Mobile Security Market Size, Share, Growth & Industry Analysis, By Component (Software (Mobile Device Security, Mobile Application Security, Services), By Deployment Mode (On-premises, Cloud), By Operating System (Android, iOS, Windows), Large Enterprises), By End-User (Individual Users, Enterprises (BFSI, Healthcare, Retail, Telecom, Government), and Regional Analysis, 2024-2031

Mobile Security Market: Global Share and Growth Trajectory

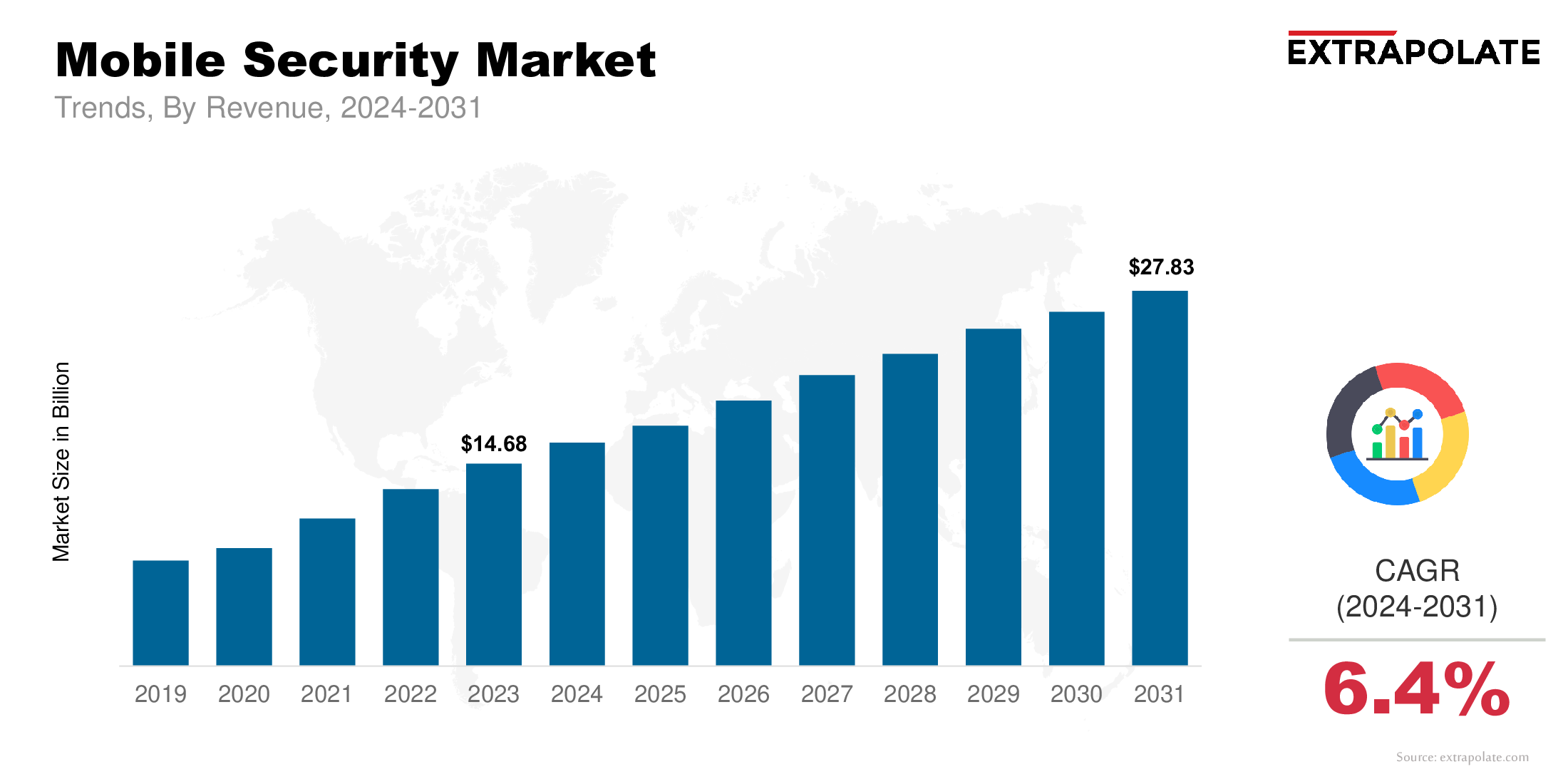

The global mobile security market size was valued at USD 14.68 billion in 2023 and is projected to grow from USD 17.96 billion in 2024 to USD 27.83 billion by 2031, exhibiting a CAGR of 6.4% during the forecast period.

The market has emerged as a critical segment within the broader cybersecurity industry, propelled by the rapid proliferation of mobile devices such as smartphones, tablets, and wearable gadgets. As these devices increasingly serve as primary access points to corporate networks, financial systems, and personal data, the imperative to safeguard them against cyber threats has intensified significantly.

Mobile security solutions encompass a range of technologies designed to protect mobile devices from malware, unauthorized access, data breaches, and other vulnerabilities inherent in wireless communication and mobile operating environments.

