Sports Trading Cards Market Size, Share, Growth & Industry Analysis, By Type (Physical Cards, Digital Cards (NFTs), Autographed Cards, Game-Worn Cards), By Sport (Baseball, Basketball, Football, Soccer, Hockey, Others), By Distribution Channel (Online Retail, Hobby Stores, Supermarkets/Hypermarkets, Auction Platforms), and Regional Analysis, 2024-2031

Sports Trading Cards Market Global Share and Growth Trajectory

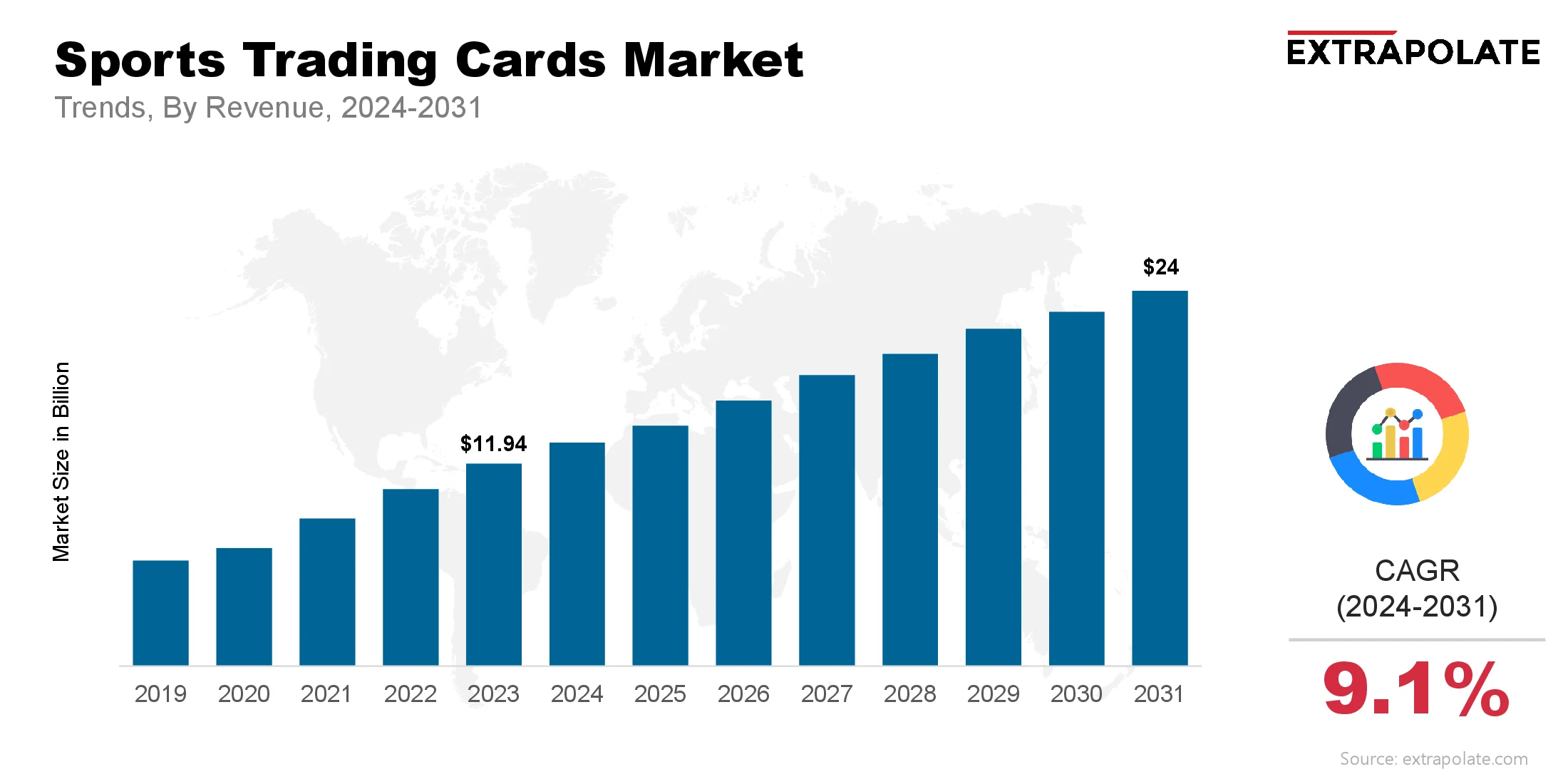

The global sports trading cards market size was valued at USD 11.94 billion in 2023 and is projected to grow from USD 12.99 billion in 2024 to USD 24 billion by 2031, exhibiting a CAGR of 9.1 % during the forecast period.

The global is experiencing a resurgence, bolstered by the intersection of nostalgia, entertainment, and digital innovation. Traditionally viewed as collectibles for hobbyists, sports trading cards have evolved into a dynamic investment class and a vital part of global sports merchandising. With increasing demand from millennials and Gen Z consumers, alongside surging interest from institutional investors, the market is transforming into a well-structured, high-growth industry.

Valued in the billions, the sports trading cards market includes physical and digital card formats across major leagues such as the National Basketball Association (NBA), Major League Baseball (MLB), National Football League (NFL), and international soccer tournaments. This diverse reach supports its expansion into global markets, aided by online marketplaces, authentication services, and grading systems. Sports cards are now seen as valuable cultural assets that celebrate athletes, encapsulate history, and carry significant financial appreciation potential.

Key Market Trends Driving Product Adoption

- Digital Transformation and NFT Integration: One of the most transformative trends driving growth in the sports trading cards market is the integration of blockchain and NFTs. Digital trading cards hosted on blockchain platforms provide a secure, verifiable, and transparent mechanism for ownership. Companies like NBA Top Shot and Sorare are redefining collecting by offering highlights, player statistics, and limited-edition NFTs, creating a digital asset class that mirrors traditional card collecting.

