Aerospace Ultracapacitors Market Size, Share, Growth & Industry Analysis, By Product Type (Modules, Cells, Hybrid Ultracapacitors) By Application (Satellite Systems, Aircraft Power Backup, UAV Systems, Launch Vehicles, Electric Propulsion) By End-User (Commercial Aviation, Military Aviation, Space Industry, UAV Manufacturers) , and Regional Analysis, 2024-2031

Aerospace Ultracapacitors Market: Global Share and Growth Trajectory

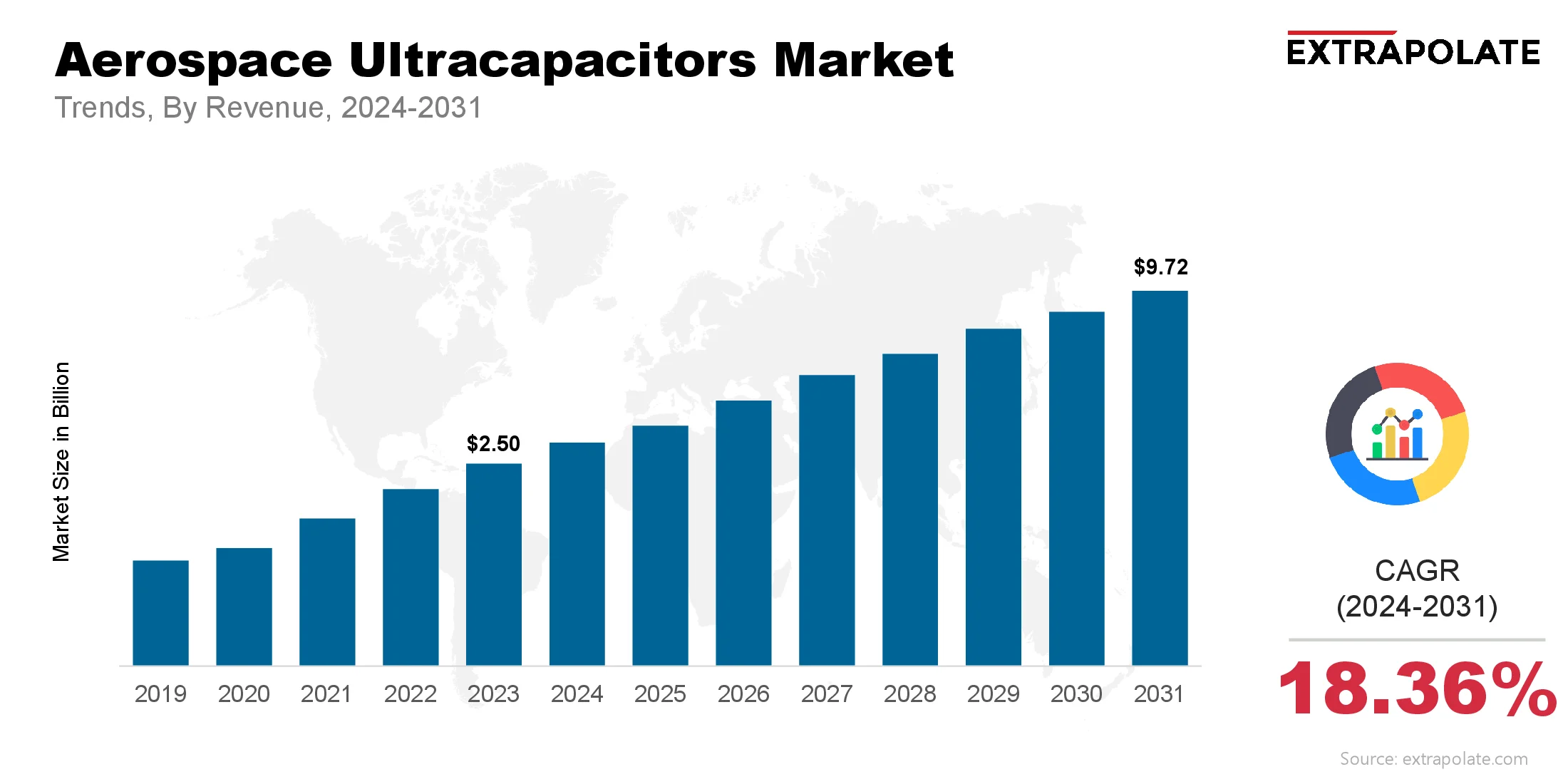

The global Aerospace Ultracapacitors Market size was valued at USD 2.50 billion in 2023 and is projected to grow from USD 2.98 billion in 2024 to USD 9.72 billion by 2031, exhibiting a CAGR of 18.36% during the forecast period.

