Gallium Arsenide (GaAs) RF Devices Market Size, Share, Growth & Industry Analysis, By Product Type (By Product Type), By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Application (Mobile Devices, Satellite Communication, Radar Systems, Wireless Infrastructure, Automotive Radar), By End-User (Telecommunications, Aerospace & Defence, Consumer Electronics, Automotive, Industrial), and Regional Analysis, 2024-2031

Gallium Arsenide (GaAs) RF Devices Market: Global Share and Growth Trajectory

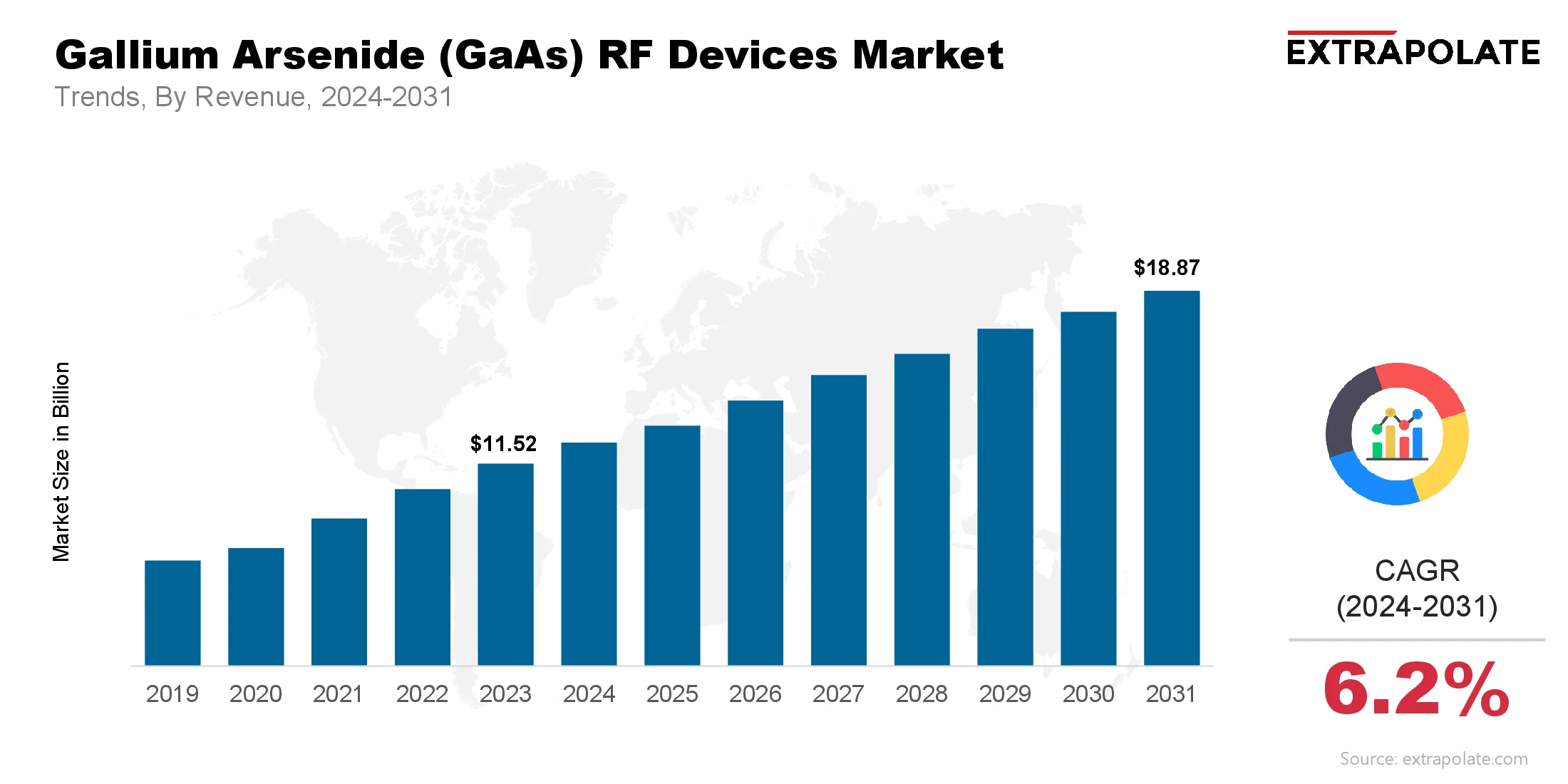

The global Gallium Arsenide (GaAs) RF Devices market size was valued at USD 11.52 billion in 2023 and is projected to grow from USD 12.34 billion in 2024 to USD 18.87 billion by 2031, exhibiting a CAGR of 6.2% during the forecast period.

The global market is growing quickly. Rising demand for high-performance, high-frequency electronics is a key driver. GaAs RF devices are now essential in mobile communication, satellite systems, radar, and wireless infrastructure. These devices offer superior electron mobility, high efficiency, and low noise. Because of this, they often perform better than silicon-based alternatives in RF applications.

The market is expanding due to major shifts in telecommunications. Increasing data usage and rapid 5G rollout are also fueling growth. GaAs RF components, such as power amplifiers, low noise amplifiers, and switches, are seeing strong demand. They can handle high frequencies with very low power loss. As data speeds rise and network reliability becomes more important, GaAs devices play a vital role. They help enable the performance needed for next-generation wireless networks.

The GaAs RF devices market is set for strong and steady growth. This is thanks to both new technology and growing customer needs. Ongoing improvements in material quality, production methods, and circuit design are unlocking better RF performance. Sectors like telecom, aerospace, automotive, and defense are all moving toward high-frequency solutions. Because of this shift, GaAs RF technology is becoming a key part of the modern wireless world.

Key Market Trends Driving Product Adoption

5G and High-Frequency Network Expansion

The global rollout of 5G infrastructure is the biggest driver of the GaAs RF devices market. 5G works at much higher frequencies than older networks. This creates a need for RF components with excellent linearity, efficiency, and thermal stability.

