Medical Devices Market Size, Share, Growth & Industry Analysis, By Product Type (Diagnostic Devices, Therapeutic Devices, Surgical Instruments, Monitoring Devices, Implantable Devices, Others), By Application (Cardiovascular, Orthopedic, Neurology, Ophthalmology, Dentistry, Diagnostics, Others), By End-User Industry (Hospitals, Clinics, Diagnostic Laboratories, Ambulatory Surgical Centers, Home Healthcare), and Regional Analysis, 2024-2031

Medical Devices Market: Global Share and Growth Trajectory

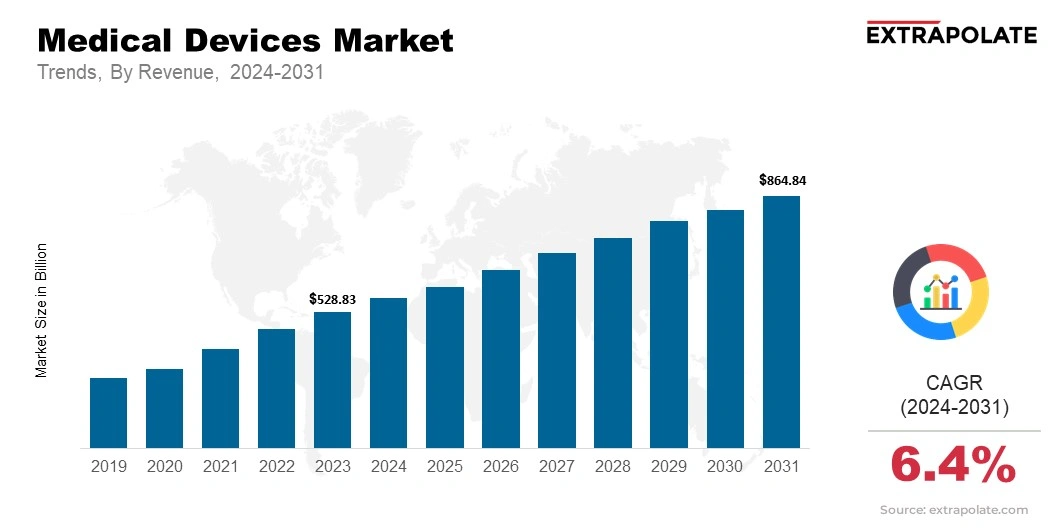

The global Medical Devices Market size was valued at USD 528.83 billion in 2023 and is projected to grow from USD 558.48 billion in 2024 to USD 864.84 billion by 2031, exhibiting a CAGR of 6.4% during the forecast period.

The global market is noticing remarkable growth, stimulated by the expanding aging population, technological breakthroughs, and a broadening focus on healthy living. The market offers a diverse range of products, which includes diagnostic devices, therapeutic equipment, imaging systems, and surgical instruments.

Technology advances, such as AI and robotics, are making medical devices smarter. This is improving both treatment outcomes and day-to-day operations in hospitals. Wearable devices, virtual patient monitoring, and AI in diagnostics are improving patient care. These tools help doctors treat patients more accurately and quickly.

They can check on patients from a distance, make better diagnoses, and reduce hospital stays. The shift to personalized healthcare is boosting the need for custom medical equipment. This equipment must fit individual health needs.

The surge of diabetes, heart disease, and cancer has sparked a demand for cutting-edge medical devices. Swift diagnosis and prompt intervention are essential in this health landscape.

With these groundbreaking devices by their side, patients can enjoy enhanced quality of life and improved long-term health outcomes. The on-going advancements in minimally invasive surgery as well as the increasing requirements for home-based healthcare are fueling growth in the market.

On a regional level, North America dominates the market, fueled by sophisticated healthcare infrastructure and substantial healthcare investment. Europe and Asia-Pacific are also going through considerable growth, with Asia-Pacific, specifically reaping benefits of the increasing health requirements of fast-growing populations and rising investments in healthcare facilities.

The medical devices industry globally is set to experience further growth, propelled by evolving innovations and a rising demand for efficient and effective healthcare solutions.

As technology advances further, the industry is projected to offer more significant opportunities for progress that will transform the future of global healthcare delivery.

