Microminiature Connector Market Size, Share, Growth & Industry Analysis, By Product Type (Circular Connectors, Rectangular Connectors, Board-to-Board, Cable-to-Board, I/O Connectors), By Application (Aerospace & Defense, Medical Devices, Consumer Electronics, Telecommunications, Industrial), By End-User (OEMs, System Integrators, Military Contractors, Healthcare Providers), and Regional Analysis, 2024-2031

Microminiature Connector Market: Global Share and Growth Trajectory

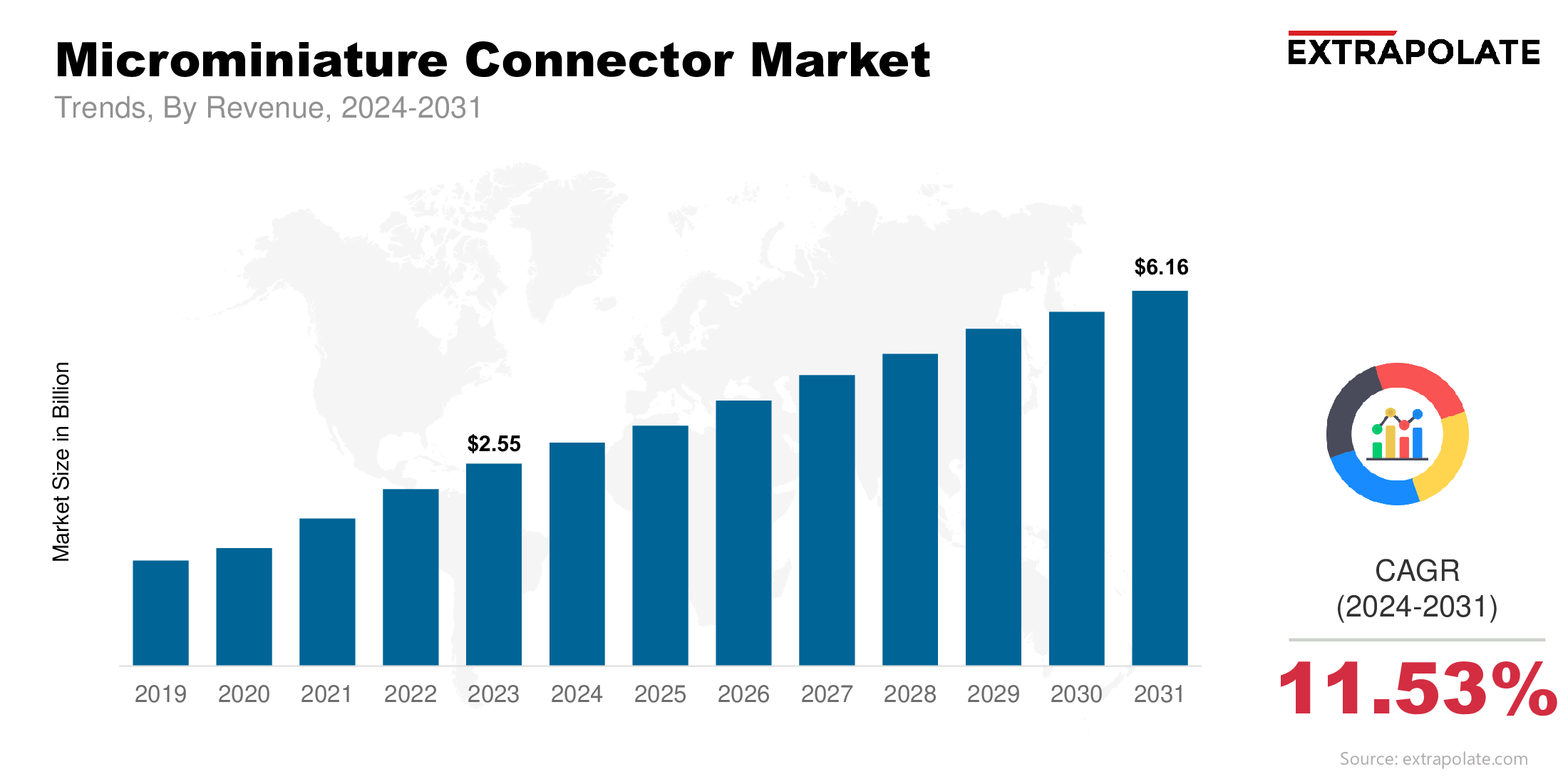

The global Microminiature Connector Market size was valued at USD 2.55 billion in 2023 and is projected to grow from USD 2.86 billion in 2024 to USD 6.16 billion by 2031, exhibiting a CAGR of 11.5% during the forecast period.