The global market is accelerating rapidly as aviation and space industries seek energy storage solutions that deliver high power density, lightweight structure, and long service life. Ultracapacitors also known as supercapacitors have emerged as a key technology for meeting the modern demands of electric aircraft systems, satellites, drones, and defense applications. These devices are increasingly being integrated into aerospace power systems for peak load handling, backup power, emergency landing systems, and regenerative braking in electric aircraft.

Driving this growth is the synergy of technological innovation and the shift toward electrification in aviation. With aircraft becoming more electric and space missions pushing for efficiency, ultracapacitors offer rapid charging capabilities and extended operational lifespans—factors critical to aerospace operations. As space exploration, urban air mobility (UAM), and electrified propulsion gain traction globally, the aerospace ultracapacitors industry is positioned for substantial expansion over the coming years.

Ultracapacitors’ ability to operate in extreme temperatures, withstand high mechanical stress, and deliver reliable energy in critical aerospace functions is revolutionizing energy storage in the sector. As aerospace platforms prioritize weight optimization, reliability, and power management, ultracapacitors are finding deeper market penetration across civil, commercial, and military aviation sectors.

Key Market Trends Driving Product Adoption

Several trends are fueling the adoption of ultracapacitors in the aerospace industry:

Electrification of Aircraft Systems: The aerospace sector is increasingly adopting More Electric Aircraft (MEA) architectures to improve fuel efficiency and reduce emissions. This trend drives demand for ultracapacitors to handle peak power loads and support electrified subsystems such as electric actuation, power stabilization, and auxiliary systems.

Shift Toward Sustainable Aviation: With net-zero goals and regulatory pressure to reduce carbon emissions, the aviation industry is embracing energy-efficient technologies. Ultracapacitors support energy recovery and reduce dependence on traditional fuel-based systems. They are crucial in hybrid-electric propulsion systems, contributing to cleaner aviation operations.

Increased Satellite Deployment and Space Missions: The surge in satellite constellations, commercial space exploration, and low-Earth orbit (LEO) missions demands energy systems that are compact, robust, and able to perform in harsh space environments. Ultracapacitors meet these needs by offering high reliability and rapid energy discharge, making them ideal for space-grade power modules.

Technological Advancements in Ultracapacitor Design: Innovations in materials, such as graphene-based electrodes and solid-state electrolytes, are enhancing ultracapacitor energy density and performance. These developments are making ultracapacitors more viable for higher-energy aerospace functions, bridging the gap between batteries and capacitors.

Major Players and Their Competitive Positioning

The aerospace ultracapacitors industry is moderately consolidated with key global players vying for technological superiority and strategic collaborations. Leading companies are investing in R&D, entering aerospace partnerships, and expanding their product portfolios to serve niche applications. Maxwell Technologies (Tesla Inc.), Skeleton Technologies, CAP-XX Limited, Eaton Corporation, AVX Corporation, Ioxus Inc., LS Mtron, Seiko Instruments Inc., Tecate Group, Nichicon Corporation.

These companies are focusing on lightweight, rugged ultracapacitor modules tailored for aircraft and spacecraft systems. Collaborations with aerospace OEMs and defense contractors are central to maintaining competitive positioning.

Consumer Behavior Analysis

Consumer behavior in the aerospace ultracapacitors market is shaped by reliability, operational performance, and lifecycle value:

- Preference for High Reliability and Redundancy: Stakeholders demand steady and fail-safe power. Redundant systems help prevent mission failure. High cycle strength and low failure risk are key traits. These support vital roles in backup and actuator units.

- Weight and Space Optimization: Keeping systems light is critical. Weight limits affect both aircraft and space vehicles. Compact and lightweight, ultracapacitors suit short-duration demands. OEMs are shifting from batteries to meet these needs.

- Total Cost of Ownership (TCO): Initial costs are higher than for regular capacitors. However, they offer long life, low maintenance, and strong efficiency. They reduce long-term expenses. That fits well with the budget goals of aerospace companies.

- Growing Confidence in Hybrid Energy Systems: Demand is growing for dual-source energy systems. Combining ultracapacitors and batteries boosts efficiency and reliability. High power and energy are key strengths. These features suit different aerospace use cases.

Pricing Trends

Cost is linked to energy specs and build quality. Certification and design needs add to the price. High specs made aerospace ultracapacitors expensive. Now, innovation and scale are making them more affordable.

Cost-saving strategies being employed include:

• Modular integration to reduce installation complexity

• Use of advanced composite materials for casings

• Vertical integration by manufacturers to reduce dependency on suppliers

State-funded programs increase need for electric aerospace systems. As demand grows, pricing becomes more competitive.

Growth Factors

Multiple factors are accelerating the growth of the aerospace ultracapacitors market:

Proliferation of Electric and Hybrid-Electric Aircraft: With prototypes and commercial programs for electric aircraft such as eVTOLs and UAVs becoming popular, ultracapacitors play a crucial role in supplying instant energy for liftoff, landing, and emergency scenarios.

