Online Trading Platform Market Size, Share, Growth & Industry Analysis, By Platform Type (Web-based, Mobile, Hybrid), By Asset Class (Stocks, Forex, Commodities, Cryptocurrencies, Derivatives), By User Type (Retail Investors, Institutional Investors), and Regional Analysis, 2024-2031

Online Trading Platform Market: Global Share and Growth Trajectory

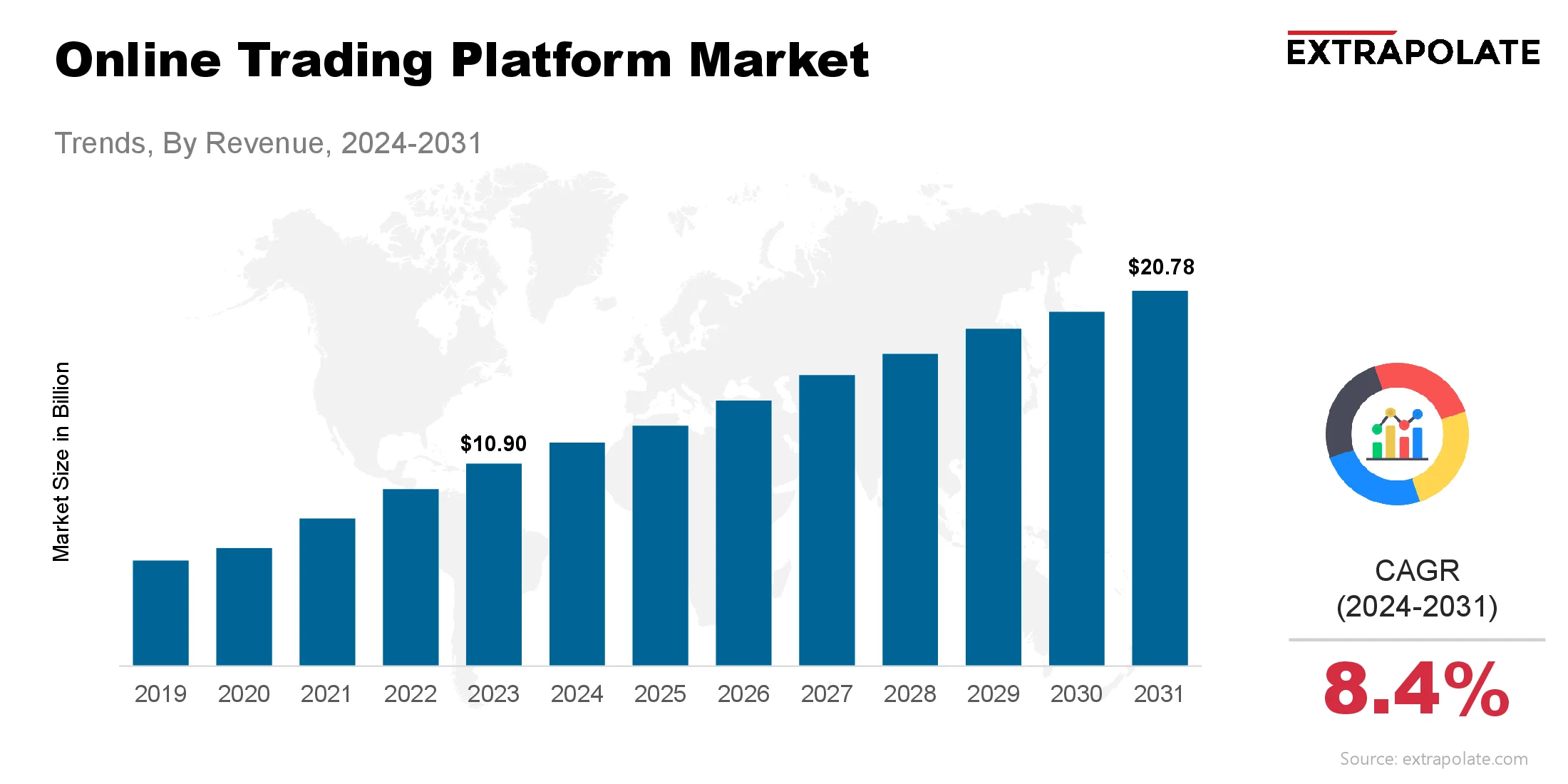

The global Online Trading Platform Market size was valued at USD 10.9 billion in 2023 and is projected to grow from USD 11.79 billion in 2024 to USD 20.78 billion by 2031, exhibiting a CAGR of 8.4 % during the forecast period.

