All-Flash Array Market Size, Share, Growth & Industry Analysis, By Product Type (Entry-level All-Flash Arrays, Midrange All-Flash Arrays, Enterprise All-Flash Arrays), By Application (Enterprise Data Storage, Cloud Storage, Big Data Analytics, Virtualization, Database Management, Backup & Recovery), By Distribution (Direct Sales, System Integrators & Resellers, Online Sales), Regional Analysis, 2025-2032

Market Definition

All-Flash Arrays are storage systems that use flash memory (solid-state drives) exclusively to store data, providing significantly faster performance compared to traditional hard disk drives (HDDs). These arrays deliver high-speed data access, low latency, and better energy efficiency for enterprise storage needs.

AFAs are widely used in data centers, cloud computing, big data analytics, virtual desktop infrastructure (VDI), and mission-critical applications where speed and reliability are essential. The report offers a detailed overview of the Market, analyzing key growth drivers, market trends, challenges, and competitive dynamics expected throughout the forecast period.

All-Flash Array Market Overview

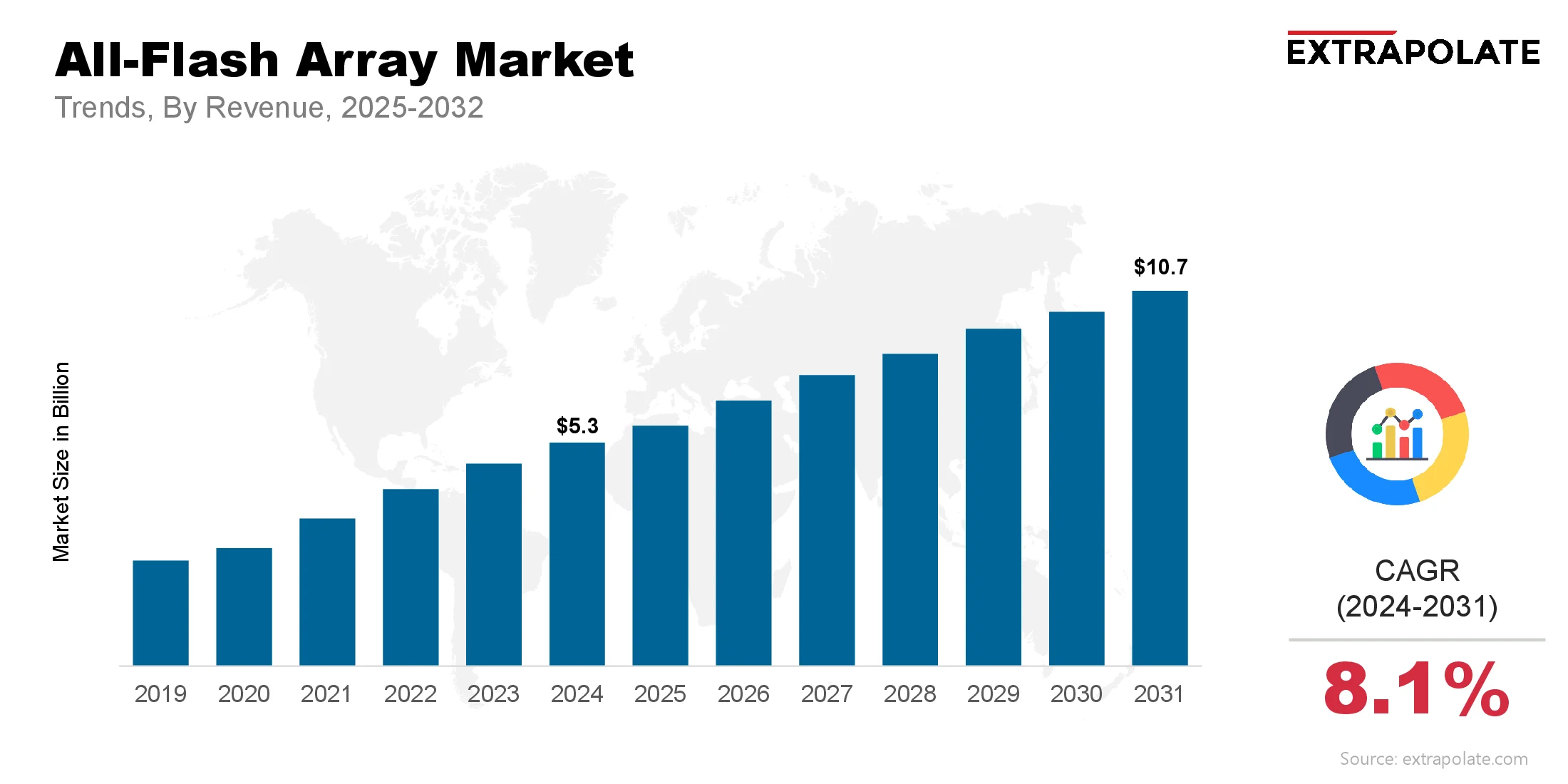

The global All-Flash Array market was valued at USD 5.3 billion in 2024 and is projected to grow from USD 5.8 billion in 2025 to USD 10.7 billion by 2032, exhibiting a CAGR of 8.1% during the forecast period.

Market growth is fueled by rising demand for high-performance storage solutions to support data-driven business operations, increasing adoption of cloud platforms, and the growing need for real-time data processing. Enterprises are prioritizing speed, scalability, and reliability to manage large-scale data workloads efficiently. Technological improvements, including AI-enabled storage management and integration with hybrid cloud environments, are further boosting market expansion.

Key Highlights

- The All-Flash Array industry was valued at USD 5.3 billion in 2024.

- The market is expected to grow at a CAGR of 8.1% from 2025 to 2032.

- North America held the largest regional market share of 41.5% in 2024, valued at USD 2.2 billion.

- The enterprise segment generated USD 3.1 billion in revenue in 2024.

- The cloud storage segment is forecasted to reach USD 4.3 billion by 2032.

- Direct sales accounted for 55.3% of revenue in 2024.

- Asia Pacific is projected to grow at a CAGR of 9.3% during the forecast period.

