Global Fintech Market: By Application (Fund Transfer & Payments, Loans, Insurance & Finance, Wealth Management, and Others), Technology (Application Programming Interface, Artificial Intelligence, Blockchain, and Others), End-Users (Banks, Financial Institutions, Insurance, and Others), and Region - Market Perspective, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecast for 2023 - 2032

Market Perspective

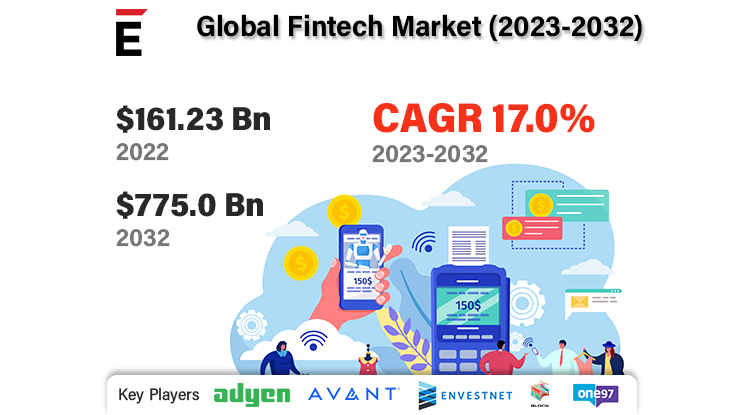

The global Fintech Market was valued at USD 161.23 billion in 2022 and is anticipated to generate a revenue of USD 775 billion by 2032 at a CAGR of around 17% during 2023-2032.

In recent years, the fintech market has witnessed an exponential surge, driven by global advancements and innovations in technology, such as automation, blockchain, and artificial intelligence. This surge has resulted in fintech offering consumers better conveniences than traditional banking or wealth management processes. One of the prominent factors attracting consumers towards using fintech in daily transactions is its inclusion of transparency. To innovate better services and solutions, financial institutions, banks, and other wealth management firms have been observed to be partnering with fintech companies. However, concerns such as data breaches, privacy, and intellectual property may restrict the growth of the market up to a certain extent.

The prominent regions contributing to the growth of the fintech market include North America, Europe, and Asia Pacific. Among these, India has experienced the highest year-on-year growth since 2017, making it the most famous country in this domain. The Middle East & Africa, and Latin America are expected to show steady growth opportunities for fintech. Furthermore, emerging economies and developed countries are increasingly encouraging the implementation of fintech solutions, which is expected to accelerate the market through the forecast period.

Key Insights

- Based on the application, the fund transfer & payments segment held the largest market share

- Based on technology, the blockchain segment dominated the market

- Based on end-users, the bank segment generated the highest revenue

- Based on region, North America accounted most significant market share

Widespread Internet Penetration to Drive Fintech Market Growth

The fintech market has experienced significant growth due to the widespread acceptance of online payments and other services offered by fintech companies. With the internet reaching the corners of developed countries and expanding its reach through economically emerging countries, there has been a significant shift towards online transactions, financing options, wealth management, and other fintech applications.

The Asia Pacific and Europe regions have seen a 13% rise in digital payments since 2017. According to statistics from the International Monetary Fund (IMF), India has experienced the highest surge in digital payments, accounting for over a 50% increase in the past five years. With the growing adoption of digital payments and increased internet penetration, the fintech market is expected to witness substantial growth in the coming years.

Unfavorable and Conflicting Government Policies May Pose Challenges to Fintech Market Growth

One of the challenges that fintech companies face is varying regulations and policies across different countries and states. Laws and regulations may differ, even within the same country or state, and fintech companies need to adapt and modify their products, solutions, and services accordingly.

Regulations such as GDPR and MiFID have been implemented in the European Union (EU) to standardize policies across all member states. However, countries outside the EU will also require similar laws to facilitate the growth of the fintech market. Unfavorable or conflicting government policies can pose a challenge to the growth of the fintech market, and the standardization of regulations across different regions will be essential for the continued success of fintech companies.

Recent Developments

February 2023: Hala, a Saudi fintech company, acquired Paymennt.com. Paymennt.com is a central online payments platform providing services for small and micro businesses in UAE. The acquisition aimed for Hala to introduce an online payment portal in its platform.

