Shipbuilding Market Size, Share, Growth & Industry Analysis, By Ship Type (Cargo Ships, Passenger Vessels, Naval Ships, Luxury Yachts, Ferries, Others) By Material Type (Steel, Aluminum, Composites, Others) By End-User (Commercial, Military, Passenger, Others), and Regional Analysis, 2024-2031

Shipbuilding Market: Global Share and Growth Trajectory

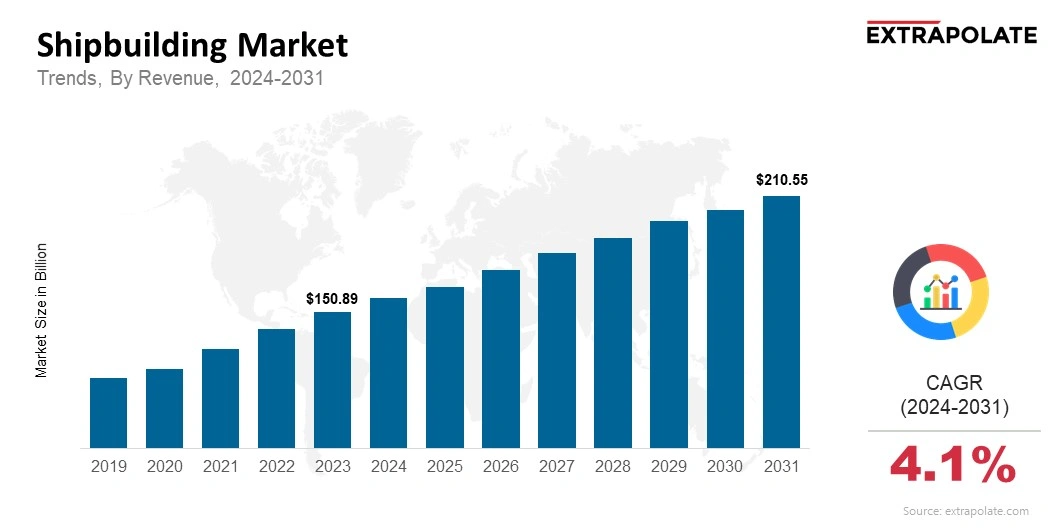

The global Shipbuilding Market size was valued at USD 150.89 Billion in 2023 and is projected to grow from USD 158.46 Billion in 2024 to USD 210.55 Billion by 2031, exhibiting a CAGR of 4.1% during the forecast period.

The global shipbuilding industry is growing quickly. This growth comes from increased world trade, better maritime technology, and a rising need for eco-friendly and energy-efficient ships. The industry includes building many types of ships. These are container vessels, tankers, bulk carriers, passenger vessels, and offshore ships. Shipbuilding technology is improving. New materials, automation, and energy-efficient designs are making ships better. They are now more reliable, sustainable, and cost-effective.

A key factor boosting the shipbuilding industry is rising international trade. This growth is tied to the higher demand for goods and commodities. This has led to a demand for bigger, more complex ships. They can transport more commodities over longer distances. Also, the growing importance of offshore energy resources, mainly in oil and gas, has led to higher demand for specialized ships like offshore support vessels and drilling rigs.

Tech innovations are revolutionizing the shipbuilding sector. Digitalization, automation, and artificial intelligence help shipbuilders design and produce vessels better and faster. Smart ships are becoming popular. They have advanced navigation and control systems. These ships boost safety, cut fuel use, and enhance performance. 3D printing and robots in shipbuilding are saving costs and improving precision.

The shipbuilding industry is shifting towards cleaner options. The growing focus on environmental sustainability is driving this change. The International Maritime Organization (IMO) has set stricter emissions rules. This change has led to the use of greener technologies. Examples include liquefied natural gas (LNG)-fueled ships, hybrid power systems, and energy-efficient ship designs. Shipbuilders are putting more money into green technologies. They do this to meet regulations, save costs, and lower their environmental impact.

