Facility Management Software Market Size, Share, Growth & Industry Analysis, By Component (Software, Services), By Deployment (On-Premise, Cloud-Based), By Application (Asset Management, Maintenance Management, Space Management, Real Estate Management, Energy Management, Others), Large Enterprises), By End-User (Commercial, Industrial, Residential, Government), and Regional Analysis, 2024-2031

Facility Management Software Market: Global Share and Growth Trajectory

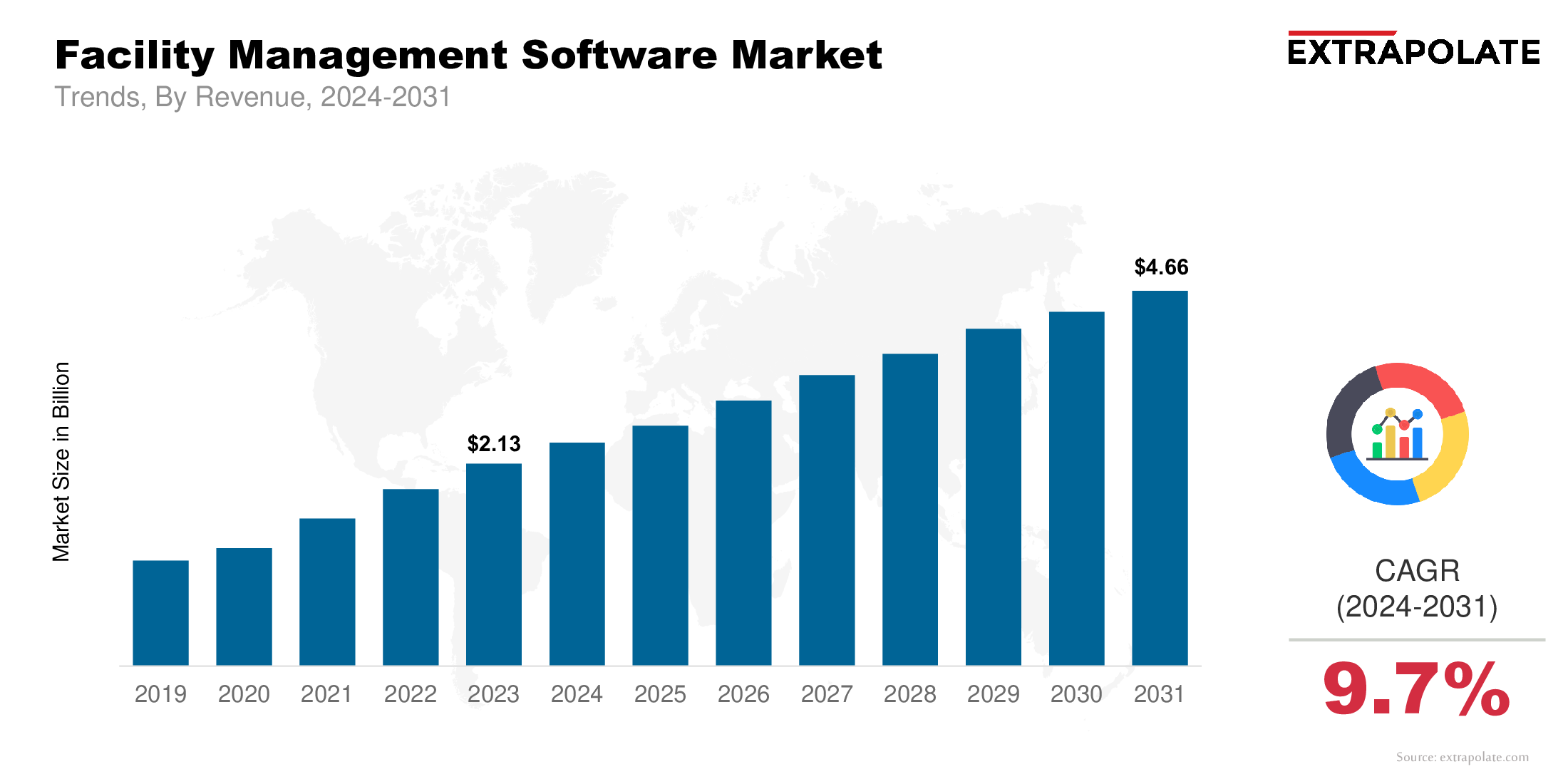

The global Facility Management Software Market size was valued at USD 2.13 billion in 2023 and is projected to grow from USD 2.44 billion in 2024 to USD 4.66 billion by 2031, exhibiting a CAGR of 9.7% during the forecast period.

