Payment Processing Solutions Market Size, Share, Growth & Industry Analysis, By Solution Type (POS Terminals, Mobile Payment Gateways, Online Payment Platforms, Contactless Payments), By End User (Retail, Hospitality, Healthcare, BFSI, E-commerce, Others), and Regional Analysis, 2026-2033

Payment Processing Solutions Market: Global Share and Growth Trajectory

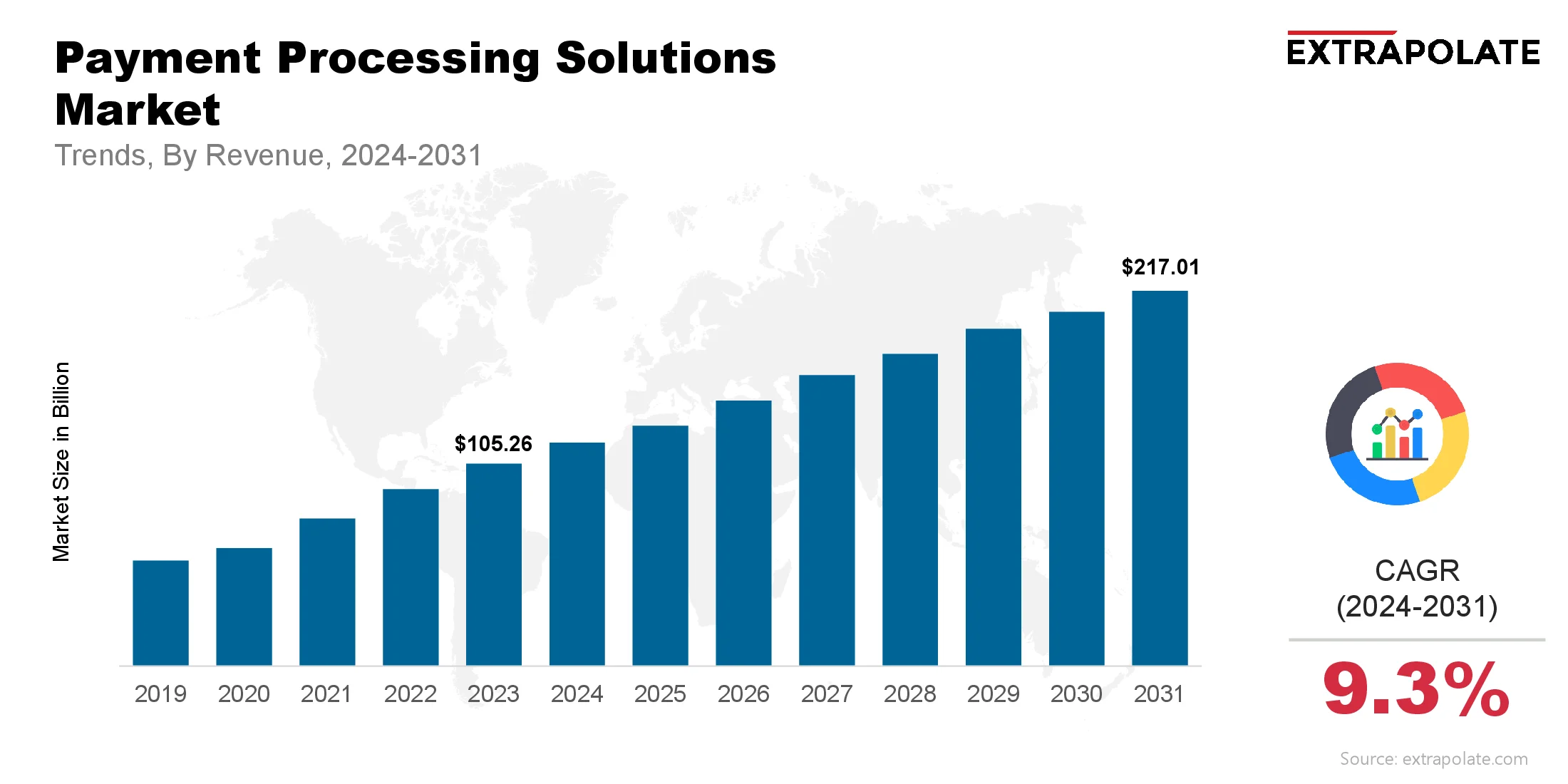

The global payment processing solutions market size was valued at USD 105.26 billion in 2023 and is projected to grow from USD 116.07 billion in 2026 to USD 217.01 billion by 2033, exhibiting a CAGR of 9.3% during the forecast period.

