Industrial Cybersecurity Market Size, Share, Growth & Industry Analysis, By Component (Software, Hardware, Services), By Security Type (Network Security, Endpoint Security, Application Security, Wireless Security, Others), By End-User Industry (Energy & Utilities, Manufacturing, Oil & Gas, Transportation, Healthcare, Others), By Deployment Mode (On-Premise, Cloud-Based), and Regional Analysis, 2026-2033

Industrial Cyber Security Market: Global Share and Growth Trajectory

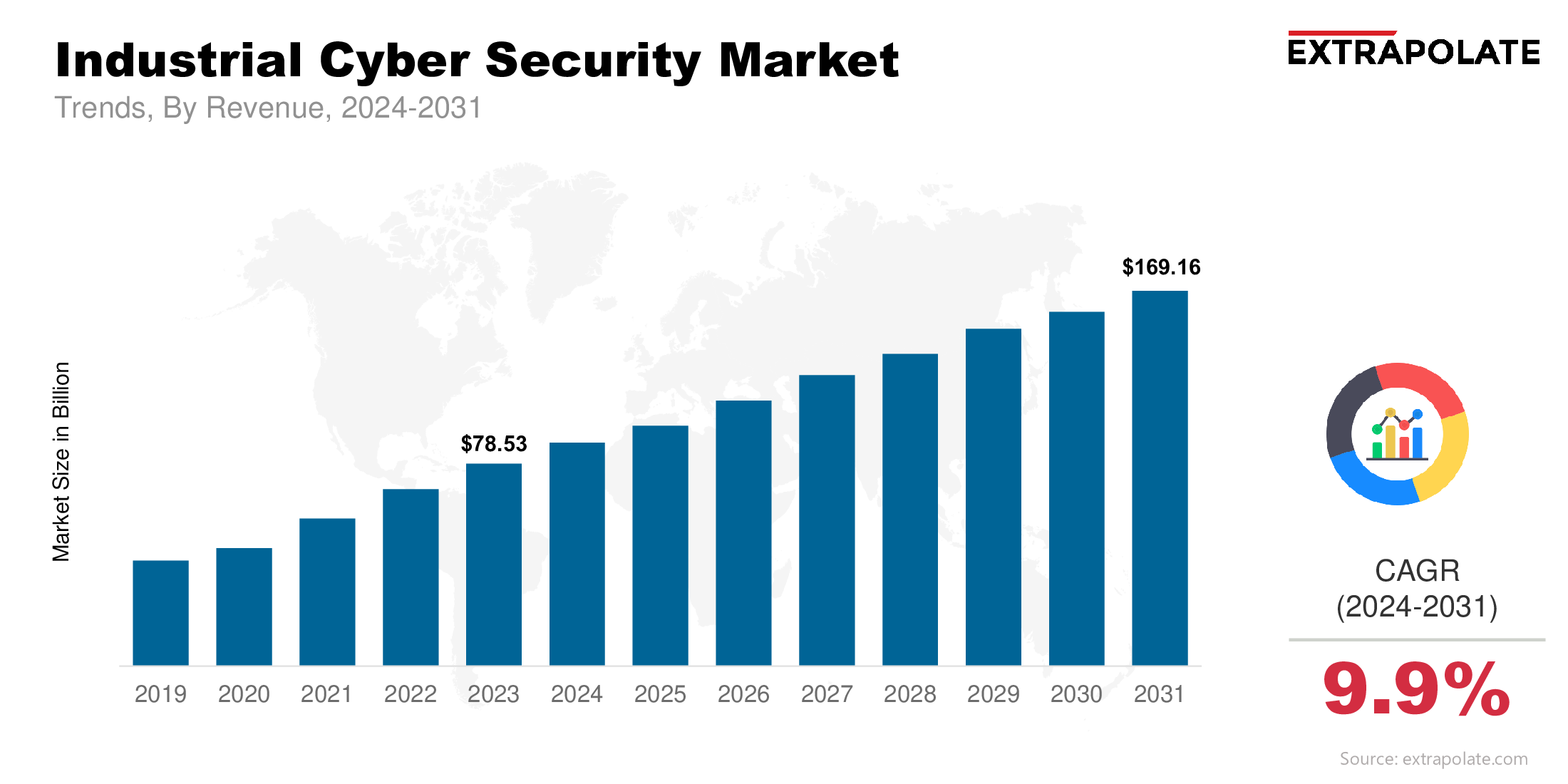

The global Industrial Cybersecurity Market size was valued at USD 78.53 billion in 2023 and is projected to grow from USD 87.07 billion in 2026 to USD 169.16 billion by 2033, exhibiting a CAGR of 9.9% during the forecast period.

The global industrial cyber security market is on a significant growth path as industries increasingly digitize their operations and adopt connected technologies. With the rising convergence of information technology (IT) and operational technology (OT), industrial systems face a growing risk of cyber threats that can disrupt critical infrastructure, halt production, and cause severe financial damage. This has made cyber security a top priority for organizations in manufacturing, energy, oil & gas, transportation, and other industrial sectors.

