Substation Automation Market Size, Share, Growth & Industry Analysis, By Module (SCADA, Communication Networks, Intelligent Electronic Devices (IEDs), Others), By Component (Hardware, Software, Services), By Type (Transmission Substations, Distribution Substations), By Installation Type (New Installations, Retrofit Installations), By End-User (Utilities, Industrial, Commercial, Others) and Regional Analysis, 2024-2031

Substation Automation Market: Global Share and Growth Trajectory

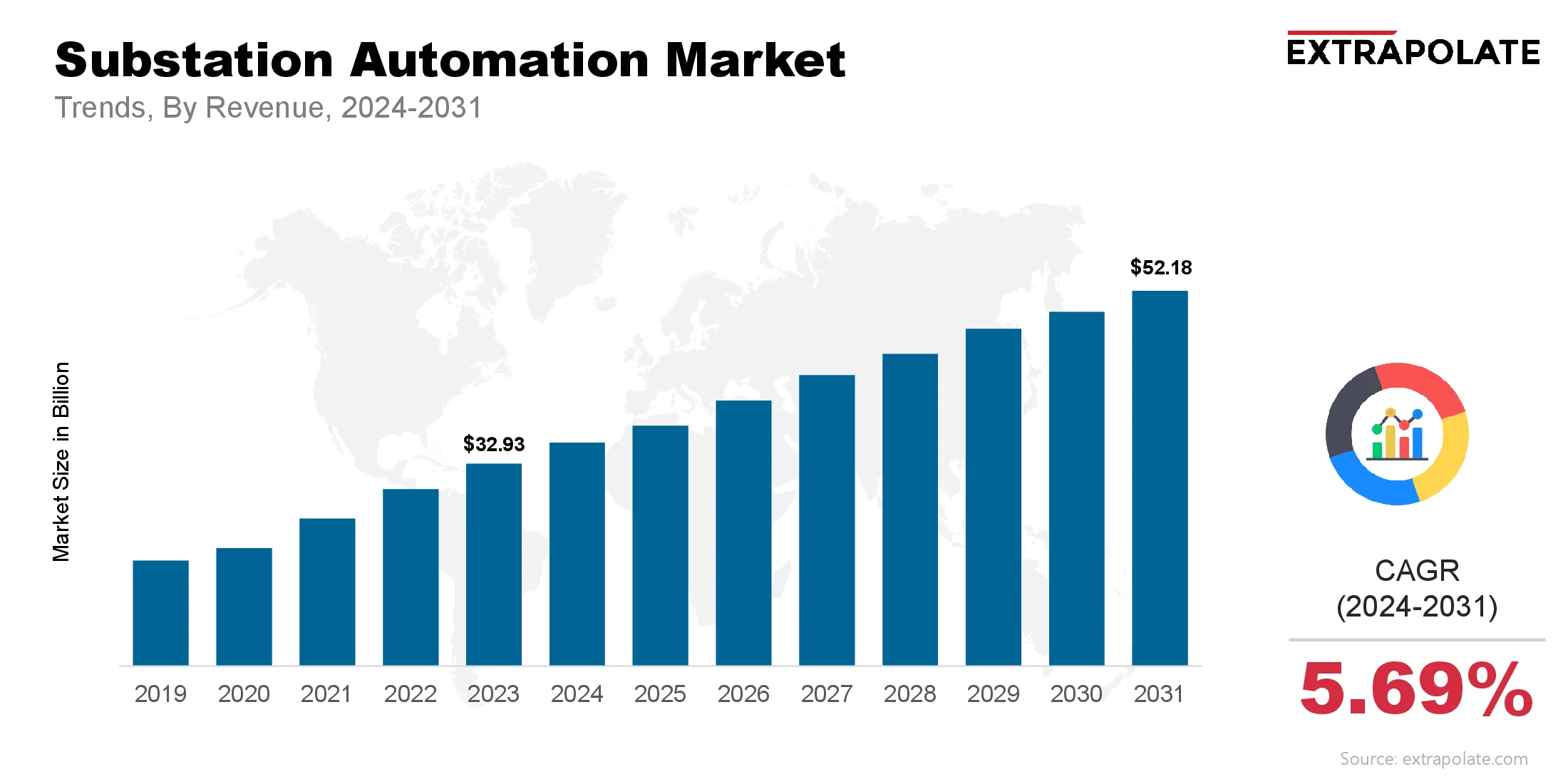

The global Substation Automation Market size was valued at USD 32.93 billion in 2023 and is projected to grow from USD 35.42 billion in 2024 to USD 52.18 billion by 2031, exhibiting a CAGR of 5.69% during the forecast period.

Substation automation refers to the use of data-driven control technologies and intelligent electronic devices (IEDs) to remotely monitor, control, and automate the operation of electrical substations. These systems ensure real-time data acquisition, fault detection, protection, and communication between devices to maintain reliability and efficiency in power transmission and distribution. Substation automation plays a critical role in modernizing grid infrastructure, improving operational performance, and reducing outage durations.

