Low Voltage Vacuum Contactor Market Size, Share, Growth & Industry Analysis, By Voltage Class (≤1kV, 1-3.6kV, 3.6-7.2kV) By Application (Motor Control, Transformer Switching, Capacitor Switching, Lighting Control) By End-User (Industrial, Commercial, Utilities, Transportation, Mining), and Regional Analysis, 2024-2031

Low Voltage Vacuum Contactor Market: Global Share and Growth Trajectory

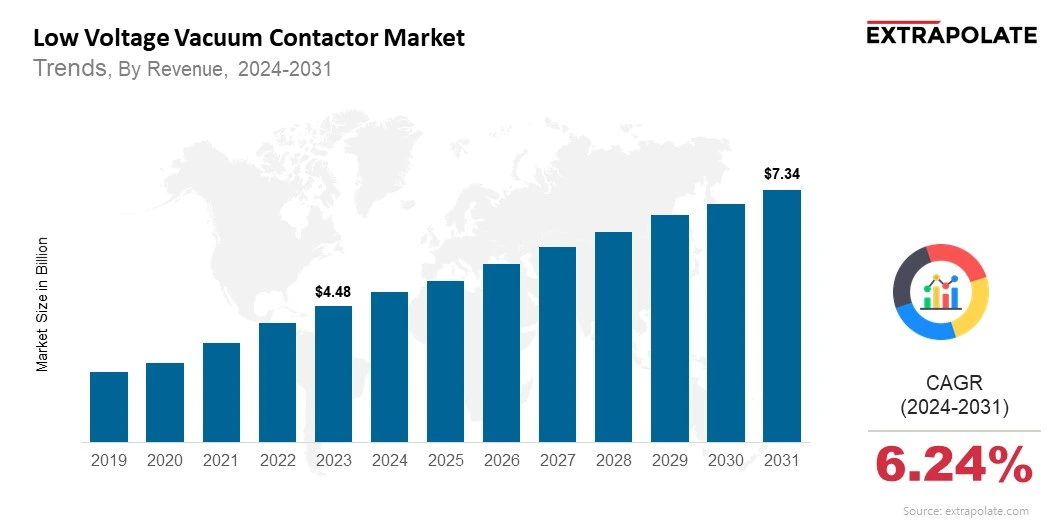

The global Low Voltage Vacuum Contactor Market size was valued at USD 4.48 billion in 2023 and is projected to grow from USD 4.80 billion in 2024 to USD 7.34 billion by 2031, exhibiting a CAGR of 6.24% during the forecast period.

The global low voltage vacuum contactor market is poised for sustained growth, driven by increasing industrial electrification, smart grid deployment, and the push for automation across diverse sectors. These contactors are integral in managing and controlling electric circuits, offering arc-free switching, long operational life, and reduced maintenance compared to traditional contactors. As industries demand safer, more efficient electrical systems, low voltage vacuum contactors have emerged as a preferred solution.

This market is gaining significant traction across industries such as manufacturing, utilities, mining, transportation, and oil & gas. The robust performance of vacuum contactors in harsh environments and their ability to handle frequent switching cycles make them ideal for mission-critical operations. Furthermore, the expansion of renewable energy systems and distributed power generation is reinforcing demand, as these systems require reliable switching equipment to ensure stability and safety.

Regionally, Asia-Pacific dominates the market owing to rapid industrialization, infrastructure development, and favorable government initiatives promoting energy efficiency. Countries like China and India are investing heavily in grid modernization and electrified transport, creating strong opportunities for market players. North America and Europe follow closely, supported by advancements in industrial automation and strict safety regulations.

Technological innovation is further propelling market growth. Manufacturers are developing contactors integrated with smart diagnostics, IoT compatibility, and condition monitoring to meet the needs of digitally connected industrial systems. These developments are enhancing operational transparency, reducing downtime, and optimizing energy use.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

- Industrial Automation and Electrification:

A global push for industrial automation is prompting widespread adoption of low voltage vacuum contactors. Automated processes require reliable, fast-switching devices, and vacuum contactors deliver just that. In sectors like manufacturing and utilities, where operational uptime and equipment safety are critical, these contactors are becoming indispensable components. - Rise in Renewable Energy Installations:

As solar and wind installations grow worldwide, so does the need for reliable switching devices within power systems. Low voltage vacuum contactors are ideal for these applications, offering fault-tolerant operation and arc-less switching. Their increasing deployment in inverter circuits and distributed energy resources highlights a significant trend in clean energy integration. - Smart Grids and Digital Substations:

The development of smart grids and digital substations is reshaping electrical infrastructure. These advanced systems require compact, efficient, and remotely operable switchgear—qualities inherent to vacuum contactors. Integration with IoT and condition-monitoring capabilities is opening up new frontiers in grid intelligence and control. - Growing Demand from the Transportation Sector:

Railways and electric vehicles (EVs) increasingly depend on robust electrical components for safety and performance. Low voltage vacuum contactors, with their high reliability and fast response, are now key elements in traction systems, auxiliary circuits, and charging infrastructure. Their ability to handle frequent operations without wear has accelerated their adoption in transport applications.