- Rising Demand for Graded Cards: Professional card grading has become a pivotal element in driving market trust and valuation. Companies like PSA (Professional Sports Authenticator), Beckett, and SGC provide third-party grading services that assess the condition, rarity, and authenticity of cards. Graded cards are highly prized by investors as they provide standardized evaluations, mitigating counterfeiting concerns and influencing resale value. High-grade cards of iconic players like Michael Jordan, Tom Brady, and Lionel Messi have fetched millions of dollars at auctions. As more collectors seek certified collectibles, demand for graded cards continues to grow.

- Surge in Athlete-Endorsed and Limited Edition Releases: Collaborations between trading card companies and athletes have led to exclusive, limited-edition card series, often featuring autographs, game-worn memorabilia, or holographic elements. These premium releases generate significant hype and drive scarcity value, making them attractive to high-end collectors. Such releases often align with major sporting events like Super Bowl championships, FIFA World Cups, or the NBA Finals, leveraging athlete visibility and fan enthusiasm to increase sales.

- Youth and Pop Culture Influence: The market has seen increasing engagement from younger consumers, largely influenced by popular YouTubers, influencers, and celebrities who showcase card openings and investing strategies online. Social media platforms, especially Instagram, TikTok, and YouTube, have become instrumental in building hype, educating new collectors, and creating trading card communities.

- Simultaneously, crossovers with entertainment franchises and fashion brands are expanding the appeal of sports trading cards beyond core sports fans, blending sports memorabilia with pop culture trends.

Major Players and their Competitive Positioning

The competitive landscape of the sports trading cards industry is defined by a mix of legacy players and digital-native startups. Prominent companies include Topps Company, Inc., Panini Group, Upper Deck Company, Leaf Trading Cards, Futera, Beckett Grading Services, PSA (Professional Sports Authenticator), Sorare (digital trading cards), Dapper Labs (NBA Top Shot), eBay (as a leading secondary market platform).

