Quantum Computing & Technologies Market Size, Share, Growth & Industry Analysis, By Product Type (Quantum Hardware, Quantum Software, Quantum Services (QaaS), Others), By Application (Cryptography, Machine Learning, Optimization, Simulation, Financial Modeling, Others), By End-User (Government, BFSI, Healthcare, Aerospace & Defense, Chemicals, Energy & Utilities, Academia), and Regional Analysis, 2024-2031

Quantum Computing & Technologies Market: Global Share and Growth Trajectory

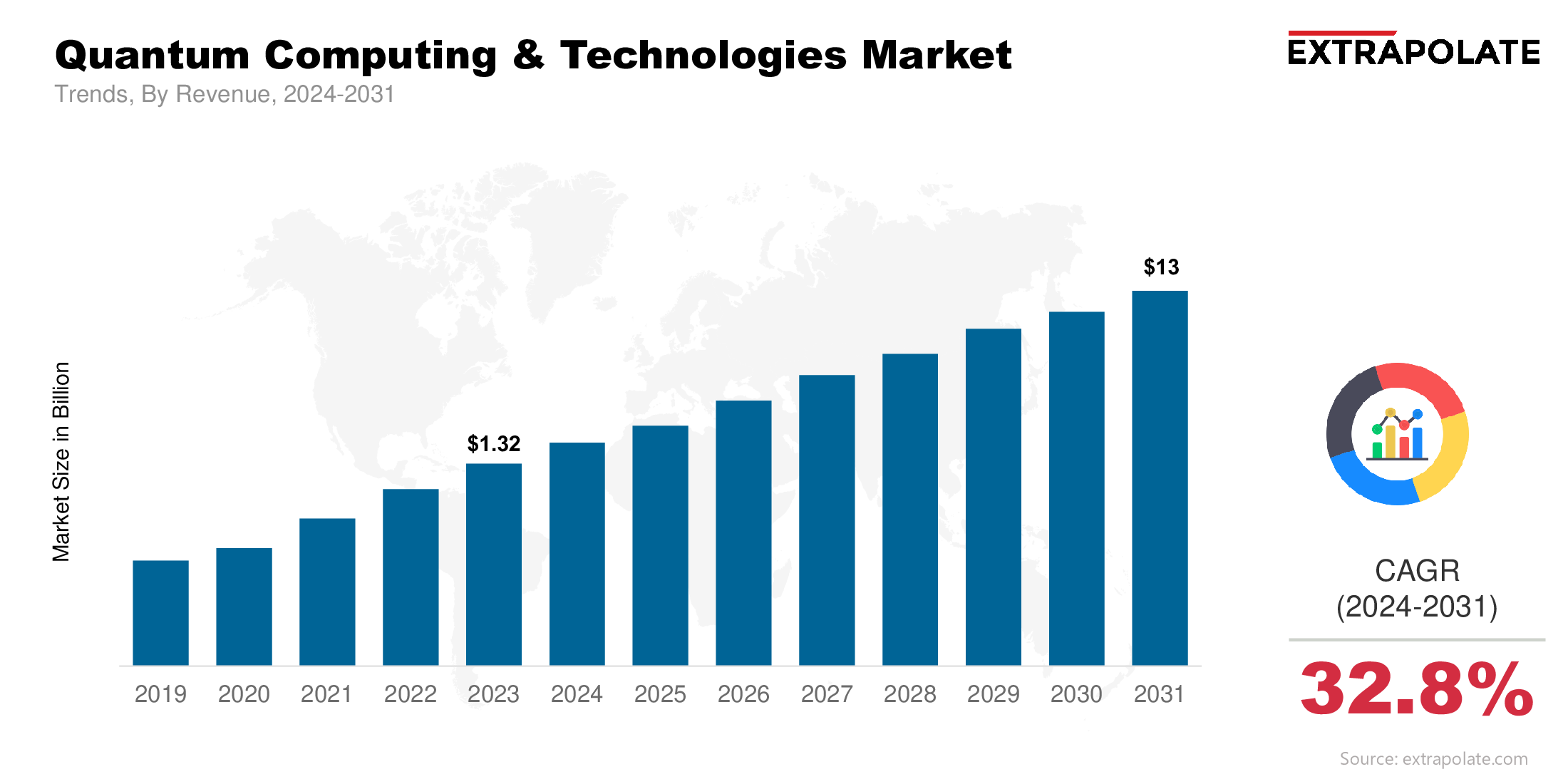

The global quantum computing & technologies market size was valued at USD 1.32 billion in 2023 and is projected to grow from USD 1.77 billion in 2024 to USD 13 billion by 2031, exhibiting a CAGR of 32.8% during the forecast period.

