Enterprise IP Management Software Market Size, Share, Growth & Industry Analysis, By Component Software, Services), By Deployment Mode (On-Premise, Cloud-Based), By Enterprise Size (SMEs, Large Enterprises), By Application (Patent Management, Trademark Management, Licensing, IP Analytics, Legal Management), By End-User (Corporates, Law Firms, Research Institutions) and Regional Analysis, 2024-2031

Enterprises IP Management Software Market: Global Share and Growth Trajectory

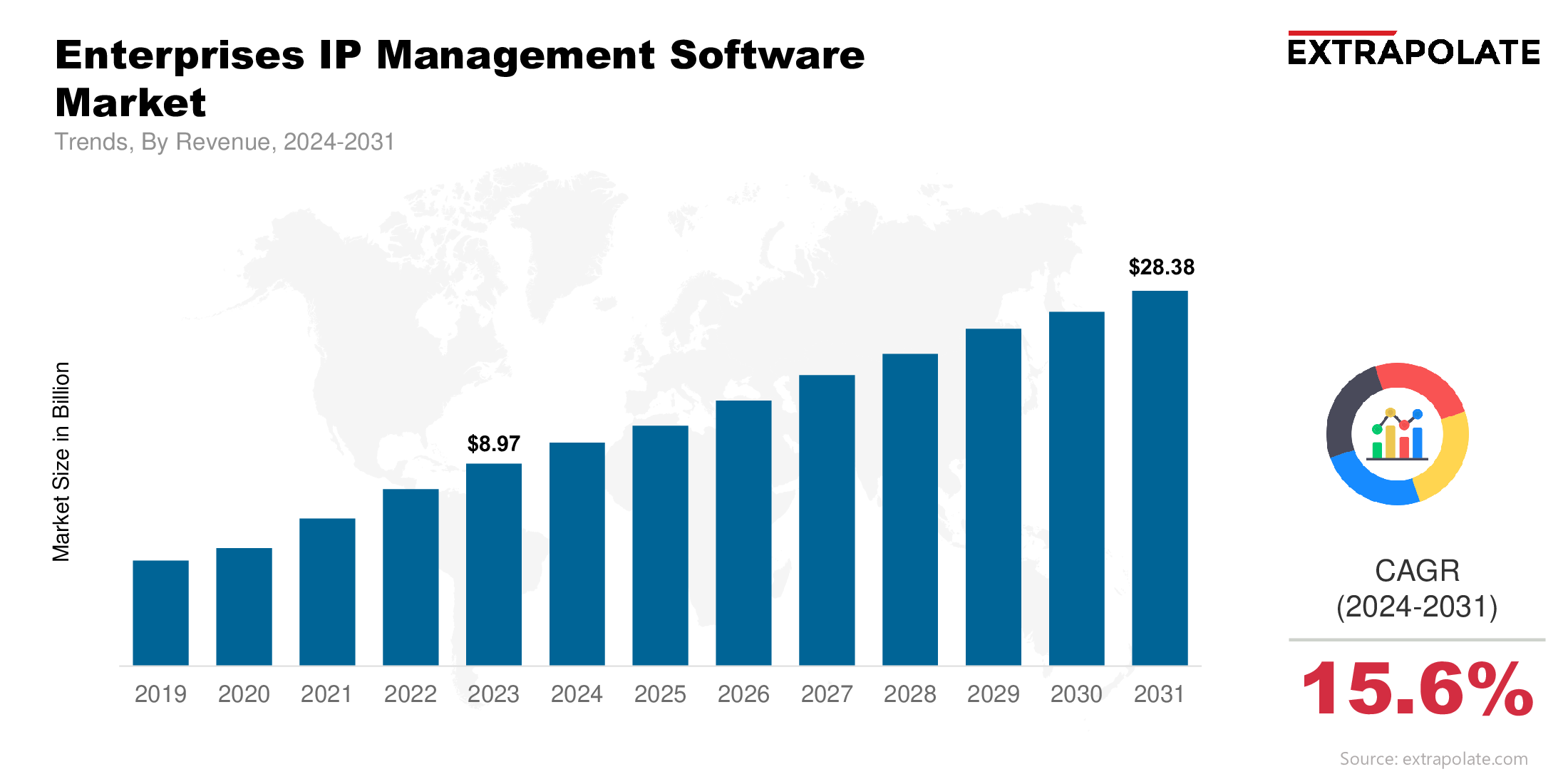

The global Enterprises IP Management Software Market size was valued at USD 8.97 billion in 2023 and is projected to grow from USD 10.27 billion in 2024 to USD 28.38 billion by 2031, exhibiting a CAGR of 15.6 % during the forecast period.

The global market is witnessing robust expansion, driven by the increasing emphasis on innovation, globalization, and strategic protection of intangible assets. As organizations across industries continue to focus on research and development, the value and volume of intellectual property—patents, trademarks, copyrights, and trade secrets—have surged. IP management software has emerged as a critical tool, empowering enterprises to monitor, organize, protect, and commercialize their IP portfolios with greater precision and efficiency.

