Complex Oxide Sputtering Target Market Size, Share, Growth & Industry Analysis, By Material Type (Indium Tin Oxide (ITO), Zinc Oxide (ZnO), Barium Titanate, Lanthanum Oxide), By Application (Semiconductors, Solar Panels, Optical Coatings, Data Storage, Sensors), By Form (Planar Targets, Rotatable Targets), By End-User (Electronics Manufacturers, Research Institutions, Solar Energy Firms), and Regional Analysis, 2024-2031

Complex Oxide Sputtering Target Market: Global Share and Growth Trajectory

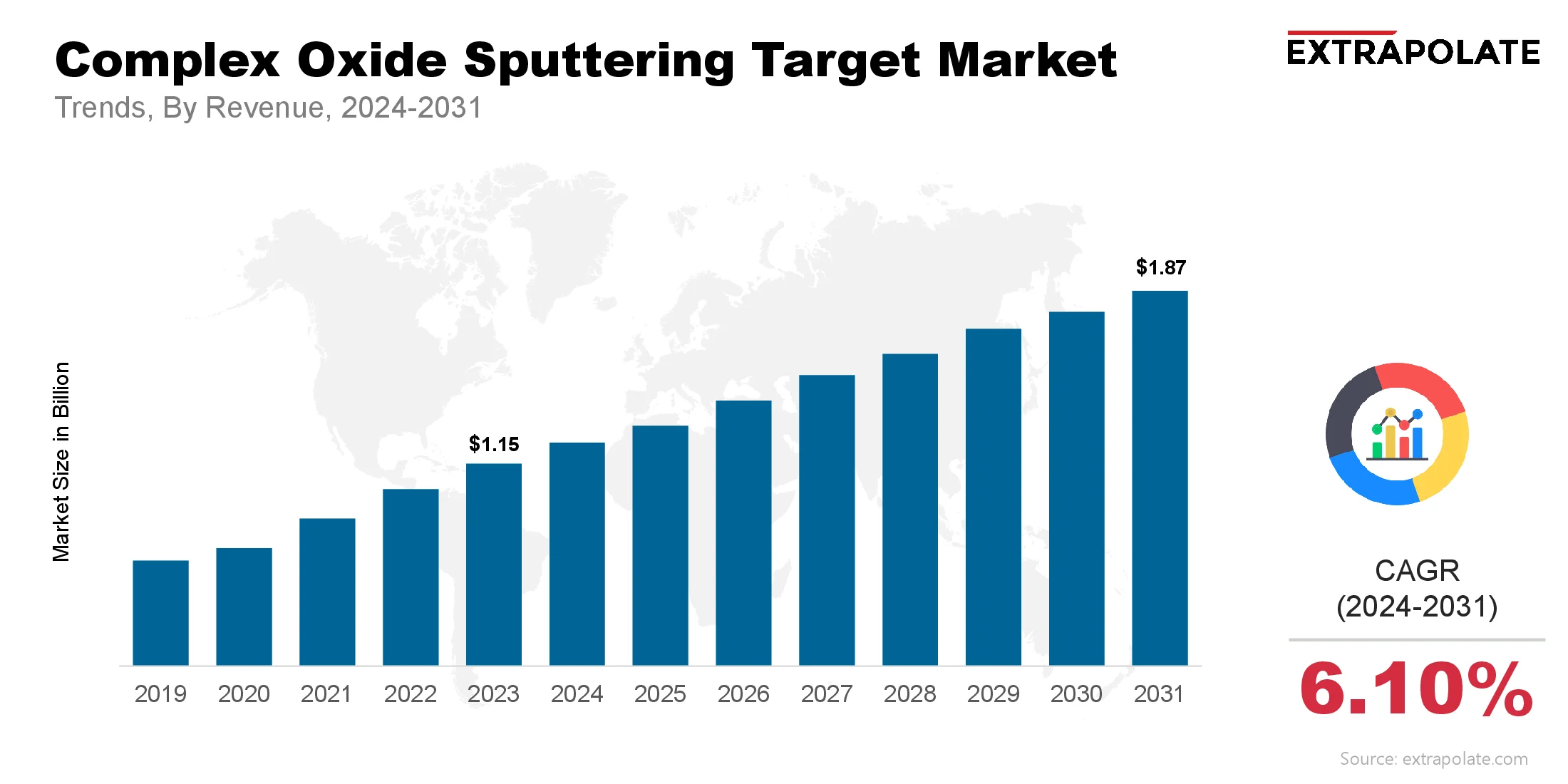

The global Complex Oxide Sputtering Target Market size was valued at USD 1.15 billion in 2023 and is projected to grow from USD 1.23 billion in 2024 to USD 1.87 billion by 2031, exhibiting a CAGR of 6.10% during the forecast period.

The global complex oxide sputtering target market is making substantial progress, fueled by rapid innovations in materials science and rising demand across diverse high-tech sectors. These specialized targets are crucial in the production of thin films that are used in electronics, photovoltaics, optical coatings, and advanced displays. As industries transition to smaller, more efficient, and highly functional devices, the use of complex oxides in sputtering technology becomes increasingly necessary.

Complex oxide sputtering targets are important due to their unique ability to deliver precise material deposition, allowing devices with enhanced electrical, optical, and magnetic properties. This capability supports the ongoing innovation in semiconductors, next-generation displays, and clean energy technologies. With increasing R&D investments and production in Asia-Pacific and North America, the market is poised for significant expansion in the coming years.

What sets this market apart is the consistent evolution of thin-film technologies. Manufacturers are customizing target compositions for emerging applications like transparent conducting oxides (TCOs), superconducting films, and resistive switching layers for memory devices. This rapid pace of innovation, along with the growing adoption of energy-efficient devices, provides strong growth momentum for the complex oxide sputtering target market.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

