Pipe Inspection Camera Market Size, Share, Growth & Industry Analysis, By Product Type (Push Rod Cameras, Robotic Crawler Cameras, Manhole Cameras, Pan & Tilt Cameras, Pole Cameras), By Application (Municipal Sewer Inspection, Industrial Pipeline Maintenance, Residential Drain Inspection, HVAC System Inspection, Water Treatment), By End-User (Utility Companies, Contractors, Industrial Facilities, Municipalities, Maintenance Service Providers), and Regional Analysis, 2024-2031

Pipe Inspection Camera Market: Global Share and Growth Trajectory

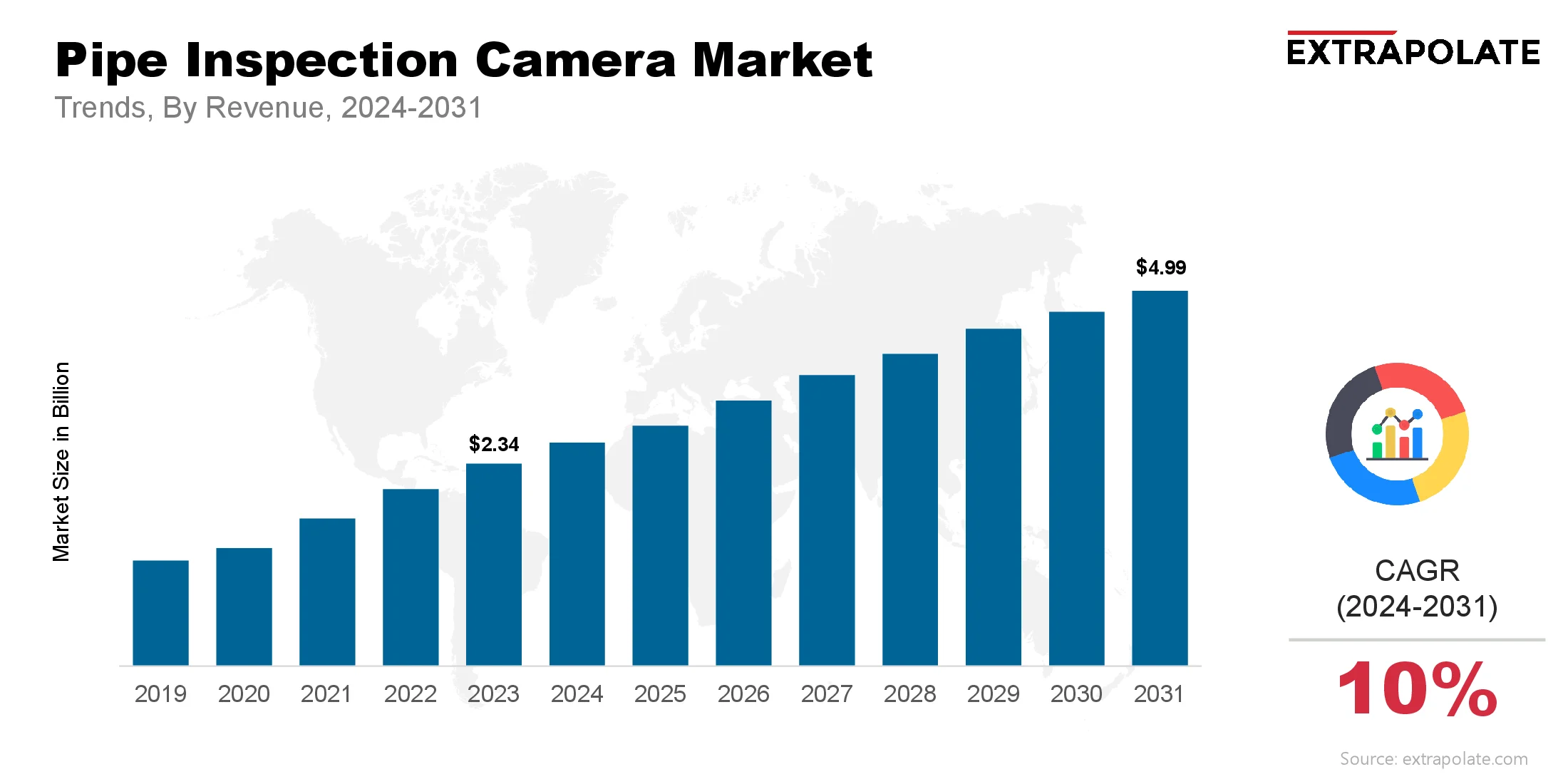

The global Pipe Inspection Camera Market size was valued at USD 2.34 billion in 2023 and is projected to grow from USD 2.56 billion in 2024 to USD 4.99 billion by 2031, exhibiting a CAGR of 10% during the forecast period.

The global pipe inspection camera market is experiencing robust growth as industries increasingly prioritize maintenance, safety, and regulatory compliance. These devices, also known as sewer or pipeline inspection cameras, are designed to navigate and visually assess the internal conditions of pipelines, drains, and sewer systems. Their application spans various sectors including water treatment, oil and gas, manufacturing, construction, and municipal utilities.

