Metal Forming Market Size, Share, Growth & Industry Analysis, By Forming Type (Rolling, Forging, Stamping, Extrusion, Hydroforming, Others), By Material (Steel, Aluminum, Magnesium, Titanium, Others), By End-Use Industry (Automotive, Aerospace, Construction, Industrial Machinery, Consumer Electronics), By Equipment (Mechanical Press, Hydraulic Press, Servo Press, Others), and Regional Analysis, 2024-2031

Metal Forming Market: Global Share and Growth Trajectory

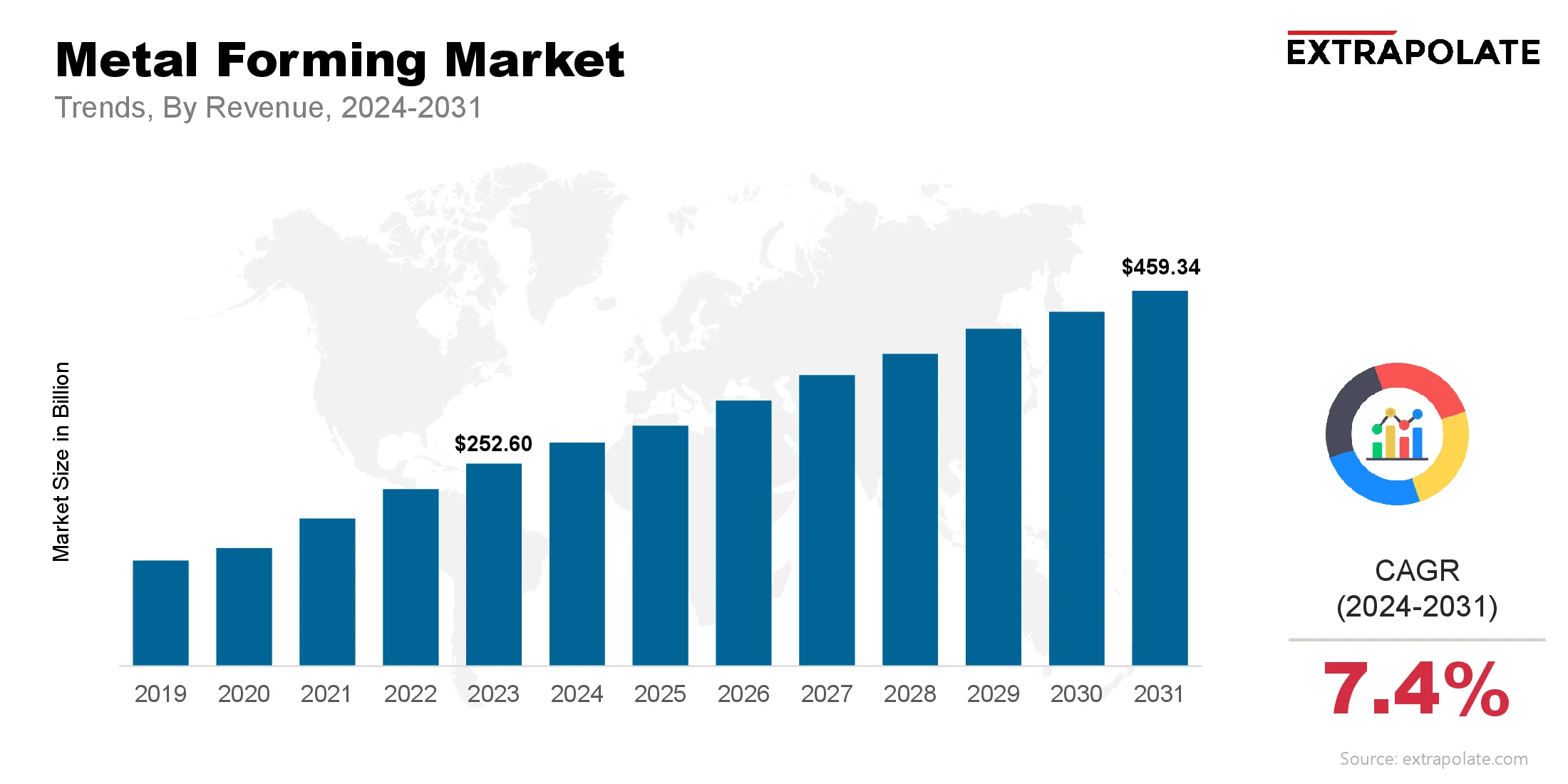

The global Metal Forming Market size was valued at USD 252.60 billion in 2023 and is projected to grow from USD 274.21 billion in 2024 to USD 459.34 billion by 2031, exhibiting a CAGR of 7.4 % during the forecast period.

The metal forming market is growing as automotive, aerospace, construction and industrial companies are using metal forming technologies to produce precision parts. As demand for lightweight, strong and complex shaped metal parts increases, the adoption of advanced forming techniques is rising. This market covers various technologies like rolling, forging, stamping, extrusion and sheet metal forming each designed to meet the end use industries requirements for strength, performance and cost.

With industrial automation on the rise, CNC machines, robotics and artificial intelligence are being integrated into metal forming processes to increase productivity and consistency. Sustainability goals and regulations are also forcing companies to adopt energy efficient and waste minimising manufacturing methods. All this combined with the global manufacturing upsurge is driving the metal forming market forward.

Key Market Trends Driving Product Adoption

Several prominent trends are shaping the growing adoption of metal forming solutions:

- Lightweighting in Automotive and Aerospace: As global automakers and aircraft manufacturers are trying to reduce vehicle weight to improve fuel efficiency and lower emissions, lightweight metals like aluminum and magnesium alloys are gaining popularity. Metal forming technologies can mold these materials into intricate high strength parts without compromising durability. This trend is more visible in electric vehicles (EVs) where lightweighting directly impacts battery efficiency and vehicle range.