- Advanced Display and Semiconductor Manufacturing: The rise in demand for ultra-high-definition displays and miniaturized semiconductor components is boosting the market. Complex oxides such as indium tin oxide (ITO), zinc oxide (ZnO), and barium titanate (BaTiO3) are progressively used in thin-film deposition for transistors, memory storage, and transparent electrodes. As devices become smaller and more complex, the need for high-purity sputtering targets with tailored compositions grows.

- Emergence of Transparent Conducting Oxides (TCOs): Transparent conducting oxides are becoming a cornerstone in optoelectronic applications. They are used in touch screens, solar panels, and smart windows. Complex oxides such as ITO and AZO (aluminum-doped zinc oxide) dominate the TCO segment. Their high optical transparency and electrical conductivity make them suitable for next-gen applications, thereby driving the demand for sputtering targets used in TCO coatings.

- Demand from Photovoltaic and Energy Applications: Thin-film photovoltaic cells are becoming popular due to their flexibility, lightweight properties, and energy efficiency. Complex oxide materials like copper indium gallium selenide (CIGS) and zinc magnesium oxide (ZnMgO) are commonly used in the fabrication of solar cell layers. As the renewable energy sector makes progress, the use of oxide targets in thin-film solar manufacturing is increasing.

- Increased Use in Sensor and Memory Devices: Complex oxide thin films are vital to the development of resistive random-access memory (RRAM), piezoelectric sensors, and magnetoresistive devices. These materials offer superior ferroelectric and dielectric properties. The incorporation of sputtered oxide layers in neuromorphic computing and IoT applications is anticipated to open new growth avenues.

Major Players and their Competitive Positioning

The complex oxide sputtering target market features a mix of established material science corporations and emerging innovators. These players engage in research collaborations, product launches, and global expansion initiatives to capture a larger share of the market.