Digital transformation is reshaping how businesses handle intellectual property, especially amid the rise of data-driven operations and complex global IP landscapes. The demand for enterprise-grade IP management solutions is growing, as companies seek platforms that offer centralized visibility, legal compliance, workflow automation, analytics, and integration with external IP databases. With a rapidly evolving regulatory environment, particularly in emerging markets and global jurisdictions, the IP management software market is positioned for substantial long-term growth.

Intellectual property is increasingly recognized as a strategic asset, often accounting for a significant portion of a company's value. To capitalize on this, enterprises are adopting comprehensive IP management systems to streamline internal processes, avoid infringements, reduce legal costs, and maximize return on investment. These platforms not only improve IP operations but also serve as decision-support tools, enabling companies to assess portfolio performance, valuation, and licensing opportunities in real time.

Key Market Trends Driving Adoption

Several key trends are driving the adoption of IP management software across enterprises:

- Digitalization of IP Workflows: Enterprises are moving from paper-based or fragmented IP tracking to fully digitalized platforms. This is enabling better collaboration between R&D, legal and finance teams. Cloud-based solutions with remote access and real-time updates are becoming the norm, global connectivity and IP lifecycle management.

- Automation and AI : Artificial intelligence is enhancing IP management systems. AI algorithms are automating tasks like prior art searches, patent classification, docketing and status tracking. Natural language processing (NLP) is helping to interpret complex legal documents, machine learning models are providing predictive analytics to guide IP strategy.

- Growth in Patent Filings and Complexity: Increasing volume and complexity of patent applications, especially in biotechnology, telecommunications and semiconductors are forcing enterprises to adopt robust IP management systems. These tools simplify global filings, translations, office actions, renewals and litigation, reducing the risk of oversight and human error.

- IP Commercialization and Valuation: IP is no longer just a legal matter, it’s a business asset. Enterprises are monetizing their IP through licensing, partnerships and sales. IP management software now has tools to evaluate the financial performance of IP assets, so companies can make commercialization decisions.

Major Players and their Positioning

The enterprise IP management software market is competitive and dynamic, with long established industry players and new entrants. Leading companies are enhancing their product portfolios through acquisitions, partnerships and technology upgrades.

Prominent players include Clarivate Plc (CPA Global), Anaqua, Inc., Questel SAS, Wellspring Worldwide, Dennemeyer Group, Gridlogics Technologies Pvt. Ltd., Innovation Asset Group, Inc., IPfolio (now part of Clarivate), PatSnap, Alt Legal Inc. and others.

These companies are investing in user-friendly interfaces, cloud-native platforms, customizable workflows, and AI-powered analytics to strengthen their market positioning. Strategic collaborations with law firms, R&D organizations, and IP offices worldwide are also enhancing their reach and product relevance.

Consumer Behavior Analysis

Understanding the behaviour of enterprise users is key to the IP management software market. Several behavioural shifts are driving demand:

- IP Awareness Across Departments: Traditionally IP was managed by legal teams. However, innovation driven enterprises are now involving cross-functional teams—R&D, marketing, product development and executive management—in IP strategy. As a result demand is increasing for role-based software interfaces that can serve multiple stakeholders.

- Scalable, Cloud-Based Solutions: Many enterprises are moving to cloud-based platforms that can scale with their IP portfolios. These solutions offer remote access, automatic updates, cybersecurity and reduced IT overhead—especially attractive for global companies operating in multiple jurisdictions.

- Real-Time Analytics and Reporting: Clients want insights from their IP data. They want software with dashboards that show real-time filing status, renewal dates, competitive benchmarks and potential infringement risks. Reporting tools for C-level executives are highly valued.

- Customization and Integration : Buyers want platforms that integrate with existing enterprise systems like ERP, CRM, document management and legal management software. Customizable modules and flexible APIs are key in the buying decision.

Pricing

Pricing in the IP management software market is influenced by:

- Subscription-Based Models: Most vendors offer tiered subscription plans based on number of users, features and volume of IP assets managed. Cloud-based SaaS platforms have popularized annual or multi-year licenses which give customers flexibility and predictability.

- Enterprise Customization Costs: Large corporations with diverse IP portfolios will have customization and implementation services that add to the total cost of ownership. These costs include configuration, data migration, API development and user training. But enterprises are willing to pay for tailored solutions that match their complex operational needs.

- Value-Based Pricing: As demand for analytics and decision support grows, some vendors are adopting value-based pricing models. These models tie pricing to the value delivered by the software – cost savings on renewals, reduced litigation risk or improved monetization outcomes.

- Bundled Services: Some providers offer bundles that include IP management software, consulting services, legal support and access to proprietary IP databases. This is particularly attractive for small and medium enterprises that lack internal IP expertise.

Growth Factors

The IP management software market will grow due to:

- Global Expansion of Innovation-Driven Companies : As companies expand into international markets managing IP across borders gets complex. Enterprises need software that supports multi-jurisdictional filings, translations, legal compliance and international IP strategy alignment.