Key drivers shaping the mobile security industry include the surge in mobile device adoption across enterprises and consumers, the escalating sophistication of cyberattacks, and the growing reliance on mobile applications for business processes.

Enterprises are adopting bring-your-own-device (BYOD) policies to enhance workforce flexibility and productivity, which simultaneously increases exposure to security risks. This trend necessitates advanced security frameworks such as Mobile Device Management (MDM), Mobile Application Management (MAM), and Mobile Threat Defense (MTD) to ensure data integrity and privacy.

Technological advancements play a pivotal role in market growth, with Artificial Intelligence (AI) and Machine Learning (ML) being integrated into mobile security systems to provide real-time threat detection and automated response mechanisms.

Biometric authentication methods, including fingerprint scanning, facial recognition, and voice identification, are gaining prominence as secure and user-friendly alternatives to traditional passwords. Cloud-based security services are also transforming the market by offering scalable, cost-effective, and easily deployable solutions that enable continuous monitoring and rapid threat mitigation.

Geographically, North America currently leads the market owing to the presence of major technology companies, high cybersecurity awareness, and stringent regulatory standards. However, regions like Asia-Pacific are expected to witness rapid growth due to increasing smartphone penetration, rising internet users, and expanding digital transformation initiatives.

Key Market Trends Driving Product Adoption

Several critical trends are accelerating the adoption of mobile security solutions:

- BYOD (Bring Your Own Device) Policies and Remote Work:

As organizations encourage employees to use personal devices for work, the risk of data breaches increases. The BYOD trend, coupled with the proliferation of remote work, has led to rising demand for mobile security solutions that safeguard business applications, emails, and data on diverse device types and operating systems.

- Rise in Mobile-Based Cyberattacks:

There is a significant uptick in cyberattacks targeting mobile devices, including phishing, ransomware, and spyware. Malware targeting mobile platforms has become more advanced, leading to increased awareness and adoption of mobile threat defense systems. Enterprises and consumers alike are prioritizing solutions that protect against real-time threats and vulnerabilities.

- Growing Use of Mobile Payments and Banking Apps:

The explosion of digital wallets and mobile banking applications has heightened concerns about transaction security. With financial data at risk, users are demanding stronger authentication methods, encrypted communication channels, and app shielding technologies to safeguard transactions.

- Integration of Artificial Intelligence and Machine Learning:

Mobile security platforms are increasingly leveraging AI and ML to detect anomalies and predict threats. These technologies allow security systems to learn from patterns, flag suspicious activity, and automate incident responses—enhancing overall protection and reducing response time.

Major Players and their Competitive Positioning

The mobile security industry is highly competitive and features several established and emerging players innovating to stay ahead. These companies offer a range of solutions, including mobile device management (MDM), endpoint security, secure web gateways, and advanced threat detection.

Key players include are Symantec Corporation (NortonLifeLock Inc.), McAfee LLC, Trend Micro Inc., Check Point Software Technologies Ltd., IBM Corporation, Microsoft Corporation, Cisco Systems, Inc., Palo Alto Networks, Inc., VMware, Inc., Sophos Ltd. And others.

These companies are expanding their portfolios through partnerships, mergers and acquisitions, and product innovation. Their goal is to meet the evolving demands of the digital ecosystem and address complex security challenges associated with mobile platforms.

Consumer Behavior Analysis

Understanding consumer behavior in the mobile security market requires a look at several influencing factors:

- Privacy Awareness: As people become more aware of privacy threats there is growing demand for mobile security tools. Consumers are taking a proactive approach by installing antivirus software, VPNs and secure messaging apps to protect their data.

- Corporate Risk Management: Enterprises view mobile security as part of their overall cybersecurity strategy. Companies are investing in integrated platforms that manage device compliance, monitor threats and ensure secure communication between endpoints.

- App Usage Habits: Users are downloading more apps than ever before and are exposed to more security risks. This has led to demand for real-time app scanning, sandboxing and permission control mechanisms that ensure apps don’t compromise device integrity.

- User Experience and Accessibility: End users want ease of use and seamless integration. Security features that run in the background and don’t interfere with user experience (like biometric authentication) are highly favored. Accessibility across multiple device platforms also drives consumer preference.

Pricing

Mobile security pricing varies based on service type, deployment model and user base. Enterprise grade solutions can be subscription based or licensed per user/device. Advanced solutions with AI powered threat detection and 24/7 monitoring command a premium price.

Consumer level mobile security apps are more affordable or freemium based. But the long term value of preventing data breaches, identity theft and financial fraud justifies the investment. Bundle offerings, cloud based services and SaaS models have made pricing more flexible and scalable.

Some providers offer tiered pricing based on the level of features (e.g. basic antivirus vs enterprise MDM with remote wipe and compliance monitoring) so mobile security is accessible to businesses of all sizes.

Growth Factors

Several major factors are driving the growth of the mobile security market:

- Expanding Mobile Ecosystem: The more devices (smartphones, tablets, IoT devices) the bigger the attack surface. This is driving demand for solutions that protect multiple endpoints across multiple platforms.