The global market is experiencing robust growth, driven by the convergence of several key factors including enhanced internet accessibility, the democratization of investment opportunities, and continuous technological advancements.

Online trading platforms serve as digital intermediaries that enable investors—ranging from individual retail traders to institutional entities—to execute trades in a variety of financial instruments such as equities, commodities, foreign exchange (forex), derivatives, and emerging assets like cryptocurrencies.

One of the primary catalysts fuelling the expansion of the market is the increasing penetration of high-speed internet and mobile connectivity across both developed and emerging economies.

This improved connectivity has lowered the barriers to market entry, allowing retail investors, who traditionally relied on brokers or financial advisors, to engage directly with markets via intuitive digital platforms. Consequently, there has been a marked rise in retail investor participation globally, reshaping the landscape of financial trading.

In parallel, the proliferation of smartphones and mobile applications has made online trading accessible anytime and anywhere, further propelling market growth. Mobile trading apps equipped with sophisticated features such as real-time market data, advanced charting tools, and automated alerts empower users with timely and actionable insights, enhancing decision-making capabilities. These platforms also often integrate social trading functionalities, enabling users to follow or copy the trades of seasoned investors, thereby attracting novice traders who seek guidance.

Moreover, the market is witnessing significant innovation driven by artificial intelligence (AI), machine learning (ML), and blockchain technologies. AI-powered analytics offer predictive insights and personalized recommendations based on individual trading behavior, risk tolerance, and market trends. Blockchain integration enhances transaction transparency, security, and settlement efficiency, fostering greater trust and reliability within the ecosystem.

Regulatory developments are also shaping the trajectory of the online trading platform. Governments and financial authorities worldwide are instituting frameworks to safeguard investor interests, promote fair trading practices, and mitigate systemic risks.

Compliance with these regulations, including Know Your Customer (KYC) and Anti-Money Laundering (AML) norms, has compelled platform providers to adopt robust verification and data protection mechanisms. While regulatory oversight presents challenges, it also contributes to market maturity and investor confidence.

Geographically, North America currently dominates the online trading platform industry due to the presence of a large base of retail investors, well-established financial markets, and the adoption of cutting-edge technologies.

However, Asia-Pacific is poised for the fastest growth, driven by rising internet users, expanding middle-class populations, and increasing financial literacy in countries like India, China, and Southeast Asia. The Middle East and Africa regions are also emerging as promising markets, supported by digital infrastructure development and growing interest in financial markets.

The market competition includes established financial institutions, fintech startups, and technology companies. Leading players prioritize improving platforms and enhancing user experience. They also expand services like zero-commission trading, fractional shares, and multi-asset access. Strategic collaborations, mergers, and acquisitions are common. These help firms strengthen their market position and gain technological advantages.

Key Market Trends Driving Product Adoption

The market is marked by continuous innovation, fierce competition, and evolving investor expectations. Key trends accelerating market growth include:

- Mobile Trading Surge: Mobile trading is surging. Smartphones and better apps let investors trade anytime and anywhere.

- AI and Automation: AI and automation improve platforms. They offer personalized advice, risk management, and faster trades.

- Social Trading Features: Social trading adds engagement. Users can follow and copy successful investors.

- Zero-Commission Trading: Zero-commission models attract cost-sensitive traders. Fees are reduced or removed.

- Cryptocurrency Integration: Increasing acceptance of crypto assets is expanding platform offerings beyond traditional securities.

Major Players and their Competitive Positioning

Key market participants such as Robinhood, Interactive Brokers, TD Ameritrade, and Charles Schwab dominate the online trading platform landscape. These companies invest heavily in technology upgrades and customer experience to retain market share. Smaller, niche platforms are emerging with specialized offerings targeting millennials and crypto traders.