The surge in demand is being propelled by aging infrastructure, the necessity for non-invasive inspection techniques, and the growing emphasis on preventive maintenance. Modern pipe inspection cameras are now equipped with advanced features such as pan-tilt capabilities, high-resolution imaging, LED illumination, and wireless connectivity, making them indispensable tools for professionals seeking efficient diagnostics and accurate reporting.

As technology continues to evolve, the integration of artificial intelligence, data analytics, and robotic enhancements is further expanding the scope of these systems. These advancements allow operators to remotely inspect and record pipe conditions in real-time, enhancing operational efficiency, safety, and decision-making.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several significant trends are shaping the growth trajectory of the pipe inspection camera market:

- Infrastructure Rehabilitation and Maintenance: Global urbanization and industrial expansion have placed considerable strain on existing infrastructure. Aging water and sewage pipelines require routine inspection to avoid failures, leaks, or contamination. Pipe inspection cameras offer a cost-effective, non-destructive method to assess pipe conditions without the need for excavation or shutdowns, making them vital in preventive maintenance strategies.

- Advancements in Imaging Technology: Modern pipe inspection cameras feature cutting-edge imaging technologies including HD and 4K video capture, digital zoom, and 360-degree articulation. Enhanced image clarity and detail allow for more accurate diagnosis of cracks, blockages, corrosion, and other structural issues. Integration with GPS and data logging tools also supports better analysis and record keeping.

- Miniaturization and Portability: With increasing demand for flexible and user-friendly systems, manufacturers are producing compact, battery-operated inspection cameras that are lightweight and portable. These systems are especially valuable in confined or difficult-to-access areas. Their ease of deployment is helping to increase adoption across small businesses and independent contractors.

- Growing Demand in Industrial and Municipal Applications: Industries such as petrochemicals, mining, and energy rely on pipeline infrastructure for critical operations. Downtime due to pipe failures can result in significant financial losses. As a result, there is increasing use of pipe inspection cameras to support predictive maintenance and reduce risk. Similarly, municipalities are using these devices to monitor sewer systems and stormwater drains to ensure compliance with environmental regulations.

Major Players and Their Competitive Positioning

The pipe inspection camera market features a range of companies offering diverse product lines tailored to different inspection needs. Key players included are CUES Inc., Envirosight LLC, Rausch Electronics USA, SPX Corporation (Pearpoint), iPEK International GmbH, Insight Vision Cameras LLC, Rothenberger USA LLC, Subsite Electronics, General Pipe Cleaners (a division of General Wire Spring Co.), Troglotech UK and others.

These companies compete on product performance, durability, ease of use, and after-sales support. Innovations such as modular systems, cloud-based software, and AI-powered defect recognition are key differentiators driving competitive advantage.

Consumer Behavior Analysis

The usage and purchasing behavior of end-users in the pipe inspection camera market is influenced by multiple key factors:

- Emphasis on Preventive Maintenance: Facility and infrastructure managers increasingly recognize the value of routine inspections to avoid costly emergencies. Customers prefer equipment that delivers accurate diagnostics quickly, minimizing disruption and saving on labor costs.

- Budget Constraints and ROI: While high-end pipe inspection cameras can be a significant investment, customers are evaluating total cost of ownership. Features that reduce the need for repeat inspections, speed up diagnostics, and integrate with existing maintenance software are viewed favorably.

- Preference for User-Friendly Interfaces: Technicians prefer intuitive systems that require minimal training. Devices offering real-time video transmission, on-screen defect annotation, and simplified file storage options are in high demand.

- Growing Role of Service Providers: Many end-users, especially municipalities and small utilities, prefer to outsource inspection to specialized service providers. These professionals, in turn, invest in advanced pipe inspection systems to provide efficient and detailed inspection reports to clients.

Pricing Trends

The pricing of pipe inspection cameras varies widely based on their application and features. Entry-level models for residential use may start around $500–$2,000, while professional-grade systems for industrial or municipal use can cost $10,000–$50,000 or more. Features such as robotic mobility, pan-and-tilt heads, long cable lengths, and software integration significantly influence the price.

To address different market segments, manufacturers offer tiered product lines and financing options. Leasing and rental services are also becoming popular, allowing contractors and small businesses to access advanced equipment without heavy upfront costs.

Growth Factors

Several factors are driving the expansion of the global pipe inspection camera market:

- Increasing Investment in Water and Wastewater Infrastructure: Governments and private sector organizations are investing heavily in upgrading aging pipelines. Pipe inspection cameras are integral to assessing these networks and planning repairs efficiently.

- Stringent Environmental and Safety Regulations: Regulatory agencies mandate regular inspection of pipelines to prevent leaks, contamination, and structural failures. These compliance requirements are pushing utilities and industries to adopt reliable inspection tools.