The market is being propelled by several key drivers. Notably, the frequency and complexity of cyberattacks on industrial control systems (ICS) are increasing, leading to heightened awareness and proactive investments in security frameworks. Additionally, regulatory bodies across regions are mandating compliance with robust cyber security standards, such as NIST, IEC 62443, and GDPR, further fueling market growth.

The market for industrial cyber security is presently led by North America. Its robust industrial foundation and stringent regulations are the reason for this. Asia-Pacific, however, is anticipated to expand at the quickest rate. This expansion in emerging economies is being driven by rapid industrialization. Also, there is a rising awareness of cyber threats.

The need for sophisticated security solutions is growing as the Industrial Internet of Things (IIoT) and digital transformation accelerate. The market for industrial cyber security is expanding rapidly on a global scale. It has enormous potential for growth and innovation in a number of industries and geographical areas.

Key Market Trends Driving Product Adoption

Here are the major trends driving industrial cyber security:

- IT-OT Convergence: IT and OT have merged to create complex systems. While this brings productivity and monitoring benefits, it also creates new vulnerabilities. Industrial cyber security tools are now needed to bridge the security gap across both networks. Solutions with unified visibility, anomaly detection and response across IT-OT boundaries are seeing high adoption.

- More Frequent and Sophisticated Attacks: Ransomware, phishing and zero-day exploits are becoming more frequent and targeted, especially against industries like energy and manufacturing. These are high-value targets because of the critical nature of their operations. Organizations are investing in multi-layered security architectures that can detect and respond in real-time.

- AI and Machine Learning in Threat Detection: Cyber protection is changing as a result of artificial intelligence. Rapid pattern recognition and anomalous activity detection are capabilities of machine learning algorithms. Compared to conventional techniques, they also aid in anticipating possible attacks more quickly. Better control during security breaches and a faster threat response are the results of this.

- IIoT Devices: The rise of Industrial Internet of Things (IIoT) devices has expanded the attack surface across industrial ecosystems. Each connected device is a potential point of vulnerability. Therefore, demand for IIoT specific security protocols, secure gateways and endpoint protection platforms is growing fast.

Major Players and Their Competitive Positioning

There is fierce competition in the industrial cybersecurity industry. There is competition for market share from both large cybersecurity corporations and specialized OT-focused businesses. Some important players are IBM Corporation, Cisco Systems, Inc., Honeywell International Inc., ABB Ltd., Schneider Electric SE, Siemens AG, Fortinet Inc., Rockwell Automation, Inc., Palo Alto Networks, Inc., Dragos, Inc.and others.

These companies keep growing by launching new products, forming partnerships, and merging with others. Many are adding advanced threat detection and automated incident response. They're also using cloud-based security platforms. This helps them offer more complete and customized solutions for industrial settings.

Consumer Behavior Analysis

Adoption in the industrial cybersecurity market is influenced by both proactive and reactive factors. Key drivers include:

- Heightened Risk Awareness: Cyber threats are becoming more frequent and visible. Incidents like the Colonial Pipeline attack have raised awareness about vulnerabilities in operational technology.

- Compliance with Regulations: Many companies are adopting cybersecurity solutions to meet standards. These include NIST, IEC 62443, and GDPR. Failure to comply can lead to operational disruptions and legal penalties.

- Need for End-to-End Security: Organizations are shifting from fragmented tools to integrated security platforms. These platforms support centralized monitoring, better threat detection, and faster response.

- Training and Cultural Change: Businesses are investing in employee training and awareness programs. Since human error remains a leading cause of cyber incidents, building a security-conscious culture is essential.

Pricing Trends

Industrial cyber security solutions can cost very differently. It mostly depends on how complex, large, or customized the system needs to be.

Several factors affect the price:

- Type of Solution: Basic tools like endpoint security or antivirus software are usually cheaper. More advanced systems for threat detection or incident response tend to cost more.

- Deployment Model: On-premise setups often come with high upfront costs. Cloud-based platforms, on the other hand, offer flexible subscriptions that grow with your needs.

- Industry Needs: Some industries, like oil & gas or nuclear energy, have strict safety rules. They often need highly customized security, which makes the solution more expensive.

To make things easier, many vendors now offer flexible pricing. These include SaaS (Software as a Service), managed services, or modular packages. This helps smaller businesses get strong cyber security without spending too much upfront.

Growth Factors

Several key factors are driving the fast growth of the industrial cybersecurity market:

- Digital Transformation Initiatives:

The Fourth Industrial Revolution is changing how industries work. Companies are automating their processes and connecting systems. This shift makes cybersecurity essential for long-term growth. - Strict Government Regulations:

Governments are now enforcing tougher cybersecurity rules for critical infrastructure. Policies like the U.S. Cybersecurity Executive Order, Europe’s NIS Directive, and India’s National Cyber Security Policy are pushing companies to invest more in cyber defense. - Growing Use of IIoT:

Factories and industrial setups are adding more sensors, data tools, and automation tech. These connected devices need strong protection, especially when they send data through public or hybrid cloud systems. - Risk of Downtime:

Cyberattacks can shut down entire plants or systems. The loss from downtime, leaks, or damage to reputation is huge. In response, companies are prioritizing cybersecurity and increasing their spending in this area.