GaAs power amplifiers and switches meet these needs. They are now key components in base stations, mobile phones, and small cells.

The shift from 4G to 5G requires major upgrades in radio hardware. This is increasing the demand for high-performance RF front-end modules.

GaAs devices are preferred for millimeter-wave applications. They offer high gain and low insertion loss. These features help maintain strong signal quality, especially in dense urban areas.

Rise in Mobile and Wireless Devices

Smartphones, tablets, wearables, and IoT devices are everywhere. This growth has led to a sharp rise in demand for better RF performance. Users expect fast data, low delays, and smooth connectivity. GaAs RF devices help deliver this. They offer clear signals even in crowded frequency bands.

Mobile device makers are using GaAs components more often. These components help save battery life without sacrificing performance. Most smartphones now contain over a dozen RF parts. This shows the growing role of GaAs technology in modern mobile design.

Demand from Aerospace and Defense Sectors

GaAs RF technology is crucial in satellite communication, radar, and electronic warfare. These uses need high-frequency performance and reliability under extreme conditions. GaAs offers strong resistance to radiation and high thermal stability. This makes it ideal for both military and space-grade systems.

Defense spending is rising as global tensions increase. More money is going into radar, surveillance, and communication programs. These projects need reliable RF devices. GaAs is a top choice, giving it a strong position in the defense sector.

Major Players and Their Competitive Positioning

The GaAs RF devices industry is characterized by fierce competition, with key players continually innovating to improve performance, integration, and scalability. Leading companies in this space include are Qorvo Inc., Skyworks Solutions Inc., Broadcom Inc., WIN Semiconductors Corp., MACOM Technology Solutions Holdings Inc., Murata Manufacturing Co., Ltd., NXP Semiconductors N.V., Analog Devices Inc., RFHIC Corporation, GlobalFoundries Inc. and others.

These firms dominate global supply chains through vertical integration, partnerships with foundries, and expanding product portfolios. By advancing GaAs HBT (heterojunction bipolar transistor) and pHEMT (pseudomorphic high electron mobility transistor) technologies, these companies are setting performance benchmarks across the RF spectrum.

