Mobile Hotspot Router Market Size, Share, Growth & Industry Analysis, By Type (3G Routers, 4G LTE Routers, 5G Routers), By Application (Residential, Commercial, Industrial, Travel and Tourism, Emergency Services), By End-User (Individuals, Enterprises, Government Organizations, Educational Institutions), Regional Analysis, 2024-2031

Mobile Hotspot Router Market: Global Share and Growth Trajectory

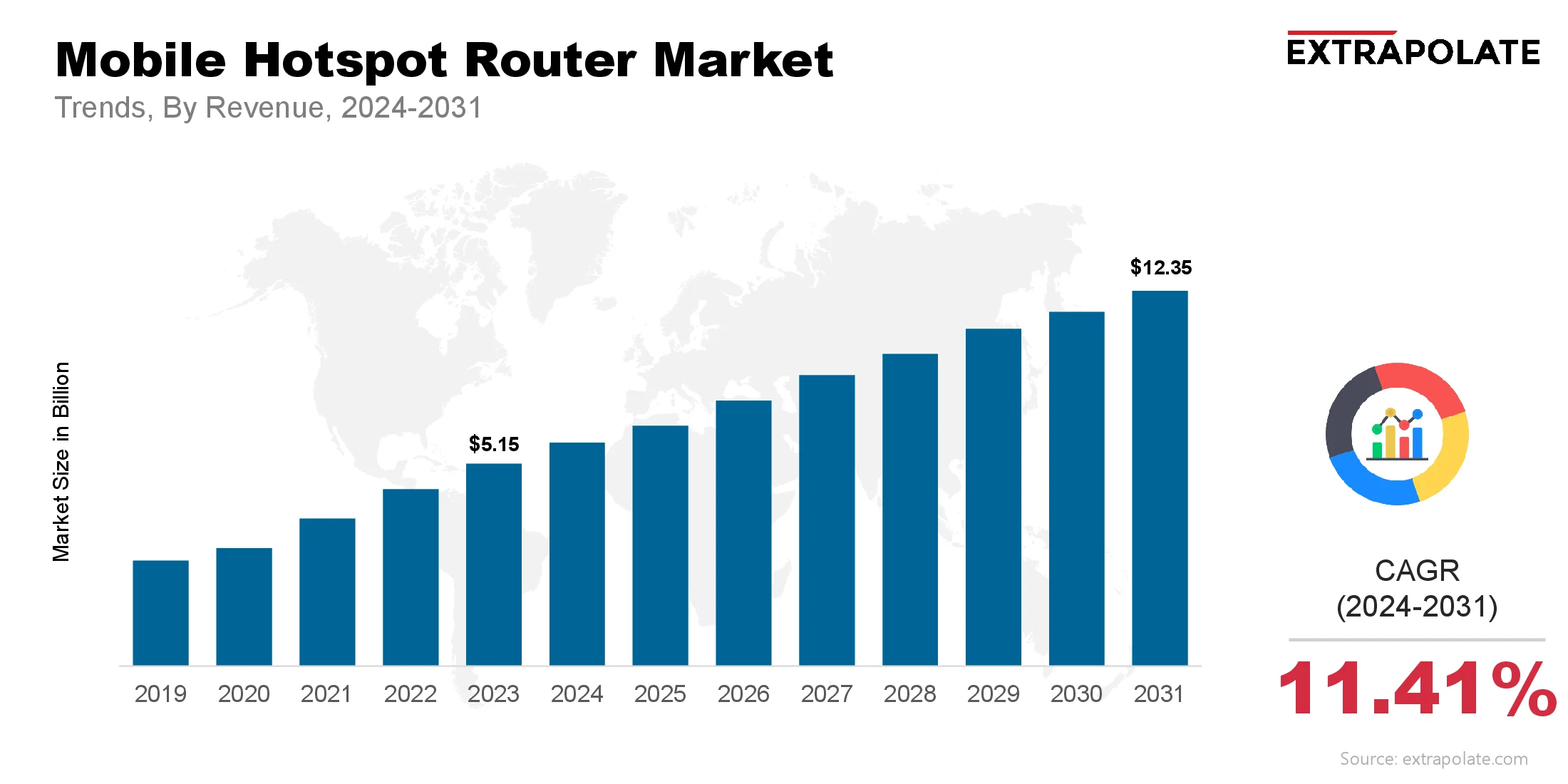

The global Mobile Hotspot Router Market size was valued at USD 5.15 billion in 2023 and is projected to grow from USD 5.79 billion in 2024 to USD 12.35 billion by 2031, exhibiting a CAGR of 11.41% during the forecast period.

The global mobile hotspot router market is experiencing rapid growth, fueled by the ever-growing demand for continous internet connectivity. As the world moves toward more flexible and mobile work, consumers and businesses alike are seeking robust and portable solutions to stay online. Mobile hotspot routers are emerging as vital tools, offering users access to secure, high-speed internet wherever cellular coverage is available.

This rise in demand is powered by multiple factors: the explosion of remote work, widespread smartphone and IoT device usage, and rapid development in 5G infrastructure. Whether it’s travelers wanting to avoid expensive roaming charges, remote workers needing reliable internet, or enterprises equipping field teams with secure connections, mobile hotspot routers are rapidly becoming a standard digital necessity.

With increasing investments in telecommunication networks, the deployment of LTE and 5G technologies, and an expanding base of tech-savvy users, the mobile hotspot router market is poised for significant and steady growth over the coming years.

Key Market Trends Driving Product Adoption

Various trends are shaping the adoption and expansion of mobile hotspot routers:

- 5G Network Rollout and Connectivity Boom: One of the most important catalysts is the global rollout of 5G technology. These next-generation networks provide increased bandwidth, ultra-low latency, and the ability to connect a large number of devices simultaneously. Mobile hotspot routers compatible with 5G are quickly replacing their 4G counterparts as users seek faster speeds and more reliable connections. Inseego and Verizon jointly launched a ruggedized 5G mobile hotspot router targeted at enterprise users in construction, logistics, and field services. It supports multi-band 5G and CBRS, comes with remote device management tools, and boasts long battery life, making it ideal for demanding, mobile work environments.