- Major companies include NetApp, Dell Technologies, Pure Storage, IBM, HPE, Hitachi Vantara, Western Digital, Huawei, Fujitsu, and Quantum Corporation.

Regulatory and Industry Standards

Regulations promoting data security, privacy, and efficient data management compel enterprises across sectors such as banking, healthcare, and telecommunications to upgrade storage infrastructures. Standards like GDPR, HIPAA, and industry-specific compliance requirements emphasize the need for reliable, fast, and secure data storage, reinforcing the demand for All-Flash Arrays in mission-critical environments.

Market Driver

Demand for High-Speed and Scalable Data Storage Solutions

Increasing digital transformation initiatives and expansion of data-intensive applications have heightened the need for storage solutions that can deliver high throughput and low latency. All-Flash Arrays provide the required performance enhancements over legacy disk-based storage, enabling faster data retrieval and seamless scalability. The surge in cloud adoption and virtualization within enterprises further drives demand for flash-based storage systems that support dynamic workloads efficiently.

Market Challenge

High Initial Investment and Integration Costs

The upfront cost of deploying All-Flash Arrays remains a challenge for many organizations, especially small and medium enterprises (SMEs). Although total cost of ownership (TCO) decreases over time due to lower power consumption and maintenance, initial procurement and integration expenses can deter adoption.

Additionally, compatibility with existing IT infrastructure and the need for skilled personnel to manage flash storage systems add to complexities. Vendors focus on offering flexible pricing models, including subscription-based services and cloud integration, to ease adoption barriers.

Market Trend

Advances in AI-Driven Storage Management and Hybrid Cloud Integration

Technological progress in AI and machine learning is transforming All-Flash Arrays by enabling intelligent data management. Features like predictive analytics for failure prevention, automated tiring, and workload optimization improve operational efficiency.

Furthermore, the integration of AFAs with hybrid cloud environments supports business continuity and disaster recovery strategies, offering flexibility and data accessibility. Portable and software-defined flash storage solutions are also gaining traction, facilitating cloud-based and edge computing use cases.

List of Companies in All-Flash Array Market

- Dell TechnologiesInc.

