HVAC Systems Market Size, Share, Growth & Industry Analysis, By Product Type (Heating Systems, Ventilation Systems, Air Conditioning Systems, and Others), By Application (Residential, Commercial, Industrial, and Others), By End User (Residential, Commercial, Industrial, and Others), and Regional Analysis, 2024-2031

HVAC Systems Market: Global Share and Growth Trajectory

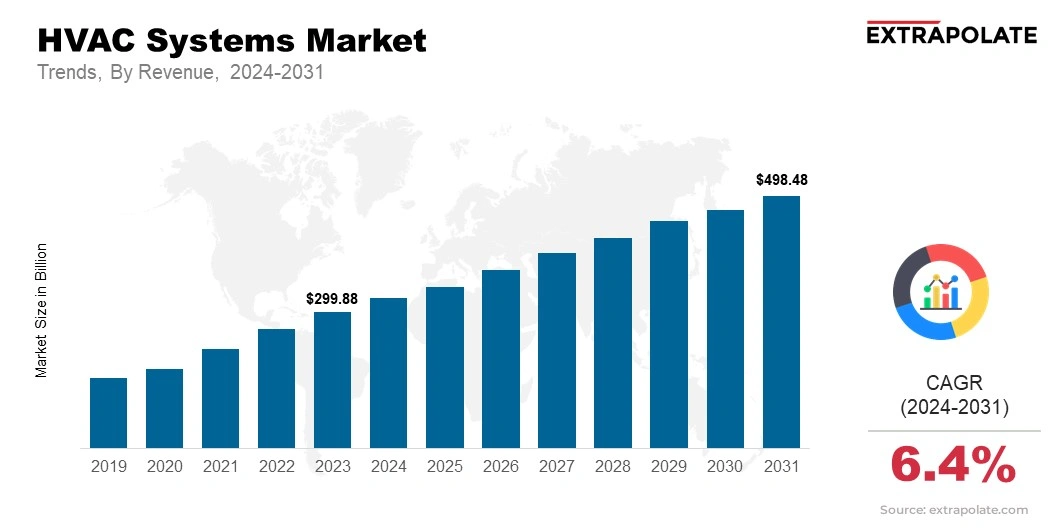

The global hvac systems market size was valued at USD 299.88 billion in 2023 and is projected to grow from USD 321.90 billion in 2024 to USD 498.48 billion by 2031, exhibiting a CAGR of 6.4% during the forecast period.

The global HVAC market is experiencing notable growth. This surge stems from an increasing demand for eco-friendly solutions alongside technological advancements. A keen focus on indoor air quality has joined the conversation.

HVAC systems are indispensable for both homes and businesses, effectively providing heating, cooling, and essential air circulation to maintain optimal indoor conditions. An ongoing construction boom, particularly in developing regions, is invigorating the market.

Furthermore, the rise of smart homes and smart buildings is seamlessly integrating automated HVAC solutions, propelling this dynamic trend forward.

Technology is transforming the market. IoT capabilities, eco-friendly designs, and streamlined features are key advancements. These innovations improve temperature control, air quality, and energy consumption. They offer greater comfort while reducing environmental impact.

For example, smart thermostats, variable refrigerant flow (VRF) systems, and demand-controlled ventilation (DCV) are leading the way. They maximize energy efficiency and enhance user comfort.

The market is also being fueled by strict rules and standards set by governments worldwide, focused on optimizing energy usage and minimizing carbon emissions. The rising consciousness about the significance of sustainable buildings has propelled the adoption of advanced HVAC systems that fulfill these standards.

In addition to this, the increasing preference of consumers for healthier internal environments, specifically due to the persistent issues concerning air pollution and airborne diseases, has given rise to a rise in demand for HVAC systems with improved air filtration and purification capabilities.

Based on region, the Asia-Pacific region is emerging as the rapidly expanding market for HVAC systems, as a result of fast-paced urbanization, industrial development, and a rise in disposable incomes.

The region's developing infrastructure projects and growing adoption of green building standards are further driving market growth. North America and Europe remain key markets, with strong demand fueled by renewal cycles and the rising trend toward smart, sustainable HVAC systems in both residential units and commercial complexes.

The market is fiercely competitive, with key players continuously funding research and development to bring new advanced products to market. The core players in the HVAC systems industry are concentrating on offering comprehensive solutions that merge heating, cooling, and ventilation in a single system to cater to the various needs of consumers.

Collaborations and mergers are also a standard approach among companies to grow their customer base and expand their international presence.

Key Market Trends Driving Product Adoption

The HVAC systems market is undergoing a remarkable transformation, with major trends driving its growth, which include:

- Energy Efficiency Focus: With the increase in energy costs and rising ecological concerns, consumers and businesses are progressively choosing energy-efficient HVAC systems that minimize operating expenses and the ecological impact.

- Smart HVAC Solutions: The incorporation of smart technologies, which include IoT and AI, is reshaping HVAC systems into smart devices that are capable of of automating temperature management, evaluating system performance, and enhancing energy management.

- Indoor Air Quality (IAQ) Awareness: There is a rising focus on indoor air quality, fueled by healthy living trends. HVAC systems are now designed to incorporate purification of air, humidity control, and enhancements in ventilation, guaranteeing improved indoor air quality.

- Green Building Trends: The rise in green building practices is boosting demand for HVAC systems that meet eco-friendly guidelines, such as LEED certifications, and adhere to sustainable regulations.

- Customization and Flexibility: HVAC systems are becoming easier to customize for meeting certain building needs, with modernized zoning systems and modular components enabling more precise temperature regulation in several environments.

