Waveguide-Type Optical Display Element Market Size, Share, Growth & Industry Analysis, By Type (Reflective Waveguides, Diffractive Waveguides, Holographic Waveguides) By Application (Consumer Electronics, Industrial & Enterprise, Defense & Aerospace, Healthcare, Automotive) By Technology (Augmented Reality (AR), Mixed Reality (MR)), and Regional Analysis, 2024-2031

Waveguide-Type Optical Display Element Market: Global Share and Growth Trajectory

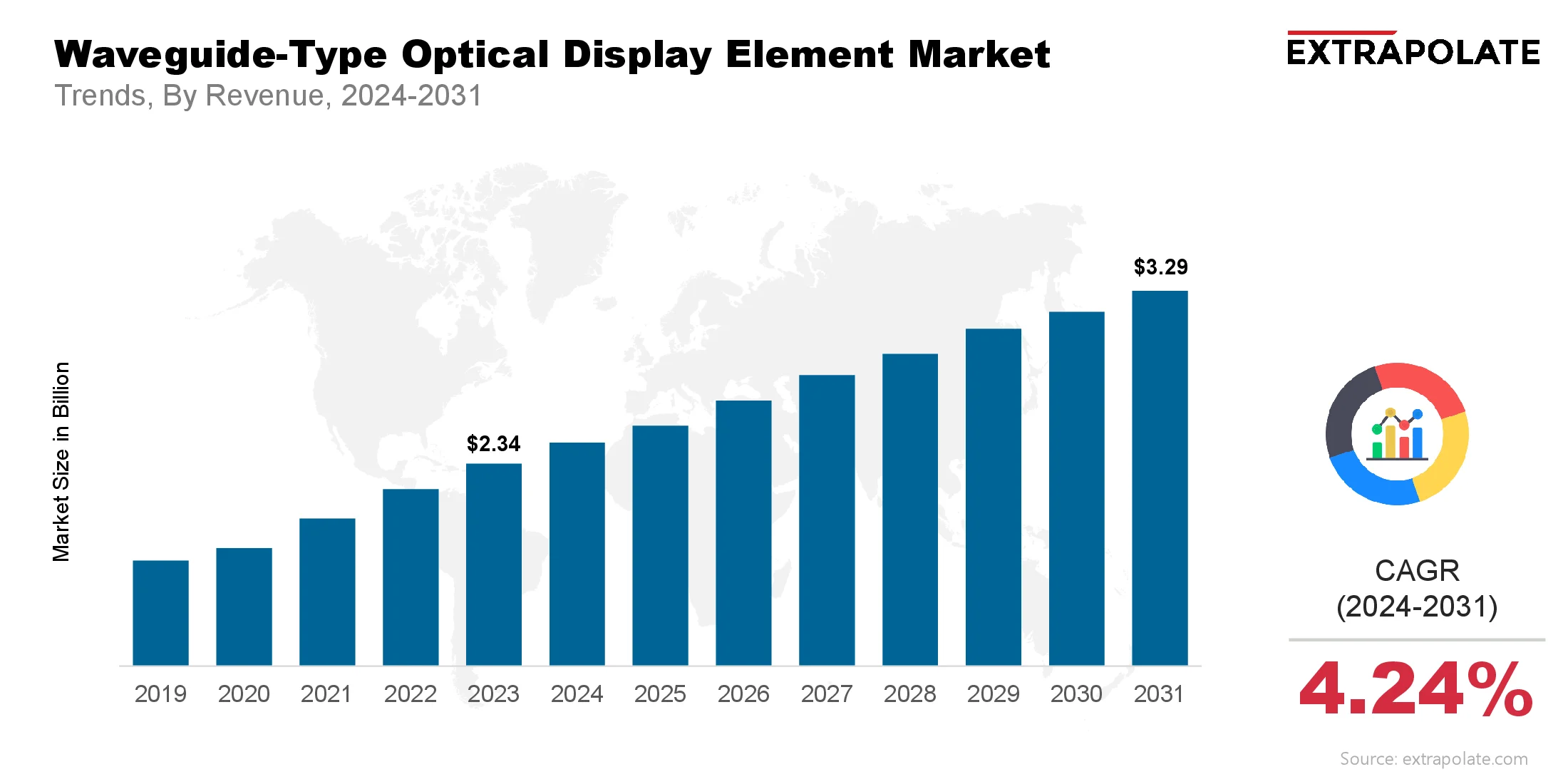

The global Waveguide-Type Optical Display Element Market size was valued at USD 2.34 billion in 2023 and is projected to grow from USD 2.46 billion in 2024 to USD 3.29 billion by 2031, exhibiting a CAGR of 4.24% during the forecast period.

The global Market is on a rapid upward trajectory, driven by the booming adoption of augmented reality (AR) and mixed reality (MR) technologies. These display elements are crucial components in wearable devices like AR glasses and head-mounted displays, enabling compact, transparent, and lightweight visualization of digital content overlaid onto the real world. As industries increasingly demand immersive and hands-free solutions for real-time data visualization, training, and collaboration, the importance of waveguide-based displays has grown significantly.