The microminiature connector market is growing globally as demand for compact high performance electronic components is increasing across multiple industries. These tiny connectors are used in space constrained applications especially in aerospace, defense, medical devices, telecommunications and consumer electronics. As technology advances there is a clear shift towards smaller, lighter and more efficient systems and microminiature connectors are the enabler of next gen innovations.

One of the key drivers of this market is the surge in demand for miniaturized electronic devices and wearables. Along with that the trend of automation, smart devices and portable healthcare equipment is further emphasizing the need for reliable high density interconnect solutions. Microminiature connectors meet these requirements with their excellent signal integrity, durability and resistance to harsh environments including vibrations, moisture and extreme temperatures.

Aerospace and defense are big contributors to the market growth, using these connectors in satellites, UAVs and tactical communication systems. In medical field they are being used in minimally invasive surgical tools, diagnostic devices and wearable monitors. These applications require not only small form factors but also high reliability and compliance to strict safety standards.

Key Market Trends Driving Product Adoption

Several key trends are driving the growth and adoption of microminiature connectors:

- Miniaturization of Electronics

One of the biggest trends is miniaturization From wearables to medical implants, industries are shrinking their products while expecting more performance. This means microminiature connectors are needed to transmit high data in small space. Their role in enabling compact, light and multi-functional products is crucial for future innovation.

- Aerospace and Defense

In aerospace and military, size, weight and power (SWaP) matters. Equipment like UAVs, satellites and advanced radar systems use microminiature connectors for secure high speed data transfer in extreme conditions. Their ruggedness and high performance under vibration, shock and temperature fluctuations make them perfect for military grade applications.

- High-Speed Data Transfer

As real-time communication demand grows, especially in telecom and automotive, the need for connectors that can support high speed data transfer becomes critical. Microminiature connectors are designed for these applications, low latency, high fidelity signal transmission across complex electronic systems .

- Medical and Healthcare Adoption

The healthcare industry is adopting microminiature connectors in diagnostic equipment, wearables and surgical tools. These connectors enable accurate and real-time health data transmission while ensuring biocompatibility and reliability. With the growing adoption of portable medical devices, their market share in healthcare is increasing.

Major Players and their Competitive Positioning

The microminiature connector market is moderately fragmented, with several leading companies competing through innovation, customized solutions, and strategic partnerships. Key market participants include are TE Connectivity, Amphenol Corporation, Molex LLC (a Koch Industries company), Hirose Electric Co., Ltd., ITT Inc., Glenair, Inc., Samtec, Inc., Omnetics Connector Corporation, Fischer Connectors, Harwin PLC and other.

These players are consistently developing robust microminiature connectors with enhanced current-carrying capacity, shielding options, and multi-contact configurations. Strategic collaborations with OEMs and the launch of specialized connector solutions for vertical applications are further helping them cement their market positions.

Consumer Behavior Analysis

Consumer behavior in the microminiature connector market is influenced by several evolving factors:

- Performance and Durability

End-users want connectors that perform stable under environmental stress. Whether in satellites, hearing aids or surgical tools, the demand is for signal integrity and resistance to corrosion, moisture and mechanical wear.

- Customization

OEMs across industries want connectors tailored to their application needs. This has led to growing demand for customized microminiature connectors with specific pin counts, locking mechanisms, cable assemblies and unique form factors.

- Quality and Compliance

Defense and healthcare industries have strict compliance requirements. Buyers look for products that meet or exceed MIL-DTL, RoHS or ISO 13485. Reliability and compliance is becoming a key buying decision.

- Cost Considerations

Microminiature connectors are more expensive than standard connectors due to precision engineering. But buyers are seeing the value in terms of product life, reduced maintenance and better performance. So the market is becoming more open to premium high quality products.

Pricing

Microminiature connector pricing varies by material (e.g. gold plated contacts, stainless steel housing), design complexity and industry specific certifications. Aerospace and medical grade connectors are more expensive due to additional testing and compliance requirements.

The market is also seeing cost effective solutions for mid-tier applications in consumer electronics and industrial automation. Some manufacturers are offering modular designs and volume pricing to attract OEM partnerships and scale deployments.

Growth Factors

Several fundamental and emerging factors are driving the microminiature connector market:

- IoT and Wearable Devices: The rise of IoT and wearables (smartwatches, AR/VR headsets, fitness trackers) demands ultra compact and high performance connectors. The microminiature connector is the backbone of connectivity in these devices.

- Satellite and UAV Launches: The aerospace industry is seeing a surge in satellite deployments and UAV development. Both require lightweight, high density connectors that can withstand radiation, high G forces and thermal variations. This is the fastest growing segment in the market.