Major Players and Their Competitive Positioning

The HVAC systems market is intensely aggressive, with prominent players such as Carrier Global Corporation, Trane Technologies, Daikin Industries, and Johnson Controls leading the market. These companies are prioritizing widening their portfolios with unconventional, sustainable, and smart HVAC systems. Emerging companies and smaller companies are also introducing disruptive innovations, further strengthening the competition.

Consumer Behavior Analysis

Consumers are actively opting for HVAC systems for several reasons:

- Comfort and Convenience: HVAC systems provide all-season comfort by keeping temperatures balanced, irrespective of the surrounding weather.

- Energy Efficiency: Cost-saving benefits offered by power-saving models are fueling the adoption of modern HVAC solutions.

- Health and Wellness: Indoor air quality concerns are encouraging consumers to invest in HVAC systems that offer air filtration and increased airflow.

- Smart Home Integration: Unification with smart home ecosystems enables users to manage HVAC systems from a distance, enhancing accessibility and upgrading overall management of energy.

Pricing Trends

Pricing trends in the market diverge considerably on basis of the type of system, features, and the size of the installation. High-quality products, which include smart and energy-efficient HVAC systems, are overpriced, whereas the cost-effective segment caters to price-sensitive consumers with standard models.

Regional Analysis

North America accounted for around 35% share of the HVAC systems market in 2023, with a valuation of USD 107.10 billion. Innovations such as variable refrigerant flow (VRF) systems, power-saving compressors, and smart thermostats are improving the functionality of HVAC systems.

Asia Pacific HVAC systems market is poised to grow at a CAGR of 7.2% through the projection period.

Growth Factors

Various factors promoting the development of the market:

- Technological Advancements: Innovations such as variable refrigerant flow (VRF) systems, power-saving compressors, and smart thermostats are improving the functionality of HVAC systems.

- Urbanization and Infrastructure Development: Fast-paced urbanization and the rise in construction projects are generating demand for HVAC solutions in both residential estates and industrial buildings.

- Climate Change: Surging temperatures and climate change are reflecting the need for improved heating and cooling systems, specifically in regions with extreme climates.

- Government Regulations and Incentives: Strict energy saving regulations power conservation standards and government incentives for green building certifications are further accelerating demand for sustainable HVAC solutions.

Regulatory Landscape

The regulatory landscape comprising HVAC systems is advancing as governments have put more strict energy conservation and environmental policies in place. Abiding to these rules is essential for manufacturers to address demands of sustainable consumers and regulatory bodies.

Recent Developments

The market continues evolving with ongoing developments, like:

- Advanced Climate Control Solutions: New HVAC systems that feature unified climate control technologies, which include humidity and management of the quality of air.

- Energy Management Integration: HVAC systems with improved energy management features that maximize energy efficiency and reduce waste.

- Sustainability in Manufacturing: Increased shift toward sustainable materials and manufacturing processes to meet rising environmental standards.

Current and Potential Growth Implications

- Demand-Supply Analysis: The demand for HVAC systems is projected to expand rapidly due to growing urbanization, change in temperature, and a focus on eco-friendly solutions. Nevertheless, supply chain challenges, such as scarcity of materials and production setbacks, could affect the market's limited availability.

- Gap Analysis: Major gaps in the market include the need for upgraded energy storage solutions, more cost-effective smart systems, and enhanced merging with clean energy sources.

Top Companies in the HVAC Systems Market

- Carrier Global Corporation

- Trane Technologies

- Daikin Industries

- Johnson Controls

- Lennox International

- Rheem Manufacturing

- Bosch Thermotechnology

- Mitsubishi Electric

- Emerson Electric

- Hitachi Ltd.

HVAC Systems Market: Report Snapshot

Segmentation | Details |

By Product Type | Heating Systems, Ventilation Systems, Air Conditioning Systems, and Others |

By Application | Residential, Commercial, Industrial, and Others |

By End User | Residential, Commercial, Industrial, and Others |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segments

Certain market segments are set to grow rapidly , including:

- Smart HVAC Systems: Devices that offer cutting-edge automation, distance control, and incorporation with other smart home solutions.

- Energy-Efficient HVAC Solutions: Systems designed to cut-down the consumption of energy while conserving its peak performance.

- Indoor Air Quality Systems: HVAC solutions focusing on elevating the quality of air through refinement, controlling humidity, and improvising ventilation.

Major Innovations

Innovation stays crucial in the HVAC systems market, with some of the recent innovations including:

- Advanced Smart Controls: HVAC systems with AI-based smart controls that control temperature and air quality on the basis of recurring conditions.

- Sustainable Refrigerants: Use of sustainable refrigerants to cut down its impact on the environment.

- Variable Speed Compressors: Compressors that conserve energy abide to various cooling and heating demands.

Potential Growth Opportunities

While the market is composed for significant growth, companies face various challenges, such as:

- Technological Complexity: The need to assimilate cutting-edge technologies, such as IoT and AI, into HVAC systems.

- Sustainability Demands: The increasing demand for sustainable solutions and strict adherence to tighter guidelines

- Competition and Innovation: Aligning with technological innovations and responding to the ever-rising expectations of customers.

Kings Research Says:

The HVAC systems industry is likely to maintain its growth trajectory as consumers and businesses progressively demand sustainable, smart, and eco-friendly solutions. Companies that utilize creativity and address the challenges facing the industry will be favorably placed for a long lasting success.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

HVAC Systems Market Size

- February-2025

- 148

- Global

- machinery-equipment

Related Research

0-Global Market Status and Trend Report 2015-2026

November-2020

2 Side Seal Machines-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

3 Side Seal Machines-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020