Smartphone Market Size, Share, Growth & Industry Analysis, By Product Type (Entry-Level Smartphones, Mid-Range Smartphones, Premium Smartphones, Foldable Smartphones) By Operating System (Android, iOS) By Distribution Channel (Online, Offline (Retail Stores, Carrier Stores)) By End-User (Individual Consumers, Enterprises, Educational Institutions), and Regional Analysis, 2024-2031

Smartphone Market: Global Share and Growth Trajectory

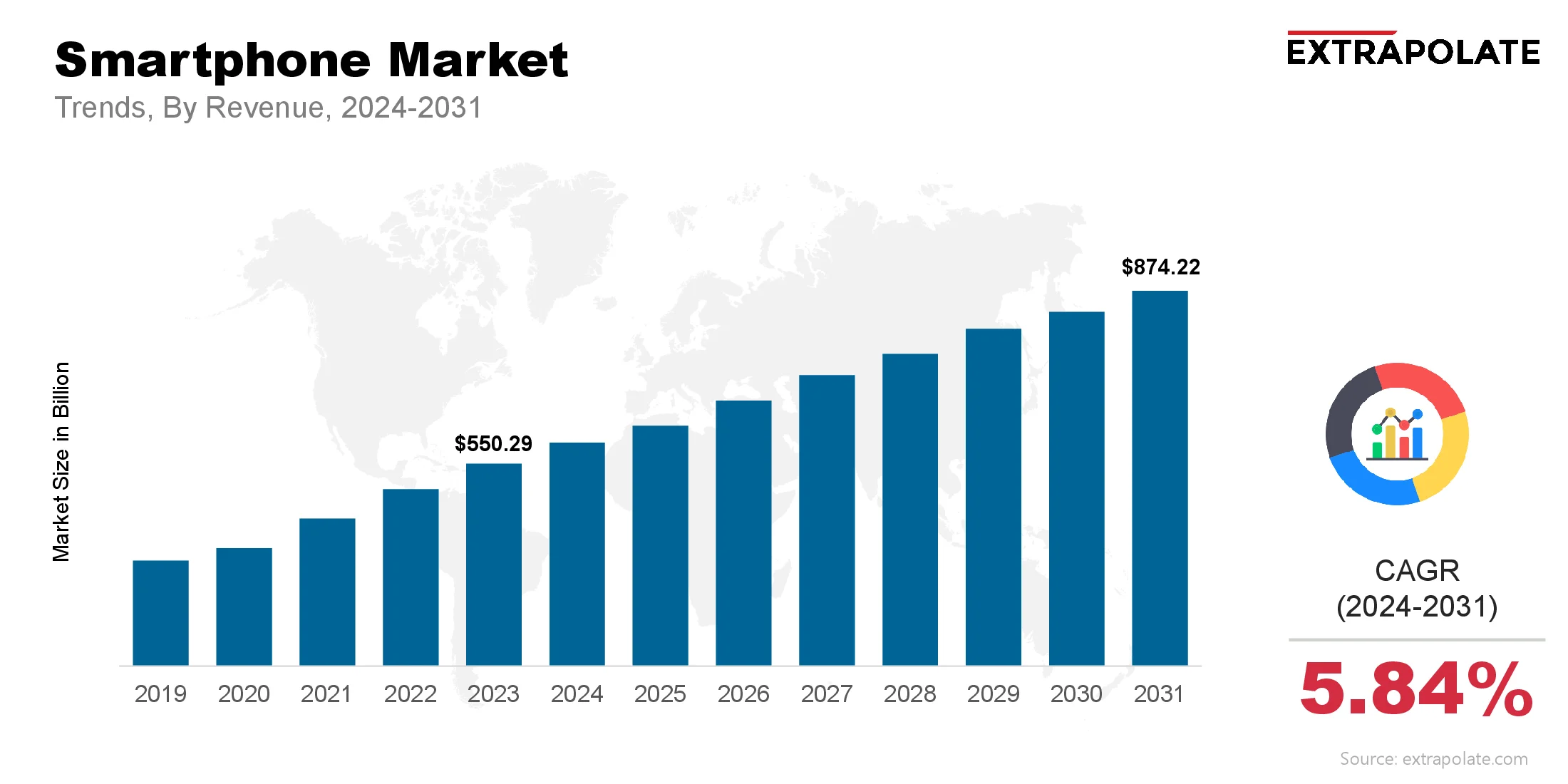

The global Smartphone Market size was valued at USD 550.29 billion in 2023 and is projected to grow from USD 587.40 billion in 2024 to USD 874.22 billion by 2031, exhibiting a CAGR of 5.84% during the forecast period.

The global smartphone market has transformed into one of the most dynamic and rapidly growing segments in the consumer electronics industry. With over 1.3 billion units shipped annually, smartphones are now considered indispensable tools in daily life, which serve as communication hubs, entertainment devices, productivity platforms, and digital wallets. As digital adoption rises worldwide, the smartphone market is prepared to experience steady growth in mature and developing economies.

Key factors fueling this upward trajectory include continuous technological innovation, growing internet penetration, the rollout of 5G networks, and rising demand for feature-rich devices across diverse price segments. Premium smartphones are becoming popular in developed markets like North America and Western Europe, where consumers prioritize performance, brand value, and ecosystem integration. Meanwhile, mid-range and budget smartphones dominate emerging markets in Asia-Pacific, Africa, and Latin America, fueled by increasing disposable incomes and affordable financing options.

The proliferation of smartphone brands and models has increased competition, motivating companies to differentiate through innovation in areas such as artificial intelligence, foldable displays, biometric security, and advanced camera systems. Moreover, software integration and ecosystem offerings like cloud storage, wearables, and smart home connectivity are becoming crucial growth enablers.

The Asia-Pacific region currently holds the largest market share, led by China, India, and Southeast Asia, which collectively account for a significant portion of global smartphone shipments. North America and Europe remain primary markets, characterized by higher average selling prices and premium device adoption.

