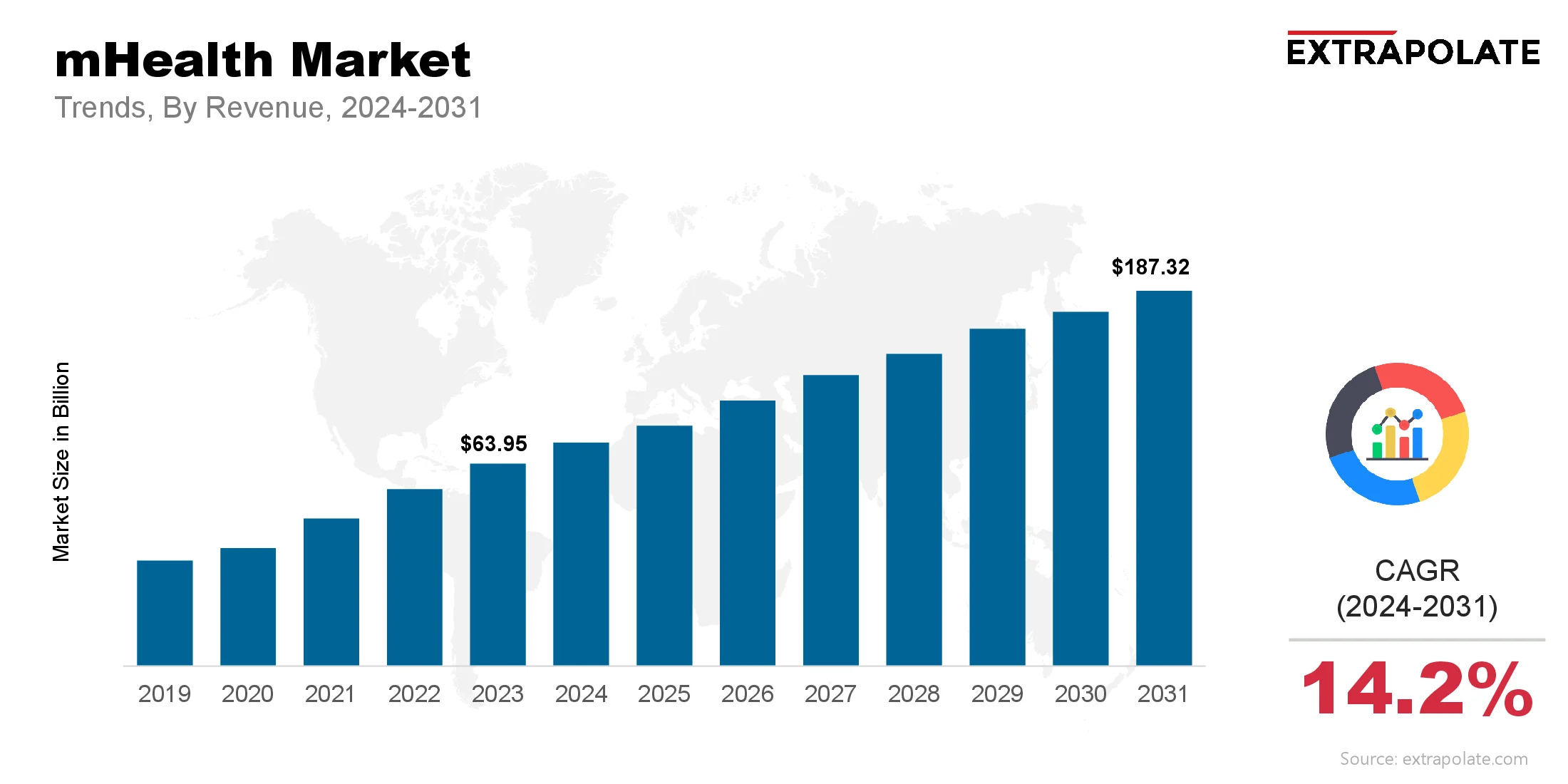

The global mHealth Market size was valued at USD 63.95 billion in 2023 and is projected to grow from USD 73.68 billion in 2024 to USD 187.32 billion by 2031, exhibiting a CAGR of 14.2 % during the forecast period.

