Computer Power Supplies Market Size, Share, Growth & Industry Analysis, By Type (ATX Power Supplies, SFX Power Supplies, TFX Power Supplies), By Wattage (Below 500W, 500W–750W, 750W–1000W, Above 1000W), By Certification (80 PLUS Bronze, Silver, Gold, Platinum, Titanium), By Modularity (Non-Modular, Semi-Modular, Fully Modular), By Application (Consumer Desktops, Gaming PCs, Workstations, Data Centers) and Regional Analysis, 2024-2031

Computer Power Supplies Market: Global Share and Growth Trajectory

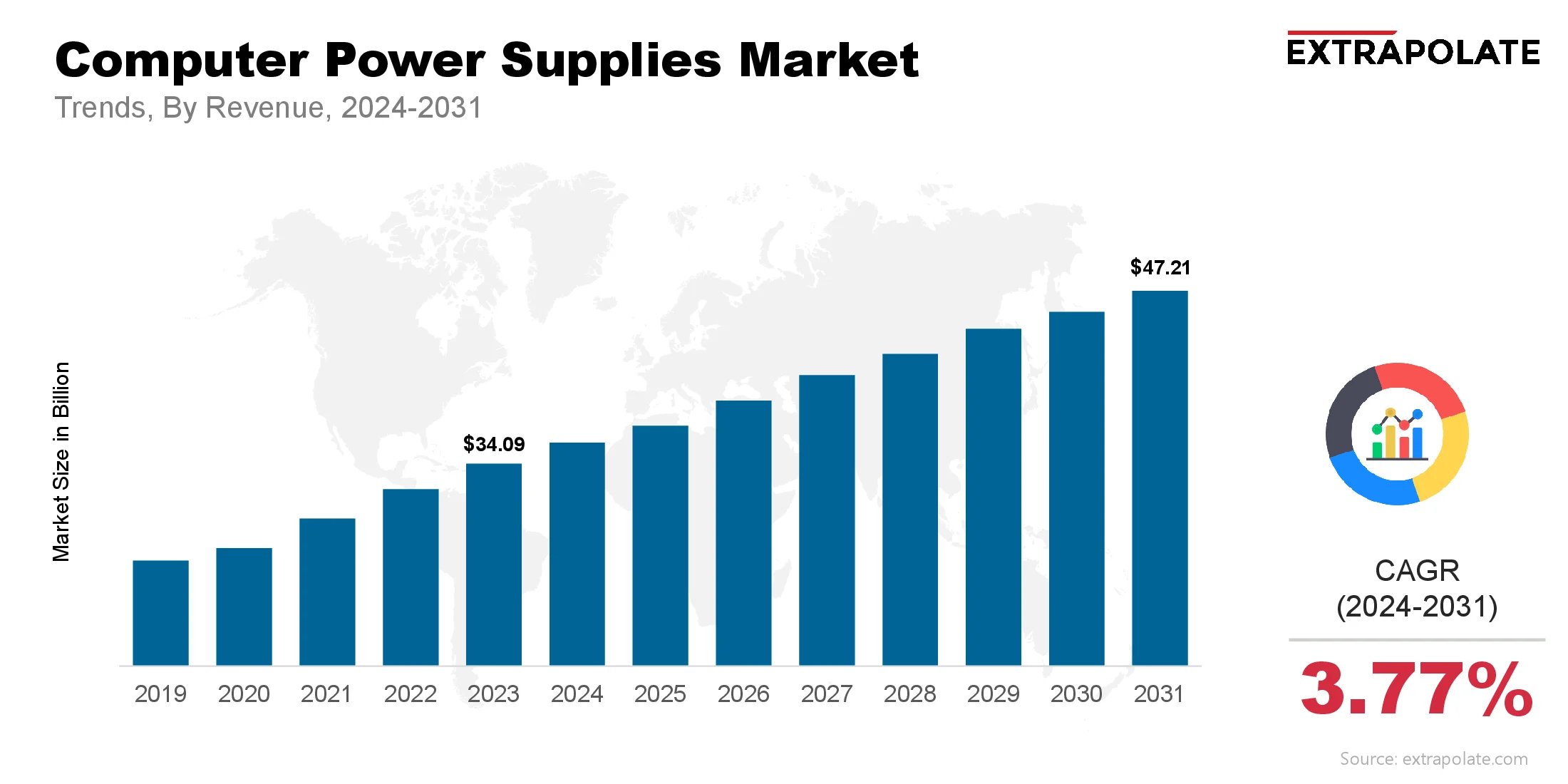

The global Computer Power Supplies Market size was valued at USD 34.09 billion in 2023 and is projected to grow from USD 36.41 billion in 2024 to USD 47.21 billion by 2031, exhibiting a CAGR of 3.77% during the forecast period.

The global computer power supplies market is experiencing consistent growth driven by rising computer usage, expanding gaming and workstation applications, and growing data center infrastructure. Computer power supplies (PSUs) serve as a critical component of computing systems by converting electric current from mains AC to usable low-voltage DC power for the internal components. This foundational hardware ensures stable energy distribution, protects against power surges, and supports efficient computing performance.