Leading players included are Praxair Surface Technologies (now part of Linde plc), Tosoh Corporation, Mitsui Mining & Smelting Co., Ltd., Materion Corporation, Hitachi Metals, Ltd., American Elements, Kurt J. Lesker Company, Stanford Advanced Materials, Umicore, Soleras Advanced Coatings and others.

These companies focus on high-purity target development, customized formulations, and scalable production for catering to rapidly changing application demands. Strategic partnerships with semiconductor and display manufacturers are helping leading firms to maintain a competitive edge.

Consumer Behavior Analysis

- Performance-Driven Purchase Decisions: End-users in electronics and solar industries prioritize material quality. Key factors include purity, grain uniformity, and consistent deposition. These characteristics have a direct effect on thin-film quality. They also determine overall device performance. Strong manufacturing and proven reliability are key advantages. They result in higher trust and repeat sales.

- Focus on Material Customization: Industries are shifting toward application-specific oxide compositions. Custom targets are increasingly needed in production. They help meet distinct electrical, magnetic, or optical goals. The need for tailored solutions fosters supplier OEM collaboration. This strengthens the strategic value of sputtering offerings.

- Cost and Supply Chain Considerations: Complex oxides deliver improved functionality. However, their cost is higher compared to simpler material systems. Cost remains a key factor for many buyers. Strategies include bulk purchasing, domestic production, and using alternate materials. Leasing programs are being introduced by suppliers. Regional support systems further help reduce ownership expenses.

- Sustainability and Environmental Compliance: Environmental regulations and sustainable manufacturing are becoming more important. Consumers are looking for targets made from eco-friendly processes or recycled materials. This growing awareness is driving suppliers to invest in sustainable production technologies and circular material flows.

Pricing Trends

The price of complex oxide sputtering targets is determined by various factors, including:

- Purity levels and compositional complexity

- Target size and density requirements

- Production techniques (hot pressing, cold isostatic pressing, etc.)

- Order volumes and supply agreements

Prices typically range from $500 to over $10,000 per unit, which depends on material and application. High-end oxides used in semiconductors and photonics generally command premium prices due to strict purity and homogeneity requirements. However, increasing automation, scaling of production, and localized sourcing are helping to stabilize prices in the mid to long term.

Growth Factors

- Technological Progress in Deposition Techniques: Magnetron sputtering and pulsed laser deposition are evolving rapidly. Now we can use complex oxide targets in high-precision electronics and optoelectronics.

- Expansion of the Electronics and Display Industry: Smartphones, wearables, OLED TVs, and flexible displays are the driving demand for sputtered oxide thin films. Vertical integration of technology and materials is driving market growth.

- Push for Renewable Energy Technologies: Global shift to green energy is driving the demand for thin film solar cells and energy-efficient coatings. Complex oxides are key in these applications, especially in transparent conducting and barrier layers.

- Government-Backed Research and Subsidies: Supportive policies and funding for semiconductor R&D, especially in countries like China, US, Japan, and South Korea, are driving innovation in target materials. This is a boost to both production and application diversity of sputtering targets.

Regulatory Landscape

The complex oxide sputtering target market is subject to stringent rules that ensure:

- Material Safety Compliance: Targets must comply with safety standards concerning hazardous substances (e.g., RoHS, REACH).

- Environmental Impact: Manufacturers are required to reduce emissions, waste, and energy usage during production.

- Quality Management Systems: ISO certifications (e.g., ISO 9001, ISO 14001) are standard requirements for target suppliers, particularly for those that serve critical sectors such as aerospace and medical electronics.

Export controls and import regulations also apply to strategic materials used in target fabrication, specifically rare earths and heavy metals.

Recent Developments

Some of the recent developments in the market include:

- Customized Target Design Services: Leading players now offer end-to-end solutions, from formulation and prototyping to production. This service model enhances customer satisfaction and accelerates product development cycles.

- Collaborations with Academic Institutions: Joint R&D efforts between suppliers and universities are enabling advancements in oxide-based thin films for memory storage and spintronic devices.