The global market is on fire, driven by the rapid adoption of mobile technology across the healthcare systems worldwide. Healthcare providers, patients and payers are embracing mobile health solutions to improve access, efficiency and patient engagement. From remote consultations to chronic disease management and personal health tracking, mHealth is changing how care is delivered and consumed.

This is driven by the proliferation of smartphones, rising internet penetration and the need for patient centric healthcare models. As healthcare systems are grappling with aging populations, rising chronic disease rates and limited resources, mHealth provides scalable and cost effective solutions that bridge the gaps in access and quality of care. With continuous technological innovations – including artificial intelligence (AI), wearable sensors and secure data analytics – mHealth is poised to redefine the healthcare landscape and deliver long term growth.

One of the biggest impact of mHealth is to expand healthcare access to underserved populations. Mobile apps and telemedicine platforms allow patients in remote and rural areas to consult with healthcare professionals without traveling long distances.

Chronic disease management programs delivered via mobile apps improve patient adherence and outcomes by offering personalized reminders, educational content and remote monitoring. The growing integration of mHealth into national health systems and insurance models is further solidifying its role as the cornerstone of modern healthcare delivery.

Key Market Trends Driving Product Adoption

Several key trends are driving mHealth product adoption:

Smartphones and Mobile Devices:

The rise of smartphones drives mHealth growth. Billions of people around the world own mobile devices. These devices can run advanced health apps. This broad access lets health providers offer scalable solutions. They can assist with scheduling appointments. They also provide personalized health advice, all directly to patients.

Shift Toward Patient Centric Care:

Modern healthcare is all about empowering patients to manage their health. mHealth apps allow users to monitor chronic conditions like diabetes and hypertension. They support medication adherence and promote lifestyle changes through personalized coaching. By focusing on patients, these tools boost engagement and enhance health outcomes.

Integration with Wearable Devices:

mHealth is growing alongside wearable technology. Smartwatches and fitness trackers collect health data in real time. They track heart rate, sleep patterns, and physical activity. When used with mHealth apps, they allow for ongoing monitoring. This helps spot health problems early and manage chronic diseases better.

Telemedicine:

The COVID-19 pandemic sped up global telemedicine adoption. mHealth platforms now offer video consultations, remote diagnostics, and e-prescriptions. This trend will likely keep going. Patients and providers value the ease and savings of virtual care.

Data and AI:

AI mHealth apps look at a lot of health data. They provide personalized recommendations. Predictive analytics can spot patients at risk for complications, allowing for timely interventions. This shift is transforming disease prevention and population health management.

Major Players and their Competitive Positioning

The mHealth industry is highly competitive, with companies investing heavily in product innovation, partnerships, and acquisitions to strengthen their market positions. Key players include are Apple Inc., Google LLC, Samsung Electronics Co. Ltd., Philips Healthcare, Medtronic PLC, Teladoc Health Inc., Cerner Corporation (now part of Oracle), Allscripts Healthcare Solutions, Fitbit Inc. (owned by Google), AliveCor Inc. and others.

These companies are at the forefront of developing cutting-edge mHealth solutions—from integrated telemedicine platforms and remote monitoring systems to advanced health analytics tools. Strategic collaborations with healthcare providers, payers, and governments help these companies expand their reach and tailor offerings to diverse healthcare systems worldwide. Mergers and acquisitions further consolidate their positions, enabling broader solution portfolios and seamless interoperability with existing health IT systems.

In June 2025, Biobeat launched its Cuffless Vital‑Sign Patch, a sticker-like chest or wrist wearable that non-invasively monitors blood pressure, heart rate, SpO₂, respiratory rate, and more. Engineered for continuous, AI-powered hospital-grade remote monitoring, it received FDA clearance and CE marking, underscoring its medical accuracy.