Consolidation through mergers, strategic licensing, and in-house GaAs fabrication capabilities has enabled these players to solidify their positions in both consumer electronics and specialized industrial markets.

Consumer Behavior Analysis

- Preference for High-Performance Connectivity: End users, from consumers to defense agencies, demand seamless and uninterrupted connectivity. This consumer behavior underscores a preference for devices and infrastructure that can deliver robust RF performance under varying conditions. GaAs RF devices enable this capability, particularly in high-density urban environments, high-speed trains, and airborne platforms.

- Cost-Performance Trade-offs: While GaAs devices generally come at a higher material and fabrication cost than silicon-based solutions, the cost-performance ratio heavily favors GaAs in high-frequency and high-power applications. Telecommunications operators and defense organizations value the long-term performance benefits, which justify the initial investment.

- Industry Push Toward Integration: Consumer and industrial buyers increasingly favor integrated solutions, RF front-end modules that include multiple components like filters, switches, and amplifiers. GaAs-based modules offer superior integration, reducing size and energy consumption. This preference has shifted the market toward complete solutions rather than discrete components.

- Design Customization and Flexibility: Companies seek design flexibility in RF solutions, especially in mission-critical and space-constrained applications. GaAs devices offer wide bandwidth and frequency tuning capabilities, which are essential in systems like satellite communications or advanced radar arrays. The customization offered by GaAs RF manufacturers drives customer loyalty and long-term contracts.

Pricing Trends

GaAs RF device cost is dependent on wafer size, fab process, device complexity and application specific requirements. GaAs wafers are more expensive than silicon but innovations in epitaxial growth and yield optimization are helping to bring down the cost per unit.

Mass market applications like smartphones benefit from economies of scale while aerospace and defense segments can tolerate higher unit price for reliability and performance. Foundries like WIN Semiconductors and GlobalFoundries have introduced cost effective 6-inch GaAs wafer process, increasing volume and reducing cost.

Outsourcing GaAs fab to specialized foundries has also helped fabless companies to control capital expenditure and offer competitive pricing. As 5G demand grows and fab matures, moderate price decline is expected especially in volume heavy segments.

Growth Factors

- 5G and Beyond: 5G is a growth engine globally. New use cases like smart cities, autonomous vehicles and industrial IoT require high frequency and reliable RF systems. GaAs RF devices are at the heart of these next gen technologies. In June 2025, at the IEEE MTT-S International Microwave Symposium (IMS 2025), TagoreTech launched new Gallium Arsenide (GaAs) Low-Noise Amplifiers (LNAs), GaAs LNAs and MCM switch-LNA modules for 5G infrastructure, aerospace, defense and automotive RF applications.

- Aerospace and Defense Modernization: Government investment in military modernization and space exploration is driving demand for GaAs based radar and communication systems. GaAs is performance reliable in extreme conditions and is a must have for air-to-ground and satellite based platforms.

- Automotive Radar Applications: Advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication rely heavily on RF systems. GaAs devices are being used in radar sensors due to their sensitivity and frequency response. As autonomous driving progresses, the automotive segment will drive new opportunities for GaAs device manufacturers.

- Increasing Data Consumption: Global internet and video data traffic is growing and requires more robust network backhaul systems. GaAs RF devices provide the bandwidth and power efficiency to support high throughput wireless networks especially in rural and hard to reach areas. In April 2025, RF Micro Devices (RFMD) completed the transition of its GaAs heterojunction bipolar transistor (HBT) from 4″ to 6″ wafer process, doubling die-per-wafer output and increasing production efficiency for GaAs power amplifiers used in high frequency mobile communications.

Regulatory Landscape

The market is governed by regulations for safety, signal integrity and environmental compliance. Regulations range from international trade to frequency spectrum allocation:

- Telecom Equipment Certification: Agencies like the FCC (U.S.), ETSI (Europe) and MIC (Japan) have RF emission standards for wireless communication equipment.

- Export Control Regulations: GaAs RF devices used in defense or satellite systems are subject to ITAR (International Traffic in Arms Regulations) and Wassenaar Arrangement.