- In April 2025, researchers unveiled a new method to control electron spin purely with an electric field in altermagnetic bilayers (specifically CrS), enabling reversible spin polarization at room temperature without magnetic fields. This breakthrough promises the development of ultra-compact, energy-efficient spintronic devices by harnessing layer‑spin locking in quantum materials.

- Growth in OLED and MicroLED Applications: The growth of advanced display formats has increased the demand for oxide targets that are used in pixel electrodes and encapsulation layers. This trend is shaping future product pipelines in the display materials market.

- Recycling and Circular Manufacturing: Companies are launching recycling programs for used sputtering targets. These efforts support material recovery and help lower production costs. This transition supports broader environmental efforts. It aligns closely with global sustainability goals.

Current and Potential Growth Implications

a. Demand-Supply Analysis: Thin-film technology adoption is accelerating. This shift is prompting manufacturers to scale up output capabilities. Advanced manufacturing requires niche equipment and inputs. This need often challenges supply chain resilience.

b. Gap Analysis: Top-tier applications benefit from robust support. Yet, affordable and scalable tools are lacking for mid-tier and small-scale users. Bridging this gap requires investment in flexible manufacturing and simplified target integration.

Top Companies in the Complex Oxide Sputtering Target Market

- Praxair Surface Technologies (Linde plc)

- Tosoh Corporation

- Materion Corporation

- Mitsui Mining & Smelting Co., Ltd.

- Hitachi Metals, Ltd.

- American Elements

- Kurt J. Lesker Company

- Stanford Advanced Materials

- Soleras Advanced Coatings

- Umicore

Complex Oxide Sputtering Target Market: Report Snapshot

Segmentation | Details |

By Material Type | Indium Tin Oxide (ITO), Zinc Oxide (ZnO), Barium Titanate, Lanthanum Oxide |

By Application | Semiconductors, Solar Panels, Optical Coatings, Data Storage, Sensors |

By Form | Planar Targets, Rotatable Targets |

By End-User | Electronics Manufacturers, Research Institutions, Solar Energy Firms |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- ITO and AZO Targets: Dominating TCO applications in touchscreens and smart windows.

- BaTiO3-Based Targets: These materials support both energy storage and sensing. They are central to capacitors and piezoelectric devices.

- Rotatable Targets: Improved durability and resource efficiency make these options attractive. They are now common in high-throughput production settings.

Major Innovations

- Nano-Structured Oxide Targets: Advances in surface area and material reactivity are emerging. They contribute to better film properties and faster deposition rates.

- Hybrid Targets with AI-Controlled Deposition: New technologies allow dynamic control of sputtering settings. This ensures consistent and uniform film quality.

- Low-Temperature Deposition Techniques: Enabling oxide film application on heat-sensitive substrates, like plastics and flexible glass.

Potential Growth Opportunities

- Penetration into Flexible Electronics: Flexible and wearable electronics are gaining traction. As a result, the need for suitable oxide films continues to grow.

- Expansion into Emerging Economies: The need for budget-friendly electronics is rising in key regions. This creates space for manufacturers to provide economical sputtering solutions.

- Integration with Smart Manufacturing (Industry 4.0): Advanced tools are reshaping thin-film processes. These include digital twins, AI-driven tracking, and smart defect detection.

Extrapolate Research Says:

Tech progress fuels the complex oxide sputtering target market. Demand from key sectors adds to this growth. As thin films power new electronics, demand will rise. High-performance sputtering targets will see strong growth.

To stay ahead, firms must offer tailored products. High purity and sustainable methods are also crucial. Firms are linking with AI-driven tools. Growth areas like smart computing and bendable displays drive gains. The alignment of innovation, production scale, and sustainability is gaining pace. It will shape the future trajectory of this essential materials segment.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Complex Oxide Sputtering Target Market Size

- August-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020