Luggage Market Size, Share, Growth & Industry Analysis, By Product Type (Travel Bags, Trolley Bags, Backpacks, Duffel Bags, Others) By Material (Polycarbonate, Polyester, Nylon, Leather, Others) By Distribution Channel (Online, Offline (Retail Stores, Supermarkets, Specialty Stores)) By Price Range (Economy, Mid-Range, Premium), and Regional Analysis, 2024-2031

Luggage Market: Global Share and Growth Trajectory

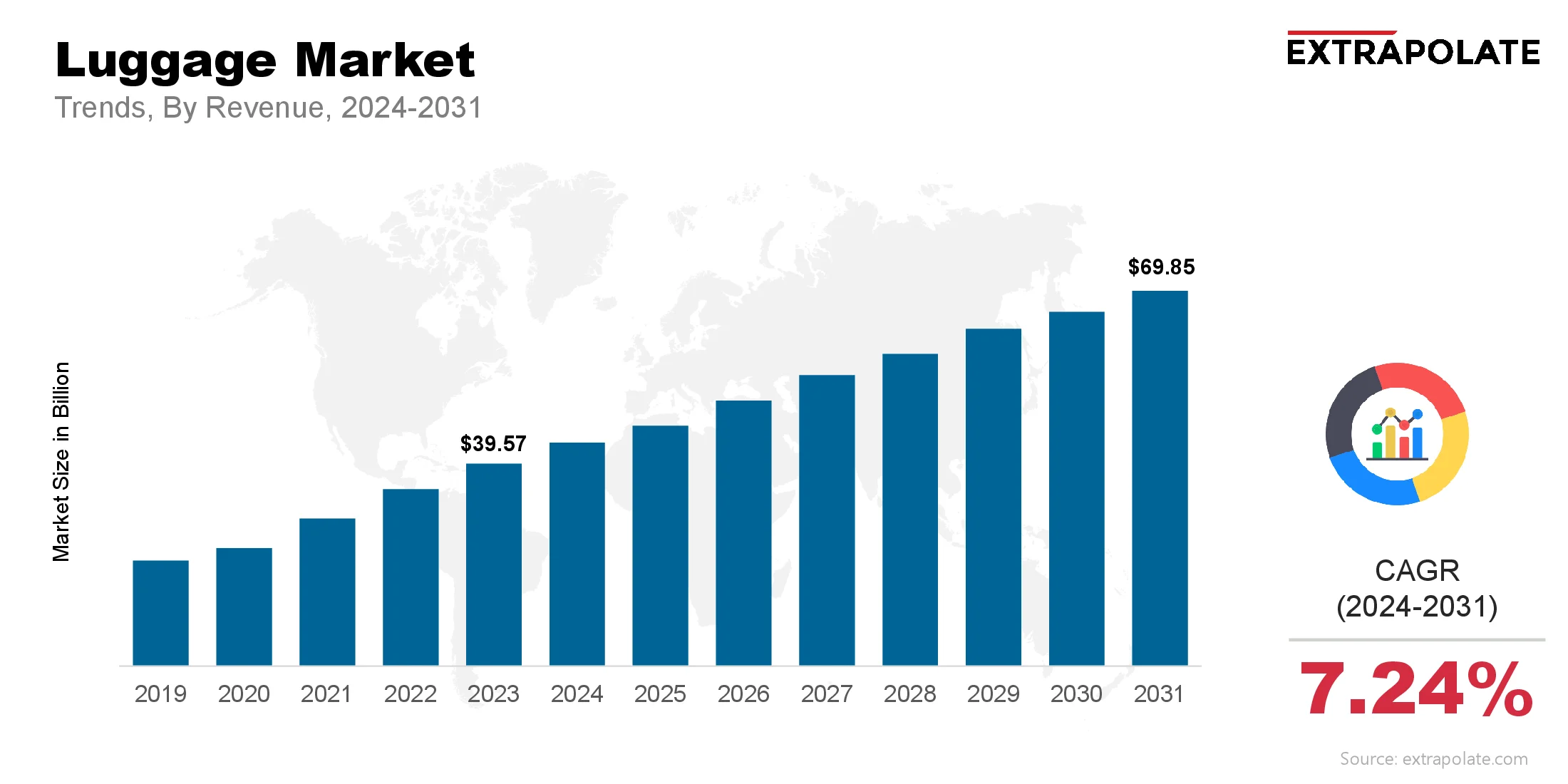

The global Luggage Market size was valued at USD 39.57 billion in 2023 and is projected to grow from USD 42.80 billion in 2024 to USD 69.85 billion by 2031, exhibiting a CAGR of 7.24% during the forecast period.

The luggage industry is rapidly evolving due to shifting lifestyles, technological advancements, and a rise in international travel. Luggage is considered as a representation of practicality, style, and smart utility beyond just travel necessity. Customers seek elements that fit their digital lifestyle and travel requirements, from embedded technology to aesthetics and brand value, in addition to storage.

E-commerce is another significant market driver. Customers all over the world may now purchase baggage brands thanks to online marketplaces like Amazon, Flipkart, and Alibaba. These websites provide customer reviews, quick returns, unique discounts, and comparisons, all of which have an impact on consumer purchasing decisions. Virtual try-ons and augmented reality (AR) in digital retail experiences are further simplifying the decision-making process for customers.

The future of the luggage industry is tied to the evolution of global mobility and consumer expectations. As travel becomes more personal and digital integration becomes the norm, the next phase of growth will be about hyper-customization, IoT enabled luggage systems and sustainable innovation. As the travel ecosystem gets more connected, the luggage industry is well placed to meet the needs of modern day explorers everywhere.

Key Market Trends Driving Product Adoption

More Travel and Tourism: A big driver of the luggage market is the ongoing recovery and growth of international and domestic travel. According to the UN World Tourism Organization, global tourist arrivals are up and up in post pandemic times. This surge has driven up demand for luggage products, including suitcases, backpacks and duffel bags.