Key Market Trends Driving Product Adoption

Various key trends are driving the adoption of medical devices in the market:

- Healthcare Advancements: The medical device market is undergoing a revolution driven by innovation. Wearable devices can track health and robotic surgeries can make precision cuts. AI-powered diagnostics can solve disease-related complexities in real-time. Telemedicine can connect doctors and patients with just a click. Together, these advancements are driving accessible healthcare for all.

- Increasing Number of Older Adults: With the world’s older generation steadily growing, the demand for medical devices is gaining further pace. Pacemakers, joint replacements, and hearing aids are in high demand, driven by the surge of chronic diseases and age-related health challenges. The need for innovative solutions has grown ever more crucial.

- High Chronic Disease Burden: The rise of chronic diseases like diabetes and heart conditions fuels a surge in demand for diagnostic medical technologies. These advances enable monitoring and treatment, aiding in the treatment of respiratory disorders and more.

- Rising Minimally Invasive Surgeries: Minimally invasive techniques are transforming surgery. With shorter recovery times and a decreased risk of complications, they are revolutionizing patient care. As a result, robotic-assisted surgery systems and laparoscopic tools are gaining popularity.

- Personalization in Medicine: Innovations in medical devices are crafting customized treatments, tailored to individual needs. Each device is a key, unlocking solutions to unique patient challenges. These advancements transform care, ensuring that every patient receives adequate attention.

Major Players and their Competitive Positioning

Medical devices is a very competitive market wherein global as well as regional companies are striving to gain a significant share of the global market. The main players dominating in the medical device market are Medtronic, Abbott Laboratories, Siemens Healthiness, Johnson & Johnson, and GE Healthcare, which are accelerating innovation, merging, and product line-ups. In addition, the rise of lesser-known players and beginners proficient in specific medical equipment and solutions is encouraging the fragmentation of the market.

Consumer Behavior Analysis

The primary buyers of medical devices include hospitals, clinics, diagnostic laboratories, and ambulatory surgical centers. Drivers of consumer behavior are:

- Rising Demand for Home Healthcare Devices: With the increasing focus on home care and digital patient monitoring, devices like home blood pressure monitors, glucose meters, and wearable health trackers are observing increased adoption

- Preference for Non-Invasive and Patient-Centric Devices: As patients look for more convenient and less intrusive treatment methods, there is a rising demand for non-invasive medical devices.

- Awareness and Trust in Technology: Healthcare providers and patients are becoming increasingly informed about the benefits of advanced medical technologies, which is accelerating the adoption of ground-breaking devices.

- Cost Considerations: While healthcare systems around the world are focused toward reduction of costs, there is stronger demand for devices that provide both value and reliability.

Pricing Trends

The price tag on a medical device reflects its intricate culmination of factors. Complexity, innovation, production costs, and regulatory hurdles all play a vital role. Advanced devices, from robotic surgical systems to cutting-edge imaging equipment, often display a price as high as their technology. Their costs reflect high-tech innovations and rigorous regulatory standards.

Yet, the demand for affordable, dependable, and user-friendly options is rising. This shift is igniting cost-cutting strategies and sparking price wars among manufacturers. As technology proceeds and production processes become more smooth-running, prices of specific medical devices might decrease, making them easy to access healthcare providers, specifically in developing markets.

Growth Factors

Various factors contributing to the growth of the medical devices market:

- Technological Innovation: Unwavering progress in medical device technologies, such as AI, robotics, and nanotechnology, is enhancing the functionality of medical devices and strengthening their role in diagnosing and addressing multiple health issues.

- Increasing Healthcare Expenditure: Increasing global healthcare expenditures, particularly in mature economies, is propelling the demand for high-tech medical devices, as healthcare systems prioritize investment in advanced technologies.

- Aging Population: The expanding senior population globally is a key driver, as older adults usually require medical devices for managing chronic conditions, rehabilitation, and surgeries.

- Rising Demand for Preventive Healthcare: Rising awareness about the significance of preventive care and early detection of diseases is encouraging the use of diagnostic and monitoring devices, which are crucial for prevention of diseases.

Regulatory Landscape

Regulatory standards for medical devices must be met since they put safety, quality, and efficacy under warranty. The U.S. Food and Drug Administration (FDA), alongside the European Medicines Agency (EMA), plays a vigilant role in shaping the landscape of medical devices.

These authorities enforce stringent rules for product release and post-market oversight. Manufacturers must navigate this complexity as a misstep can cause delay or even a product recall. As the medical device market grows, regulators continue crafting fresh guidelines that align with emerging technologies—all to safeguard patient well-being.