Waveguide-type optical display elements offer several advantages over traditional optics. They support high brightness, wide fields of view, and full-color imaging, all while maintaining a sleek and ergonomic design. This makes them especially appealing in consumer electronics, industrial applications, healthcare, and defense. Key technological innovations—such as diffractive waveguides, holographic waveguides, and reflective designs—have further enhanced performance, paving the way for broader adoption across diverse markets.

According to market analysts, the demand for waveguide-type optical display elements is expected to grow exponentially over the next decade. From consumer wearables and automotive HUDs to enterprise AR tools and telemedicine, these elements are emerging as foundational building blocks in the next generation of interactive digital interfaces. As the market matures, innovation, affordability, and cross-industry collaboration will play a key role in shaping its global growth trajectory.

Key Market Trends Driving Product Adoption

Several powerful trends are shaping the waveguide-type optical display element market:

Surge in AR/MR Headset Development

The increasing production of AR/MR headsets by major tech players is a key market driver. Companies like Microsoft (HoloLens), Apple (Vision Pro), and Magic Leap are incorporating waveguide technology into their wearable devices to ensure compactness and high image quality. Waveguides provide lightweight, full-color projections while maintaining a transparent and sleek lens profile, making them ideal for consumer and enterprise-grade headsets.

Advancements in Optical Waveguide Design

Technological breakthroughs in optical materials and nanofabrication have improved the performance of waveguide-type displays. New generations of diffractive optical elements and holographic optical elements (HOEs) provide better light efficiency, reduced color dispersion, and wider viewing angles. These advancements have enabled more natural visual experiences, drawing in more users across industrial and commercial applications.

Rising Demand for Hands-Free Visualization

Sectors like healthcare, manufacturing, and logistics increasingly demand hands-free AR displays for complex tasks. Waveguide-type elements are a preferred choice due to their durability and optical transparency. Surgeons can overlay medical images during procedures, while factory workers use AR glasses for guided assembly—streamlining workflows and minimizing errors.

Expansion of 5G and Edge Computing

The adoption of 5G and edge computing has unlocked real-time rendering capabilities and reduced latency in AR devices. This has allowed for faster image generation and seamless content delivery through waveguide-based displays. These advancements enhance user experiences in mobile AR applications, further driving adoption.

Major Players and Their Competitive Positioning

The waveguide-type optical display element market is highly competitive, marked by rapid innovation and strategic partnerships. Key players include: WaveOptics (Snap Inc.), Lumus Ltd., Digilens Inc., Sony Corporation, Dispelix Oy, Vuzix Corporation, Huawei Technologies Co., Ltd., Microsoft Corporation, LetinAR Inc., and Goertek Inc.

These companies focus on proprietary waveguide technologies—ranging from holographic and diffractive waveguides to reflective and polarized optics. They are actively pursuing collaborations with hardware manufacturers and software developers to expand their presence in AR/MR ecosystems.

Consumer Behavior Analysis

Understanding how consumers interact with waveguide-type optical display elements is critical for market expansion:

Immersive and Natural Visual Experience

Users prioritize clarity, contrast, and a wide field of view in AR displays. Waveguide optics offer superior image fidelity while maintaining transparency. As consumers demand more immersive experiences—especially in gaming and entertainment—brands are pressured to innovate in optical element design.

Wearability and Comfort

Consumers are increasingly sensitive to the weight, bulk, and aesthetics of wearable AR devices. Waveguide elements address these concerns by enabling thinner, lighter lenses that do not obstruct the user’s natural vision. This makes them ideal for extended wear, a key factor in consumer satisfaction.

Enterprise Adoption Accelerates

Enterprise users in industries such as healthcare, construction, and defense show growing interest in AR tools for efficiency and precision. Companies deploying AR for remote support, diagnostics, and digital twin integration choose waveguide displays for their durability and optical performance in demanding environments.

Early Technology Enthusiasts Drive Consumer Market

Tech-savvy consumers and early adopters are key drivers in the initial stages of product rollouts. Their feedback on image quality, responsiveness, and aesthetics is shaping the next generation of waveguide display elements.

Pricing Trends

The pricing of waveguide-type optical display elements varies based on:

- Type of waveguide (holographic, diffractive, reflective)

- Production complexity

- Volume of purchase

- Level of integration with AR/MR devices

Waveguide elements remain relatively expensive due to advanced material requirements and precision fabrication. However, with mass production scaling and investment in nanophotonics manufacturing techniques, prices are expected to decline.

Consumer AR glasses often retail between $500 to $3,000, depending heavily on the optics. Industrial-grade AR headsets with waveguide elements command even higher prices due to ruggedization and specialized capabilities.

Leasing models, subscription-based AR-as-a-service offerings, and OEM partnerships are emerging pricing strategies to reduce upfront costs and improve accessibility.

Growth Factors

Numerous factors are contributing to the rapid expansion of this market:

Rise in AR/MR Applications

Smooth AR and MR need waveguide optics. These elements are now core to display systems. Applications like retail visualization and field engineering are now possible. Traditional optics could not support these use cases effectively.