- Increased Demand for Remote and Hybrid Work Solutions: The pandemic permanently transformed how the world works. A large section of the workforce now operates in hybrid or fully remote roles. As a result, dependable internet connectivity is crucial not just at home, but also during travel or in remote areas. Mobile hotspot routers provide a flexible solution for this demand, specifically in regions where wired broadband is unavailable or unreliable.

- Proliferation of IoT Devices: With the proliferation of Internet of Things (IoT) devices in both consumer and industrial settings, there is a growth in need for reliable internet access beyond traditional network boundaries. Mobile hotspots are being used to provide network access in moving vehicles, temporary installations, and field operations enabling smart devices to remain connected across locations.

- Growing Popularity of SIM-Free and eSIM Technologies: Technological innovations like eSIM and SIM-free options are transforming how we connect. They offer more flexibility and convenience for mobile users. These advances allow smooth moves between providers. They cut down on device limits and boost international roaming ease. Hotspot devices integrated with eSIM offer flexible connectivity. This allows users to change networks quickly and hassle-free.

Major Players and their Competitive Positioning

Big networking giants and tech startups fill the hotspot router market. This creates a highly competitive environment. Manufacturers update their devices to include new wireless protocols. Battery efficiency and enhanced security are also key focus areas.

Leading players included are Netgear Inc., Huawei Technologies Co., Ltd., TP-Link Technologies Co., Ltd., ZTE Corporation, D-Link Corporation, Samsung Electronics Co., Ltd., Inseego Corp., Xiaomi Corporation, Alcatel-Lucent, Teldat Group and others. Collaboration with telecoms helps improve device functions. Features such as beamforming, MU-MIMO, and Wi-Fi 6 boost performance. Market competition is fierce and increasing. Companies with top technology and loyal users win more market share.