Major Players and their Competitive Positioning

The low voltage vacuum contactor market is marked by strong competition among global electrical equipment manufacturers. Companies are investing in technological innovation, product reliability, and energy efficiency to secure market share. Key players dominating this competitive space include: - Schneider Electric SE, ABB Ltd., Siemens AG, Eaton Corporation, GE Grid Solutions (General Electric Company), Mitsubishi Electric Corporation, Toshiba Corporation, Rockwell Automation, Inc., LS Industrial Systems, TE Connectivity Ltd., Fuji Electric Co., Ltd., Delixi Electric Co., Ltd., Chint Group Corporation, Joslyn Clark Controls (Dynapar Corporation), Ampcontrol Limited.

These companies are focused on expanding product lines, acquiring complementary technologies, and forming strategic alliances. Their emphasis lies in catering to diverse industrial applications, improving contactor durability, and integrating digital features such as remote diagnostics and smart protection.

Consumer Behavior Analysis

Focus on Reliability and Safety:

End-users prioritize long-term performance, safety, and low maintenance. Vacuum contactors meet these needs by minimizing contact wear, preventing arc flash hazards, and enabling consistent operation across voltage and load conditions. This focus is pushing industries to shift from air or oil contactors to vacuum-based systems.

Emphasis on Energy Efficiency:

Many consumers, particularly in energy-intensive sectors, are adopting technologies that contribute to energy efficiency and sustainability. Vacuum contactors, with minimal power losses and robust insulation, align well with corporate goals of reducing operational carbon footprints.

Rising Awareness of Lifecycle Costs:

Though vacuum contactors may entail higher upfront costs than traditional alternatives, their lower failure rates, maintenance needs, and operational downtime significantly reduce total cost of ownership (TCO). Consumers increasingly consider these lifecycle benefits when selecting components.

Demand for Digital Features:

Users are seeking smart-ready contactors equipped with condition monitoring, remote control, and predictive maintenance capabilities. This demand reflects the broader transition toward Industry 4.0, where digitalization drives efficiency, reliability, and transparency in operations.

Pricing Trends

Pricing in the low voltage vacuum contactor market varies by voltage class, rated current, application, and added features such as embedded communication protocols. Basic models used in standard industrial environments are competitively priced, while advanced contactors with smart capabilities or those rated for high-duty cycles command premium prices.

Despite these variances, price-performance ratios are improving due to technological advancements and economies of scale. Additionally, regional production centers—particularly in Asia-Pacific—have helped reduce manufacturing and logistics costs. For customers wary of capital expenditures, leasing options and service-based procurement models are emerging, especially in large-scale infrastructure and utility projects.

Growth Factors

Increasing Industrial Electrification:

Industries are shifting to electric systems for automation. This raises demand for strong and reliable switching tools. Low voltage vacuum contactors help support this shift. They safely switch electric drives, pumps, and HVAC systems.

Surge in Construction and Infrastructure Development:

Infrastructure growth in Asia-Pacific, Latin America, and the Middle East is driving demand for reliable electrical components. Vacuum contactors support uninterrupted operations and meet safety standards in buildings, data centers, and transit systems.

Stringent Safety Standards and Regulations:

Safety norms and compliance standards such as IEC and UL are promoting the adoption of vacuum contactors in hazardous and mission-critical environments. These devices offer arc-free operation and superior insulation, reducing fire and electrical accident risks.

Technological Advancements in Vacuum Interruption:

Innovations in vacuum interrupter design have significantly improved switching performance, compactness, and lifespan. Hybrid contactors with solid-state and vacuum switching elements are further enhancing control accuracy and reliability, opening new application frontiers.

Regulatory Landscape

The low voltage vacuum contactor market is influenced by various global and regional regulations concerning safety, performance, and environmental impact. Compliance ensures product credibility and facilitates global market access.

IEC 60947 Standards:

Most low voltage vacuum contactors must adhere to IEC 60947 standards, which govern low-voltage switchgear and controlgear. These guidelines define performance, durability, and safety requirements.