Increased reliance on desktop computers, gaming rigs, servers, and edge computing devices is encouraging demand for high-quality, efficient, and modular power supply units. Additionally, trends in energy efficiency, form factor standardization, and advanced thermal management are reshaping the power supply ecosystem.

The adoption of power supplies is further strengthened by the global push toward energy conservation. Regulatory bodies are introducing mandates for energy-efficient components, pushing manufacturers to develop power supplies that meet or exceed standards such as 80 PLUS certifications. With environmental sustainability and performance optimization becoming dual priorities, the computer power supplies market is poised for sustained growth and innovation.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

- Energy-Efficient Power Supply Standards: Energy efficiency is a major trend in the computer power supplies market. The demand for PSUs that comply with 80 PLUS certification standards (ranging from Bronze to Titanium) is increasing. These standards validate the efficiency levels of PSUs under varying loads, ensuring minimal energy wastage and reduced operational costs. As computing environments become more complex, energy-conscious users—from individual consumers to hyperscale data centers—prefer high-efficiency power supply units that also contribute to lower heat output and noise.

- Growth of Gaming and Custom PCs: The booming gaming industry is fueling the need for high-wattage, aesthetically enhanced, and modular PSUs. Enthusiasts and professional gamers require reliable power delivery for GPUs, CPUs, and other high-performance components. RGB lighting, modular cabling, silent operation, and premium build quality are now common requirements in gaming-oriented PSUs. This has prompted companies to launch specialized product lines targeting the gaming community.

- Miniaturization and SFX Power Supplies: The shift toward compact form factors like Mini-ITX systems and small form factor (SFF) PCs is encouraging demand for smaller but equally powerful power supplies, such as SFX and SFX-L units. Manufacturers are optimizing designs to pack higher wattages into reduced footprints without sacrificing efficiency or thermal performance. This trend is especially prominent in consumer desktops, edge computing devices, and portable workstations.

- Rise in Server and Data Center Infrastructure: The exponential growth of cloud computing, edge computing, and data center deployments is a significant driver for the computer power supplies market. Data centers rely heavily on redundant, scalable, and energy-efficient power solutions. PSUs tailored for server racks, blade systems, and modular infrastructure must meet strict uptime and efficiency criteria. Hot-swappable redundant PSUs and rack-mounted power delivery systems are gaining traction among enterprise users.

Major Players and Their Competitive Positioning

The computer power supplies market is highly competitive, with companies investing in innovation, energy compliance, and customization. Some of the major players in this space included are Corsair Components Inc., Cooler Master Technology Inc., SeaSonic Electronics Co., Ltd., Thermaltake Technology Co., Ltd., EVGA Corporation, SilverStone Technology Co., Ltd., Antec Inc., FSP Group, Delta Electronics, Inc., Lite-On Technology Corporation and others. These companies are continually refining power delivery technology, enhancing product portfolios, and launching certified units that cater to both consumer and enterprise segments. Strategic collaborations, OEM partnerships, and regional expansions are also being employed to strengthen their competitive stance.

Consumer Behavior Analysis

- Performance and Reliability Preferences: Consumers are increasingly seeking PSUs that offer long-term reliability, quiet operation, and stable performance under load. Whether for general home use, gaming, or professional computing, the need for uninterrupted and efficient power delivery is paramount. Users often compare units based on efficiency ratings, build quality, brand reputation, and modularity before making a purchase.

- Customization and Aesthetics: Gamers and PC builders often prioritize customization and aesthetics in addition to performance. Features like RGB lighting, fully modular cables, and custom-sleeved wires influence consumer decisions. The visual appeal of a PSU has grown in importance due to transparent chassis and RGB-themed PC builds.

- Value for Money and Warranty: Budget-conscious consumers, particularly in emerging markets, focus on achieving the best performance-to-price ratio. High-efficiency units with longer warranty periods (5 to 10 years) are preferred as they imply reliability and lower total cost of ownership.

- Brand Loyalty and Online Reviews: Brand loyalty plays a significant role in the PSU market. Positive user reviews, expert recommendations, and benchmark test results sway purchasing decisions. Consumers are also more inclined to buy from manufacturers offering robust customer support and return policies.

Pricing Trends

Pricing in the computer power supplies market varies based on wattage, efficiency rating, modularity, brand, and features. Entry-level non-modular units (300–500W) are priced affordably for basic home or office use. Mid-range modular PSUs (550–750W) with 80 PLUS Gold certification fall in a moderate price bracket, catering to gamers and content creators.

Platinum and Titanium PSUs offer top performance. These serve data centers, creators, and advanced PC builds. Hybrid cooling and custom cables offer better control. But they make power supplies more expensive. Component and freight constraints influenced PSU pricing. These external pressures are starting to ease.

Growth Factors

- Technological Advancements in Power Regulation: Digital power tech and LLC designs are evolving. They enhance stability, cut ripple, and boost cooling efficiency. Smart monitoring and fan control technologies also enhance operational efficiency and noise management.