These players are competing on the basis of product quality, brand partnerships, exclusive athlete deals, technology adoption, and card grading services. Traditional firms like Topps and Panini continue to dominate the physical cards segment, while newcomers such as Sorare and Dapper Labs are pioneering blockchain-based card innovations. Strategic partnerships with major leagues and the integration of augmented reality (AR) and digital redemption codes are further fueling competitive differentiation.

Consumer Behavior Analysis

- Investment as a Motivation: Many collectors now view sports trading cards as tangible investments. This perception shift has altered buying behavior, as consumers increasingly seek rare, graded, or rookie cards that hold long-term financial value. Auction results and media coverage of high-value sales have attracted new market entrants focused on investment returns.

- Emotional and Nostalgic Appeal: The emotional resonance of sports figures and the nostalgia of childhood collecting continue to play a significant role. Collectors often express strong attachments to specific teams, eras, or athletes, driving them to pursue particular sets or complete series.

- Online Buying and Trading Preferences: Consumers are increasingly purchasing cards through online platforms rather than traditional hobby shops. Marketplaces like eBay, COMC, Goldin Auctions, and Whatnot offer 24/7 access to global inventories, real-time pricing, and digital bidding tools. Livestreamed card breaks—where buyers watch packs opened live—have become a popular and interactive method of engagement.

- Customization and Personalization: A rising trend involves consumers ordering personalized or custom cards, either through print-on-demand services or third-party creators. This trend appeals particularly to niche collectors and supports market segmentation.

Pricing Trends

Pricing in the sports trading cards market varies widely based on rarity, condition, athlete popularity, and grade. Key pricing patterns include:

- High-end Cards: Cards of legendary players or rookie cards in mint condition can command prices upwards of several million dollars. For instance, a 1952 Topps Mickey Mantle card graded PSA 9 sold for over $12 million.

- Mass Market Cards: Entry-level products aimed at beginners are priced affordably and often sold in retail packs or boxes. These are commonly found in stores and are used to engage casual consumers.

- Grading Premiums: Professionally graded cards often sell for 3–10 times more than their ungraded counterparts, depending on the grade received.

- Digital Cards: NFT-based cards range in price from a few dollars to thousands, depending on scarcity and market demand, and often come with dynamic pricing on blockchain platforms.

Overall, market pricing has become increasingly sophisticated, with real-time tracking tools and pricing indexes enabling better price discovery.

Growth Factors

Several macro and microeconomic factors are propelling the growth of the sports trading cards market:

- Increased Disposable Income: As consumer purchasing power rises, more individuals are allocating income toward hobbyist and investment activities, including collectible cards.

- E-commerce Expansion: The rapid digitization of retail has made cards more accessible than ever, with platforms enabling global reach and seamless transactions.

- Athlete Popularity and Sports Culture: Rising viewership and athlete branding, bolstered by social media, drive fan engagement and interest in athlete-centric merchandise like trading cards.

- Mainstream Media Coverage: News stories highlighting record-breaking card sales have normalized collecting as a financially sound pursuit.

- Tech Integration: Innovations such as AR, blockchain, and mobile grading apps are enhancing user experiences, authenticity, and trust—leading to more widespread adoption.

Regulatory Landscape

The sports trading cards market remains relatively lightly regulated compared to traditional financial instruments but is witnessing increased oversight in certain areas:

- Anti-Fraud Measures: Platforms and grading services are enhancing protocols to detect and prevent counterfeit cards and fraudulent listings.

- Securities Classification for NFTs: Regulatory bodies in the U.S. and EU are examining whether some NFT-based sports cards qualify as securities, which may lead to new compliance rules.

- Intellectual Property Licensing: Companies must obtain proper licensing from sports leagues and athlete associations to produce official cards. IP violations are subject to legal enforcement.

- Taxation Policies: In some regions, sales of high-value collectibles are subject to capital gains taxes, which can influence trading strategies.

While the regulatory environment is still evolving, a shift toward more formal compliance and ethical standards is expected, especially for online and blockchain-based transactions.

Recent Developments

- Fanatics Acquires Topps: In 2022, Fanatics Inc. acquired Topps’ trading card business, securing licensing deals with MLB and positioning itself as a major force in the industry.