The market is growing fast. This is a big shift towards digitization in property and infrastructure management. As commercial, residential and industrial facilities change, owners and operators are under more pressure to be more efficient, cut costs, be compliant and improve occupant experience. FM software is becoming essential to monitor and manage tasks like maintenance, asset tracking, space utilisation and energy management.

Technology and complexity in facility operations is driving this growth. Companies in healthcare, education, manufacturing, government and real estate are adopting FM software to streamline workflows, increase transparency and do predictive maintenance. The COVID 19 pandemic accelerated this adoption.

Now organizations are focusing on workplace safety, sanitation and remote monitoring. Cloud based solutions, mobile access, IoT integration and AI analytics is turning facility management from reactive to proactive.

As companies are focusing on sustainability, energy efficiency and ESG (environmental, social, governance) standards, FM software is the key to tracking and reducing carbon footprint. With strategic investments and digital transformation, the facility management software industry is ready to boom and create opportunities for vendors and stakeholders globally.

Key Market Trends Driving Product Adoption

Several trends are driving the adoption of facility management software:

- Cloud First:More organizations are moving from on-premise to cloud-based solutions. These solutions provide scalability, remote access, automated updates, and lower infrastructure costs.

- IoT and Smart Sensors:IoT enabled FM systems are changing the way we operate buildings. Sensors track air quality, temperature, lighting, occupancy and energy use, sending data for actionable insights. This connectivity enables preventive maintenance, energy efficiency and a safer more comfortable space.

- Focus on Workplace Experience:Employee and tenant experience is now central to facility management. FM software supports desk booking, room scheduling, wayfinding, and feedback systems, enhancing productivity and satisfaction. These features are vital in flexible, hybrid, and return-to-office settings.

- Energy and Sustainability Management:FM tools are increasingly designed with sustainability in mind. They track energy use, spot inefficiencies, and support green building initiatives. Organizations use FM platforms to report on ESG compliance and pursue LEED, WELL, and ISO 50001 certifications.

- Cybersecurity and Data Protection:As FM software manages sensitive building data and links to critical infrastructure, cybersecurity is top of mind. Vendors are investing in encryption, multi-factor authentication and secure APIs to protect against cyber threats and comply with data protection regulations like GDPR.

Major Players and Their Competitive Positioning

The facility management software industry is highly competitive and rapidly evolving. Both established companies and new startups are creating feature-rich solutions for various sectors. Key market players include IBM Corporation, Oracle Corporation, SAP SE, Trimble Inc., Archibus (SpaceIQ + iOffice), Accruent (Fortive), FM:Systems, Planon Group, CA Technologies (Broadcom), ServiceChannel and others.

These companies provide Integrated Workplace Management Systems (IWMS), Computerized Maintenance Management Systems (CMMS), and specialized FM tools. Their market positioning relies on strategic moves like acquisitions, partnerships, and product innovations. For example, SpaceIQ's acquisition of iOffice and its merger with Archibus has created a stronger platform for global enterprises.

Consumer Behavior Analysis

Consumer behavior in the market is influenced by operational needs, cost efficiency, and digital readiness.

- Emphasis on Operational Efficiency: Facility managers want software that simplifies daily operations. Automation of work orders, maintenance scheduling, asset tracking and vendor management saves time and costs and leads to higher adoption of software.

- Demand for Customization and Integration: Users want platforms that offer customization, modularity and seamless integration with systems like ERP, HR and BMS. This integration gives data visibility and cross functional decision making.

- Rising Preference for Mobile Access: With mobile workforces, consumers value platforms that allow access to data, dashboards, and service requests on the go. Mobile apps enhance field technician performance and responsiveness.

- Sustainability-Driven Purchases: Eco-conscious businesses choose FM platforms that align with sustainability goals. Software providing energy reporting and carbon tracking is increasingly popular, especially among large enterprises and public sectors.

- ROI-Centric Decision Making: Budget-conscious decision-makers evaluate FM software investments based on ROI, which typically shows as reduced downtime, lower maintenance costs, and improved asset management.

Pricing Trends

Facility management software pricing varies by deployment model, user count, features, and integrations. Common pricing models include:

- Subscription-Based SaaS: Most vendors offer monthly or annual SaaS subscriptions. Prices range from $30 to $200 per user each month, depending on features like mobile support and analytics.

- Tiered Pricing: Vendors present tiered packages for small, mid-sized, and large enterprises. Each tier has different features, user limits, and support levels.

- Custom Enterprise Pricing: Large organizations with complex needs often negotiate tailored packages with dedicated account management and support.

- Freemium and Entry-Level Tools: Some vendors attract small businesses with freemium models, providing limited modules that users can upgrade as their needs grow.

As competition intensifies, vendors are offering flexible pricing, modular licensing, and bundled services to attract and keep customers.