As smartphone usage continues to increase across demographics and regions, the global market is expected to maintain strong growth. With digital transformation reshaping consumer behavior and lifestyle preferences, smartphones are set to remain central to global connectivity and innovation in the years ahead.

Key Market Trends Driving Product Adoption

Various trends are driving the widespread adoption of smartphones:

- 5G Connectivity Expansion: The global rollout of 5G networks is reforming the smartphone experience. With ultra-low latency and improved data speeds, 5G-enabled smartphones are enabling advanced applications from seamless streaming to cloud gaming and real-time AR/VR interaction. As telecom operators invest in infrastructure, the demand for 5G-capable smartphones is rising.

- Technological Convergence: Smartphones are advancing into all-in-one devices that combine photography, computing, health tracking, and smart home control. Innovations such as foldable displays, under-display fingerprint sensors, and AI-enhanced processors are reshaping the user experience. These advanced features are transforming consumer expectations and driving frequent upgrade cycles.

- Digital Lifestyle and Remote Work: The shift toward digital lifestyles intensified by the COVID-19 pandemic has made smartphones the primary access point for work, education, social interaction, and e-commerce. Remote work trends have led to an increase in demand for high-performance smartphones with strong cameras, fast processors, and large screens for video conferencing and multitasking.

- Growing Affordability in Emerging Markets: Affordable smartphones with premium features are delving into markets like India, Southeast Asia, and Africa. Local manufacturing, government incentives, and carrier-led financing models have made it easier for consumers in lower-income segments to access smartphones, substantially increasing the market base.

Major Players and Their Competitive Positioning

Big tech firms lead the global smartphone space with strong reach and brand power. But local brands grow fast by offering low prices, fast changes, and features made for local users. These brands stay ahead with fresh tech, strong ads, and better support. The top companies in this field include global leaders and fast-moving challengers: Apple Inc., Samsung Electronics Co., Ltd., Xiaomi Corporation, Oppo, Vivo, Huawei Technologies Co., Ltd., Transsion Holdings, OnePlus, Realme, and Google LLC (Pixel smartphones).