Expansion of Commercial Space Activities: Private space enterprises like SpaceX and Blue Origin, alongside national agencies such as NASA and ESA, are incorporating ultracapacitors into space modules for fast charge-discharge cycles, payload deployment systems, and solar energy buffering.

In May 2025, China announced plans to launch new modules to its Tiangong space station to accommodate growing scientific research needs and potentially expand international collaboration. These additions are expected to increase the station’s capabilities and support future cooperative missions.

Defense Sector Modernization: Global militaries are adopting ultracapacitor tech. Applications span radar systems, EW tools, and electric protection. Rapid action in real-time scenarios is critical. It boosts mission success rates.

Government Incentives and R&D Support: Governments are funding advanced aerospace tech. They use grants and contracts to support innovation. Programs such as NASA’s Electrified Aircraft Propulsion (EAP) and Europe’s Clean Aviation initiative promote the development and adoption of ultracapacitors.

Regulatory Landscape

Strong compliance is required for ultracapacitors in aerospace. It helps maintain safety and function in extreme settings. These include:

- RTCA DO-160: The standards focus on environmental stress for aircraft parts. Clear test methods help prove reliability.

• MIL-STD-704F: It outlines how electric power should perform in military planes. These rules support mission safety and function.

• ISO 9001 / AS9100: Quality systems in aerospace are highly detailed. They ensure parts meet strict flight safety rules.

• REACH and RoHS Compliance: It ensures all inputs are safe to handle. At the same time, it guards against environmental damage.

Suppliers must follow these rules to stay competitive. OEMs and defense bodies require full compliance.

Recent Developments

Notable developments in the aerospace ultracapacitors market include:

- Skeleton Technologies' SuperBattery Modules: Aerospace-grade modules with curved graphene were launched. They boost energy density for eVTOLs and satellites.

- Partnerships with Aerospace OEMs: CAP-XX teamed up with UAV and satellite firms. The goal is to use ultracapacitors in launch and release systems.

- Defense-Funded Research Initiatives: Ultracapacitors are being tested in defense systems. DARPA supports work on lasers and drone power balance.

- Graphene and Nanomaterial Innovations: Companies are improving material tech for ultracapacitors. Goals include better charge, lower weight, and higher heat limits.

These trends confirm their aerospace benefits. They also reflect active research and tech development.

Current and Potential Growth Implications

a. Demand-Supply Analysis: The move to electrification is gaining speed. High-power density units are now in high demand. Production now targets low-volume, high-cost areas. Big markets lie ahead in air mobility and defense upgrades.

b. Gap Analysis: They offer fast power flow. But batteries last longer due to higher energy storage. Market players are addressing this by developing hybrid modules and investing in material science to improve energy-per-mass ratios.

Top Companies in the Aerospace Ultracapacitors Market

• Maxwell Technologies (Tesla Inc.)

• Skeleton Technologies

• Eaton Corporation

• AVX Corporation

• CAP-XX Limited

• Ioxus Inc.

• LS Mtron

• Seiko Instruments Inc.

• Nichicon Corporation

• Tecate Group

Aerospace Ultracapacitors Market: Report Snapshot

Segmentation | Details |

By Product Type | Modules, Cells, Hybrid Ultracapacitors |

By Application | Satellite Systems, Aircraft Power Backup, UAV Systems, Launch Vehicles, Electric Propulsion |

By End-User | Commercial Aviation, Military Aviation, Space Industry, UAV Manufacturers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Electric Aircraft Subsystems: Ultracapacitors are increasingly replacing hydraulic systems in next-gen aircraft. Fast power support aids braking and surface control. It also ensures backup power in MEA use.

- Satellite Systems: For motion control and solar storage, ultracapacitors work well. They are more stable than batteries in harsh radiation.

- UAVs and Drones: With fast output and low weight, they fit UAV needs. Takeoff and mid-air shifts need such quick energy.

Major Innovations

- Hybrid Ultracapacitor-Battery Systems: Power stays steady with these systems. That helps planes and rockets perform well.

- Solid-State Electrolytes: Keeps systems steady in high heat. Reduces flammability during flight or space work.

- Self-Healing Capacitor Materials: Stronger and longer-lasting parts are coming up. They are useful in risky settings.

Potential Growth Opportunities

- Urban Air Mobility (UAM): Urban air travel is growing with eVTOLs. They need ultracapacitors for quick power boosts.

- Space-Based Solar Power: Space systems are turning to solar energy. Ultracapacitors help control and spread the power.

- Retrofit Programs: Defense and civil flight groups are upgrading old planes. They now add electric parts using ultracapacitors.

Extrapolate says:

The market for aerospace ultracapacitors is changing fast. This comes from more space flights and clean energy rules. Aerospace systems need power that is light, quick, and steady. Ultracapacitors are now a key part. These are used in planes, defense drones, and small satellites. Their use is growing fast.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Aerospace Ultracapacitors Market Size

- July-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020