- Advancements in High Strength Material Forming: Development of high strength steels (HSS), advanced high strength steels (AHSS) and titanium alloys is opening up new opportunities and challenges for metal forming. To process these hard to form materials without defects or inconsistencies, manufacturers are investing in advanced forming technologies like hot forming, hydroforming and electromagnetic forming. These techniques can produce complex geometries and superior mechanical properties especially in safety critical components.

- Automation and Industry 4.0: Automation is transforming the metal forming landscape. Intelligent systems that use sensors, robotics and real time monitoring are enhancing production control and reducing errors. Industry 4.0 is further changing the operations by enabling predictive maintenance, digital twins and data analytics. These technologies not only improve product quality but also optimize operational efficiency

- Growing Demand in Construction and Infrastructure: With global infrastructure development and urbanization ongoing, demand for formed metal products like beams, channels, panels and tubes is increasing. Formed metals are used in bridges, buildings, rail systems and pipelines due to their strength, malleability and design flexibility

Major Players and their Competitive Positioning

The metal forming market is highly competitive and fragmented with many global and regional players vying for leadership. Companies are focusing on mergers, acquisitions and technological innovations to stay ahead. Key players are:

- Schuler Group

- Magna International Inc.

- Toyota Boshoku Corporation

- Aisin Seiki Co. Ltd.

- BENTELER International AG

- CIE Automotive

- Gestamp Automoción, S.A.

- Interplex Holdings Pte. Ltd.

- Hirotec Corporation

- BTD Manufacturing, Inc.

These companies have global manufacturing footprint and invest heavily in R&D. Many are working closely with automotive and aerospace companies to design custom metal forming solutions. Through strategic partnerships and automation and green manufacturing, they are strengthening their position.

Consumer Behavior Analysis

Consumer behavior in the metal forming market is influenced by several key factors:

- Customization and Quality: Industrial customers are demanding custom formed components with tight tolerances and high surface finish. Whether in automotive, electronics or construction, it’s all about quality assurance and repeatability. As a result, manufacturers are under pressure to deliver consistently and are investing in advanced forming equipment.