Consumer Behavior Analysis

Rising digital dependence drives consumer behavior in this market. Higher connectivity needs and lifestyle shifts influence their decisions:

- Preference for Portability and Performance: Compact and lightweight designs appeal to users. Strong and stable connections are needed across different environments. Consumers want lightweight routers with long-lasting power. They also value the ability to connect many devices at once.

- Awareness of Data Security: As online risks grow, built-in protection features matter more. Users prefer hotspot routers that offer VPNs, WPA3, and firewalls. Working from home or on the go can expose data to threats. Secure connections help protect sensitive corporate details.

- Brand Reputation and Reviews: Buyers often rely on digital content before choosing a device. Reviews, video demos, and personal recommendations influence what they buy. Buyers look for reliable brands that offer solid product performance. They also value responsive service and regular software support.

- Subscription Bundling: Routers are often bundled with mobile service deals. This makes price and flexible data plans key selling points. Devices that work with various carriers are in high demand. Simple SIM swapping helps users choose the best plan available at any time.

Pricing Trends

Device power and wireless tech affect pricing. Stronger brands and 5G-ready models often cost more. Entry-level 4G models are typically priced between $40–$100, making them easy to access for most users. Premium 5G-capable routers, however, can exceed $300 due to enhanced speed, greater range, and increased device support.

With more 5G coverage and larger production runs, costs go down. This will make 5G routers more affordable for users. To reduce upfront costs, brands offer more buying options. They include EMIs, device-data bundles, and finance deals.

Growth Factors

Various factors are contributing to the continued expansion of the mobile hotspot router market:

- Rapid Digitization Across Sectors: Digital change is happening in schools, hospitals, stores, and transit systems. These areas need fast and reliable connections to keep up. These devices offer rapid network access in minutes. They serve well in short-term setups like events or mobile clinics.

- Network Infrastructure Development: Telecom growth is booming in developing regions. Firms are investing heavily in new infrastructure. Mobile router sales grow with LTE and 5G rollouts. They help connect places with limited network access.

- Travel and Tourism Rebound: With global travel returning, hotspot use is growing. Tourists choose them to skip costly roaming fees. Hotspots let users avoid pricey international data plans. They offer smooth and steady web access while traveling.

- Government and Disaster Response Use Cases: Mobile routers play a big role in disaster response. They provide quick internet when other systems fail. At disaster sites or major events, mobile routers create pop-up networks. They connect rescue teams, base camps, and public update points.

Regulatory Landscape

Many rules apply to mobile hotspot routers worldwide. They cover how signals are used and how data is kept safe:

- FCC Certification (U.S.): The FCC sets limits for device interference and emissions. Products must follow these rules, especially on licensed bands.

- CE Marking (Europe): To enter the European market, products need the CE mark. It ensures compliance with EU standards for safety, health, and eco protection.

- RoHS and WEEE Compliance: Rules like RoHS limit toxic parts in devices. WEEE guides how to collect and recycle them).

- Carrier Locking and SIM Regulations: Locked phones are not allowed in some regions. They must show how SIMs and networks work.

Market Highlights

Several recent developments underscore the evolving landscape of the mobile hotspot router market:

- Launch of 5G Mobile Hotspot Devices: Netgear and Inseego now offer advanced 5G hotspots equipped with Wi-Fi 6 and multi-antenna systems. They allow up to 32 devices to connect simultaneously, boosting speed and stability.

- Strategic Partnerships with Telecom Providers: Device makers are working with major mobile carriers across different regions. Through these partnerships, brands offer service bundles suited to specific user need.

- Expansion of eSIM-Based Hotspots: New eSIM-enabled routers by Huawei and Xiaomi offer seamless network switching. These devices are tailored for users who need reliable connectivity across regions.

- AI and Remote Management: Advanced features like AI-based controls and remote checks are now standard in some routers. They improve user control while making the network faster and more reliable.

