Capture and Production Equipment Market Size, Share, Growth & Industry Analysis, By Product Type (Cameras, Camcorders, Audio Equipment, Video Switchers, Lighting Systems, Monitors, Storage Devices), By Application (Film & Cinema Production, Broadcasting, Corporate Video, Educational Content, Live Events, Online Streaming), By End-User (Professional Studios, Freelancers & Content Creators, Educational Institutions, Broadcasting Networks, Corporate Enterprises), and Regional Analysis, 2024-2031

Capture and Production Equipment Market: Global Share and Growth Trajectory

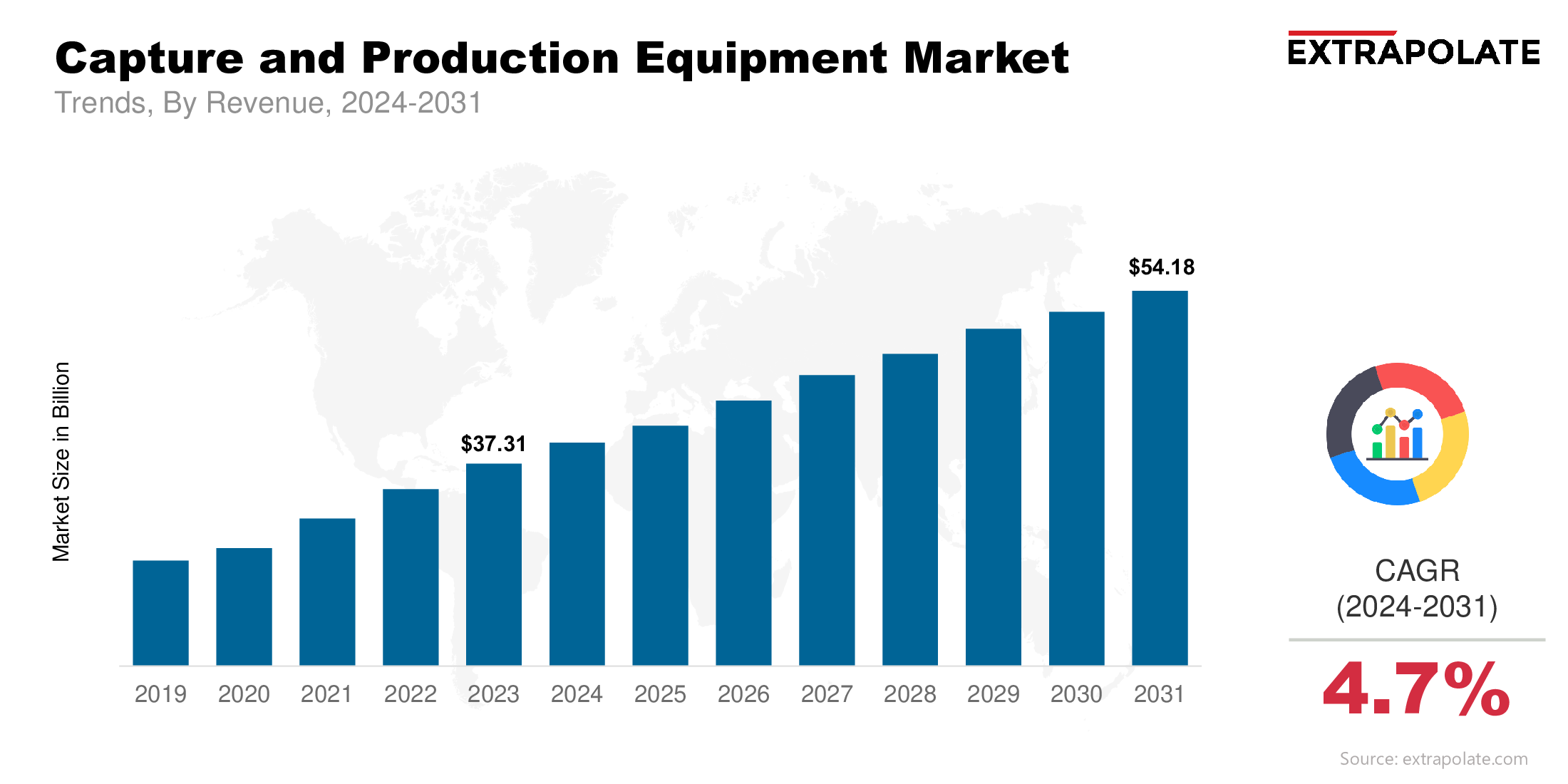

The global Capture and Production Equipment Market size was valued at USD 37.31 billion in 2023 and is projected to grow from USD 39.03 billion in 2024 to USD 54.18 billion by 2031, exhibiting a CAGR of 4.7 % during the forecast period.

The global capture and production equipment market is experiencing steady expansion, driven by the surging demand for high-quality video and audio content. As industries across entertainment, education, corporate communications, sports, and social media increasingly rely on visual storytelling, the need for advanced capture and production tools has never been higher. This equipment includes cameras, camcorders, switchers, monitors, microphones, lighting systems, and storage solutions all essential components of modern content production workflows.