The shipbuilding industry is mainly led by Asian-Pacific countries. South Korea, China, and Japan have some of the largest and most advanced shipyards in the world. Emerging economies are also seeing more shipbuilding activity. This is due to higher demand for ships in these markets. The European shipbuilding industry is growing well. This growth focuses on luxury and specialty ships. Meanwhile, North America is also expanding, mainly in offshore and naval shipbuilding.

The shipbuilding industry is changing to match market trends, technology, and environmental needs. This shift means the market will keep growing. Demand for specialized ships and cost-efficient, eco-friendly vessels will drive innovation and investment. This trend will make the shipbuilding market a key player in the global economy over the forecast period.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several major trends are influencing the development of the shipbuilding industry:

- Global Trade Growth: More global trade and the demand for quick, reliable shipping are driving the cargo and containership market. This market makes up a large part of global trade.

- Tech Innovation: New ship designs, automation, and improved propulsion make vessels more efficient and eco-friendly. Shipbuilding processes are being made more efficient with digitalization and automation.

- Sustainability Focus: There is a greater focus on reducing carbon emissions. This encourages the growth of eco-friendly ships. Examples include LNG-powered vessels and hybrid technology ships. Regulations for eco-friendly solutions are pushing shipbuilders to invest in green technologies.

- Growth of Cruise and Ferry Markets: Luxury cruises and ferries are in high demand. This trend is strong, especially in regions with busy tourist industries. The trend is triggering investments in new passenger ships and new onboard experiences.

Major Players and Their Competitive Positioning

The shipbuilding industry is very fragmented. Major players have interests in three segments: commercial, naval, and luxury shipbuilding. Key industry players are Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering, Samsung Heavy Industries, China State Shipbuilding Corporation, and Mitsubishi Heavy Industries. These players focus on boosting production, investing in green tech, and expanding globally to stay competitive.

Consumer Behavior Analysis

In the shipbuilding industry, customers include shipping firms, defense institutions, and cruise line operators. Shipping companies want ships that save money, use less fuel, and carry more cargo. Cruise lines aim to improve passenger comfort and be eco-friendlier. Defense and military institutions seek advanced naval ships with state-of-the-art defense technologies. Also, more companies are starting to outsource shipbuilding to countries with lower costs.

Pricing Trends

Pricing in shipbuilding varies a lot based on the ship type. Commercial vessels, such as bulk carriers and container ships, cost less than special purpose ships. These include luxury cruise liners and defense vessels. Demand for green ships is impacting prices. Green technology can increase production costs. However, 3D printing and modular construction, are helping lower shipbuilding costs.

Regional Market Insights

The shipbuilding industry is growing fast in many parts of the world. However, the Asia-Pacific region is leading the way. It dominates both shipbuilding and manufacturing. China, South Korea, and Japan are major producers of commercial ships and naval vessels. Europe plays a key role, especially in luxury and cruise shipbuilding. Italy and Germany lead the way. North America is thriving, especially in naval and defense sectors. Latin America and the Middle East are also growing markets with rising investments in shipbuilding.

Growth Factors

There are several reasons why the shipbuilding industry is expanding:

- Rising Maritime Trade: As trade around the world increases, the need for ships that can move goods well is growing too. The demand is especially high in the bulk carrier and container ship segments.

- Ship Design Improvements: New designs are making ships smarter and using less fuel. Shipbuilders are using automation, digital tools, and alternative fuels. This helps them boost performance and sustainability.

- Government Spending: Upgrading naval fleets and investing in military ships helps the defense shipbuilding industry. Countries are investing in infrastructure to boost the cruise and ferry industries.

- Tourism Industry Growth: The world tourism industry is growing fast. Cruise tourism, in particular, is increasing demand for new and advanced passenger ships. This has led to massive investments in the construction of cruise ships.

Regulatory Landscape

The shipbuilding sector is subject to various regulations. These rules aim to ensure safety, promote environmental care, and support efficient operations. Organizations such as the International Maritime Organization (IMO) lay out rules for emissions, safety, and design standards. Rising demand for lower carbon emissions is impacting green ship production. Many countries are enforcing stricter emission standards. The shipbuilding sector has to balance these regulations with profitability and operational efficiency.