January 2023: Fondsdepot Bank, a German institution providing financial and credit services, was acquired by FNZ, a prominent wealth management platform. With the acquisition of Fondsdepot Bank, FNZ now has over 1,000 customers accounting for over USD 130 million in value.

September 2022: Cleareye.ai and JP Morgan signed a partnership agreement to innovate a platform that would provide digital trade financing solutions to numerous banks. Trade Processing System by JP Morgan is already working fine in the Asia Pacific market, and with this agreement, the aim is to take these services globally.

Segmentation Analysis

By application, the market is further categorized into fund transfer & payments, loans, insurance & finance, wealth management, and others. In 2022, fund transfers & payments held the largest revenue share, the segment was responsible for generating more than 41.32% of total segmental revenue. Growth in integrating advanced technology such as API and AI in payment portals or services based on mobiles is estimated to accelerate the segment further. Fund transfers & payments are among the widely used services in traditional banking and fintech or online applications. Advancing solutions provided by companies in the market will further drive the segment’s growth.

By technology, the fintech market is further categorized into application programming interface, artificial intelligence, blockchain, and others. In 2022, blockchain technology held the largest segmental share in terms of revenue. It has become the most convenient and prominent technology provided by fintech companies globally, providing secure payment gateways for consumers without the need for banks or financial institutions. Blockchain offers enhanced security, efficiency, and accessibility and has been a convenient way for consumers to transact.

The transparency of fintech companies has driven end-users to opt for blockchain technology. On the other hand, the AI category of the technology segment is estimated to grow significantly due to efficient decision-making, reduced processing time, and simple query resolution. Fintech companies are leveraging AI to provide better customer service and streamline operations.

The market is also categorized by end-users into banks, financial institutions, insurance, and others. In 2022, banks held the largest share of end-users of fintech in terms of users and revenues. The crucial reason for banks' dominance is the elimination of flaws and recurring errors consumers face in the traditional banking sector. Fintech solutions and platforms provide banks with convenient, error-free transactions, and other services.

The insurance category is estimated to observe the fastest growth through the forecast period, owing to services available for insurance companies, such as risk calculation and efficient processing of claims and returns. Financial institutions are also adopting fintech solutions to provide better services to their clients.

North America Dominates the Global Fintech Market Due to Largescale Adoption of Online Financial Services

In 2022, North America dominated the fintech market with a regional share of more than 33.84% in revenues. This was mainly due to the wide-scale adoption of IoT (Internet of Things) and ICT (Information and Communication Technology), which are critical in generating revenues. In the U.S., more than 52% of consumers preferred contactless payment methods, and over 82% of citizens have been transacting through digital or online platforms. Key regional players' services and solutions played a vital role in the shift towards fintech solutions. Innovative platform and services development is estimated to drive growth for North America through the forecast period, with the U.S. being the significant country, followed by Canada in the region.

Asia Pacific to Remain Fastest Growing Fintech Market Due to Increasing Number and Acceptance of Online Platforms

Asia Pacific is expected to be the fastest-growing region for fintech service platforms and revenues generated therein. India is the most prominent country in the region due to its high population and widespread acceptance of fintech solutions. In recent years, India recorded the highest number of online transactions, with over 46.8 billion transactions in 2021 and around 70 billion in 2022. The increasing working population, convenience of online portals, and other solutions provided by fintech companies are the critical reasons for rapid growth. Internet services penetration has reached the rural areas of India in terms of mobile applications, online payment portals, and transactions. China, Japan, and Australia are significant countries in the region.

Competitive Landscape

- ADYEN

- Avant, LLC.

- BEIJING DAOKAU JINKE TECHNOLOGY CO., LTD.

- BLOCK, INC.

- Envestnet

- One97 Communications

- PayPal, Inc.

- Revolut Ltd

- Synctera

- Wise Payments Limited

The global Fintech market is segmented as follows:

By Application

- Fund Transfer & Payments

- Loans

- Insurance & Finance

- Wealth Management

- Others

By Form

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Others

By End-Users

- Banks

- Financial Institutions

- Insurance

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Global Fintech Market By Application

- March-2023

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021