The global market is rapidly transitioning from research-centric initiatives to scalable commercial applications. Once confined to academic and theoretical domains, quantum computing is now commanding significant investment from government agencies, major corporations, and venture capital firms. With the promise to outperform classical computers in solving complex problems such as molecular simulation, cryptography, and combinatorial optimization, the technology is entering a transformative phase. This evolution is giving rise to a global market with immense potential.

As of the current landscape, North America dominates the quantum ecosystem, bolstered by strong government funding, advanced research institutions, and active technology firms. The United States, in particular, leads with initiatives such as the National Quantum Initiative Act and substantial R&D investments by companies like IBM, Google, and Microsoft. Europe follows closely with its Quantum Flagship program, while China has made aggressive moves to accelerate its quantum capabilities, constructing the world’s largest quantum research center and pioneering advancements in quantum communication.

Cloud-based platforms are further democratizing access to quantum computing. Quantum-as-a-Service (QaaS) offerings allow enterprises to experiment with quantum workloads, fostering adoption across sectors such as finance, pharmaceuticals, aerospace, and materials science. As more companies explore use cases and develop in-house quantum strategies, the market is expected to witness exponential growth.

According to industry forecasts, the global quantum computing is projected to grow at a compound annual growth rate (CAGR) exceeding 30% over the next decade. This trajectory is fueled by expanding industrial demand, increased government support, and ongoing technological breakthroughs in quantum hardware and software. With innovation accelerating and early applications proving viable, the quantum computing market is poised to redefine the global computational landscape over the coming years.

Key Market Trends Driving Product Adoption

- Rise of Quantum-as-a-Service (QaaS):

Quantum-as-a-Service is emerging as a key model for market adoption. Leading tech giants are offering cloud-based quantum computing platforms, making high-powered quantum processing accessible to enterprises without requiring specialized hardware infrastructure. Platforms like IBM Quantum, Amazon Braket, and Microsoft Azure Quantum allow users to experiment with quantum algorithms and applications. This trend lowers the barrier to entry and accelerates innovation across industries, creating a robust pipeline for enterprise adoption.

- Increasing Government and Defense Investment

Governments worldwide recognize the strategic importance of quantum computing. National initiatives such as the U.S. National Quantum Initiative Act, the EU’s Quantum Flagship program, and China’s multi-billion-dollar investments are fueling research and development. These efforts aim to build domestic capabilities in quantum technologies, given their potential to disrupt encryption, surveillance, and communications. Defense and intelligence agencies are particularly focused on quantum’s ability to break traditional encryption schemes, prompting aggressive funding to gain a competitive edge.

- Growth of Hybrid Quantum-Classical Computing

As full-scale fault-tolerant quantum computers are still years away, hybrid quantum-classical models are gaining traction. These systems combine classical computing with quantum processing units (QPUs) to optimize performance and solve specific problems more efficiently. Industries such as finance, supply chain, and pharmaceuticals are leveraging hybrid models to conduct quantum simulations, accelerate Monte Carlo analyses, and optimize portfolios—demonstrating practical use cases in the near term.

- Expansion of Quantum Hardware Innovations

Hardware innovation is a cornerstone of the market's progress. Diverse approaches—such as superconducting qubits, trapped ions, photonics, and topological qubits—are being explored to achieve scalability and coherence. Companies like IonQ, Rigetti, PsiQuantum, and D-Wave are each pursuing different paths to overcome quantum decoherence and error correction challenges. Advancements in cryogenics, quantum memory, and chip fabrication are accelerating the race toward scalable quantum machines.