- Turnaround Times and Cost: The shift to just-in-time (JIT) manufacturing and lean production means customers are looking for suppliers who can deliver high quality components fast and cost effective. This is driving metal forming companies to optimize their processes and reduce lead times.

- Eco-friendly Procurement: Many industrial buyers are now factoring in sustainability into their procurement decisions. Suppliers who adopt environmentally friendly practices such as closed-loop recycling systems or low-energy forming methods have a competitive advantage. This is more prominent in Europe and North America where environmental compliance is key.

- Digital Collaboration: Customers are looking for digital collaboration tools such as CAD/CAM integration, simulation and prototyping platforms. This enables faster design iterations, prototyping and reduces errors during tooling phase.

Pricing

Pricing in metal forming is influenced by many factors including raw material prices, technology adoption and global economic conditions. Fluctuations in steel, aluminum and other metal prices can impact production costs. Investments in automation and high precision machinery can increase initial capex but long term cost savings are achieved through improved yield and productivity.

High volume orders benefit from economies of scale especially in automotive and appliance sectors. Low volume or customized projects can be more expensive per unit due to tooling and setup requirements. To cater to small and medium enterprises (SMEs), many suppliers are offering flexible pricing, modular machines or contract forming services.

Growth Factors

Several key drivers are fueling the expansion of the metal forming market:

- Automotive and Aerospace Production Boom: As global vehicle and aircraft production bounces back post pandemic, demand for high performance formed components is growing. From body-in-white to engine and transmission parts, metal forming is key in both ICE and EV platforms. Lightweighting is further driving the marke.

- Forming Equipment Advancements: Next gen forming machines with servo technology, precision controls and energy efficient mechanisms can run faster and more accurate. These machines reduce tool wear, minimize waste and improve repeatability – making them very attractive to manufacturers looking for quality and scalability.

- Electric Vehicles (EVs): EVs have unique structural and thermal management requirements. Formed aluminum parts are used in battery housings, thermal plates and body structures. As EVs grow globally metal forming is getting more important in automotive component manufacturing.

- Reshoring and Localization Trends: Geopolitical shifts and supply chain disruptions have made many companies to localize production. Governments are also giving incentives to domestic manufacturing through tax benefits and subsidies. These trends are driving investments in local metal forming facilities especially in North America and Asia-Pacific

Regulatory Landscape

Metal forming industry operates under strict regulations to ensure workplace safety, environmental compliance and quality standards. Key regulations impacting the market are:

- OSHA: OSHA regulations in US govern machine guarding, operator safety, noise levels and ergonomic standards for metal forming operations.

- Environmental Regulations: Emissions from metal forming—especially forging and hot rolling—must comply with air and water quality standards set by agencies like EPA (US), EEA (Europe) and CPCB (India). Many facilities are using filtration systems and recycling lubricants to reduce environmental impact.

- ISO Standards: ISO 9001 (Quality Management), ISO 14001 (Environmental Management) and ISO 45001 (Occupational Health and Safety) are widely adopted by companies to demonstrate compliance and improve customer confidence.

- REACH and RoHS: In Europe REACH and RoHS directives affect the use of certain materials and chemicals in metal forming process especially for products used in electronics and automotive applications.

Recent Developments

Notable developments in the metal forming market include:

- Servo Press: Servo press machines which allow programmable slide motions and control are replacing traditional mechanical presses in high precision applications. These presses are more energy efficient and extend die life.

- Digital Twin: Big companies are using digital twins to simulate forming operations virtually, optimize tool paths and predict material flow. This reduces trial and error in physical world and accelerates product development.