Current and Potential Growth Implications

- Demand-Supply Analysis: Rising demand for routers is pushing manufacturers to expand output. However, they continue to face hurdles such as material shortages and supply chain delays. Production is sometimes limited by global chip shortages and logistics issues. Yet, growing consumer use supports steady demand and a promising market future.

- Gap Analysis: 4G routers are common in mature markets with strong infrastructure. In contrast, developing regions struggle with poor access and higher prices. To improve access, both device pricing and mobile coverage must improve. Government and NGO-led subsidies can make these technologies more reachable for low-income groups. Additionally, the industry must address demand for greater battery life and ruggedized models for industrial use.

Top Companies in the Mobile Hotspot Router Market

Leading players driving innovation and growth in the mobile hotspot router industry include:

- Netgear Inc.

- Huawei Technologies Co., Ltd.

- TP-Link Technologies Co., Ltd.

- ZTE Corporation

- D-Link Corporation

- Samsung Electronics Co., Ltd.

- Inseego Corp.

- Xiaomi Corporation

- Alcatel-Lucent

- Teldat Group

Heavy R&D investment is driving device innovation across the market. New models are built for speed, smart features, and efficiency serving everyone from mobile users to corporate teams.

SIMO Solis Go unveiled at CES on January 2025, this 4G LTE mobile hotspot doubles as an 8,000 mAh power bank and uses virtual SIM (vSIM) tech to support multi‑carrier connectivity and charge up to 10 devices simultaneously.

Mobile Hotspot Router Market: Report Snapshot

Segmentation | Details |

By Type | 3G Routers, 4G LTE Routers, 5G Routers |

By Application | Residential, Commercial, Industrial, Travel and Tourism, Emergency Services |

By End-User | Individuals, Enterprises, Government Organizations, Educational Institutions |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

Some segments in the mobile hotspot router market are showing high growth:

- 5G Routers: The rise of 5G is fueling rapid adoption of next-gen routers. Users prefer them for their superior speed, stability, and ability to handle more devices.

- Commercial and Enterprise Use: Mobile hotspots are helping businesses stay connected beyond the office. They offer secure and flexible internet access for field and remote staff.

Major Innovations

The market is witnessing a stream of technological innovations:

- Wi-Fi 6 and Wi-Fi 6E Integration: With support for advanced Wi-Fi standards, new routers perform better. Users benefit from faster internet, longer range, and smoother connections.

- Battery Optimization Technologies: Modern mobile hotspots now feature intelligent power management, extending battery life and offering power bank capabilities.

- Multi-Network and Global Roaming Support: With dual-SIM or eSIM, premium routers connect to more than one network. This ensures users stay online even if one provider fails.

Potential Growth Opportunities

There are numerous opportunities for growth in the mobile hotspot router space:

- Expansion into Rural and Remote Areas: In many places, poor infrastructure limits broadband access. Mobile hotspots help fill this gap by offering wireless connectivity. To support equal access, governments and NGOs are getting involved. They deploy mobile hotspots in areas with little or no connectivity.

- Enterprise Adoption in Construction and Logistics: Sectors with mobile workforces, such as transport and construction, face unique connectivity needs. These devices provide internet access wherever the team goes. As a result, operations can continue without delays or disconnects.

- Integration with Smart Devices and Vehicles: Vehicles and smart systems now use built-in hotspot routers. These offer mobile internet, media access, and GPS-based services.

Extrapolate Research says:

Growth in the mobile hotspot router market is picking up speed. This is due to rising needs for wireless freedom and constant internet access. With the rise of flexible work and connected infrastructure, reliable internet is a must. Mobile hotspots are stepping in as vital tools for daily use.

New hotspot models include advanced tech like 5G and Wi-Fi 6. This makes them more efficient, secure, and ready for heavy use. On-the-go internet and digital access are now daily needs. Mobile hotspots are set to become vital for future connectivity.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Mobile Hotspot Router Market Size

- July-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020