Growth Factors

Several factors are driving growth in the facility management software market:

- Digital Transformation Initiatives: Companies are investing in smart infrastructure and digital tools to modernize operations. FM software is crucial for organizations moving from manual to automated processes.

- Urbanization and Infrastructure Development: As cities expand, efficient facility operations become vital. Governments and developers are using FM platforms in smart city projects to manage utilities and public services.

- Increasing Maintenance Complexity: Modern buildings have advanced systems that require integrated software for centralized management and task automation.

- Post-Pandemic Workplace Changes: The COVID-19 pandemic changed workplace strategies. Organizations now need FM solutions for remote monitoring, occupancy tracking, and health compliance.

- Growing Need for Compliance and Risk Management: Strict regulations on safety and energy use push organizations to adopt FM tools that simplify audits and compliance tracking.

Regulatory Landscape

The market is shaped by various regional and industry-specific regulations:

- Data Privacy and Security Compliance: FM platforms collect sensitive data. Compliance with GDPR (Europe), CCPA (California), and other privacy laws is essential.

- Fire and Building Codes: FM tools ensure adherence to local building safety codes and fire standards through automated alerts and record-keeping.

- Health and Safety Regulations: FM systems help organisations comply with OSHA (US), HSE (UK) and other safety laws through equipment inspections and hazard tracking.

- Environmental and Energy Standards: Frameworks like ISO 14001 and LEED encourage the use of FM platforms that monitor energy use and environmental impact.

Compliance features in FM platforms provide audit trails and risk management capabilities.

Recent Developments

Recent developments are shaping the market:

- AI and Predictive Maintenance: Vendors are adding AI to detect issues, predict failures and schedule maintenance to reduce repair costs.

- Digital Twins: Companies are using digital twins – virtual models linked to FM platforms – to simulate scenarios and optimise performance.

- Strategic Mergers and Acquisitions: The industry is consolidating with key players buying niche vendors to expand capabilities, like Archibus merging with SpaceIQ.

- Enhanced Mobile Apps: Mobile apps now have voice interfaces, AR support and QR code scanning to boost technician productivity.

- Sustainability Dashboards: New features provide real-time energy insights to help organisations track their sustainability goals.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Demand for FM software is increasing in real estate, healthcare, retail, and manufacturing. Vendors are expanding infrastructure to support more users and multi-location clients. However, high implementation costs can slow adoption in small and mid-sized firms.

b. Gap Analysis

While large enterprises adopt FM platforms quickly, small and medium businesses face barriers like cost and integration challenges. There is a need for affordable, easy-to-use solutions for SMBs. Emerging economies also present a growth opportunity for localized, cloud-based FM tools.

Top Companies in the Facility Management Software Market

Leading companies in the FM software space include:

- IBM Corporation

- Oracle Corporation

- SAP SE

- Trimble Inc.

- Archibus (SpaceIQ + iOffice)

- Accruent (Fortive)

- FM:Systems

- Planon Group

- CA Technologies (Broadcom)

- ServiceChannel

These companies lead the market with advanced products and industry expertise.

Facility Management Software Market: Report Snapshot

Segmentation | Details |

By Component | Software, Services |

By Deployment | On-Premise, Cloud-Based |

By Application | Asset Management, Maintenance Management, Space Management, Real Estate Management, Energy Management, Others |

By End-User | Commercial, Industrial, Residential, Government |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Cloud-Based Software: These platforms are growing quickly due to scalability and lower costs.

- Maintenance and Asset Management: These modules are key for saving costs, especially in manufacturing and public sectors.

- Energy and Sustainability Management: ESG initiatives are driving the use of energy-focused FM modules.

Major Innovations

- AI-Driven Predictive Analytics: AI tools predict maintenance needs and reduce asset downtime.

- Mobile and AR Interfaces: Field teams use AR apps for real-time diagnostics and guided repairs.

- Digital Twin Integration: Linking real-world data with 3D models supports lifecycle planning and virtual walkthroughs.

Potential Growth Opportunities

- SMB Market Penetration: Vendors can target SMBs with affordable, modular platforms.

- Expansion in Emerging Economies: Developing countries with growing infrastructure need simple, cloud-based FM tools.

- AI and Automation: There are many opportunities for AI features that enhance efficiency.

- IoT and Smart Building Integration: FM software is central to the smart building ecosystem.

Extrapolate Research says:

The global facility management software market is set for rapid growth. As organizations embrace digital transformation, FM solutions become essential. Cloud-based models, AI features, and mobile access are empowering users with data-driven tools.

With a focus on sustainability, efficiency, and occupant well-being, FM software will shape the future of buildings. Vendors prioritizing usability and integration will lead the market. The rise of smart technologies and complex facilities marks a new era for facility management—digitized, intelligent, and performance-driven.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Facility Management Software Market Size

- June-2025

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021