Major Players and their Competitive Positioning

The competitive landscape of the quantum computing market is dynamic, characterized by innovation, partnerships, and significant capital investments. Leading participants include both tech conglomerates and specialized startups are IBM Corporation, Google LLC (Alphabet Inc.), Microsoft Corporation, Intel Corporation, D-Wave Systems Inc., IonQ, Inc., Rigetti Computing, Honeywell Quantum Solutions (now part of Quantinuum), Xanadu Quantum Technologies, PsiQuantum Corp. and others.

These companies are building quantum processors, developing quantum programming languages, and collaborating with academia to advance quantum research. Their strategies include cloud deployment, hardware-software integration, and vertical-specific quantum applications to differentiate their offerings in an evolving market.

Consumer Behavior Analysis

- Early Adoption Driven by Strategic R&D Goals

Corporate and academic consumers are putting quantum computing into their long term R&D roadmaps. Enterprises in pharma, chemicals, energy and financial services see quantum computing as a way to solve optimization and simulation problems that classical systems can’t. Rather than waiting for full fault-tolerant systems, companies are doing pilot projects with current noisy intermediate-scale quantum (NISQ) devices.

- Cloud-Based Experimentation

End-users prefer cloud-based because quantum hardware is too expensive and complex. By using QaaS platforms, companies can test quantum algorithms, train personnel and develop use cases without investing in physical quantum infrastructure. This behavior allows for scalable engagement across startups, academia and enterprise labs.

- Strategic Collaborations with Tech Providers

Companies are forming strategic partnerships with quantum tech providers to co-develop industry specific solutions. Examples are JP Morgan with IonQ for financial modeling and Mercedes-Benz with IBM for quantum chemistry simulations. These partnerships reflect consumer preference for tailored solutions over generic quantum services.

- Education and Talent Acquisition

Consumer behavior is also influenced by availability of talent. Companies are investing in workforce training, quantum certifications and academic collaboration to build internal quantum teams. Universities worldwide are expanding quantum curricula to meet growing demand, indicating long term consumer commitment to this paradigm shift.

Pricing Trends

Quantum computing systems are capital intensive. Quantum processors can cost millions of dollars due to special materials, ultra low temperature requirements and precision engineering. But pricing is being mitigated by QaaS models that offer metered access, subscription pricing and tiered services based on computational requirements.

In software, quantum development kits and simulators like Qiskit (IBM), Cirq (Google), and Forest (Rigetti) are often open source or low cost and encourage broad experimentation. Venture backed startups and academic institutions are getting funding to access quantum systems at subsidized rates and are shaping flexible pricing frameworks.

Growth Factors

- Accelerated Research Funding: Governments and venture capital firms are pouring billions into quantum computing. U.S. federal funding surpassed $1.2 billion under the National Quantum Initiative. Similarly, the EU and China have committed multi-billion-dollar budgets. This influx of capital supports long-term R&D, hardware development, and commercialization initiatives.

- Increasing Demand for Complex Problem Solving: As industries confront challenges in molecular modeling, climate simulation, and secure communication, the demand for quantum computing intensifies. Classical systems fall short when it comes to simulating quantum behavior at atomic or subatomic levels. Quantum technologies are uniquely positioned to handle these demands, driving market expansion.

- Emergence of Quantum Startups: A surge in quantum-focused startups has invigorated the market. These companies offer innovative solutions in hardware, cryptography, software development, and quantum networking. Their agility and focus often lead to rapid innovation cycles, attracting both public and private investment.

- Advances in Quantum Error Correction: One of the main barriers to scalability—quantum decoherence—is gradually being addressed through quantum error correction techniques. Significant strides in surface codes, topological qubits, and logical qubit construction are enabling longer operational times and higher fidelity, key drivers for the next phase of commercial viability

Regulatory Landscape

Quantum computing is not yet subject to the same level of regulatory oversight as medical or financial technologies, but several developments are emerging:

- Cybersecurity Standards: Regulatory bodies like NIST are exploring post-quantum cryptography (PQC) standards to protect systems against future quantum-enabled cyber threats.

- Export Controls: Governments are implementing export restrictions on quantum technologies to prevent adversarial use or proliferation of quantum hardware and software.

