Infuser Water Bottles Market Size, Share, Growth & Industry Analysis, By Product Type (Plastic Infuser Bottles, Glass Infuser Bottles, Stainless Steel Infuser Bottles), By Capacity (Less than 500 ml, 500 ml – 1 Liter, Above 1 Liter), By Distribution Channel (Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Others), By End-User (Individuals, Corporates, Fitness Centers, Schools & Institutions), and Regional Analysis, 2024-2031

Infuser Water Bottles Market: Global Share and Growth Trajectory

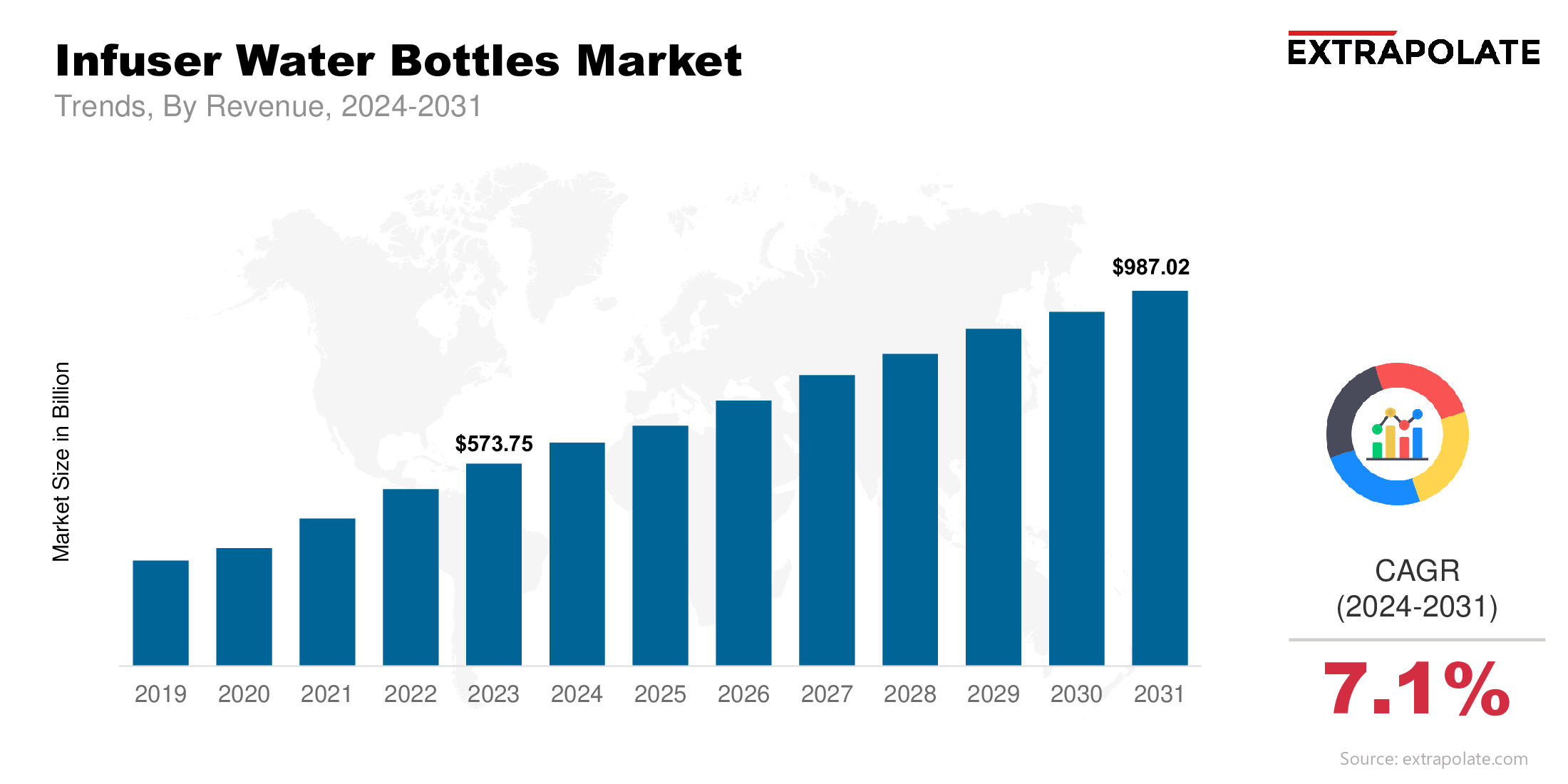

The global Infuser Water Bottles Market size was valued at USD 573.75 billion in 2023 and is projected to grow from USD 610.49 billion in 2024 to USD 987.02 billion by 2031, exhibiting a CAGR of 7.1% during the forecast period.