Technological innovations and the shift toward digital broadcasting, live streaming, and virtual production are transforming how content is captured and distributed. High-resolution formats like 4K and 8K, along with immersive technologies such as augmented reality (AR) and virtual reality (VR), are pushing manufacturers to innovate. As a result, the global market for capture and production equipment is positioned for long-term, sustained growth with promising opportunities for industry players.

Key Market Trends Driving Product Adoption

Several trends are propelling the widespread adoption of capture and production equipment:

- Rising Demand for High-Resolution Content: The popularity of 4K and 8K video, driven by consumer expectations for ultra-high-definition viewing experiences, is accelerating investments in professional-grade capture equipment. Content creators, from film studios to independent videographers, are embracing cutting-edge tools to deliver cinematic quality visuals.

- Live Streaming and Remote Production: The rise of social media, virtual events, and hybrid work environments has fueled demand for real-time content. Live streaming platforms like YouTube Live, Twitch, and corporate webinars are increasingly mainstream, requiring reliable capture tools and low-latency production systems. Remote production capabilities have become a priority, especially post-pandemic.

- Adoption of Virtual and Augmented Reality Technologies: Immersive content creation is gaining momentum in gaming, education, training, and simulation industries. Capture equipment now supports volumetric video and 360-degree footage, while production tools integrate with AR and VR environments to offer engaging experiences.

- Cloud-Based Production Workflows: Cloud-based storage, editing, and collaboration tools are redefining media workflows. Broadcasters and studios are adopting cloud-first strategies to facilitate remote editing, version control, and scalable asset management. Capture devices are being designed to integrate seamlessly with cloud platforms.

Major Players and Their Competitive Positioning

The global capture and production equipment market is highly competitive, with prominent technology companies and specialist manufacturers offering innovative solutions. These players continuously improve performance, portability, and compatibility of their equipment. Key market participants include Canon Inc., Sony Corporation, Panasonic Corporation, Blackmagic Design Pty Ltd, Avid Technology, Inc., ARRI (Arnold & Richter Cine Technik), RED Digital Cinema, JVC Kenwood Corporation, Grass Valley (a Belden Brand), GoPro Inc and others.

These companies compete on quality, innovation, brand recognition, and pricing. Partnerships with content platforms, broadcasters, and OTT providers help these firms reach new customer segments and expand market penetration.

Consumer Behavior Analysis

Understanding end-user behavior is essential to capturing market demand for production and capture equipment. Several key patterns have emerged:

- Preference for User-Friendly and Portable Equipment: Content creators, especially independent professionals and small studios, favor compact gear with intuitive interfaces. Lightweight DSLR and mirrorless cameras with advanced video features are gaining traction over bulkier cinema cameras in some segments.

- DIY Content Creation Boom: From YouTubers to TikTok influencers, user-generated content is a major force. This demographic seeks affordable, versatile equipment that offers professional-level output. The growing creator economy has significantly expanded the market's lower and mid-tier segments.

- Professional Studios Seek High-End Performance: Established studios and broadcasters prioritize reliability, redundancy, and integration with multi-camera systems and editing suites. These customers demand premium equipment with advanced sensor technology, seamless editing workflows, and compatibility with post-production ecosystems.

- Cloud and Subscription-Based Preferences: Software-defined production environments and subscription models (e.g., Adobe Creative Cloud, Blackmagic DaVinci Resolve Studio) influence hardware adoption. Users increasingly expect gear that integrates with their preferred software or comes bundled with platform support.

Pricing Trends

Pricing in the capture and production equipment market varies widely based on application, resolution capabilities, and feature sets:

- Consumer-Level Equipment: Entry-level gear like mirrorless cameras, microphones, and LED panels ranges from $300 to $2,000. Popular with solo creators and small teams.

- Professional-Grade Equipment: Cinema cameras, broadcast switchers, and high-end monitors can exceed $50,000 each, targeting film studios, live broadcasters, and commercial production houses.

- Rental and Leasing Models: Due to high costs, studios and freelancers are increasingly opting for rental and leasing to access the latest professional equipment without major upfront investment.

- Bundled Systems and Turnkey Solutions: Manufacturers now offer bundled kits with capture, lighting, audio, and monitoring gear to simplify purchases for studios and educational institutions.

Growth Factors

The capture and production equipment market is expanding due to several key growth drivers:

- Explosive Content Consumption: Video is now the dominant form of media consumption. Platforms like Netflix, YouTube, and TikTok drive demand for diverse content formats, spurring continuous investment in new production equipment.

- Rise of OTT and Digital Broadcasting: OTT content delivery skips traditional broadcasting, enabling producers to reach global audiences directly. This shift has boosted demand for high-end, accessible capture tools.

- Surge in e-Learning and Virtual Events: The post-pandemic world has embraced virtual learning, webinars, and digital conferences. Educational institutions, training providers, and corporations are purchasing capture equipment to produce engaging virtual content.

- Corporate and Brand Video Marketing: Companies are increasingly investing in in-house video teams to produce content for internal communications, brand storytelling, and marketing. This trend fuels demand for studio-quality but budget-conscious production solutions.