- Panini Digital Expansion: Panini has expanded its digital card offering, introducing blockchain-based cards with player signatures and limited-run prints.

- eBay Vault: In response to demand for secure storage and trading, eBay launched its Vault service, a secure facility for storing high-value trading cards and enabling digital ownership transfers.

- Partnerships with Football Leagues: Sorare has signed agreements with multiple soccer leagues, including La Liga and the Bundesliga, expanding the global reach of NFT-based sports cards.

- Increased Auction Activity: Goldin Auctions and Heritage Auctions reported record sales. That indicates growing investor interest and market acceptance.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Surging consumer and investor demand is putting pressure on manufacturers to produce innovative and high-quality cards. While scarcity remains a key value driver, maintaining equilibrium between supply control and market saturation is crucial.

b. Gap Analysis

A significant gap exists in the affordability and accessibility of premium cards for casual consumers. Additionally, educational resources and transparent grading systems remain limited in emerging markets. Bridging these gaps presents opportunities for companies to expand their consumer base.

Top Companies in the Sports Trading Cards Market

- Topps Company, Inc.

- Panini Group

- Upper Deck Company

- Leaf Trading Cards

- Futera

- PSA (Professional Sports Authenticator)

- Beckett Grading Services

- SGC Grading

- Sorare

- Dapper Labs

Sports Trading Cards Market: Report Snapshot

Segmentation | Details |

By Type | Physical Cards, Digital Cards (NFTs), Autographed Cards, Game-Worn Cards |

By Sport | Baseball, Basketball, Football, Soccer, Hockey, Others |

By Distribution Channel | Online Retail, Hobby Stores, Supermarkets/Hypermarkets, Auction Platforms |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Digital Trading Cards (NFTs): The NFT segment is expected to register rapid growth due to enhanced security and digital ownership features.

- Basketball and Soccer Cards: Rising global popularity of the NBA and FIFA tournaments is fueling demand for athlete-specific cards in these categories.

- Online Retail Channels: With e-commerce platforms becoming the main trading hub, this segment is experiencing exponential growth.

Major Innovations

- Blockchain-Based Authenticity Verification: Ensures traceable and tamper-proof provenance.

- AR-Enhanced Cards: Integrate multimedia experiences when scanned with a smartphone.

- Hybrid Card Platforms: Combine physical and digital ownership, appealing to traditional and modern collectors alike.

Potential Growth Opportunities

- Expansion into Asia-Pacific and Latin America: Untapped fan bases and rising disposable income present fertile ground for market expansion.

- Youth Engagement and Education: Programs aimed at educating younger demographics on card value and collecting ethics can foster long-term consumer loyalty.

- Subscription-Based Collecting Services: Monthly card box subscriptions and personalized curation experiences are attracting casual buyers into the collector ecosystem.

Extrapolate Research says:

The sports trading cards market is evolving into a vibrant global industry driven by the convergence of tradition and innovation. As digital platforms enhance accessibility and blockchain secures authenticity, both physical and digital cards are gaining significant investor traction. Strong demand, particularly from younger demographics and global sports fans, is reshaping the collector landscape.

With key players investing in athlete partnerships, digital enhancements, and distribution expansions, the market is set to witness substantial growth across all regions. Innovations such as NFT-based ownership, graded card marketplaces, and immersive card experiences will be central to shaping future dynamics. For stakeholders across sports, media, and technology sectors, the sports trading cards market offers lucrative opportunities in both cultural and financial realms.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Sports Trading Cards Market Size

- June-2025

- 148

- Global

- retail

Related Research

Activewear Market Size, Share, Growth & Industry Analysis, By Product Type (Athletic Shoes, Sports B

March-2025

Agrobacterium tumefaciens Competent Cells Market Insights 2022, Global Analysis and Forecast to 2030

July-2021

Aluminium Composite Panels (ACP) Market Insights 2022, Global Analysis and Forecast to 2030

July-2021