The global market is experiencing robust growth as consumers worldwide prioritize wellness, hydration, and sustainability. These bottles, designed with built-in compartments for fruits, herbs, or vegetables, offer a convenient way to naturally flavor water. Their rise reflects a broader shift in consumer behavior toward healthier lifestyles and a reduced reliance on sugary beverages and single-use plastics.

In recent years, the infuser water bottle has transformed from a niche health accessory to a mainstream lifestyle product. This growth is fueled by increasing awareness around proper hydration, the negative health effects of sodas and processed drinks, and the growing popularity of reusable and eco-friendly products. The bottles appeal particularly to health-conscious millennials and Gen Z consumers who seek both functionality and aesthetic appeal in their daily-use items.

E-commerce platforms have significantly contributed to the market’s global expansion. Online marketplaces like Amazon, Flipkart, and specialty wellness retailers make it easier for consumers to access a wide range of designs, price points, and customization options. Additionally, rising social media influence and endorsements by fitness influencers have helped drive widespread product visibility and desirability.

Regionally, North America and Europe dominate the market due to higher health awareness and early adoption of sustainable practices. However, the Asia-Pacific region is rapidly catching up, driven by urbanization, increasing disposable incomes, and a growing interest in wellness culture.

With continued innovation in product design—such as insulated options, time markers, and smart hydration tracking—and rising adoption across corporate gifting, fitness, and lifestyle sectors, the infuser water bottles industry is expected to maintain a strong upward trajectory. As more consumers turn to personalized, eco-conscious hydration solutions, the global market is poised for sustained, long-term growth.

Key Market Trends Driving Product Adoption

Several important trends are accelerating the adoption and popularity of infuser water bottles:

- Surge in Health and Wellness Trends: Health and fitness trends are a dominant force behind the growth of this market. As consumers increasingly pursue clean and active lifestyles, hydration becomes a critical component. Infuser water bottles help users naturally flavor their water with fruits like lemon, berries, or mint, encouraging hydration without the sugar found in commercial beverages. Wellness influencers and fitness experts also promote these bottles on social media, further amplifying their appeal.

- Sustainability and Eco-Friendly Consumer Behavior: In response to growing environmental concerns, consumers are making more sustainable choices. Infuser water bottles, often made of BPA-free plastic, stainless steel, or glass, are reusable and help reduce single-use plastic consumption. This sustainable benefit is playing a vital role in their adoption, especially among environmentally conscious millennials and Gen Z consumers.

- Customization and Aesthetic Appeal: Aesthetic and customizable features—such as color options, inspirational quotes, time-marked hydration lines, and fruit compartments—make these bottles particularly popular among younger buyers. Stylish, Instagrammable designs are fueling market penetration as consumers increasingly value form along with function.

- Rising Demand in Corporate and Promotional Gifting: Brands and businesses are also using infuser water bottles in promotional gifting strategies. With the wellness trend permeating corporate culture, these products are being distributed during events and campaigns as eco-conscious, functional gifts. This demand from the B2B segment is giving a boost to global market sales.

Major Players and their Competitive Positioning

The infuser water bottles industry is moderately fragmented, with several brands competing on product design, material quality, innovation, and price. Key players are continuously investing in R&D to improve functionality, durability, and aesthetics.

Prominent companies in this market include Hydracy, Live Infinitely, Bevgo, Infusion Pro, Danum, Brimma, Contigo (Newell Brands), CamelBak Products LLC, Cactaki, Thermos L.L.C. and others.

These companies offer a wide variety of designs and sizes, often including leak-proof lids, insulated double walls, and carry straps. Market leaders are also expanding their global footprint through online retail channels and regional partnerships to capture untapped customer bases in developing markets.