Consumer Behavior Analysis

Consumer behavior in the mHealth market is driven by:

- Convenience and Accessibility: Patients love managing their health with mobile apps. They can schedule appointments, refill prescriptions, or consult doctors remotely. mHealth solutions make this easy.

- Growing Health Awareness: More people are health conscious and using mHealth tools. These apps help track physical activity, nutrition, sleep, and vital signs. They empower users to make informed lifestyle choices.

- Cost: mHealth solutions lower healthcare costs. They cut down on in-person visits, prevent complications, and improve chronic disease management. Insurers and health systems are covering these tools, making them more accessible.

- Trust and Privacy: Demand is high, but consumers worry about sharing health data. Companies are prioritizing strong data protection. They provide clear privacy policies and comply with regulations like HIPAA and GDPR.

- Familiarity with Technology: More patients, even older adults, are using mHealth solutions. This rise is due to increased mobile device use and better digital skills. User-friendly designs, multilingual options, and accessibility features are expanding the market.

Pricing Trends

mHealth solutions pricing varies widely depending on the service, technology and target market:

- Freemium: Many consumer facing health apps use freemium models offering basic features for free and charging for premium content, advanced analytics or personalized coaching.

- Subscription: Telemedicine platforms and chronic disease management apps use subscription models with monthly or annual fees. These can range from low cost for individuals to enterprise level plans for health systems.

- Device Bundling: Companies often bundle wearable devices with associated mHealth apps offering integrated solutions for remote monitoring and personal health management.

- Insurance Reimbursement: In many markets insurers are starting to reimburse or subsidize mHealth services reducing out of pocket costs for patients. This is driving adoption especially for chronic disease management and telemedicine.

- Regional Variations: Prices and business models adapt to local conditions. In emerging markets companies often offer low cost solutions tailored to resource constrained settings to expand reach and impact.

Growth Factors

Several factors are driving the growth of mHealth:

- Chronic Disease Burden: Global rise in chronic conditions like diabetes, cardiovascular disease and respiratory illnesses is driving demand for cost effective management solutions. mHealth apps provide patients with reminders, educational resources and remote monitoring to improve adherence and outcomes.

- Healthcare System Strain: Overwhelmed healthcare systems are looking for ways to deliver high quality care more efficiently. mHealth enables task-shifting, reduces unnecessary hospital visits and supports remote care delivery – helping systems cope with limited resources.

- Technology Advancements: AI, machine learning and wearable sensors are transforming mHealth. These technologies enable real-time data analysis, personalized recommendations and early detection of health issues.

- Government Support and Regulation: Many governments are promoting digital health through funding, regulatory frameworks and national health strategies. Initiatives to expand broadband access and digital literacy are further driving mHealth adoption.

- COVID-19 Pandemic: The pandemic has changed healthcare forever, normalised virtual care and accelerated mHealth adoption. Even post pandemic, demand for remote care and monitoring will remain high.

Regulatory Landscape

The mHealth market operates within a complex regulatory environment to ensure safety, efficacy, and privacy. Key regulatory considerations include:

- Medical Device Classification: Some mHealth tools are seen as medical devices. They need approval before hitting the market. For instance, the U.S. Food and Drug Administration (FDA) regulates certain diagnostic and monitoring apps under its Digital Health guidelines.

- Data Privacy Laws: Regulations like HIPAA and GDPR protect health data. They set strong rules for storing and sharing info.

- Interoperability Standards: Governments and industry bodies promote interoperability so mHealth solutions can integrate with electronic health records (EHRs) and other health IT systems.

- Telemedicine Policies: National telehealth regulations govern licensing, reimbursement and cross border consultations. These are evolving rapidly to meet the growing demand for virtual care.