- Cloud-Based Deployment: Cloud computing enables scalable and cost effective security services. Many mobile security solutions now operate in the cloud, enabling real-time updates, centralized management and collaboration between security teams.

- Regulatory Compliance Requirements: Data protection laws like GDPR, HIPAA and CCPA require strict mobile data security practices. Businesses are implementing mobile security to avoid penalties, be compliant and protect user privacy.

- Growing Threat Landscape: Nation state actors, ransomware gangs and cybercriminals are now targeting mobile devices. As threats get more complex and frequent mobile security needs to keep up.

Regulatory Landscape

The market is governed by a strict regulatory environment to ensure user data safety and organisational accountability:

- General Data Protection Regulation (GDPR): In the EU, GDPR requires strict control over personal data especially when accessed or processed through mobile apps or devices.

- California Consumer Privacy Act (CCPA): In the U.S., this regulation gives consumers control over their data and requires companies to provide transparent data handling mechanisms on mobile platforms.

- Health Insurance Portability and Accountability Act (HIPAA): In healthcare, mobile security systems must comply with HIPAA regulations to protect patient data on mobile devices.

- Payment Card Industry Data Security Standard (PCI DSS): For mobile payment solutions, these guidelines ensure secure transmission and storage of payment data.

ISO/IEC 27001 and SOC 2 certifications also guide vendors to implement secure information systems and build consumer trust in mobile security solutions.

Recent Developments

Several recent developments in the mobile security space show the market is moving forward:

- Zero Trust Architecture Integration: Mobile security providers are aligning their platforms with zero trust models, requiring strict identity verification and continuous authentication before granting access to apps or data.

- Secure Access Service Edge (SASE): SASE is becoming the centre of mobile security by merging network security with WAN capabilities. This convergence enables secure, remote access to enterprise apps across mobile devices.

- Behavioral Biometrics: Behavioural analytics—tracking typing patterns, swipe gestures and user behaviour—are being used to detect anomalies and prevent fraud in real-time.

- High-Profile Data Breaches: Mobile app leaks, SMS phishing and spyware attacks have made consumers and corporations prioritise mobile threat defence solutions and app shielding technologies.

Current and Potential Growth Implications

a. Demand-Supply Analysis:

The growing threat landscape and increasing mobile device adoption is creating a huge demand for mobile security solutions. Vendors are scaling up, investing in cloud infrastructure and expanding globally to meet this growing need.

b. Gap Analysis:

While the enterprise sector has adopted mobile security solutions fast, SMBs and consumers in emerging markets are lagging. High cost and limited digital literacy is the gap that vendors need to bridge through education, pricing and simplified offerings.

Top Companies in the Mobile Security Market

Key players shaping the global mobile security market include:

- Symantec Corporation (NortonLifeLock Inc.)

- McAfee LLC

- Trend Micro Inc.

- Check Point Software Technologies Ltd.

- IBM Corporation

- Microsoft Corporation

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- VMware, Inc.

- Sophos Ltd.

Mobile Security Market: Report Snapshot

Segmentation | Details |

By Component | Software (Mobile Device Security, Mobile Application Security), Services |

By Deployment Mode | On-premises, Cloud |

By Operating System | Android, iOS, Windows |

By End-User | Individual Users, Enterprises (BFSI, Healthcare, Retail, Telecom, Government) |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are expected to experience significant growth:

- Mobile Application Security: With more apps handling sensitive transactions and data, securing apps at code and API level is crucial. This will grow fast.

- Cloud-Based Security Solutions: Cloud is scalable and flexible, so attractive to all businesses. Real-time updates and analytics are making cloud-based mobile security more appealing.

Major Innovations

Innovations that are changing the mobile security landscape:

- AI-Powered Threat Detection: AI engines can analyze behavior, detect anomalies and act faster than traditional methods.

- App Shielding and Runtime Application Self-Protection (RASP): These technologies protect mobile apps from tampering and reverse engineering.

- Biometric Authentication: Fingerprint scanning, facial recognition and voice authentication makes user experience and security better.

Potential Growth Opportunities

Key opportunities in the market include:

- Emerging Markets: With smartphone penetration growing in Southeast Asia, Africa and Latin America, mobile security vendors can enter new markets with cost-effective and lightweight solutions.

- IoT and 5G: 5G and IoT will connect billions of devices, security will be paramount. Mobile security solutions that address this complexity will have an edge.

Extrapolate Research says:

Overall, the mobile security market will grow fast as we need to protect sensitive data and devices in a connected world. As mobile devices dominate personal and professional life, the demand for advanced security solutions to counter cyber threats will intensify.

This report shows how AI-powered threat detection, biometric authentication and cloud-based security services are changing the landscape, providing comprehensive protection against sophisticated attacks. We recommend stakeholders to invest in scalable and adaptive security and form strategic partnerships to navigate regulatory complexities and consumer privacy concerns. The insights here will help businesses to capitalize on the opportunities and build mobile security ecosystem for the future.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Mobile Security Market Size

- June-2025

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021