Smart Luggage: Modern travelers want more than just space. Smart luggage with tracking systems, biometric locks, weight sensors and USB charging are gaining prominence. These innovations provide more travel convenience and are for tech savvy consumers especially in premium segments.

Sustainable and Eco-Friendly Materials: With growing environmental awareness, consumers are looking for sustainable products. Luggage manufacturers are responding by launching products made from recycled plastics, plant based fabrics and biodegradable materials. Sustainable luggage is no longer a nice to have but a growing trend in the industry.

Customization and Fashion Forward Design: Consumers are treating luggage as a lifestyle accessory. Companies are offering personalized and fashionable luggage to match individual style. Collaborations with fashion designers and brands are becoming more common, aesthetics is playing a big role in product appeal.

Major Players and Their Competitive Positioning

The luggage market is highly competitive, with both global giants and regional brands vying for consumer attention. Key players in the industry are investing heavily in design innovation, brand positioning, and geographic expansion.

Some of the major players include: Major global and regional luggage brands include Samsonite International S.A., VIP Industries Ltd., VF Corporation (JanSport, Eastpak), American Tourister, Tumi Holdings Inc., Delsey S.A., Rimowa GmbH (owned by LVMH), Away Travel, Safari Industries, and Briggs & Riley Travelware.

These companies focus on expanding their product portfolios through innovations, strategic partnerships, and aggressive marketing. They also engage in mergers and acquisitions to penetrate new markets and diversify offerings.

Consumer Behavior Analysis

- Lightweight and Durable: Modern travelers want to be mobile and convenient. Lightweight luggage made from polycarbonate, aluminum or hybrid materials is super popular. Consumers are willing to pay more for durable, ergonomic and carry-on luggage.

- Brand Loyalty and Perceived Value: Luggage purchases are driven by brand trust and product quality. Consumers especially in premium segment are more likely to buy from established brands that promise durability, design, and functionality. Word of mouth and online reviews play a big role in buying decisions.