Recent Developments

Recent developments in the market include:

- Advancements in Telemedicine and Remote Monitoring: The COVID-19 pandemic boosted the adoption of telehealth and remote monitoring technologies. This trend is progressing, with devices like wearable health trackers, glucose monitors, and blood pressure monitors undergoing mass adoption.

- AI and Robotics Integration: Medical devices are progressively including AI and robotics to improve accuracy of the diagnosis and enhance accuracy in surgery. Robotic surgery systems and AI-powered diagnostic tools are modernizing healthcare solutions.

- 3D Printing Technology in Medical Devices: The use of 3D printing technology is reshaping the production of healthcare equipment, especially in creating tailored implants, prosthetics, and orthotics, making them more customized and cost-effective.

Current and Potential Growth Implications

a. Demand-Supply Analysis

The demand for medical devices is set to soar, fueled by advanced technologies in emerging markets. Yet, supply chain disruptions, regulatory hurdles, and soaring production costs may hinder availability. Companies must navigate these challenges to meet the rising demand. The steady progress in developing budget-friendly and compact devices could help tackle these issues and facilitate new growth opportunities.

b. Gap Analysis

Regardless of the general expansion, there are specific gaps in the market, which include the need for reasonable medical devices in developing markets and the on-going struggle to overcome healthcare inequalities. Manufacturers are focused on filling out these gaps by designing affordable, superior devices that are suitable for a range of healthcare settings.

Top Companies in the Medical Devices Market

- Medtronic

- Abbott Laboratories

- Siemens Healthineers

- Johnson & Johnson

- GE Healthcare

- Philips Healthcare

- Stryker Corporation

- Boston Scientific

- Zimmer Biomet

- Intuitive Surgical

Medical Devices Market: Report Snapshot

Segmentation | Details |

By Product Type | Diagnostic Devices, Therapeutic Devices, Surgical Instruments, Monitoring Devices, Implantable Devices, Others |

By Application | Cardiovascular, Orthopedic, Neurology, Ophthalmology, Dentistry, Diagnostics, Others |

By End-User | Hospitals, Clinics, Diagnostic Laboratories, Ambulatory Surgical Centers, Home Healthcare |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are projected to grow significantly:

- Wearable Medical Devices: The demand for wearable devices like smartwatches, fitness trackers, and constant glucose monitors is increasing due to the growing focus on health tracking and illness prevention

- Surgical Robotics: Surgeries assisted by robots are gaining popularity, with advanced robots providing enhanced accuracy and accelerated healing times, leading the shift toward surgical robots.

- Diagnostic Imaging: The rise in non-invasive diagnostic technologies, such as MRI, CT scans, and ultrasound, is driving the expansion of diagnostic imaging devices.

Major Innovations

Innovation is propelling the expansion of the medical devices market, with significant advances including:

- AI-Powered Diagnostics: The incorporation of AI in diagnostic devices is increasing the accuracy of diagnostic imaging, supporting quicker and more exact diagnoses.

- Robotic-Assisted Surgery: Robotics technology is upgrading the accuracy and minimally invasive nature of surgeries, resulting in improved patient outcomes and faster recovery.

- Personalized Medical Devices: Developments in 3D printing and biocompatible materials are allowing the innovation of personalized implants, prosthetics, and other medical devices, customized according to individual patients.

Potential Growth Opportunities

Multiple growth opportunities exist in the medical devices market, including:

- Emerging Markets: The growing healthcare infrastructure in emerging markets offers a major opportunity for medical device manufacturers to broaden their market.

- Technological Advancements: The constant development of next-generation technologies, such as AI, robotics, and telemedicine, is creating new possibilities for medical device uses.

- Increasing Healthcare Focus on Preventive Care: As healthcare systems place greater focus on prevention and early intervention, the demand for diagnostic and monitoring devices is set to grow.

Extrapolate Research says:

The medical devices industry is seeing accelerated growth. It is stimulated by technology development, growth in healthcare expenditure, and an ageing population all over the world. Given that the need for high-end health solutions keeps increasing, producers must consider efficiency, adherence to regulatory standards, and responsiveness to changes in health service providers' and consumers' needs to stay ahead in this competitive market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Medical Devices Market Size

- February-2025

- 148

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021