Recent Developments

The shipbuilding industry has experienced some of the most significant developments:

- Embracing Green Technology: Shipyards are using green tech more and more. They rely on LNG-powered engines, battery-electric power, and hybrid systems. This helps them meet pollution standards and save fuel.

- Cruise Ship Bookings on the Rise: Premium cruise lines are building bigger ships. They offer exciting new services and eco-friendly designs. Demand in the high-end and cruise shipbuilding is thus on an upswing.

- Defense Shipbuilding Growth: Governments worldwide are investing heavily to upgrade their warship fleets. This spending is driving growth in the defense shipbuilding industry. Military ships that use advanced technologies, such as destroyers and submarines, are needed.

Current and Potential Growth Implications

Demand-Supply Analysis: Demand for container ships and cargo vessels is strong. But interest in specialized ships is rising too. This includes naval defense vessels, luxury cruise ships, and ferries. The supply of advanced materials and skilled workers can impact production capacity. However, better manufacturing methods, such as automation and modular construction, can reduce these risks.

Gap Analysis: Shipbuilding is booming in Asia. However, Europe still leads in luxury and cruise shipbuilding. Companies that use advanced technologies and creative designs will benefit from growth opportunities in many regions.

Top Companies in the Shipbuilding Market

- Hyundai Heavy Industries

- Daewoo Shipbuilding & Marine Engineering

- Samsung Heavy Industries

- China State Shipbuilding Corporation

- Mitsubishi Heavy Industries

- Fincantieri

- STX Offshore & Shipbuilding

- Damen Shipyards Group

- Japan Marine United Corporation

Report Snapshot

Segmentation | Details |

By Ship Type | Cargo Ships, Passenger Vessels, Naval Ships, Luxury Yachts, Ferries, Others |

By Material Type | Steel, Aluminum, Composites, Others |

By End-User | Commercial, Military, Passenger, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Shipbuilding Market: High-Growth Segments

The following segments are likely to witness strong growth:

Luxury and Cruise Shipbuilding: The demand for high-end cruise vacations is rising. This trend boosts the growth of luxury cruise ships. Leading cruise operators are investing in larger and more advanced vessels.

Eco-Friendly Shipbuilding: The push for sustainability is increasing the demand for LNG-powered ships and other green vessels. Propulsion and fuel technology breakthroughs will power the growth in this segment.

Major Innovations

Innovation in the shipbuilding market includes:

- Green Shipbuilding Technologies: The shipping industry can use LNG, hybrid engines, and renewable energy sources. This helps cut fuel use and emissions. As a result, it meets stricter environmental rules.

- Digitalization and Automation: Shipbuilders use digital tools, automation, and AI. This boosts production efficiency, cuts costs, and improves the design process. As a result, they achieve better outcomes.

- Modular Construction: This technique builds ships in sections and assembles them later. It has changed the industry by improving production efficiency and cutting lead times.

Shipbuilding Market: Potential Growth Opportunities

The shipbuilding market presents numerous growth opportunities, including:

- Expansion in Emerging Markets: Growing demand for ships in emerging markets, especially in Asia-Pacific and Latin America, offers significant opportunities for shipbuilders to tap into new markets.

- Eco-friendly Vessels: With increasing environmental regulations, there is an opportunity to develop new, more sustainable ship designs that reduce carbon emissions and improve fuel efficiency.

- Defense Shipbuilding: Rising global defense spending and the modernization of naval fleets are driving demand for military vessels, providing substantial growth opportunities for shipbuilders in the defense sector.

Extrapolate Research says:

The shipbuilding market is poised for steady growth, driven by advancements in technology, increasing global trade, and the rising demand for eco-friendly and specialized vessels. Companies that invest in sustainable technologies, expand their presence in emerging markets, and innovate in ship design and construction will be well-positioned to capitalize on the vast opportunities in this dynamic sector.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Shipbuilding Market Size

- May-2025

- 148

- Global

- machinery-equipment

Related Research

0-Global Market Status and Trend Report 2015-2026

November-2020

2 Side Seal Machines-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

3 Side Seal Machines-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020