These brands each follow a set strategy. Some aim for top-end design, others for budget buyers or strong app support. Fierce market rivalry pushes fast phone launches. It also leads to custom plans and more tools or services.

Consumer Behavior Analysis

Smartphone buyers change preferences often, making behavior hard to predict. Brand trust and how people choose phones depend on many key drivers:

- Feature-Driven Demand: Consumers now evaluate technical specifications closely before purchasing a smartphone. The main focus is on camera, battery, screen, and how fast it runs. AI helps phones take better photos, which many users love. They also want smooth screen flow and fast battery charge.

- Brand Perception and Ecosystem Integration: Brand reputation plays a vital role, especially among high-end users. Consumers are inclined towards brands that offer seamless integration with wearables, laptops, tablets, and cloud services particularly in Apple’s and Samsung’s ecosystems.

- Pricing Sensitivity and Financing: While premium segments remain durable, consumers conscious about prices control the market. Flexible EMI options, trade-in programs, and carrier subsidies have made mid-range and flagship phones easy to access, especially in developing economies.

- Preference for Online Shopping: Online channels are expanding rapidly as primary sales platforms, particularly post-pandemic. Flash sales, exclusive online models, and deep discounts attract consumers to e-commerce, transforming the distribution landscape.

Pricing Trends

Pricing dynamics in the smartphone market differ on basis of brand, segment, and region. The market is divided into entry-level (below $200), mid-range ($200–$600), and premium (above $600) categories. The premium smartphone segment experiences minimal price flexibility, while competitive pressures in the mid and low-end markets commonly drive brands to engage in price wars.

Recent trends include:

- Increasing Average Selling Price (ASP) in developed markets due to high-end model popularity.

- Aggressive Pricing Strategies by Chinese OEMs (e.g., Xiaomi, Realme, and Vivo) to capture emerging markets.

- Innovative Financing Models such as “Buy Now, Pay Later” and carrier bundling to increase affordability.

In areas where few people own smartphones, buyers look for good value. A strong balance between price and performance is key to sales.

Growth Factors

Multiple elements are contributing to the growth of the smartphone market:

- Global Internet Penetration: First-time internet users in remote and low-income regions rely on smartphones. This trend drives the need for affordable phones that use less data.

- Rising Demand for Advanced Features: People use smartphones for everything from payments to video calls. As usage grows, they look for faster chips, better lenses, and smart tools powered by AI. This trend pushes faster hardware cycles. People now compare phones closely before buying, focusing on what meets their needs best.

- Government and Regulatory Support: Governments in India and Brazil back smartphone assembly with financial incentives and better infrastructure. These steps improve supply chains and make phones more affordable.

- Enterprise and Education Sectors: The role of smartphones in daily operations is expanding. They enable flexible work setups in businesses and improve learning access in remote and hybrid education models. Phones are now used more in business and employee settings. This adds new value and drives market expansion.

Regulatory Landscape

Laws for smartphones focus on user safety, privacy, wireless rules, and green practices. Important points include safe use, clean tech, and secure data handling:

- Radiation and SAR Compliance: To protect user health, phones are tested for radiation exposure. They must follow Specific Absorption Rate rules set by bodies such as the Federal Communications Commission and the Bureau of Indian Standards.

- E-waste and Recycling Regulations: Growing e-waste has led to new laws in several nations. Phone makers are required to collect and recycle old products.

- Data Privacy Laws: Laws such as GDPR and CCPA set strict data rules. Phones with voice and face tools must meet them to guard user privacy.

Rules for labeling, wireless spectrum, and app control differ by region. These factors influence phone features and where they can be sold.

Recent Developments

Several developments continue to shape the smartphone market’s trajectory:

- Rise of Foldable Smartphones: Foldables are gaining traction with support from brands like Samsung, Huawei, and Motorola. The mix of small bodies and large displays appeals to many users.