Consumer Behavior Analysis

Understanding consumer behavior is key to unlocking the infuser water bottles market. Here are the key behavioral drivers:

- Health-Conscious Consumption: Consumers are replacing sugary drinks with healthier options, including infused water. This has led to widespread adoption of infuser water bottles among gym goers, office professionals and homemakers looking for daily hydration in a health positive format.

- Price Sensitivity Balanced by Long-Term Use: Although price is a consideration, consumers are willing to invest in higher quality reusable bottles due to their durability and value over time. Cost effectiveness also plays into sustainability – one reusable infuser bottle can replace hundreds of disposable plastic bottles, making it more appealing.

- Convenience and On-the-Go Lifestyle: In today’s fast paced world, convenience is key. Infuser water bottles cater to busy professionals, students and travelers with a lightweight, portable and spill proof hydration solution. Time marked variants encourage regular hydration, aligning with modern wellness routines.

- Influence of Social Media and Reviews: Social media plays a big role in influencing buying behavior. Consumers often check out peer reviews, fitness influencers and product demos before making a purchase. Positive visibility online drives demand and encourages word of mouth marketing.

Pricing Trends

The market offers a range of price points depending on features, brand, and materials used:

- Entry-level bottles made from BPA free plastic can cost between USD 8-USD 15.

- Mid-range bottles with added features such as time markers, larger capacity or improved aesthetics typically range between USD 15-USD 25.

- Premium bottles, often made of borosilicate glass or stainless steel with thermal insulation, ergonomic design and premium packaging can cost USD 25-USD 45 or more.

Bulk purchases and seasonal discounts on e-commerce platforms also impact pricing. Subscription based hydration plans and bundling with fitness gear or nutrition kits are other pricing strategies used by some brands.

Growth Factors

The market has several growth drivers:

- Urbanization and Lifestyle Changes: Urban consumers are health conscious and have access to more fitness and wellness content. This demographic shift is driving demand for convenient and smart hydration tools like infuser bottles especially in urban areas of Asia-Pacific and Latin America.

- E-commerce Growth: E-commerce and online retail platforms like Amazon, Flipkart and Walmart are expanding the global reach of these products. Product comparison, customer reviews and targeted ads are making it easier for brands to find and convert customers.

- Environmental Awareness: The rise in anti-plastic legislation and environmental awareness campaigns has directly led to an increase in demand for reusable products. Infuser bottles fit into this trend by promoting hydration and sustainability which is in line with global values.

- Innovation and New Product Launches: Infuser water bottle manufacturers are constantly innovating to improve ease of use, versatility, and style. New features such as fruit filters, double insulation, collapsible designs, or self-cleaning functions are driving consumer interest and differentiating products in a crowded market.

Regulatory Landscape

Infuser water bottles aren’t as heavily regulated as medical devices but still need to comply with health, safety and environmental standards in their respective regions:

- Food-grade certifications such as FDA approval (for US) or LFGB certification (in Europe) to ensure materials used are safe for food contact.

- BPA-free labeling is a must-have especially in North America and Europe.

- ISO 9001 certification may apply to manufacturers for quality assurance practices.

- Environmental packaging regulations are influencing labeling and material sourcing to align with national recycling and sustainability mandates.

Compliance with these guidelines ensures consumer trust and product safety and facilitates market entry across geographies.

Recent Developments

Recent developments in the infuser water bottles market include:

- Smart Infuser Bottles: Some brands are adding technology like hydration tracking sensors, Bluetooth connectivity and reminder alerts to keep users on track with their daily water intake.

- Collaborations and Brand Licensing: Sportswear and wellness brands are partnering with bottle manufacturers to create co-branded hydration products. This is increasing visibility and brand equity in new segments.

- Sustainable Packaging Initiatives: Companies are using recycled packaging and minimalist designs to reduce environmental impact and meet the growing demand for eco-friendly products.

- Subscription and Customization Models: Startups and niche brands are exploring direct-to-consumer business models with bottle customization options and refillable infusion pods on subscription basis.

Current and Potential Growth Implications

a. Demand-Supply Analysis

As demand grows especially during warmer seasons and health awareness months, manufacturers are increasing production and expanding distribution networks. With low barriers to entry, new startups are entering the market and consumers have more options.