Consumer Behavior Analysis

Investor adoption of online trading platforms is driven by:

- Ease of Access: Ability to trade without intermediaries and with minimal paperwork.

- Cost Efficiency: Lower fees compared to traditional brokerage.

- Education and Research: Education and research provide real-time data and analytics. Learning tools help users make informed decisions.

- Customization: Tailored alerts, watch lists, and portfolios enhance user engagement.

- Community Interaction: Community interaction uses social features. These allow users to collaborate and share strategies.

Pricing Trends

Pricing models vary widely, from subscription-based premium services to commission-free trades supported by alternative revenue streams such as payment for order flow. Platforms catering to high-frequency traders tend to charge more for advanced tools and analytics.

The market shows strong growth globally, with North America leading, followed by fast-growing regions such as Asia-Pacific, where rising financial literacy and digital adoption are key drivers.

Growth Factors

Several factors are propelling market expansion:

- Digital Transformation: Continuous improvements in fintech infrastructure and cloud computing.

- Increasing Retail Participation: More individuals engaging in self-directed investing.

- Regulatory Support: Regulatory support eases rules for online trading. It helps protect investors.

- Technological Innovations: Technological innovations include AI-powered trading. They also offer better security and real-time analytics.

- Market Volatility: Greater trading volumes during volatile periods increase platform usage.

Regulatory Landscape

Regulations governing online trading platforms are evolving, with key focuses on investor protection, anti-money laundering (AML), and data privacy. Compliance with regional regulatory bodies like SEC (US), FCA (UK), and SEBI (India) is critical for market players.

Recent Developments

The online trading platform continues to innovate with features such as:

- Enhanced Mobile User Interfaces: Streamlined navigation and faster trade execution.

- Integration of Cryptocurrency Trading: Support for a broader asset class.

- Advanced Risk Management Tools: Real-time risk assessment and margin controls.

- Gamification Elements: Features to boost engagement and education.

Current and Potential Growth Implications

a. Demand Supply Analysis

Demand for online trading platforms is growing rapidly due to investor enthusiasm and technology access. Supply-side constraints, such as cybersecurity threats and platform outages, pose challenges.

b. Gap Analysis

Despite growth, some gaps remain:

- Cybersecurity and Data Privacy: Need for robust protection against breaches.

- User Experience: Further simplification for novice traders.

- Market Education: Greater efforts to enhance investor knowledge.

- Infrastructure Scalability: Ensuring platforms can handle surges in user activity.

Top Companies in the Online Trading Platform Market

- E*TRADE

- Robinhood

- Interactive Brokers

- TD Ameritrade

- Charles Schwab

- Fidelity Investments

- Saxo Bank

- Plus500

- eToro

- Zerodha

Online Trading Platform Market: Report Snapshot

Segmentation | Details |

By Platform Type | Web-based, Mobile, Hybrid |

By Asset Class | Stocks, Forex, Commodities, Cryptocurrencies, Derivatives |

By User Type | Retail Investors, Institutional Investors |

By Region | North America, Europe, Asia-Pacific, MEA, Latin America |

High Growth Segments

The following segments are expected to show robust growth:

- Mobile Trading Apps: Preferred by millennials and active traders.

- Cryptocurrency Trading: Increasing adoption in global markets.

- Social Trading Platforms: Rising popularity among beginner traders.

Major Innovations

Innovation remains a key differentiator:

- AI-driven Trading Assistants: Providing personalized trade suggestions.

- Blockchain Integration: Enhancing transparency and settlement speed.

- Voice-Activated Trading: Simplifying user interaction.

Potential Growth Opportunities

Key challenges and opportunities include:

- Intense Competition: Differentiating through user experience and features.

- Rapid Technological Evolution: Staying ahead in AI and cybersecurity.

- Regulatory Compliance: Navigating complex, evolving rules.

- Financial Literacy: Expanding education to boost adoption.

Extrapolate Research says:

The global online trading platform market is poised for substantial growth, supported by rising digital adoption, innovation, and evolving investor behavior. Companies that effectively navigate regulatory landscapes and technology shifts will be best positioned to capitalize on this expanding opportunity.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Online Trading Platform Market Size

- May-2025

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021