The global payment processing solutions market is experiencing remarkable growth, driven primarily by the surge in digital transactions, widespread adoption of e-commerce platforms, and continuous innovations in financial technology (fintech). This expansive market encompasses various technologies and services designed to facilitate seamless and secure payment processing for both consumers and businesses.

Key components include point-of-sale (POS) systems, mobile payment gateways, online payment platforms, and contactless payment technologies, all playing crucial roles in transforming how payments are executed globally.A significant factor propelling this market's expansion is the ongoing shift towards cashless economies, particularly in developed and emerging regions.

Increasing smartphone penetration and internet accessibility have paved the way for digital wallets and mobile payment options, which are becoming preferred payment modes across demographics. Consumers appreciate the convenience, speed, and safety that digital payment methods offer, thereby driving higher transaction volumes through these solutions.

Additionally, e-commerce growth is a major contributor to the demand for sophisticated payment processing solutions. Online retail platforms require robust and reliable payment gateways to handle vast numbers of transactions securely. As businesses compete to provide frictionless shopping experiences, payment processors are innovating to ensure fast authorization, fraud prevention, and compliance with regulatory standards such as PCI DSS (Payment Card Industry Data Security Standard).

Advancements in technology have further enhanced the payment processing landscape. Contactless payment options, such as NFC (Near Field Communication) enabled cards and mobile wallets, have gained immense popularity due to their speed and hygiene benefits, especially in a post-pandemic world. Integration of artificial intelligence (AI) and machine learning (ML) into payment systems helps in detecting fraudulent activities in real-time, improving overall transaction security and customer confidence.

The market also benefits from the rising adoption of cloud-based payment solutions, which provide scalability and reduce infrastructure costs for businesses of all sizes. Cloud technology enables seamless integration with existing financial systems and supports multi-channel payment acceptance, including in-store, online, and mobile transactions. This flexibility is crucial for small and medium enterprises (SMEs) looking to expand their payment options without heavy investments.

Geographically, North America and Europe currently dominate the payment processing solutions market due to high digital payment adoption rates, well-established banking infrastructures, and favorable regulatory environments.

However, the Asia-Pacific region is emerging as the fastest-growing market, driven by rapid urbanization, expanding internet penetration, and supportive government initiatives promoting digital payments. Countries like China, India, and Southeast Asian nations are witnessing massive growth in mobile wallet usage and innovative payment platforms tailored to local consumer behaviours.

Key Market Trends Driving Product Adoption

The payment processing solutions market is characterized by continuous innovation, competitive dynamics, and evolving consumer preferences. Key trends propelling market growth include:

- Digital Payment Adoption: Online and mobile payments are rising. Growth is fuelled by increased smartphone use and internet access.

- Contactless Payments: NFC and QR code payments are preferred. Convenience and hygiene concerns, especially after the pandemic, drive this trend.

- Security Enhancements: Advanced fraud detection, encryption, and tokenization are widely deployed. These improve transaction safety.

- Integration with Financial Services: Payment solutions now integrate with banking, lending, and loyalty programs. This boosts customer experience.

- AI and Machine Learning: AI analytics are used for personalized offers and fraud prevention. They also optimize transaction processes.

Major Players and their Competitive Positioning

The market is led by key players such as PayPal, Square, Stripe, Adyen, and Worldpay, who continuously innovate to expand their product portfolios and geographic reach. Emerging fintech startups are also disrupting the landscape with niche and specialized payment solutions.