- Certification and Quality Standards: ISO 13485 gives rules for making safe health tools. It guides how mHealth devices are built and checked.

Recent Developments

Key recent developments in the market include:

- AI Integration: Smart mHealth apps now use AI to check symptoms and give health tips. Firms like Babylon and Ada lead with AI-based care.

- Wearable-Integrated Care: Device makers now work with health providers to manage chronic care. Apple teams with hospitals to track AFib using its Watch.

- Telemedicine Expansion: Leading telehealth providers are expanding into mental health, chronic disease management and specialty care. Teladoc Health for example has broadened its platform to deliver comprehensive virtual care.

- Strategic Acquisitions: Major technology firms continue to acquire digital health startups to enhance capabilities. Google’s acquisition of Fitbit has deepened its presence in health tracking and analytics.

- Government Initiatives: Countries are launching national digital health strategies, funding telemedicine infrastructure and updating regulations to encourage mHealth adoption.

Current and Potential Growth Implications

Demand-Supply Analysis: The surging demand for remote care and health monitoring is prompting rapid expansion of mHealth solutions. App developers and device manufacturers are scaling production and capabilities to meet growing user bases. However, uneven internet access and digital literacy remain barriers in some regions.

Gap Analysis: While adoption is strong in high-income and urban areas, significant gaps persist in rural and low-income regions. Affordability, connectivity, and cultural factors limit mHealth penetration. Addressing these gaps through targeted strategies and affordable solutions is a priority for industry players.

Top Companies in the mHealth Market

- Apple Inc.

- Google LLC

- Samsung Electronics Co. Ltd.

- Philips Healthcare

- Medtronic PLC

- Teladoc Health Inc.

- Cerner Corporation

- Allscripts Healthcare Solutions

- Fitbit Inc.

- AliveCor Inc.

mHealth Market: Report Snapshot

Segmentation | Details |

By Product Type | mHealth Apps, Wearable Devices, Telemedicine Platforms, Remote Monitoring Devices, Others |

By Application | Chronic Disease Management, General Wellness, Diagnostic Services, Remote Consultations, Others |

By End-User | Patients, Healthcare Providers, Payers, Employers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are expected to see significant growth in the mHealth market:

- Telemedicine Platforms: More people now want virtual consultations. Telemedicine is growing fast for checks and advice.

- Remote Monitoring Devices: Chronic care needs tools that track from home. These devices send health data to doctors in real time.

- mHealth Apps for Chronic Disease Management: Chronic care apps for diabetes and BP are growing fast. They help patients stay healthy and cut medical costs.

Major Innovations

- AI-Powered Health Apps: AI in health apps gives users custom tips and checks. It also helps with triage and remote diagnosis.

- Wearable Integration: Wearables now work with mHealth apps for live tracking. This helps spot health issues early in chronic cases.

- Secure Data Sharing Platforms: New tools keep patient data safe during sharing. They also link well with EHR systems.

Potential Growth Opportunities

- Expansion into Emerging Markets: Emerging markets show big promise with more phone users. Firms now build local health tools to reach more people.

- Integration with National Health Systems: mHealth tools now link with national health plans. This helps reach more people through public systems.

- Advancements in AI and Remote Diagnostics: Continued innovation in AI and remote diagnostics is enhancing the accuracy, usability, and value proposition of mHealth solutions.

Extrapolate says:

The mHealth market is set to expand significantly over the forecast period. As technology becomes more sophisticated, mHealth solutions are evolving from basic health apps to comprehensive platforms supporting remote care, chronic disease management, and personalized health insights.

Driven by rising smartphone penetration, a growing need for cost-effective healthcare delivery, and continuous innovation, the market promises robust, sustained growth. By empowering patients, improving healthcare access, and enhancing system efficiency, mHealth is emerging as an essential pillar of modern healthcare worldwide.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

mHealth Market Size

- July-2025

- ���1���4���0

- Global

- Healthcare-Medical-Devices-Biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021