- Environmental Standards: GaAs manufacturing involves arsenic, a hazardous material. So companies must comply with REACH and RoHS directives for safe handling and disposal.

- Space-Grade Qualification: Components for satellite use must go through space qualification process like QML-V and QML-Q to ensure reliability in vacuum and radiation environment.

Recent Developments

- GaAs in 5G Smartphones: Apple and Samsung are putting GaAs based PA modules in their 5G phones and it’s going mainstream.

- Foundry Capacity: WIN Semiconductors and GlobalFoundries have announced GaAs capacity expansion to meet the global 5G and satellite communication demand.

- Defense Contracts: MACOM and Qorvo have secured multi-year contracts to supply GaAs MMICs for defense radar and avionics programs.

- Automotive RF: Skyworks and NXP have launched GaAs based radar chipsets for automotive use for ADAS and smart traffic applications.

- GaAs-on-Si: Hybrid technologies are emerging like GaAs-on-silicon (GaAs-on-Si) to combine the performance of GaAs with the cost and scalability of silicon platforms.

Current and Potential Growth Implications

Demand-Supply Analysis

Demand for GaAs RF devices is growing faster than supply. This is especially true in high-frequency segments. To address this, foundries are expanding wafer capacity and improving cycle times. However, there are still challenges. High raw material costs and long wait times for specialized equipment slow down production. These issues continue to limit output.

Gap Analysis

GaAs performs well in high-end applications. But it faces challenges in cost-sensitive markets. Entry-level mobile phones and low-power IoT devices often avoid GaAs due to cost. This leaves a gap in the market. To close this gap, companies are exploring hybrid solutions. Some are also looking at alternatives like GaN and SiGe. There is growing interest in more affordable GaAs options to meet this unmet demand.

Top Companies in the GaAs RF Devices Market

- Qorvo Inc.

- Skyworks Solutions Inc.

- Broadcom Inc.

- WIN Semiconductors Corp.

- MACOM Technology Solutions Holdings Inc.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Analog Devices Inc.

- RFHIC Corporation

- GlobalFoundries Inc.

Gallium Arsenide (GaAs) RF Devices Market: Report Snapshot

Segmentation | Details |

By Product Type | Power Amplifiers, Low Noise Amplifiers, Mixers, Oscillators, Switches, Filters |

By Application | Mobile Devices, Satellite Communication, Radar Systems, Wireless Infrastructure, Automotive Radar |

By End-User | Telecommunications, Aerospace & Defense, Consumer Electronics, Automotive, Industrial |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Power Amplifiers: As base stations and handsets go big, GaAs PAs are leading the 5G charge.

- Satellite Communication: As constellations go global, GaAs devices power LEO and MEO satellite links.

- Automotive Radar: Radar-based collision detection systems are counting on GaAs for high frequency sensitivity.

New Developments

- Advanced GaAs MMICs: Miniaturized circuits combine amplifiers, mixers and filters for compact RF designs.

- GaAs HEMT and pHEMT Devices: Improvements in these technologies mean more gain and less noise in comms systems.

- GaAs-on-Si Integration: Research into GaAs-silicon integration aims to marry high performance with CMOS compatibility.

Potential Growth Opportunities

- Emerging Markets: Countries rolling out 5G and satellite coverage are a goldmine for GaAs suppliers.

- Defense Modernization Programs: Governments worldwide are upgrading radar and secure comms, driving demand.

- IoT and Industrial Wireless: As factories go wireless, GaAs modules enable fast and reliable transmission.

Extrapolate says:

The GaAs RF Devices market is growing. Strong demand for high frequency and reliable comms is driving this. With 5G networks rolling out, satellite constellations growing and automotive radar improving GaAs is more important than ever. The market is moving to integrated and high performance RF solutions. GaAs is leading this charge because of its excellent electrical properties.

MMIC innovation, wafer processing and hybrid integration is ongoing. This is driving steady growth. Top companies are investing in GaAs. Demand is rising across key sectors. GaAs RF devices will be at the heart of global connectivity in the years to come.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Gallium Arsenide

- July-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020