Consumer Behavior Analysis

Consumers and businesses are increasingly adopting payment processing solutions due to:

- Convenience: Transactions are faster and hassle-free. This applies to both online and offline channels.

- Security: Users trust secure gateways. These systems reduce the risk of fraud.

- Omnichannel Experience: Payments can be made seamlessly. Multiple platforms and devices are supported.

- Cost Efficiency: Transaction fees and operational costs are lower. This attracts both consumers and businesses.

Pricing Trends

Pricing varies widely based on service complexity, transaction volume, and customization. Premium solutions provide advanced features and strong security. They come at higher costs. At the same time, affordable and scalable options grow. These serve small and medium businesses well.

The market is expanding globally with significant adoption in North America, Europe, and Asia-Pacific regions. Asia-Pacific, led by China and India, is emerging as a vital market driven by rising e-commerce penetration and government initiatives promoting digital payments.

Growth Factors

Key factors driving the market include:

- Technological Advancements: Innovations in blockchain, AI, and biometrics are improving payment security. They also boost processing efficiency.

- Rising E-commerce Transactions: Online retail is growing rapidly. This drives demand for reliable payment solutions.

- Government Initiatives: Policies support cashless economies. They also promote digital financial inclusion.

- Consumer Preference Shift: More consumers prefer cashless payments. Contactless options are becoming increasingly popular.

Regulatory Landscape

The regulatory framework is changing rapidly. Authorities now enforce strict rules on data privacy, anti-money laundering (AML), and payment security like PCI DSS. Payment processors must navigate these regulations to maintain consumer trust and avoid penalties.

Recent Developments

The payment processing solutions market is dynamic, with recent advancements including:

- Integration of Cryptocurrency Payments: Digital currencies are accepted more widely. This opens new payment options for users.

- Enhanced Mobile Wallet Features: Mobile wallets now support peer-to-peer transfers. They also handle bill payments and multi-currency transactions.

- Cloud-Based Payment Solutions: These offer scalability for merchants. Flexibility in payment management is improved.

- Biometric Authentication: Fingerprint and facial recognition are used. These methods enhance transaction security.

Current and Potential Growth Implications

a. Demand Supply Analysis

The demand for payment processing solutions is robust due to increasing digital transactions. However, challenges such as cybersecurity threats and infrastructure limitations in developing regions can affect supply stability.

b. Gap Analysis

Areas needing improvement include:

- Interoperability: Greater compatibility across different payment platforms and devices.

- Latency Reduction: Faster transaction processing to improve user experience.

- Cost Transparency: Clear pricing models to build merchant trust.

- Enhanced Fraud Detection: More sophisticated tools to prevent emerging cyber threats.

Top Companies in the Payment Processing Solutions Market

- PayPal

- Square

- Stripe

- Adyen

- Worldpay

- Fiserv

- Global Payments

- Clover Network

- First Data

- Wirecard

Payment Processing Solutions Market: Report Snapshot

Segmentation | Details |

By Solution Type | POS Terminals, Mobile Payment Gateways, Online Payment Platforms, Contactless Payments |

By End User | Retail, Hospitality, Healthcare, BFSI, E-commerce, Others |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segment

- Mobile Payment Gateways: Increasing usage with smartphone penetration.

- Contactless Payments: Preferred for hygiene and convenience.

- Online Payment Platforms: Growth driven by e-commerce expansion.

Major Innovations

- Blockchain-based payment settlements for faster clearing.

- AI-driven fraud detection and transaction analytics.

- Voice-activated payment authorizations.

Potential Growth Opportunities

Challenges to address include:

- The market faces strong competition. New fintech entrants are disrupting the space. Traditional banks remain significant players.

- Rapidly evolving technology requiring constant upgrades.

- Data privacy and cybersecurity concerns.

- Infrastructure gaps in emerging markets.

Extrapolate Research says:

The global payment processing solutions market is set for strong growth fueled by digital transformation, changing consumer payment preferences, and ongoing innovation. Companies that effectively leverage technology, ensure security, and deliver seamless payment experiences will thrive in this evolving landscape.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Payment Processing Solutions Market Size

- May-2025

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021