- Strategic Acquisitions: Companies like Schuler and Gestamp have acquired smaller forming companies or entered into joint ventures to expand capabilities and enter new geographic markets

- EV Component Manufacturing: OEMs and tier-one suppliers are partnering to co-develop EV specific formed components like battery frames, crumple zones and thermal systems

- Product Innovation: In April 2025, ANDRITZ Schuler launched the Laser Blanking Line 1.18 DFT, a next gen system that uses advanced laser technology to improve material utilization, increase output rates and support high-strength and lightweight materials, addressing trends like automation, lightweighting and flexible manufacturing in automotive and industrial sectors.

Current and Potential Growth Implications

- Demand-Supply Analysis: With the global resurgence of manufacturing, especially in automotive and infrastructure, demand for metal formed parts is increasing. However, challenges like labor shortages, raw material price volatility and energy costs can put pressure on supply. Companies that automate and secure long term raw material contracts are better placed to meet demand.

- Gap Analysis: While automation and advanced technologies are widespread in developed regions, many SMEs in emerging markets are still using manual forming techniques. Bridging this gap with affordable automation solutions, training programs and financing options is a big opportunity for the industry.

Top Companies in the Metal Forming Market

Key players driving innovation and competition in the metal forming market include:

- Schuler Group

- Magna International Inc.

- Toyota Boshoku Corporation

- Aisin Seiki Co. Ltd.

- BENTELER International AG

- CIE Automotive

- Gestamp Automoción, S.A.

- Interplex Holdings Pte. Ltd.

- Hirotec Corporation

- BTD Manufacturing, Inc.

These companies continue to innovate in forming technologies, expand their global footprints, and support key industries with customized forming solutions.

Metal Forming Market: Report Snapshot

Segmentation | Details |

By Forming Type | Rolling, Forging, Stamping, Extrusion, Hydroforming, Others |

By Material | Steel, Aluminum, Magnesium, Titanium, Others |

By End-Use Industry | Automotive, Aerospace, Construction, Industrial Machinery, Consumer Electronics |

By Equipment | Mechanical Press, Hydraulic Press, Servo Press, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are witnessing notable expansion:

- Hydroforming and Hot Forming: Gaining traction in automotive and aerospace due to ability to form lightweight, high-strength materials into complex shapes.

- Servo Press Segment: With increasing demand for precision and flexibility, servo press systems are being used for critical component manufacturing.

- Aluminum-Based Forming: Aluminum components are in high demand in EV and aerospace due to fuel efficiency goals and weight reduction needs.

Major Innovations

Key innovations transforming the metal forming landscape include:

- AI-Enabled Process Monitoring: AI detects anomalies in real-time and adjusts forming parameters for consistent quality and reduced material waste.

- Modular Forming Equipment: To address customization and flexibility demands, manufacturers are offering modular machines that can be reconfigured for different forming tasks.

- Green Forming Technologies: Energy-efficient systems, waste heat recovery and lubrication recycling are being integrated to meet sustainability standards.

Potential Growth Opportunities

- Emerging Economies: As industrialization accelerates in Asia, Africa and Latin America, demand for cost-effective and efficient forming technologies is growing. Localization and low-cost automation is key to unlocking these markets.

- Additive Manufacturing: Combining metal forming with 3D printing can optimize production especially in prototyping and low-volume runs, new efficiencies.

- Collaborative Robotics (Cobots): Cobots in forming lines are enabling safer human-machine collaboration and higher productivity in small batch production.

Extrapolate Research says:

The metal forming market is growing strongly driven by technology, industrial output and demand for lightweight, precision components. As manufacturers automate, AI and sustainable production, metal forming processes are getting more efficient and responsive to market needs. With continued investment in innovation and expanding applications across end-use sectors, the market has a lot of growth potential. Expansion into emerging economies and synergistic technologies like additive manufacturing and digital twins will be the key drivers for the metal forming industry.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Metal Forming Market Size

- July-2025

- 140

- Global

- machinery-equipment

Related Research

0-Global Market Status and Trend Report 2015-2026

November-2020

2 Side Seal Machines-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

3 Side Seal Machines-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020