Payment Gateway Market Size, Share, Growth & Industry Analysis, By Type (Hosted, Non-Hosted, Direct Payment Gateway, Platform-Based) By Application (E-commerce, BFSI, Travel & Hospitality, Retail, Healthcare, Others) By End-User (SMEs, Large Enterprises), and Regional Analysis, 2024-2031

Payment Gateway Market: Global Share and Growth Trajectory

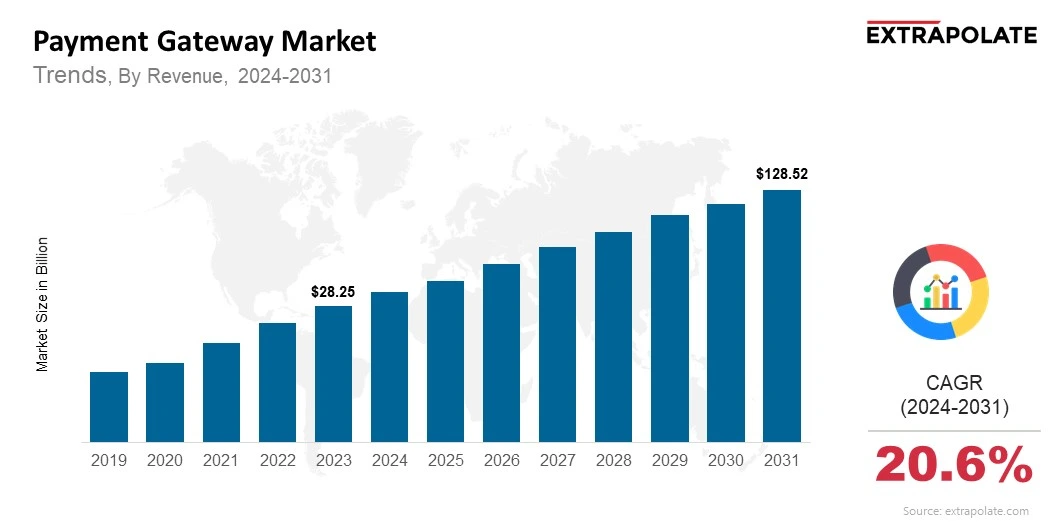

The global Payment Gateway Market size was valued at USD 28.25 billion in 2023 and is projected to grow from USD 34.74 billion in 2024 to USD 128.52 billion by 2031, exhibiting a CAGR of 20.6% during the forecast period.

The global payment gateway market is undergoing a major change, driven by the rising wave of digitalization. Businesses and consumers are increasingly opting for seamless and real-time online payment experiences. At the core of this trend lies payment gateways secure and reliable platforms that authorize and facilitate digital transactions between merchants and financial institutions. Whether on e-commerce websites, mobile apps, or point-of-sale terminals, payment gateways play a critical role in today’s global economy.

The expansion of e-commerce, mobile commerce, and contactless payments, along with expanding internet and smartphone penetration, is prompting the market’s growth. Moreover, evolving regulatory frameworks, consumer demand for secure transactions, and technological innovations in encryption and tokenization are fueling this sector forward. As the financial ecosystem continues to digitize, the payment gateway market is expected to experience escalated growth in the coming years.

Payment gateways have not only simplified how businesses collect payments but also improved customer trust through robust security protocols. From micro-enterprises to multinational corporations, organizations across industries rely on these platforms to provide quick, error-free, and secure payment experiences. With real-time fraud detection, multi-currency processing, and advanced API integrations, the market is innovating at a pace never seen before.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several crucial trends are influencing the adoption of payment gateway solutions:

Surge in Online and Mobile Commerce

The growth in online shopping has substantially increased the demand for robust digital transaction mechanisms. Consumers expect fast and smooth payment experiences across all devices. Payment gateways enable this by supporting a variety of payment modes including credit/debit cards, net banking, digital wallets, and UPI systems. As mobile commerce gains further traction, particularly in Asia-Pacific and Latin America, the reliance on payment gateways is set to grow.

Embedded and Invisible Payments

Embedded payment experiences are rapidly becoming popular. Businesses are incorporating payment gateways directly into applications, websites, and devices to offer effortless checkouts. Invisible payments where transactions are completed without direct consumer input (e.g., ride-sharing apps) are made possible by sophisticated payment gateway integrations. This trend is transforming how users interact with financial services.