Regulatory Landscape

While capture and production equipment does not face the same stringent medical or pharmaceutical regulatory scrutiny, several standards and compliance factors still apply:

- Broadcast Standards Compliance: Professional equipment used in television production must comply with region-specific broadcast standards (e.g., NTSC, PAL, SECAM). Cameras and switchers must support frame rates and resolutions approved for broadcast.

- Safety and Electromagnetic Compliance: Products must adhere to global safety and EMC standards, such as CE marking (Europe), FCC (United States), and RoHS for environmental compliance.

- Licensing for Wireless Equipment: Audio capture devices like wireless microphones may require frequency licenses, especially in regulated frequency bands. Manufacturers design equipment to comply with regional spectrum allocation rules.

Recent Developments

The capture and production equipment market is witnessing rapid evolution. Key developments include:

- Integration of AI in Post-Production: AI-driven editing, color grading, and asset tagging are becoming mainstream. Cameras and editing tools increasingly support machine learning algorithms to automate routine tasks and enhance creativity.

- Adoption of Virtual Production Techniques: Virtual sets using LED walls (e.g., Disney’s "The Mandalorian") are revolutionizing traditional green-screen workflows. Equipment vendors are now offering tools optimized for virtual production environments.

- Wireless and IP-Based Workflows: SDI cables are giving way to IP video and wireless transmission systems. This shift supports flexible, scalable production environments and reduces cable clutter in multi-camera setups.

- Modular and Scalable Solutions: Equipment is now built for scalability. Studios can customize setups using modular camera rigs, switchers, and lighting systems to fit specific production needs.

Current and Potential Growth Implications

- Demand-Supply Analysis: Rising content consumption and evolving production needs have created strong demand across multiple sectors—film, education, sports, and marketing. Manufacturers are racing to launch compact, AI-ready, and cloud-compatible tools to address this growing demand.

- Gap Analysis: While innovation is strong, gaps persist in affordability and technical training. Emerging creators often lack access to high-end gear or the skills to use advanced tools. Bridging this gap requires broader availability of mid-tier solutions and education programs.

Top Companies in the Capture and Production Equipment Market

Some of the major players shaping the future of this market include:

- Canon Inc.

- Sony Corporation

- Panasonic Corporation

- Blackmagic Design Pty Ltd

- ARRI (Arnold & Richter Cine Technik)

- RED Digital Cinema

- Avid Technology, Inc.

- JVC Kenwood Corporation

- Grass Valley

- GoPro Inc.

Capture and Production Equipment Market: Report Snapshot

Segmentation | Details |

By Product Type | Cameras, Camcorders, Audio Equipment, Video Switchers, Lighting Systems, Monitors, Storage Devices |

By Application | Film & Cinema Production, Broadcasting, Corporate Video, Educational Content, Live Events, Online Streaming |

By End-User | Professional Studios, Freelancers & Content Creators, Educational Institutions, Broadcasting Networks, Corporate Enterprises |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Cameras and Camcorders: The demand for compact and high-resolution cameras is soaring among vloggers, filmmakers, and broadcasters.

- Online Streaming Equipment: The rise of social media and influencer marketing is driving the adoption of streaming gear, including capture cards, switchers, and wireless mics.

- Corporate and Education Solutions: Schools, universities, and companies are setting up in-house studios, fueling demand for complete AV solutions.

Major Innovations

- AI-Powered Editing Tools: Integrated artificial intelligence features in software and hardware help automate editing, color correction, and sound balancing.

- Modular Equipment Designs: Cameras, lighting, and switchers are now modular, allowing for customization and easy upgrades.

- Virtual Production Support: Virtual production support tools are now common in both high-end and mid-range projects. These include equipment optimized for virtual sets and real-time compositing.

Potential Growth Opportunities

- Expansion into Emerging Markets: As internet penetration and smartphone usage grow in emerging regions, so does demand for content. Affordable, entry-level production gear holds massive potential.

- Integration with AR/VR Platforms: As immersive storytelling becomes a norm, there is an opportunity for companies to develop hardware compatible with AR/VR content capture and production.

- Cloud-Based Production Ecosystems: SaaS-based editing platforms and remote production solutions offer growth potential, particularly for distributed teams and global projects.

Extrapolate Research Says:

The capture and production equipment market is undergoing a dynamic transformation, driven by the digital revolution in content creation and distribution. Kings Research observes that increasing demand for high-resolution video, the rise of live streaming, and the growing popularity of remote and virtual production are major forces shaping this sector. As consumers, educators, corporations, and broadcasters invest in professional-grade yet accessible tools, the market continues to broaden its base—spanning from elite production studios to individual content creators.

With innovations in AI integration, cloud-native workflows, and immersive technologies such as AR and VR, production processes are becoming more efficient, flexible, and scalable. Furthermore, the expansion into emerging markets and the proliferation of cost-effective equipment are expected to significantly increase global adoption. Looking ahead, the capture and production equipment market is poised for sustained growth, offering strong investment opportunities and strategic advantages to stakeholders ready to embrace this rapidly evolving digital media landscape.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Capture and Production Equipment Market Size

- June-2025

- 148

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020