Regulatory Landscape

Regulatory compliance is a central driver for industrial cyber security implementation. Some of the key frameworks include:

- IEC 62443 is a globally recognized standard. It applies to industrial automation and control systems. Both system integrators and asset owners follow it.

- NIST Cybersecurity Framework (CSF) is widely used in the U.S. It provides guidelines to strengthen critical infrastructure security.

- GDPR and data privacy laws are essential for companies handling sensitive personal or operational data. Compliance is necessary to protect user information and avoid penalties.

- Sector-specific regulations apply to industries like power, water, transport, and healthcare. For instance, energy providers must comply with NERC CIP standards.

These regulations promote baseline security measures. They also support regular risk assessments and effective response plans. This helps organizations stay protected from evolving cyber threats.

Recent Developments

Here are some key updates in the industrial cyber security market:

- More Focus on OT Security: Companies like Dragos and Nozomi Networks are creating special platforms just for OT (Operational Technology). These tools protect industrial control systems without causing any downtime.

- AI and Analytics Integration: Cybersecurity platforms are getting smarter with AI. They can now predict possible threats in advance. Tools like IBM’s QRadar and Cisco’s SecureX are great examples of this.

- Big Partnerships and Acquisitions: Large tech firms are teaming up with or buying smaller cybersecurity companies. For example, Honeywell has partnered with Fortinet to improve OT threat protection in the energy sector.

- Growth of Managed Security Services (MSS): Since cyber threats are getting more complex, many businesses now rely on MSS providers. These services help manage and monitor security, especially in remote or less-staffed locations.

These developments signify a clear commitment across the industry to modernize security strategies and embrace next-generation technologies.

Current and Potential Growth Implications

- Demand-Supply Analysis: Demand for cybersecurity solutions is increasing rapidly. Companies are actively seeking reliable protection tools. However, there is a shortage of skilled professionals to design and manage these systems. This gap is a key challenge. Vendors are addressing it through automation and managed services.

- Gap Analysis: Big businesses are implementing cutting-edge cybersecurity systems. Small and medium-sized enterprises, on the other hand, fall behind. Two of the biggest obstacles are low resources and insufficient experience. For SMEs, this generates a high need for scalable and reasonably priced solutions.

Top Companies in the Industrial Cyber Security Market

Prominent players shaping the industrial cyber security landscape include:

- IBM Corporation

- Cisco Systems, Inc.

- Honeywell International Inc.

- ABB Ltd.

- Schneider Electric SE

- Siemens AG

- Fortinet Inc.

- Rockwell Automation, Inc.

- Palo Alto Networks, Inc.

- Dragos, Inc.

Industrial Cyber Security Market: Report Snapshot

Segmentation | Details |

By Component | Software, Hardware, Services |

By Security Type | Network Security, Endpoint Security, Application Security, Wireless Security, Others |

By End-User Industry | Energy & Utilities, Manufacturing, Oil & Gas, Transportation, Healthcare, Others |

By Deployment Mode | On-Premise, Cloud-Based |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Services Segment: More firms are outsourcing security tasks. This boosts demand for services like managed detection and response (MDR).

- Energy and Utilities Sector: Smart grids and digital substations are increasing. The sector is investing more in cyber resilience tools.

- Cloud-Based Deployment: Industrial firms are moving to the cloud. Cloud-native security tools are seeing faster adoption.

Major Innovations

Recent innovations are playing a key role in driving the market forward.

- Behavioral Analytics Engines: These tools analyze user and machine behavior. They help detect unusual activity and prevent insider threats or zero-day attacks.

- Zero Trust Architectures: This approach replaces traditional perimeter-based security. It assumes no implicit trust and helps isolate and contain breaches more effectively.

- Digital Twin for Cybersecurity: These are digital replicas of physical assets. They allow real-time simulation of threats and testing of defense systems without disrupting operations.

Potential Growth Opportunities

- Emerging Economies: Industrialization is growing fast in regions like Africa, Southeast Asia, and Latin America. This is driving up the demand for better cybersecurity infrastructure.

- 5G and Edge Computing Security: Technologies like 5G and edge computing are expanding. They need stronger security systems, which is creating new opportunities for innovation.

- Remote Monitoring Solutions: Remote work and plant management are now more common. Because of this, there’s a growing need for secure remote access solutions.

Extrapolate Research says:

The industrial cyber security market is set to grow rapidly. Growing industrial operations digitalization is the main driver of this expansion. With the increasing frequency of cyberattacks on key infrastructure, businesses can no longer ignore OT security. Defense-related technologies such as IIoT protection, AI-based threat detection, and Zero Trust models are increasingly indispensable.

Additionally, the market landscape is being shaped by government rules and compliance needs. Businesses are concentrating on reducing interruptions and guaranteeing operational security. This has led to a rise in the need for cost-effective, scalable, and intelligent security systems. Industrial productivity depends on robust cybersecurity in the future. Companies that invest now will build secure and resilient digital operations for the future.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Industrial Cybersecurity Market Size

- June-2025

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021