Contactless and QR Code Payments

Driven by the pandemic and subsequent health concerns, contactless payments have been widely embraced. Payment gateways that support near-field communication (NFC) and QR-based solutions are becoming increasingly popular. As digital wallets and scan-to-pay systems escalate, merchants are depending on advanced payment gateway solutions to meet changing preferences of consumers.

Fraud Prevention and Security Enhancements

Cybersecurity remains a leading concern for digital transactions. The market is witnessing a strong shift towards payment gateways that are equipped with AI-driven fraud detection, biometric authentication, and end-to-end encryption. With incidents of online payment fraud increasing, businesses are prioritizing gateways that offer real-time threat detection and regulatory compliance (such as PCI DSS and PSD2).

Major Players and their Competitive Positioning

The payment gateway market is highly competitive and comprise a mix of traditional financial service providers, fintech innovators, and technology conglomerates. These key players are investing heavily in technological advancements, regional expansion, and strategic partnerships to strengthen their position in the market are:- PayPal Holdings Inc., Stripe Inc., Adyen N.V., Square Inc. (Block Inc.), Amazon Pay, Fiserv Inc., Visa Inc., Mastercard Inc., Worldpay Inc. (FIS Global), Razorpay Software Pvt. Ltd.

These companies are progressively developing their platforms to handle larger volumes of transactions, ensure better scalability, and maintain low failure rates. Global expansion, vertical integration, and the provision of value-added services like recurring billing, analytics dashboards, and loyalty programs are critical strategies adopted to gain a competitive edge.

Consumer Behavior Analysis

Understanding user preferences is necessary for shaping successful payment gateway strategies. The following behavioral patterns are shaping the market:

Demand for Seamless Experiences

Today’s consumers demand intuitive and one-click payment experiences. They are more likely to discard a purchase if the checkout process is slow. This trend is convincing businesses to integrate fast and optimized payment gateways that reduce friction and enhance user satisfaction.

Security-First Mindset

Consumers are more aware of cybersecurity risks than ever before. They look for trust indicators like the SSL certification, two-factor authentication, and brand recognition before making payments. Consequently, businesses are giving priority to payment gateway providers known for their strong security credentials.

Mobile-First Transactions

A substantial portion of online transactions is now performed through smartphones. Mobile-optimized payment gateways that support in-app payments, push notifications, and biometric verifications are in high demand, specifically among younger, tech-savvy demographics.

Growing Acceptance of Alternative Payment Methods

Beyond traditional card payments, consumers are supporting the buy-now-pay-later (BNPL) models, cryptocurrency, and local payment options. Businesses are responding by collaborating with payment gateway providers that support a vast variety of regional and emerging payment formats.

Pricing Trends

The cost structure depends on how many transactions you process, your region, your sector, and feature needs. Typically, gateways charge a combination of the following:

- Setup Fees: Often waived for SMEs but applicable for custom enterprise solutions.

- Transaction Fees: Gateways typically apply a percentage-based fee, occasionally with a flat added amount.

- Monthly Maintenance: Increased rivalry and cheaper alternatives are expected to reduce pricing pressure in the payment space.

- Custom Integration Costs: Applicable when businesses require bespoke payment flows.

Global firms such as Stripe and PayPal offer flat rates, whereas regional options may use flexible pricing models. Growing competition and budget-friendly newcomers are expected to drive payment fees lower.

Growth Factors

Several drivers are contributing to the rapid growth of the payment gateway market:

Digital Transformation of Businesses

Digitization is reshaping how retailers, service firms, and governments run daily processes. Secure and scalable payment tech is critical to support high-volume digital transactions.

Financial Inclusion and Fintech Growth

Affordable internet, mobile access, and friendly regulations are fueling fintech growth in developing regions. Payment gateways are at the center of this financial inclusion movement, bridging gaps between consumers and digital commerce.

Subscription Economy and Recurring Billing

With more firms adopting subscriptions, demand is rising for gateways that handle auto-renewing payments. These tools help automate retries, allow easy cancellations, and adjust pricing based on demand.