However, supply chain disruptions (especially in raw materials like stainless steel and borosilicate glass) can cause price fluctuations and product delays. Efficient inventory planning and diversified sourcing is key to maintaining a steady supply.

b. Gap Analysis

Despite global adoption, certain gaps remain:

- Limited availability in rural regions and lower-income markets restricts full market penetration.

- Premium product pricing still limits adoption in price-sensitive areas.

- Lack of awareness about BPA and microplastic health hazards can prevent consumers from choosing safer alternatives.

Bridging these gaps through awareness campaigns, affordable product lines, and localized marketing strategies can unlock untapped potential in emerging markets.

Top Companies in the Infuser Water Bottles Market

- Hydracy

- Bevgo

- Infusion Pro

- Live Infinitely

- Danum

- Cactaki

- Brimma

- Thermos L.L.C.

- CamelBak Products LLC

- Contigo (Newell Brands)

Infuser Water Bottles Market: Report Snapshot

Segmentation | Details |

By Product Type | Plastic Infuser Bottles, Glass Infuser Bottles, Stainless Steel Infuser Bottles |

By Capacity | Less than 500 ml, 500 ml – 1 Liter, Above 1 Liter |

By Distribution Channel | Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Others |

By End-User | Individuals, Corporates, Fitness Centers, Schools & Institutions |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Plastic Infuser Bottles: Lightweight, affordable, and available in various designs, plastic bottles dominate the market, especially for first-time users.

- Online Retail: With better discounts, wider product selection, and convenience, online channels are expected to grow fastest.

- 500 ml – 1 Liter Capacity: This segment hits the sweet spot between portability and sufficient daily hydration for users on the go.

Major Innovations

- Detachable Infusion Compartments: For easy cleaning and refilling.

- Time-Marker Bottles: To help users track hydration goals throughout the day.

- Double-Wall Insulation Keeps drinks cold or hot for hours.

- Smart Bottles: Integration with hydration apps and Bluetooth sensors for tracking.

Growth Opportunities

- Expansion into School Wellness Programs: With childhood obesity on the rise, schools are looking into health-driven initiatives and infuser water bottles are a wellness tool.

- Personalized Bottles and Corporate Branding: Printing logos and quotes is a branding opportunity and user engagement.

- Emerging Markets: India, Brazil and parts of Southeast Asia are ready for growth as health awareness and urbanization increases.

- Fitness Subscriptions: Bundling bottles with gym memberships or diet plans is added value and convenience for health conscious users.

Extrapolate Research says:

The infuser water bottles market is growing fast, driven by wellness trends, sustainability and smart hydration. As product awareness and personalization increases and eco-conscious consumers lead the way, the market will grow across developed and emerging markets.

With continuous design innovation, expansion into digital and corporate wellness and consumers focusing on health, infuser water bottles are not a trend – they’re an everyday essential for modern life.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Infuser Water Bottles Market Size

- June-2025

- 148

- Global

- smart-utilities

Related Research

Collaborative Robot Market By Payload (Upto 5 Kg, Upto 5-10 Kg, Upto 10-20 Kg, above 20 Kg), Compone

February-2023

E-Cigarette and Vaping Market By Product (Rechargeable, Disposable, Modular, Modular, and Others), D

January-2023

Global Smart Clothing Market: by Product (Outer Wear, Inner Wear), Fabric Type (Active Smart, Passiv

January-2023

Infuser Water Bottles Market Size, Share, Growth & Industry Analysis, By Product Type (Plastic Infus

June-2025

Modular Kitchen Appliances Market By Product Type (Built-in Ovens, Built-in Microwaves, Built-in Dis

May-2023

Motorcycle Gear Market Size, Share, Growth & Industry Analysis, By Product Type (Helmets, Jackets, G

May-2025

Online Home Services Market Size, Share, Growth & Industry Analysis, By Service Type (Cleaning, Repa

June-2025

Smart Manufacturing Market Size, Share, Growth & Industry Analysis, By Component (Services, Solution

September-2024

Smart Plugs Market By Type (Bluetooth, Zigbee, Wi-Fi, and Others), Application (Household, Commercia

March-2023

Smart Remote Market Size, Share, Growth & Industry Analysis, By Type (Infrared Smart Remote-Control,

September-2024