Fanless Heat Sinks Market Size, Share, Growth & Industry Analysis, By Product Type (Extruded Heat Sinks, Stamped Heat Sinks, Bonded Fin Heat Sinks, Skived Heat Sinks, Forged Heat Sinks, Others) By Material (Aluminium, Copper, Graphite Composites, Others) By Application (Consumer Electronics, LED Lighting, Automotive Electronics, Industrial Equipment, Telecommunications, Others), and Regional Analysis, 2024-2031

Fanless Heat Sinks Market: Global Share and Growth Trajectory

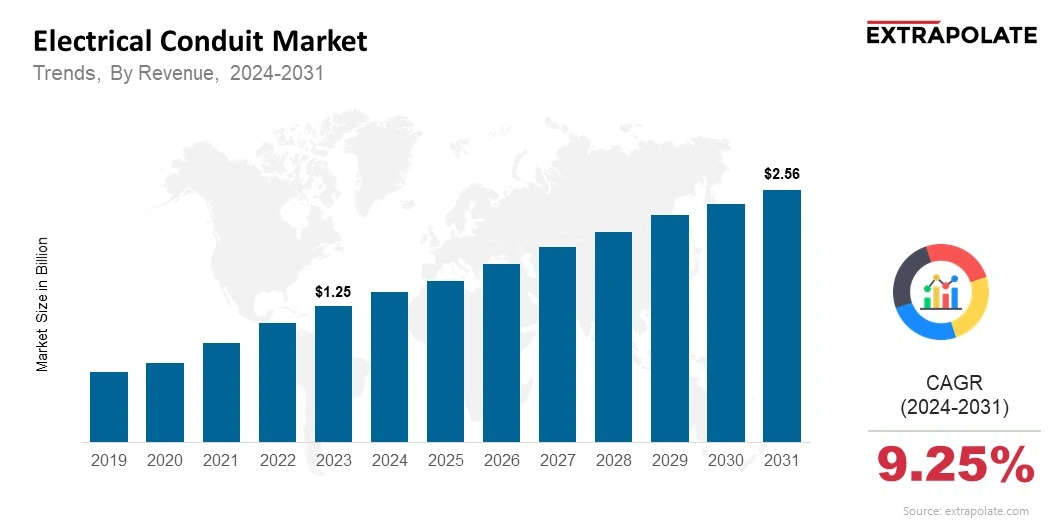

Global Fanless Heat Sinks Market size was recorded at USD 1.25 billion in 2023, which is estimated to be valued at USD 1.38 billion in 2024 and reach USD 2.56 billion by 2031, growing at a CAGR of 9.25% during the forecast period.

The global fanless heat sinks market is growing steadily. This growth is driven by rising demand for efficient, silent, and maintenance-free cooling systems. These systems are used in a wide range of electronic and industrial applications.

Fanless heat sinks are passive thermal components. They remove heat without using fans. This makes them ideal for improving reliability and lowering power consumption. They are commonly used in power electronics, LED lighting, industrial automation, and computing equipment.

Trends like miniaturization, energy efficiency, and ruggedized electronics are supporting this growth. These trends are visible in both industrial and consumer markets.

Fanless designs offer several advantages. They reduce failures caused by dust, vibration, or moving parts. They also improve product lifespan and ensure stable performance.

New developments in thermal interface materials, heat pipes, and optimized shapes are making fanless heat sinks even more effective. With these innovations, the market is expected to grow further in the years ahead.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several key trends are driving the growing use of fanless heat sinks:

Silent and Maintenance-Free Cooling

Fanless heat sinks operate without making noise. This is a major benefit in places where silence is important, such as hospitals, offices, broadcast studios, and homes.

Since they have no moving parts, fanless systems need very little maintenance. This helps lower ownership costs and reduces equipment downtime.

Heat Management in Industrial and Harsh Environments

Fanless heat sinks are well-suited for tough working conditions. In places with dust, vibrations, or harsh chemicals, fans can break down easily.

Industries like manufacturing, mining, railways, and defense often use fanless cooling for their embedded systems and industrial PCs. In these sectors, passive cooling has become essential.

Rising Demand in LED Lighting

High-power LED lights produce a lot of heat. Fanless heat sinks help keep these lights cool, which improves their life and performance.

As smart cities and infrastructure lighting expand, demand for large, high-efficiency fanless heat sinks is increasing. This is also true for horticultural lighting and outdoor applications.

Innovation in Material and Design

New materials like aluminum alloys, copper composites, and graphite are making fanless heat sinks more effective and lightweight.