- Net App

- Pure Storage, Inc.

- Hewlett Packard Enterprise Company

- Internationa Business Machines Corporation

- Hitachi Vantara LLC

- Huawei Technologies Co. Ltd.

- FujitsuLimited

- Inspur Information Industry Co.Ltd.

- Western Digital Corporation

All-Flash Array Market Report Snapshot

Segmentation | Details |

By Product Type | Entry-level All-Flash Arrays, Midrange All-Flash Arrays, Enterprise All-Flash Arrays |

By Application | Enterprise Data Storage, Cloud Storage, Big Data Analytics, Virtualization, Database Management, Backup & Recovery |

By Distribution | Direct Sales, System Integrators & Resellers, Online Sales |

By Region | North America (U.S., Canada, Mexico); Europe (Germany, UK, France, Rest of Europe); Asia Pacific (China, Japan, India, Australia, South Korea); Middle East & Africa; South America |

All-Flash Array Market Segmentation

- By Product Type: Enterprise All-Flash Arrays dominate the market, accounting for a significant revenue share due to their scalability and support for critical applications requiring maximum performance. Midrange and entry-level arrays are gaining popularity among SMEs and mid-tier businesses embracing digital transformation.

- By Application: Enterprise data storage and cloud storage applications lead growth, driven by the need for real-time processing, high availability, and data security. Virtualization and database management segments are also expanding as companies modernize their IT environments.

- By Distribution Channel: Direct sales remain the major channel for All-Flash Arrays, favored for personalized solutions and post-sale support, contributing to a 55.3% revenue share in 2024. System integrators and online platforms are expanding their roles to improve accessibility and reach.

Regional Analysis

Regional Analysis

- North America: The region holds the largest market share, driven by early adoption of cloud services and strong presence of technology vendors. Regulatory compliance and digitally advanced industries such as finance and healthcare push demand for high-performance AFAs.

- Asia Pacific: The fastest-growing market, with high investments in data centers across China, India, Japan, and South Korea. Rapid digitization, government initiatives, and expanding enterprises are adopting all-flash storage to meet evolving data needs.

- Europe, Middle East & Africa, and South America also show steady growth, with increasing focus on digital infrastructure upgrades and cloud adoption fueling market expansion.

Competitive Landscape

Leading companies focus on innovation through improved flash memory management, energy-efficient designs, and integration with cloud-native architectures. Strategic partnerships, product launches, and customer-centric solutions help solidify All-Flash Array Market positioning. For example:

- In February 2025, Pure Storage launched FlashArray//X90, offering up to 5 times faster throughput for enterprise applications, emphasizing AI integration for system optimization.

- Dell Technologies introduced PowerStore 6000 Series in late 2024, supporting containerized workloads and seamless hybrid cloud environments.

- IBM unveiled the IBM FlashSystem 5500, featuring enhanced end-to-end encryption and AI-based monitoring tools to improve data security and performance management.

Recent Developments

- In March 2024, NetApp expanded its AFA portfolio with new NVMe-based systems that reduce latency and improve throughput for cloud-native applications.

- Huawei showcased its OceanStor Pacific All-Flash Series in Asia, targeting large-scale data centers with high-density storage and intelligent management capabilities.

Extrapolate says

The global All-Flash Array (AFA) market is on a strong growth trajectory, supported by a convergence of digital transformation trends, increasing enterprise focus on data-driven operations, and rapid cloud adoption.

With performance, scalability, and security becoming critical priorities, organizations are steadily shifting from traditional storage systems to flash-based alternatives. The dominance of enterprise-grade AFAs, along with rising demand in midrange and entry-level segments, reflects broader market accessibility and diversification.

Technological innovations—such as AI-enabled storage optimization and hybrid cloud integration—are reshaping the competitive landscape and enabling smarter infrastructure strategies. Despite the challenge of high initial investments, the long-term value in performance and efficiency is driving adoption across industries and geographies. As businesses continue to modernize their IT frameworks, All-Flash Arrays are expected to play a pivotal role in future-ready data storage solutions.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

All-Flash Array Market Size

- August-2025

- 148

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020