- R&D Investments: In sectors like pharmaceuticals, automotive, electronics and information technology companies are investing heavily in innovation. As the number of IP assets grows so does the need for scalable platforms that support end-to-end IP lifecycle management.

- Evolving IP Regulations and Standards: Governments and global IP organizations are refining policies to encourage innovation while protecting IP rights. Enterprises need to stay on top of these changes making software that provides automatic compliance updates and regulatory intelligence very valuable.

- Competitive Intelligence: IP is a lens through which companies look at their competitors’ innovation strategies. Advanced software solutions now include modules for IP landscaping, patent citation analysis and trend forecasting – features that help companies make informed strategic decisions.

Regulatory Landscape

Given the sensitivity of intellectual property, regulatory compliance is a key part of enterprise IP management. Software providers must ensure their platforms comply with various regional and international regulations:

- General Data Protection Regulation (GDPR): For European clients, IP management platforms must comply with GDPR, to process personal and proprietary data securely.

- USPTO and EPO Integration: In the U.S. and Europe, systems must sync with the United States Patent and Trademark Office (USPTO) and the European Patent Office (EPO) for real-time updates on filings, statuses and regulatory changes.

- Data Sovereignty Requirements: Enterprises in countries with strict data localization laws require cloud providers to host data within national borders. IP management vendors must offer region specific data centers and security assurances.

- Industry-Specific Compliance: In industries like healthcare or defense, enterprises may have unique IP related compliance obligations (e.g. export control regulations) and need customized features and high security standards.

Recent Developments

Recent advancements and strategic moves are shaping the IP management software landscape:

- Clarivate acquired IPfolio and integrated its capabilities into its broader IP intelligence services.

- Anaqua launched AQX Law Firm, a platform for legal service providers to collaborate with corporate IP clients.

- Questel unveiled Orbit Express, a lightweight IP management solution for smaller firms and startups.

- Dennemeyer developed new automation tools for annuity management and IP docketing to boost operational efficiency.

These developments show a focus on automation, integration and customer segmentation with solutions for corporates, law firms and innovators of all sizes.

Current and Potential Growth Implications

a. Demand-Supply Analysis

The growing demand for IP software solutions is attracting new entrants and investment in development. But there is still a gap to provide solutions that are both advanced and affordable for small and mid-sized enterprises.

b. Gap Analysis

Large enterprises have rapidly adopted advanced systems, smaller companies struggle with cost and complexity. Filling this gap with intuitive, low cost and scalable solutions is a big opportunity for growth.

Top Companies in the Enterprises IP Management Software Market

Leading companies in the IP management software market include:

- Clarivate Plc (CPA Global)

- Anaqua, Inc.

- Questel SAS

- Dennemeyer Group

- Wellspring Worldwide

- PatSnap

- Innovation Asset Group, Inc.

- IPfolio

- Alt Legal Inc.

- Gridlogics Technologies Pvt. Ltd.

Enterprises IP Management Software Market: Report Snapshot

Segmentation | Details |

By Component | Software, Services |

By Deployment Mode | On-Premise, Cloud-Based |

By Enterprise Size | SMEs, Large Enterprises |

By Application | Patent Management, Trademark Management, Licensing, IP Analytics, Legal Management |

By End-User | Corporates, Law Firms, Research Institutions |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Cloud-Based IP Management Solutions: Growing demand for flexible and accessible platforms is driving the cloud-based deployment segment.

- IP Analytics Applications: As enterprises seek deeper insights, analytics tools for competitive intelligence and valuation are gaining momentum.

- SMEs Segment: Cost-effective solutions designed for SMEs are projected to see rapid adoption, especially in emerging markets.

Major Innovations

- AI-Powered Patent Search Engines: These tools use NLP and semantic analysis to improve patent search accuracy and efficiency.

- Automated IP Renewal Systems: These modules reduce human error and help enterprises avoid missed deadlines and penalties.

- Integrated Collaboration Platforms: Enabling real-time coordination between IP teams, external counsel, and stakeholders.

Potential Growth Opportunities

- Expansion in Emerging Economies: With rising IP awareness and support from government initiatives, countries like India, China, and Brazil represent significant untapped markets.

- Integration with Blockchain: Blockchain offers potential in securing IP ownership, tracking licensing agreements, and preventing counterfeiting.

- Partnerships with Universities and R&D Institutes: Collaborations can enhance innovation pipelines and expand user bases.

Extrapolate Research says:

The Enterprises IP Management Software Market is evolving into an indispensable tool for innovation-led enterprises. As companies increasingly recognize IP as a core business asset, demand for sophisticated, scalable, and analytics-driven platforms is set to accelerate. Innovations in AI, automation, and cloud computing are reshaping the market, allowing enterprises to derive strategic value from their IP portfolios.

With global regulatory complexities and increasing litigation risks, IP management software is no longer optional—it is essential. The future belongs to adaptive platforms that not only manage IP assets but also empower enterprises to compete, collaborate, and commercialize with confidence in an innovation-driven economy.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Enterprise IP Management Software Market Size

- June-2025

- 140

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021