- Online Shopping is on the Rise: E-commerce has changed the luggage game. A big chunk of consumers now research and buy luggage online, because of competitive pricing, variety and convenience. Brands are responding with better digital interfaces and direct to consumer sales channels. In July 2025, Carl Friedrik launched its Carry-on X Core on July 2, 2025. This hybrid carry-on has a soft-side recycled-polyester front pocket, paired with a hard-shell German Makrolon polycarbonate back, for sleek, lightweight mobility with tech-smart usability like a 16″ laptop sleeve and Hinomoto spinner wheels.

- Multipurpose and Compact Luggage: With changing airline baggage policies and rise of short trips, there is growing demand for cabin luggage and multi-functional travel gear. This includes expandable compartments, convertible backpacks and luggage that can serve multiple travel needs.

Pricing Trends

Prices vary greatly depending on material, brand, smart features and target market. From budget friendly for mass market to high end designer and smart luggage for premium customers.

Entry Level: This segment is for cost conscious travelers and students. Prices are competitive and products are made of synthetic fabrics or lower grade plastics.

Mid-Range: Products offer a balance of durability, style and affordability. For frequent travelers and business professionals.

Premium: High end luggage made of luxury materials, smart features and unique designs for affluent travelers. Prices can be very high especially for designer collaborations and limited edition models.

In the last few years raw material costs and inflation have gone up slightly. But with promotional discounts, seasonal sales and bundling options consumer interest remains high across all segments.

Growth Factors

Several factors are fueling the growth of the luggage market:

- Growing Disposable Incomes: People are spending more on travel and lifestyle items as their disposable incomes rise, particularly in emerging economies. Nowadays, a lot of people are prepared to spend money on premium luggage.

- Urbanization and Changing Lifestyles: Mobility is increasing along with cities. The need for luggage keeps growing as more people travel for business or leisure.

- Digital Influence and Marketing: People are being encouraged to enhance their trip gear by social media and influencer content. These days, increasing luggage sales requires both a strong web presence and aesthetic appeal.

- Differentiation and Product Innovation: The luggage is getting smarter and safer. Buyers are drawn to features like smart locks, RFID-blocking compartments, anti-theft zippers, and app connectivity. In a crowded market, these innovations help brands stand out. Five new luggage items, including backpacks, weekender bags, carry-on rollers, and checked suitcases in the pastel denim-inspired "Pale Aqua" color, were part of Gap's limited-edition travel collection with BÉIS, which was introduced in August 2025. Priced between $128 and $378, this capsule collection blends fashion appeal with travel-ready design, and it is selling out quickly in the US, Canada, and Japan through the Gap and BÉIS channels.

Regulatory Landscape

Luggage doesn’t have the same level of regulatory requirements as medical equipment but there are still some compliance and safety standards to follow:

- Product Safety and Quality Standards: Luggage must meet safety norms for flammability, durability and chemical composition especially in the US and EU. CPSIA (Consumer Product Safety Improvement Act) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) compliance is required.

- Sustainability Certifications: Products made from recycled or biodegradable materials need certifications like Global Recycled Standard (GRS), OEKO-TEX or ISO environmental management standards to back up claims.

- Smart Luggage Regulations: Products with lithium-ion batteries (like those with charging features) must comply with airline and transportation safety guidelines. Many airlines now require batteries to be removable or comply with certain watt-hour limitations.

Recent Developments

- Sustainable Luggage: Samsonite introduced the "Ecolite" line, which is composed of trash and recycled plastic bottles. Additionally, companies like Solgaard and Paravel are growing their eco-friendly product lines. Their goal is to draw in customers who are concerned about sustainability. The Stockholm-based company NUDIENT made its debut in the baggage industry in May 2025 with a line composed of recycled materials and aerospace-grade polycarbonate. In an effort to reinvent travel gear through sustainability and great performance, the launch features cabin and check-in luggage with a minimalist Scandinavian style.