- Rising Gaming and Content Creation Demands: Gamers and creators use power-heavy systems. These need consistent and efficient power delivery. Hardware advances increase PSU needs. Units must support multiple GPUs and future CPUs.

- Expansion of Edge Computing and IoT: Computing is shifting to the edge. Compact units now support many public and private uses. Growing edge deployment requires versatile power supplies. These must perform reliably in diverse conditions.

- Regulatory Push Toward Energy Efficiency: Rules from global energy bodies are strict. They drive PSU makers to boost efficiency. These rules help cut environmental harm. They also make products top industry picks.

Regulatory Landscape

PSU firms must follow strict global norms. These protect users and the environment:

- 80 PLUS Certification: PSUs are tested at 20%, 50%, and full load. Ratings like Bronze to Titanium show efficiency.

- ENERGY STAR Compliance: Energy use must be kept low. Rules cover both residential and enterprise gear.

- RoHS and WEEE Directives (EU): New laws reduce toxic content in devices. They also promote reuse and recycling.

- UL and CE Marking: Safety standards differ across regions. PSUs must meet all local requirements.

- ISO 9001 and ISO 14001: Manufacturers need quality system certifications. Environmental standards are also required for compliance ].

Recent Developments

- Smart PSUs with Monitoring Software: New PSUs include software for real-time tracking. Users can monitor voltage, power, fan speed, and heat.

- Modular Innovations: Clean cable setup is easier with modular PSUs. Flat cords also support better airflow.

- Integration of GaN Components: GaN semiconductors are replacing silicon in power systems. They offer better heat control and smaller size.

- Eco Modes and Zero RPM Fan Designs: Energy-saving modes and hybrid fan settings that remain off during low load are now standard among premium power supplies.

In January 2025, ASUS ROG unveiled a wide range of next-gen gaming products at CES, including ROG Strix and Zephyrus laptops, the Flow Z13 tablet, new GPUs, mini-PCs, monitors, and the world’s first AI-powered Wi-Fi 7 router. These innovations feature Intel Core Ultra 9 CPUs, NVIDIA RTX 5090 Laptop GPUs, Nebula HDR Mini-LED displays, and advanced cooling and upgrade-friendly designs.

Current and Potential Growth Implications

a. Demand-Supply Analysis

With computing hardware cycles accelerating and demand from gamers and data centers rising, the market is experiencing healthy supply-side activity. Manufacturers are expanding their production capacities to meet varied demand while maintaining product quality.

b. Gap Analysis

High-end segments have strong PSU supply. Developing areas still need budget-friendly, efficient choices. Cost remains a key barrier in many regions. Strong local support can help boost adoption.

Top Companies in the Computer Power Supplies Market

- Corsair Components Inc.

- Cooler Master Technology Inc.

- SeaSonic Electronics Co., Ltd.

- Thermaltake Technology Co., Ltd.

- EVGA Corporation

- SilverStone Technology Co., Ltd.

- FSP Group

- Delta Electronics, Inc.

- Lite-On Technology Corporation

- Antec Inc.

Computer Power Supplies Market: Report Snapshot

Segmentation | Details |

By Type | ATX Power Supplies, SFX Power Supplies, TFX Power Supplies |

By Wattage | Below 500W, 500W–750W, 750W–1000W, Above 1000W |

By Certification | 80 PLUS Bronze, Silver, Gold, Platinum, Titanium |

By Modularity | Non-Modular, Semi-Modular, Fully Modular |

By Application | Consumer Desktops, Gaming PCs, Workstations, Data Centers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Gaming and Custom PC Segment: Demand is rising for powerful, modular PSUs with lighting. They are popular in gaming and custom PC setups.

- 80 PLUS Gold and Above Certified PSUs: Gold-level efficiency reduces power loss. This makes such PSUs a top choice for modern systems.

- Compact and SFF PSUs: As compact PCs become more common, PSU size matters. Users prefer small, efficient power units.

Major Innovations

- Digital Control PSUs: With software, voltage and feedback can be managed closely. This improves control and energy savings.

- GaN Transistor Integration: Efficiency gains and size cuts are driving attention. R&D teams are investing heavily in this space.

- Smart Fan Management: Thermal controls adjust based on system load and room temperature. This reduces noise and helps the unit last longer.

Potential Growth Opportunities

- Emerging Markets Expansion: PC use is growing in Southeast Asia, Latin America, and Africa. This opens strong demand for low-cost, efficient power supplies.

- Data Center Investments: Hyperscale growth calls for advanced power systems. Redundant and scalable PSUs are now essential.

- Green Computing Initiatives: Public and private support for eco-computing is growing. As a result, efficient power units may see higher demand.

Extrapolate Research Says:

The computer power supply market shows strong growth potential. It is well-placed for long-term expansion. Gaming, efficiency, and custom builds are driving PSU changes. New models focus on low noise and high dependability. Leadership depends on innovation, reach, and regulation. Firms investing in these areas will likely outperform rivals. Computing needs are growing across all regions. Power supplies must keep up, making this a critical and evolving market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Computer Power Supplies Market Size

- July-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020