- Ethical Frameworks: There is a growing conversation about ethical implications, including quantum supremacy, data privacy, and the weaponization of quantum systems.

These developments suggest that while currently lightly regulated, the quantum market will face increasing scrutiny as applications expand into sensitive domains.

Recent Developments

- Google's Quantum Supremacy Milestone: Google’s Sycamore processor demonstrated quantum supremacy by performing a computation in 200 seconds that would take classical supercomputers 10,000 years. This milestone reignited global interest in quantum research.

- IBM's 127-Qubit Eagle Processor: IBM unveiled a 127-qubit processor, marking a leap toward scalable quantum computing. The company aims to launch a 1000+ qubit system within the next few years.

- Honeywell and Cambridge Quantum Merger: The merger created Quantinuum, one of the most well-capitalized quantum companies, focusing on both hardware and software innovation.

- Quantum Networking Initiatives: Countries such as the Netherlands, the U.S., and China are launching quantum internet pilots, building infrastructure for secure communication via quantum entanglement.

Current and Potential Growth Implications

a. Demand-Supply Analysis

The demand for quantum computing talent, hardware, and algorithms is outpacing current supply. Companies are grappling with a shortage of skilled quantum engineers and reliable qubit production. Quantum cloud platforms are helping bridge this gap by centralizing access to scarce hardware resources.

b. Gap Analysis

Despite progress, the market is hindered by challenges in scaling qubit systems, ensuring error correction, and training skilled labor. These gaps present opportunities for specialized startups and academic collaborations. Bridging the quantum-readiness gap among industries through education and consulting will also be critical for mass adoption.

Top Companies in the Quantum Computing & Technologies Market

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Intel Corporation

- D-Wave Systems Inc.

- IonQ, Inc.

- Rigetti Computing

- Quantinuum

- Xanadu Quantum Technologies

- PsiQuantum Corp.

Quantum Computing & Technologies Market: Report Snapshot

Segmentation | Details |

By Product Type | Quantum Hardware, Quantum Software, Quantum Services (QaaS), Others |

By Application | Cryptography, Machine Learning, Optimization, Simulation, Financial Modeling, Others |

By End-User | Government, BFSI, Healthcare, Aerospace & Defense, Chemicals, Energy & Utilities, Academia |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Quantum Software: Expected to witness the highest CAGR due to growing enterprise demand for quantum algorithms and simulation tools.

- Optimization Applications: Quantum algorithms are enabling rapid optimization in logistics, portfolio management, and supply chains.

- BFSI Sector: The financial industry is rapidly experimenting with quantum models for fraud detection, pricing strategies, and risk analysis.

Major Innovations

- Quantum Supremacy Benchmarks: Demonstrations proving computational dominance over classical machines.

- Quantum Error Correction Systems: Crucial for stabilizing qubits and achieving fault-tolerant computing.

- Photonic Quantum Computing: An emerging technology using photons instead of electrons, offering room-temperature operation.

Potential Growth Opportunities

- Expansion into Emerging Markets: Nations like India and Brazil are investing in quantum research, opening new avenues for market penetration.

- Integration with AI and 5G: Combining quantum capabilities with AI and next-gen networks is expected to revolutionize real-time analytics and decision-making.

- Quantum Cryptography Services: As cyber threats evolve, quantum key distribution (QKD) is emerging as a vital solution for ultra-secure communication.

Extrapolate Research says:

The quantum computing & technologies market is on the brink of explosive growth. As industries seek solutions beyond classical limits, quantum platforms are gaining relevance in real-world applications. Rapid advancements in hardware, increasing QaaS availability, and rising government support are positioning quantum computing as a transformative force across sectors.

While challenges in scalability and talent remain, the progress in hybrid systems, software platforms, and post-quantum security solutions highlights the market’s readiness. Quantum is no longer a futuristic concept—it's fast becoming a competitive advantage. Stakeholders who invest early in infrastructure, talent, and partnerships stand to gain exponentially as quantum transitions from lab experiments to enterprise-critical solutions.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Quantum Computing Technologies Market Size

- June-2025

- 160

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021