Through integration with SCADA systems, communication protocols like IEC 61850, and automation components such as PLCs and digital relays, substations become smarter and more adaptive. Utilities and power companies increasingly rely on these systems to manage rising energy demands, incorporate renewable energy sources, and improve grid resilience. The move toward digital substations also aligns with broader smart grid initiatives, making substation automation essential for next-generation energy infrastructure.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several notable trends are accelerating the global adoption of substation automation:

- Integration with Smart Grids and Renewable Energy: Substation automation is a vital building block of the smart grid ecosystem. As utilities integrate solar, wind, and other decentralized energy sources into the grid, substation automation ensures real-time coordination, voltage regulation, and load balancing. Automated substations offer dynamic adaptability to fluctuating energy flows, optimizing performance and stability in an increasingly complex energy landscape.

- Technological Innovations and Digitalization: Advances in digital relays, intelligent sensors, IoT platforms, and AI-based analytics are transforming the way substations are monitored and controlled. Emerging technologies allow real-time fault analysis, predictive maintenance, and data visualization, which reduce downtime and operational costs. Additionally, communication standards such as IEC 61850 enable seamless interoperability and remote control across different device manufacturers.

- Shift Toward Remote Monitoring and Maintenance: Substation automation allows utilities to reduce the need for on-site personnel, leading to operational efficiency and improved worker safety. Remote monitoring through SCADA systems enables early fault detection and timely interventions, reducing the impact of outages and minimizing equipment damage. This trend became particularly important during the COVID-19 pandemic and remains a strong driver of automation investments.

- Decentralized Energy Infrastructure: With the decentralization of energy systems and the growing use of microgrids, substation automation helps manage bi-directional power flows and ensures optimal coordination between distributed energy resources (DERs). Automated substations provide real-time visibility and control, supporting more flexible, resilient, and decentralized energy grids.

Major Players and their Competitive Positioning

The global substation automation market features intense competition among established power and automation companies, with firms focusing on strategic collaborations, product innovation, and regional expansion. Some of the key players dominating this space included are ABB Ltd., Siemens AG, General Electric Company (GE Grid Solutions), Schneider Electric SE, Eaton Corporation, Hitachi Energy Ltd., Crompton Greaves Ltd., Larsen & Toubro Limited, Emerson Electric Co., Rockwell Automation, Inc. and others.

These companies offer end-to-end automation solutions, including protection systems, automation hardware, communication devices, and software platforms. They are actively developing smart substations and digital twin technologies while investing in grid modernization projects globally.

Consumer Behavior Analysis

Consumer behavior in the substation automation market is largely shaped by grid modernization goals, cost efficiency imperatives, and environmental concerns:

- Preference for Integrated Solutions: Utilities increasingly prefer fully integrated automation packages rather than deploying components from multiple vendors. This minimizes compatibility issues and improves overall system performance. Vendors offering comprehensive end-to-end solutions are gaining favor among buyers.

- Emphasis on Reliability and Uptime: With electricity now critical to nearly every aspect of life and industry, grid reliability has become paramount. Consumers demand automation systems that ensure uninterrupted power supply, faster fault recovery, and minimal equipment failure. This is influencing purchasing decisions in favor of high-performance systems with predictive analytics and self-healing capabilities.

- Budget-Conscious Adoption in Developing Markets: While developed economies rapidly implement advanced digital substations, price sensitivity in developing regions drives demand for cost-effective automation. Customers in these markets prioritize basic remote monitoring, fault detection, and protection features over full-scale digital transformation.

- Environmental and Regulatory Influences: Many utilities are adopting substation automation to meet emissions goals and grid energy efficiency mandates. The need to optimize energy distribution and minimize losses aligns well with automation technology. As consumers grow more environmentally conscious, systems that enable the integration of renewables and reduce carbon footprints are gaining popularity.

Pricing Trends

Pricing in the substation automation market depends on the scope of automation, device complexity, network scalability, and system integration. Entry-level installations with basic monitoring and control features are relatively affordable, appealing to utilities with budget constraints. However, advanced digital substations equipped with high-end IEDs, SCADA systems, and AI-driven platforms involve higher capital expenditure.

Long-term cost savings in the form of reduced outages, improved asset life, and efficient maintenance justify the higher upfront investment. Vendors are now offering flexible financing options, including leasing and as-a-service models, which help reduce CAPEX burdens. Additionally, software-defined automation platforms are emerging as cost-effective solutions, providing modular upgrades and reducing hardware dependency.

Growth Factors

Several drivers are fueling the rapid expansion of the substation automation market:

- Grid Modernization Programs: Across North America, Europe, and Asia-Pacific, governments and utility companies are investing in modernizing aging grid infrastructure. Substation automation is at the heart of these initiatives, offering real-time control and improved grid reliability. National smart grid policies and incentive programs further boost investment in this segment.

- Rising Electricity Demand: Urbanization, industrial growth, and digitalization are propelling electricity consumption. To meet demand without overburdening grid systems, utilities are deploying automation technologies that optimize power flow, balance load, and minimize transmission losses.

- Integration of Renewable Energy: The increasing share of intermittent renewables in the energy mix necessitates more agile grid management. Automated substations facilitate real-time voltage and frequency regulation, smooth energy transitions, and improved DER coordination, supporting a more sustainable grid model.