- DTC Brands: Away and Monos are direct-to-consumer (DTC) brands. They offer high-quality luggage at lower prices by removing the middleman. This shift has pushed traditional brands to invest in digital-first strategies.

- Smart Features and Connectivity: Tumi and Samsonite now offer smart luggage. These bags come with GPS tracking, digital locks, and charging ports. While these features were once premium, they are becoming more common as travelers adopt tech-driven solutions.

- Customization: Brands are now offering options like monogramming, custom colors, and accessories. This lets customers design luggage that fits their style and needs. It also helps increase brand loyalty and engagement.

Current and Future Growth Implications

a. Demand-Supply Analysis: Luggage brands are launching new products and speeding up production to meet demand. However, recent supply chain issues and raw material shortages have affected delivery times and prices.

b. Gap Analysis: Developed markets like North America and Europe are saturated, especially in the mid-to-premium segments. But developing regions have strong potential. There’s a clear gap in affordable, durable, and stylish luggage for the rising middle class in Asia-Pacific and Latin America.

Top Companies in the Luggage Market

- Samsonite International S.A.

- VIP Industries Ltd.

- VF Corporation

- American Tourister

- Tumi Holdings Inc.

- Delsey S.A.

- Rimowa GmbH

- Away Travel

- Safari Industries

- Briggs & Riley Travelware

Luggage Market: Report Snapshot

Segmentation | Details |

By Product Type | Travel Bags, Trolley Bags, Backpacks, Duffel Bags, Others |

By Material | Polycarbonate, Polyester, Nylon, Leather, Others |

By Distribution Channel | Online, Offline (Retail Stores, Supermarkets, Specialty Stores) |

By Price Range | Economy, Mid-Range, Premium |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Areas

- Smart Luggage: There’s a growing demand for tech-friendly travel gear. This is boosting interest in smart luggage. Features like app integration, anti-theft alerts, and built-in power banks are shaping this trend.

- Backpacks and Duffel Bags: These bags are gaining popularity due to their versatility. They’re widely used by students, gym-goers, and weekend travelers. People like them because they’re lightweight and affordable.

Big Innovations

- Sustainable Materials: Brands are launching eco-friendly luggage lines. These use recycled plastics and plant-based fabrics. The goal is to reduce environmental impact.

- Modular Luggage Systems: Some new brands are offering modular luggage. You can attach or remove compartments based on your needs. This adds convenience and flexibility.

- Connected Travel Ecosystems: Brands are also building mobile apps that link luggage to travel services. These include flight tracking, weather updates, and lost luggage recovery tools.

Luggage Market: Growth Opportunities

- Tier 2 and Tier 3 Cities: Urban growth in smaller cities, especially in India and Southeast Asia, is opening new markets. Brands can tap into these regions to expand.

- Business Travel and Corporate Gifting: With business travel picking up again, premium luggage is in demand. Companies are using it for gifting and employee rewards.

- Customized and Thematic Collections: Collaborations with influencers, athletes, or movie franchises are helping brands reach niche audiences. This also appeals to younger buyers.

Extrapolate Research Says:

The market for luggage is expanding quickly. It is fueled by changes in lifestyle, product advancements, and travel trends. Luggage is becoming a fashion and technology statement as the business moves toward sustainability, smart features, and individual style. The sector is expected to grow significantly in the upcoming years due to the arrival of new markets and fluctuating consumer tastes.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Luggage Market Size

- August-2025

- 148

- Global

- retail

Related Research

Activewear Market Size, Share, Growth & Industry Analysis, By Product Type (Athletic Shoes, Sports B

March-2025

Agrobacterium tumefaciens Competent Cells Market Insights 2022, Global Analysis and Forecast to 2030

July-2021

Aluminium Composite Panels (ACP) Market Insights 2022, Global Analysis and Forecast to 2030

July-2021