- Chipset Innovation: Chips like Apple’s A17 Bionic and Snapdragon 8 Gen 3 use less power and run AI tasks faster. They also boost graphics, making high-end phones perform better.

In July 2025, Nothing launched the Phone (3) featuring a Snapdragon 8s Gen 4 chip, triple 50 MP cameras, and a 6.67" AMOLED display. It includes a unique Glyph interface with 489 LEDs and runs on Nothing OS 3.5 (Android 15).

- Environmental Consciousness: E-waste is a growing concern in the tech industry. Brands now reduce it through simple packaging, durable builds, and longer software lifecycles.

- AI Integration: AI in phones boosts image quality, helps with languages, and saves battery. It also makes digital assistants more useful.

Current and Potential Growth Implications

Demand-Supply Analysis: Companies saw supply chain delays during the pandemic. Many added suppliers and built local units to stay on track. In some segments, demand is still higher than supply. This is especially true for 5G phones in markets where price matters most.

Gap Analysis: Buyers in fast-growing regions look for advanced phones. Yet, cost remains a barrier, pointing to the need for affordable models with strong features. To close this gap, OEMs must cut costs by improving manufacturing. They also need lighter software and strong financing deals to reach low-income buyers.

Top Companies in the Smartphone Market

- Apple Inc.

- Samsung Electronics

- Xiaomi Corporation

- Vivo

- Oppo

- Huawei

- Realme

- Google (Pixel)

- OnePlus

- Transsion Holdings

Companies protect their market share by focusing on what they do best. That could be sleek design, OS control, strong sales channels, or constant innovation.

Smartphone Market: Report Snapshot

Segmentation | Details |

By Product Type | Entry-Level Smartphones, Mid-Range Smartphones, Premium Smartphones, Foldable Smartphones |

By Operating System | Android, iOS |

By Distribution Channel | Online, Offline (Retail Stores, Carrier Stores) |

By End-User | Individual Consumers, Enterprises, Educational Institutions |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Smartphone Market: High Growth Segments

Segments expected to exhibit significant growth include:

- 5G Smartphones: 5G is spreading fast as networks grow and prices fall. Many mid and high-end phones now offer 5G for better speed and use.

- Foldable Devices: Phones with foldable screens offer fresh features and a new user experience. Tech-forward users are driving this trend.

- Mid-Range Smartphones: The $200–$600 smartphone segment is growing quickly. Affordable phones with top features attract more users.

Major Innovations

Key innovations transforming the smartphone market:

- Foldable and Rollable Screens: With OLED, displays can be flexible. This allows compact phones to have larger viewing space when opened.

- AI Photography and Computational Imaging: Smartphones now handle tough photo conditions better. AI and added lenses boost image quality in low light and motion.

- Battery Innovations: Users want longer battery life and quicker charging. Fast-charging, health tracking, and solid-state research are meeting these needs.

- Smartphone Market: Potential Growth Opportunities

- Future growth in the smartphone market can be unlocked through:

- Emerging Market Penetration: Access to smartphones is low in some areas of Africa and Asia. Growth is possible with local apps and affordable pricing.

- Software and Service Integration: Services like cloud storage, finance apps, and health tools keep users loyal. These features make them less likely to switch. These bundles also boost repeat income for brands.

- Smartphone-as-a-Service (SaaS) Models: High-end phones cost less upfront with leasing plans. This helps more people access premium models. This model also keeps customers connected to brands over time.

Extrapolate Research says:

The global smartphone market shows steady growth. Rising digital use drives strong demand. Tech progress and wider internet access are shaping demand. Shifts in how people use phones are also speeding up growth. More users now look for phones with AI and 5G. High-performance models are in demand across all age groups.

Leaders in the market are building full device ecosystems and standing out with special features. They tailor their approach to fit each region. Foldables and AI-powered tools are setting new trends. These changes are raising the bar for what users look for in a phone. Mobile-first habits and rising digital use keep smartphones in focus. They drive key gains for both consumers and companies.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Smartphone Market Size

- July-2025

- 148

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020