Investment in Next-Gen Display Technology

Global funding supports next-gen optics. Key areas include waveguide coupling and compact light engines. The focus is on sharper images and lower power. These gains come from recent optical advances.

Proliferation of Consumer AR Wearables

Apple Vision Pro and Meta Quest 3 may use waveguide optics. Their launch could drive mass consumer adoption. Better design and size make AR wearables easier to adopt. Mainstream use is now within reach.

Industrial Digital Transformation

Across sectors, operations are becoming more digital. This global trend is accelerating innovation and productivity. Waveguide AR glasses are gaining use in advanced firms. They offer live data, remote support, and easy documentation.

Regulatory Landscape

The waveguide-type optical display element market operates under several safety and regulatory frameworks:

- FCC and CE Compliance: Radio frequency and electromagnetic compatibility standards apply to AR devices. Meeting them is essential in U.S. and EU markets.

- ISO Standards: ISO 12312-1 governs how much light passes through optical parts. ISO 9241 ensures visual comfort and usability.

- Health and Safety Requirements: To ensure eye safety, light levels must meet exposure standards. Transmission must not exceed these limits.

- Export Regulations: Export regulations apply to high-end optics and imaging systems. In the U.S., such controls can restrict product distribution.

These rules affect how products are built and launched. Global deployment depends on meeting regulatory standards.

Recent Developments

Apple Vision Pro Launch

Apple’s long-anticipated entry into the AR/MR space through the Vision Pro headset is reshaping the competitive landscape. The device reportedly integrates custom-built waveguide optics, boosting investor interest in suppliers of these components.

In January 2025, researchers introduced AlGaN/AlN heterostructures as a promising platform for integrated photonics. The study demonstrated key photonic components and nonlinear optical functions across a wide spectral range from ultraviolet to infrared.

Partnership between Dispelix and Snap

Dispelix will provide diffractive waveguides for future Spectacles. The partnership with Snap aims to improve performance and lower device bulk.

Advancements in Nanoimprint Lithography

Waveguide displays benefit from nanoimprint lithography improvements. Costs are down, and large-scale production is more feasible. This allows manufacturers to meet growing demands without compromising optical quality.

Microsoft’s Industrial Push with HoloLens 2

Equipped with diffractive waveguides, HoloLens 2 is growing in use. It supports enterprise needs in logistics, factories, and field service.

Current and Potential Growth Implications

Demand-Supply Analysis

High-quality and transparent display optics are in high demand. Some areas face supply shortages due to rapid growth. Manufacturers are growing capacity through new plants and automation. These moves help increase production scale.

Gap Analysis

These optics are widely used in defense and industrial fields. But cost and complexity slow their entry into consumer markets. The market gap offers strong opportunities for innovation. Firms can target affordability and better user experience.

Top Companies in the Waveguide-Type Optical Display Element Market

- WaveOptics (Snap Inc.)

- Digilens Inc.

- Lumus Ltd.

- Dispelix Oy

- Sony Corporation

- LetinAR Inc.

- Vuzix Corporation

- Goertek Inc.

- Microsoft Corporation

- Huawei Technologies Co., Ltd.

Waveguide-Type Optical Display Element Market: Report Snapshot

Segmentation | Details |

By Type | Reflective Waveguides, Diffractive Waveguides, Holographic Waveguides |

By Application | Consumer Electronics, Industrial & Enterprise, Defense & Aerospace, Healthcare, Automotive |

By Technology | Augmented Reality (AR), Mixed Reality (MR) |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

Diffractive Waveguides

This segment dominates the market due to high light efficiency, ease of integration with microdisplays, and compact design. Their compatibility with consumer wearables makes them highly sought after.

Industrial & Enterprise Applications

Enterprise demand for AR visualization is propelling this segment. Applications range from digital twins to training simulations. They also include remote work and assembly support.

Major Innovations

- Full-Color Waveguides: Lumus has developed waveguides with full-color capability. Brightness is preserved in these advanced displays.

- Curved Waveguide Optics: Curved optics reduce the bulk of AR/VR headsets. They enable compact designs with wider viewing angles.

- AI-Integrated Optics: Eye-tracking and adaptive content delivery systems are being integrated directly into the waveguide layer.

Potential Growth Opportunities

- Expansion into Consumer AR Wearables: Smart glasses are now easier to wear and more affordable. This opens strong opportunities in fitness, lifestyle, and everyday use.

- Adoption in Automotive HUDs: Electric and autonomous vehicles need advanced display tech. Waveguide HUDs offer clear visuals for safety and infotainment.

- Integration with Telemedicine: Healthcare applications like remote diagnostics and guided surgery benefit from AR. Waveguide optics can boost their accuracy and efficiency.

- Emerging Market Penetration: Stronger telecom systems support AR expansion in key regions. Cost-effective waveguide solutions may see rising demand in India, Brazil, and Indonesia.

Extrapolate Says:

The waveguide-type optical display market is set to grow rapidly. Strong gains are expected over the next decade. AR and MR are now central to many applications. Waveguide optics support compact, immersive, and high-quality display systems.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Waveguide-Type Optical Display Element Market Size

- July-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020