Manufacturers are also using simulation software and 3D printing to design better shapes and cooling paths. These improvements allow for better performance, even in smaller spaces.

Major Players and their Competitive Positioning

The fanless heat sinks market is competitive with global and regional players offering custom and standard thermal management solutions. They are investing in R&D to meet the growing demand for advanced and compact cooling solutions.

Key players in the market are: Advanced Thermal Solutions Inc., Aavid Thermalloy (Boyd Corporation), Wakefield-Vette, CUI Devices, Noctua, Fischer Elektronik GmbH & Co. KG, CTS Corporation, Delta Electronics Inc., Ohmite Manufacturing Company, Sunonwealth Electric Machine Industry Co. Ltd.

They focus on product development, material development and customer specific designs. Strategic partnerships with electronics manufacturers and OEMs help them to expand their global presence and respond to changing application needs.

The AirJet Mini Slim, a 2.5 mm thick fanless heat-sink solution for ultra-thin laptops that was showcased at CES 2024, was introduced by Force Systems in January 2024. It has a higher thermal capacity, approximately 5.25 W cooling, while using just about 1 W of electricity through passive thermal conduction, despite having a small form factor (~8 g).

Consumer Behavior Analysis

Consumer behavior in the fanless heat sinks market is influenced by both technological needs and practical choices.

Focus on Reliability and Longevity

Users are placing greater value on cooling solutions that last long and need little maintenance. In fields like telecommunications, military, and healthcare, reliability is critical. Fanless heat sinks are becoming the go-to option in these sectors due to their stable, low-maintenance performance.

Cost vs. Performance Trade-Off

Fanless heat sinks can be expensive up front. This is because of their complex design and high-quality materials. However, buyers see long-term value. Lower maintenance, better device uptime, and energy savings make them a smart investment over time. These benefits often outweigh the higher initial cost.

Customization Demand

Applications vary widely, from small embedded systems to heavy-duty industrial machines. As a result, many customers want thermal solutions that fit specific needs. Manufacturers offering options in size, shape, mounting style, and material are seeing stronger customer loyalty and satisfaction.

Sustainability and Energy Efficiency

Environmentally conscious users prefer passive cooling. It helps cut energy use and reduces electronic waste. The silent, durable, and energy-efficient nature of fanless heat sinks adds to their appeal. These eco-friendly features are becoming more important in buying decisions.

Pricing Trends

Pricing in the fanless heat sinks is influenced by many factors, material type, size, design complexity, heat pipes or vapor chambers integration and volume production. Extruded aluminum heat sinks are cost effective and dominate the market, but forged or die-cast for higher power dissipation command premium pricing.

Custom designed fanless heat sinks, often integrated in ruggedized or compact electronics, are more expensive due to prototyping, tooling and low volume production. But pricing pressure from end use sectors like consumer electronics and IT hardware is forcing manufacturers to innovate cost effective production methods.

As 3D printing and automation advances, pricing will stabilize especially for high efficiency designs. And economies of scale from mass production for sectors like lighting and automotive electronics will further help to rationalize pricing.

Growth Factors

Here are the factors driving the growth of fanless heat sinks:

Compact Devices with Increasing Heat Loads: As electronics get smaller, thermal densities are rising and passive cooling solutions are needed. Fanless heat sinks are the answer for these compact systems, providing heat dissipation without complexity or noise.

Industrial Automation and IoT Devices: As factories get smarter and smart devices multiply, demand for rugged, passively cooled embedded systems is growing. These devices need to work in remote, dusty or vibration-prone environments—perfect conditions for fanless heat sinks.

Renewable Energy and EV Infrastructure: Power inverters, battery management systems and energy control units in solar power systems and electric vehicles generate heat during operation. Fanless heat sinks keep these systems cool without adding power consumption, so they perform better and last longer.

Regulatory Pressure for Energy Efficiency: Government regulations for energy saving, especially in lighting and consumer electronics, are forcing manufacturers to adopt passive cooling to meet thermal design requirements without adding power consumption.

Regulatory Landscape

The fanless heat sinks market is not highly regulated, mainly through industry thermal standards and safety norms. Compliance to these standards ensures the heat sinks are safe, reliable and compatible with end use electronics.

Key regulatory aspects are:

- RoHS and REACH Compliance: Fanless heat sinks must comply to environmental directives restricting hazardous substances and safe material use, especially in EU.

- UL and CE Certifications: These certifications ensures the products meet the essential safety and performance requirements in North America and Europe.