UL and CSA Certification:

In North America, products must comply with UL (Underwriters Laboratories) or CSA (Canadian Standards Association) certifications to be installed in residential, commercial, or industrial settings.

RoHS and REACH Compliance:

Environmental directives such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) are shaping product development. Manufacturers are designing contactors with non-toxic, recyclable materials to meet sustainability goals.

Recent Developments

Digitalization of Switching Components: Leading manufacturers are launching smart vacuum contactors with built-in diagnostics, IoT, and real-time status monitoring. These features support predictive maintenance, reduce downtime, and enhance operational efficiency.

- Customized Industry Solutions: Companies now design contactors tailored to specific industries. Sectors like mining, marine, railways, and oil & gas benefit from customized features and durability. These solutions feature rugged enclosures, tropicalized coatings, and vibration-resistant components. Such enhancements ensure reliability in harsh and demanding environments

- Strategic Collaborations: Recent partnerships aim to co-develop integrated control systems. For example, Schneider Electric and AVEVA have jointly worked on digital industrial ecosystems that include smart switchgear with advanced contactors.

- Product Miniaturization: New R&D has led to smaller vacuum contactors. They save space and cool better, helping data centers and EV chargers.

Current and Potential Growth Implications

Demand-Supply Analysis:

Global demand is rising rapidly, with supply chains adapting to new expectations for shorter lead times and customization. The manufacturing ecosystem—particularly in China, India, and Germany—is scaling up production and localization to address delivery timelines and regulatory requirements.

Gap Analysis:

While adoption is strong in developed regions, penetration remains modest in cost-sensitive and technologically nascent markets. The gap lies in awareness, upfront costs, and the availability of technical support. Bridging this gap calls for regional training programs, lower-cost variants, and better after-sales service.

Top Companies in the Low Voltage Vacuum Contactor Market

- Schneider Electric SE

- ABB Ltd.

- Siemens AG

- Eaton Corporation

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Rockwell Automation, Inc.

- GE Grid Solutions

- LS Industrial Systems

- TE Connectivity Ltd.

- Fuji Electric Co., Ltd.

- Delixi Electric Co., Ltd.

- Chint Group Corporation

- Joslyn Clark Controls (Dynapar Corporation)

- Ampcontrol Limited.

Low Voltage Vacuum Contactor Market: Report Snapshot

Segmentation | Details |

By Voltage Class | ≤1kV, 1-3.6kV, 3.6-7.2kV |

By Application | Motor Control, Transformer Switching, Capacitor Switching, Lighting Control |

By End-User | Industrial, Commercial, Utilities, Transportation, Mining |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Low Voltage Vacuum Contactor Market: High Growth Segments

Motor Control:

This remains the largest application segment due to the widespread use of electric motors in industrial operations. Contactors ensure operational efficiency and protection in various motor-driven systems.

Utilities and Smart Grids:

With utilities modernizing their infrastructure to handle decentralized energy flows, vacuum contactors are essential for reliable distribution switching. Their ability to perform in high-load environments makes them invaluable to the sector.

Transportation Systems:

Electric railways and charging stations for EVs require compact, durable contactors for high-frequency operations. The transportation sector will be a key driver in the coming years.

Major Innovations

Solid-State Hybrid Contactors:

Combining vacuum and solid-state switching offers precision, zero contact wear, and low energy loss. These systems are ideal for applications demanding rapid and frequent switching.

IoT-Enabled Monitoring:

Advanced models feature real-time temperature, voltage, and wear monitoring via cloud dashboards. This data-driven control enhances system reliability and reduces maintenance downtime.

Low Voltage Vacuum Contactor Market: Potential Growth Opportunities

- Emerging Markets Expansion:

Asia-Pacific holds big potential, especially India and Southeast Asia. Government push for industry, rural power, and infrastructure fuels growth. - Electrification of Transportation and Mining:

Sectors like mining and metro rail systems are expanding their use of electric power systems, offering ample opportunities for advanced contactors that withstand extreme operating conditions. - Integration with Smart Panels and Controllers:

Opportunities abound in integrating contactors into smart distribution panels, programmable logic controllers (PLCs), and modular control systems—catering to factories of the future.

Extrapolate Research says:

The low voltage vacuum contactor market is poised for steady growth. As industries adopt electrification, automation, and energy-efficient systems, demand for smart switching components is rising. Innovations in digital and hybrid designs are driving wider adoption.

Ongoing investments in infrastructure, clean energy, and transport electrification will support market expansion. Manufacturers are focusing on scalable, customizable, and compliant solutions to meet evolving industrial needs.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Low Voltage Vacuum Contactor Market Size

- June-2025

- 148

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020