- Emphasis on Cybersecurity: With growing digitalization comes the threat of cyberattacks on critical infrastructure. Advanced substation automation systems now incorporate cybersecurity features such as secure communication protocols, intrusion detection, and firmware authentication. This drives customer confidence and regulatory compliance.

Regulatory Landscape

Automation tools in substations are tightly regulated. Rules focus on safety, smooth function, and working across systems. Key frameworks and guidelines include:

- IEC 61850: It sets rules for networks used in utility automation. The goal is better teamwork between systems and easier design.

- IEEE Standards: IEEE C37.1 and C37.2 cover relay and control functions. These standards support safe and reliable grid operations.

- NERC CIP: In North America, NERC CIP standards are in place. They ensure strong cybersecurity across the energy sector.

- EU Directives: This includes the EU Network Code on System Operation. It also covers cybersecurity rules for smart grids in Europe.

Meeting these rules improves system performance and safety. This boosts trust and growth across the industry.

Recent Developments

Recent industry developments reflect technological breakthroughs, strategic partnerships, and increasing market dynamism:

- Digital Twin Technology: Digital twins are being launched by major companies. They model operations and support fault prediction and maintenance planning. This improves how assets are tracked and maintained. It also boosts the reliability of the whole system.

- AI and Edge Computing Integration: Substation automation now uses AI and edge computing. This allows quick local decisions and faster system responses.

- Cybersecure SCADA Systems: Cyber threats are pushing updates in SCADA tools. Modern platforms use deep security to stop attacks.

- Strategic Mergers: In 2024, Hitachi Energy and Schneider Electric teamed up. They built secure, shared automation tools for green substations, showing a trend toward market consolidation.

In March 2025, ABB and Charbone Hydrogen signed an agreement to develop up to 15 modular green hydrogen production facilities across North America over the next five years. The partnership will leverage ABB’s automation, electrification, and digital technologies to improve efficiency, scalability, and real-time monitoring of the plants.

Current and Potential Growth Implications

Demand-Supply Analysis

Utilities are putting more money into modern grid systems. This is driving strong growth in substation automation tech. More money is going into research and new plants. Suppliers are scaling up to serve the growing need. Supply chain problems affect key parts like semiconductors. This has slowed project rollouts in tough times.

Gap Analysis

The market is growing fast in many regions. But cost, skilled labor, and infrastructure gaps still exist. High setup costs limit digital substation projects. Utilities in low-income areas face funding issues. Trained staff for automation and communication is scarce. This gap makes full implementation harder. Closing these gaps needs the right support and tools. Training, funding, and scalable tech are key steps.

Top Companies in the Substation Automation Market

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Hitachi Energy Ltd.

- Eaton Corporation

- Schweitzer Engineering Laboratories, Inc.

- Cisco Systems, Inc.

- Mitsubishi Electric Corporation

- Honeywell International Inc.

Substation Automation Market: Report Snapshot

Segmentation | Details |

By Module | SCADA, Communication Networks, Intelligent Electronic Devices (IEDs), Others |

By Component | Hardware, Software, Services |

By Type | Transmission Substations, Distribution Substations |

By Installation Type | New Installations, Retrofit Installations |

By End-User | Utilities, Industrial, Commercial, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

Some of the fastest-growing segments in the market include:

- SCADA Systems: Utilities want better control and real-time monitoring. This is raising demand for SCADA in big substations.

- Communication Networks: Many systems now use IEC 61850 for smart communication. Fiber-optic networks also boost this segment’s growth.

- Retrofit Installations: Many older substations in developed areas need upgrades. Modern automation systems are key to these retrofits.

Major Innovations

Innovative developments are rapidly transforming the landscape:

- Modular Substation Platforms: Engineered systems come pre-packed and quick to install. This reduces setup time and need for extra workers.

- AI-Based Fault Prediction Tools: Intelligent IEDs powered by AI can spot problems instantly. They also assist in planning maintenance before failures occur.

- Cloud-Based Automation Platforms: Utilities now use secure and scalable tools to manage sites. These tools can be accessed remotely from any location.

Potential Growth Opportunities

The market presents several key growth opportunities:

- Expansion in Emerging Economies: Governments in Asia, Africa, and Latin America are funding power upgrades. These steps are raising demand for better grid systems.

- AI and IoT Integration: Live analytics and smart networks improve automation. They allow faster fixes and better upkeep planning.

- Utility-As-A-Service (UaaS): Cloud automation platforms offer flexible pricing based on usage. This helps companies lower financial barriers and adopt solutions more quickly.

Extrapolate Research says:

The substation automation market is set to grow fast. Firms now focus more on saving power and using clean energy. Supportive laws and tech advances are key drivers. They boost the need for intelligent automation tools.

Grids are getting smarter across regions. This makes substation automation a key need. Firms are making tools that connect and protect. These help tackle energy needs around the world. As tech reshapes energy systems, smart substations are vital. They help build clean and strong power networks.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Substation Automation Market Size

- July-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020