- Thermal Management Guidelines: For applications in critical industries like medical electronics, aerospace and defense, thermal performance must meet strict reliability standards, often guided by customer specific validation protocols.

Compliance to these regulatory and certification frameworks is crucial for product acceptance especially in international markets.

Recent Developments

Here are some of the developments in the fanless heat sinks market that show how the industry is responding to technology:

- Advanced Materials and Coatings: Graphene infused composites, anodized aluminum surfaces and ceramic based coatings to improve thermal performance and environmental resistance.

- Heat Pipe and Vapor Chamber Integration: To handle higher thermal loads without fans, companies are embedding heat pipes and vapor chambers in fanless heat sinks to increase heat transfer and keep it passive.

- Custom Extrusions and Modular Designs: Custom heat sink profiles and modular components are becoming more common, making it easier to integrate into different form factors especially in space constrained designs.

- 3D Printed Heat Sinks: Additive manufacturing is enabling complex geometries that improve surface area and airflow, pushing the limits of passive cooling.

These are changing the efficiency benchmarks and making fanless heat sinks more viable for high performance applications.

Current and Potential Growth Implications

Demand-Supply Analysis: Demand for fanless heat sinks is strong across industrial, computing and lighting applications. Large scale suppliers meet mainstream demand but niche applications requiring custom designs have created a market for custom solution providers. Raw material availability (aluminum, copper) supply chain disruptions could impact pricing and lead times.

Gap Analysis: Although the fanless heat sink market is growing the gaps are in cost effective high performance solutions for compact and portable electronics. Lack of awareness in emerging markets is limiting penetration despite the benefits of passive cooling.

Manufacturers who focus on low cost design innovation and raise awareness of the total cost of ownership benefits of fanless cooling can fill these gaps and open up more market.

Top Companies in the Fanless Heat Sinks Market

- Advanced Thermal Solutions Inc.

- Aavid Thermalloy (Boyd Corporation)

- Wakefield-Vette

- CUI Devices

- Noctua

- Fischer Elektronik GmbH & Co. KG

- CTS Corporation

- Delta Electronics Inc.

- Ohmite Manufacturing Company

- Sunonwealth Electric Machine Industry Co. Ltd.

Fanless Heat Sinks Market: Report Snapshot

Segmentation | Details |

By Product Type | Extruded Heat Sinks, Stamped Heat Sinks, Bonded Fin Heat Sinks, Skived Heat Sinks, Forged Heat Sinks, Others |

By Material | Aluminum, Copper, Graphite Composites, Others |

By Application | Consumer Electronics, LED Lighting, Automotive Electronics, Industrial Equipment, Telecommunications, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Fanless Heat Sinks Market: High-Growth Segments

Key segments with anticipated high growth include:

- LED Lighting Applications: With demand for energy-efficient, long-lasting lighting increasing globally, fanless heat sinks are critical to thermal management in high-lumen fixtures.

- Industrial Automation: Rugged, dust-proof environments in manufacturing rely heavily on fanless designs for operational continuity and thermal reliability.

- Consumer Electronics and Mini PCs: Silent cooling in compact PCs, set-top boxes, and home servers drives growth in extruded and skived aluminum heat sinks.

Major Innovations

Innovations transforming the market include:

- Fin Topology: CFD based design of fins to dissipate heat better with minimal material usage.

- Hybrid Cooling: Combination of passive and phase change technologies like vapor chambers to increase power handling of fanless systems.

- Smart Coatings: Micro textures and advanced coatings to increase emissivity and heat dissipation is the new focus.

Fanless Heat Sinks Market: Potential Growth Opportunities

- 5G and Telecom Infrastructure: Edge computing and base station installations require passive cooling for reliability, opportunity for fanless heat sink providers.

- Renewable Energy Systems: Solar inverters and energy storage systems are moving towards passive cooling for efficiency and reliability in remote areas.

- New Markets: Rapid industrialization and urbanization in regions like Southeast Asia, Latin America and Africa is the new market.

Extrapolate says:

The fanless heat sinks market is growing as demand for silent, efficient and low maintenance thermal management solutions increases. Advances in material science, product design and thermal performance are pushing the boundaries of what passive cooling can do. As industries move to fanless and compact designs – especially in LED lighting, telecom and industrial automation – the demand for high performance and cost effective solutions will skyrocket.

With focus on reliability, energy efficiency and sustainability the market will continue to grow. Companies that invest in innovation, scalability and customization will lead this charge and unlock value across a broad range of electronic and industrial applications.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Fanless Heat Sinks Market Size

- August-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020