- Electrification of Vehicles: As automotive OEMs move to electric and hybrid vehicles, electronic complexity in vehicles increases. Microminiature connectors are used in ADAS, infotainment units, sensors and battery management systems.

- Connector Technology Advancements: Push-pull locking mechanisms, high speed transmission protocols (USB 3.1, HDMI, Thunderbolt) and material engineering are enhancing the value proposition of microminiature connectors. This is opening up new use cases.

Regulatory Landscape

The microminiature connector market operates in a well regulated environment that ensures product reliability and industry compliance:

- MIL-DTL Standards: Military connectors must meet the Department of Defense’s durability and reliability requirements.

- RoHS Compliance: Products especially in Europe must comply with the Restriction of Hazardous Substances Directive, limiting harmful materials.

- ISO 13485 & FDA: For medical applications, connectors must comply with medical device specific quality standards.

- IEC & UL Standards: Ensures safe use of connectors in industrial, telecommunication and consumer electronics sectors.

Strict adherence to these standards builds consumer trust and allows suppliers to access international markets more easily.

Recent Developments

Several developments are shaping the microminiature connector market landscape:

- Ultra-High-Density Connectors: Samtec and Harwin have launched microminiature connectors that can support >40 Gbps data rates, required for high speed computing and telecom applications.

- Strategic Acquisitions: TE Connectivity and Amphenol have acquired smaller players to expand their microminiature product range and enter new markets.

- Medical Innovation: Omnetics and Fischer Connectors are introducing sterilizable, biocompatible connectors for MRI machines, insulin pumps and minimally invasive surgical tools.

- Ruggedized Solutions for Space Missions: Glenair and ITT Cannon are expanding their range of space qualified microminiature connectors to support commercial and defense satellite projects.

These milestones underline the dynamic innovation landscape within the market.

Current and Potential Growth Implications

a. Demand-Supply Analysis

As demand for smaller, more powerful electronics grows, suppliers are increasing production capacity. But supply chain constraints, raw material price fluctuations and skilled labor shortages sometimes limit capacity. Manufacturers are investing in automation and precision manufacturing to bridge the gap and meet global demand.

b. Gap Analysis

Innovation is happening but cost and availability is still a barrier to adoption in low resource markets. For example startups and small manufacturers can’t access high quality microminiature connectors due to minimum order quantities or long lead times. Standardization across connector types is also a challenge causing interoperability issues. The industry is working on modularity and universal interface to solve these challenges and expand the customer base.

Top Companies in the Microminiature Connector Market

The leading companies include:

- TE Connectivity

- Amphenol Corporation

- Molex LLC (a Koch Industries company)

- Hirose Electric Co., Ltd.

- ITT Inc.

- Glenair, Inc.

- Samtec, Inc.

- Omnetics Connector Corporation

- Fischer Connectors

- Harwin PLC

Microminiature Connector Market: Report Snapshot

Segmentation | Details |

By Product Type | Circular Connectors, Rectangular Connectors, Board-to-Board, Cable-to-Board, I/O Connectors |

By Application | Aerospace & Defense, Medical Devices, Consumer Electronics, Telecommunications, Industrial |

By End-User | OEMs, System Integrators, Military Contractors, Healthcare Providers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Aerospace & Defense: High demand for SWaP-optimized solutions in satellites, avionics, and combat systems.

- Medical Devices: Rising use in wearable monitors, hearing aids, and surgical instruments.

- Telecommunications: Increasing deployment in 5G infrastructure and fiber optic networks.

Major Innovations

- Nano-D Connectors: Provide ultra-compact connectivity solutions with high contact density.

- Push-Pull Locking Systems: Improve ease of use in confined spaces.

- Hybrid Connectors: Combine power and signal in a single miniature interface.

- High-Frequency Designs: Support data rates beyond 40 Gbps.

Potential Growth Opportunities

- Emerging Economies: Rising industrialization and urbanization are increasing the adoption of advanced electronics in regions like Southeast Asia, Latin America, and Africa.

- Medical Robotics and Surgical Tools: As robotic-assisted procedures increase, demand for microminiature connectors in medical robotics grows.

- 5G and Edge Computing: The roll-out of 5G networks and edge data centers will require compact connectors with high-speed capabilities.

Extrapolate Research says:

The microminiature connector market is poised for substantial growth. As electronic designs continue to shrink and become more complex, demand for high-performance, compact connectors is accelerating. Innovations in materials, signal integrity, and ruggedization are unlocking new applications across industries. The market’s trajectory is upward, driven by a powerful convergence of technology, design trends, and global demand for precision connectivity.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Microminiature Connector Market Size

- June-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020