Global E-Commerce Expansion

Gateways meet global e-commerce needs by enabling currency flexibility, local pay options, and secure regional compliance.

Regulatory Landscape

Given their critical role in handling financial data, payment gateways operate within stringent regulatory environments:

- PCI DSS Compliance: The standard enforces strict data protection for anyone processing, storing, or transmitting cardholder information.

- PSD2 (Europe): SCA and open banking APIs are now required by regulation to safeguard users and support fintech growth.

- KYC/AML Regulations: Customer verification is mandatory to stop financial crimes such as fraud and money laundering.

- Data Protection Laws: Regional rules like GDPR (Europe), CCPA (California), and India's DPDP Act influence how consumer data is stored and shared.

Companies must stay ahead of changing laws and ensure seamless compliance to avoid costly fines and preserve brand credibility.

Recent Developments

Multiple recent events and trends are shaping the payment gateway landscape:

- Crypto-Compatible Gateways: BitPay and Coinbase Commerce are rolling out crypto gateways for merchant transactions.

- Embedded Finance Partnerships: With setups like Stripe, Shopify and PayPal’s ecosystem, fintech is becoming part of daily commerce.

- BNPL Integration: Many gateways now provide Buy Now Pay Later, either via partners like Klarna or built-in features.

- AI-Driven Fraud Detection: New gateways are embedding artificial intelligence to flag suspicious activities, detect chargeback fraud, and protect customer identities in real time.

- Expansion into Emerging Markets: Fintech leaders like Razorpay, Flutterwave, and Paystack are pushing into underserved markets in Asia and Africa with scalable solutions.

Current and Potential Growth Implications

Demand-Supply Analysis

Digital commerce growth is driving the need for strong and scalable payment systems. Despite demand, gateway growth is slowed by setup complexity and regional infrastructure gaps.

Gap Analysis

Gaps in advanced tools such as dynamic security and real-time insights hold back mid-sized gateways. By meeting rising demands, incumbents can secure a larger share of the gateway space.

Top Companies in the Payment Gateway Market

- PayPal Holdings Inc.

- Stripe Inc.

- Adyen N.V.

- Square Inc. (Block Inc.)

- Amazon Pay

- Visa Inc.

- Mastercard Inc.

- Worldpay Inc. (FIS Global)

- Checkout.com

- Razorpay Software Pvt. Ltd.

Payment Gateway Market: Report Snapshot

Segmentation | Details |

By Type | Hosted, Non-Hosted, Direct Payment Gateway, Platform-Based |

By Application | E-commerce, BFSI, Travel & Hospitality, Retail, Healthcare, Others |

By End-User | SMEs, Large Enterprises |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Payment Gateway Market: High-Growth Segments

- Platform-Based Payment Gateways:- Platform-based solutions integrated with ERP, CRM, and e-commerce systems are gaining momentum due to their agility and real-time capabilities.

- E-Commerce and Retail Applications:- Online retail is one of the largest contributors to payment gateway adoption. Enhanced customer experiences and secure transactions make this the fastest-growing application segment.

Major Innovations

- Tokenization and Biometrics:- New gateways leverage tokenization to reduce data breaches and support biometric authentication, enhancing user trust and security.

- AI-Powered Smart Routing:- Smart routing technology powered by AI optimizes transaction paths in real-time, minimizing failures and improving conversion rates.

Payment Gateway Market: Potential Growth Opportunities

- Integration with Super Apps: Asia-based super apps like Grab and Paytm offer in-built gateways for multiple services, signaling a scalable future model.

- White-Label Gateway Solutions: Smaller enterprises and fintech startups are increasingly licensing white-label solutions for cost-effective entry into digital payments.

- Offline-to-Online Transition: As traditional retailers digitize, opportunities for omnichannel gateways that unify physical and digital payments will grow significantly.

Extrapolate Research says:

Digital payments, mobile shopping, and rising user demands are driving strong growth in the payment gateway market. Payment gateways are becoming core to how digital businesses handle and innovate payments. With AI, biometric checks, and flexible APIs, top players are shaping the future of transactions. The integration of alternative payment methods and real-time fraud prevention capabilities will only accelerate this momentum. The future of the payment gateway market is fast, secure, and universally accessible.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Payment Gateway Market Size

- June-2025

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021