- Demand for Non-Destructive Testing (NDT):These cameras belong to the non-destructive testing group. They help assess pipe conditions without causing harm. The ability to inspect pipe interiors without harming the structure offers a key advantage. It is particularly important in areas with safety risks or strict environmental controls.

- Technological Integration and Automation: Integration with robotics and cloud platforms is advancing inspection systems. It supports live diagnostics and predictive upkeep. Inspection methods are evolving due to these advances. Multiple sectors are adopting new workflows.

Regulatory Landscape

The pipe inspection camera market is impacted by several regulatory factors, particularly in utilities and industrial sectors:

- Occupational Safety and Health Administration (OSHA) Guidelines set safety rules for confined space checks. They require remote visual inspection systems.

- Environmental Protection Agency (EPA) Periodic sewer inspection is part of wastewater standards. This drives the use of trusted diagnostic systems.

- International Organization for Standardization (ISO) standards such as ISO 9001 (Quality Management) and ISO 55000 (Asset Management) encourage systematic inspection and maintenance practices.

These standards support wider camera adoption. They aid in both inspections and lifecycle control.

Recent Developments

The following developments are shaping the pipe inspection camera market:

- AI and Automated Defect Detection: AI-driven systems are being built into new models. They spot faults and rank them, cutting the need for manual checks.

- Cloud-Based Reporting Platforms: Remote access is enabled through cloud integration. This also allows secure storage and shared data use. Contractors benefit from these platforms. They simplify handling several client accounts. In May 2025, Aderant launched four next-gen cloud financial management tools at its Momentum Global event in Dallas. The new solutions use AI and real-time data to simplify law firm billing, analytics, and financial operations.

- Robotic Crawlers and Drones: Robotic motion is built into newer models. It helps cameras navigate turns, pipe joints, and submerged areas. Drones are entering the pipe inspection space. They help reach large pipes in remote areas.

- Sustainable Materials and Energy Efficiency: Manufacturers use light, recyclable parts. Energy-saving batteries improve use in the field.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Demand for pipe inspection cameras is rising quickly. Supply remains limited in areas with rapid development and strict oversight. Production is being scaled to address market needs. Still, advanced components like sensors and optics face cost and supply hurdles.

b. Gap Analysis

Despite strong growth prospects, challenges persist:

- Affordability: Smaller firms and local utilities face financial constraints. High startup costs make advanced systems less accessible.

- Training: Skilled staff are key to using advanced tools effectively. Their absence reduces system value and output.

- Connectivity in Remote Areas: Real-time data sharing depends on strong internet access. In weak coverage areas, remote functions are limited.

There is potential to close these gaps through innovation. This includes new pricing strategies, training programs, and offline tools.

Top Companies in the Pipe Inspection Camera Market

- CUES Inc.

- Envirosight LLC

- Rausch Electronics USA

- iPEK International GmbH

- SPX Corporation (Pearpoint)

- Rothenberger USA LLC

- Insight Vision Cameras LLC

- Subsite Electronics

- Hathorn Corporation

- General Pipe Cleaners

Pipe Inspection Camera Market: Report Snapshot

Segmentation | Details |

By Product Type | Push Rod Cameras, Robotic Crawler Cameras, Manhole Cameras, Pan & Tilt Cameras, Pole Cameras |

By Application | Municipal Sewer Inspection, Industrial Pipeline Maintenance, Residential Drain Inspection, HVAC System Inspection, Water Treatment |

By End-User | Utility Companies, Contractors, Industrial Facilities, Municipalities, Maintenance Service Providers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Robotic Crawler Cameras: These systems move easily and reach deep areas. They work well for wide pipes and long-distance checks. Strong video and rugged design boost their value. They are now a fast-growing part of the market.

- Municipal Sewer Inspection: As systems wear out and rules grow, action is needed. Cities turn to smart tools to track and fix buried lines.

Major Innovations

- AI-Powered Image Analysis: Next-gen tools come with smart software. The AI scans for damage such as cracks and intrusions.

- Hybrid Inspection Platforms: Hybrid models are entering the market. They join different camera tools in one setup for more value.

Potential Growth Opportunities

- Expansion in Developing Markets: Developing areas in Asia-Pacific and Africa are changing. They invest in clean water, waste systems, and industry sites. These markets offer significant potential for affordable, durable pipe inspection solutions.

- Integration with Smart City Infrastructure: As cities upgrade, they need better ways to track assets. Pipe cameras will be a key part of these smart system. The data from these systems is highly valuable. It aids urban planning, emergency services, and environmental checks.

Extrapolate Research Says:

The pipe inspection camera market will expand in the coming years. Growth is backed by tech upgrades and the need for resilient systems. As users look for quick and clean inspection tools, demand is shifting. AI-powered and portable systems are gaining traction. New tech in imaging, links, and automation is changing pipe checks. These cameras are now key for managing modern systems.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Pipe Inspection Camera Market Size

- August-2025

- 140

- Global

- machinery-equipment

Related Research

0-Global Market Status and Trend Report 2015-2026

November-2020

2 Side Seal Machines-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

3 Side Seal Machines-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020