Employment Criminal Background Check Services Market Size, Share, Growth & Industry Analysis, By Service Type (Criminal Background Checks, Identity Verification, Continuous Monitoring, International Checks, Drug Screening), By End-User (BFSI, Healthcare, IT & Telecom, Retail, Transportation, Government, Education, Others), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), and Regional Analysis, 2026-2033

Employment Criminal Background Check Services Market: Global Share and Growth Trajectory

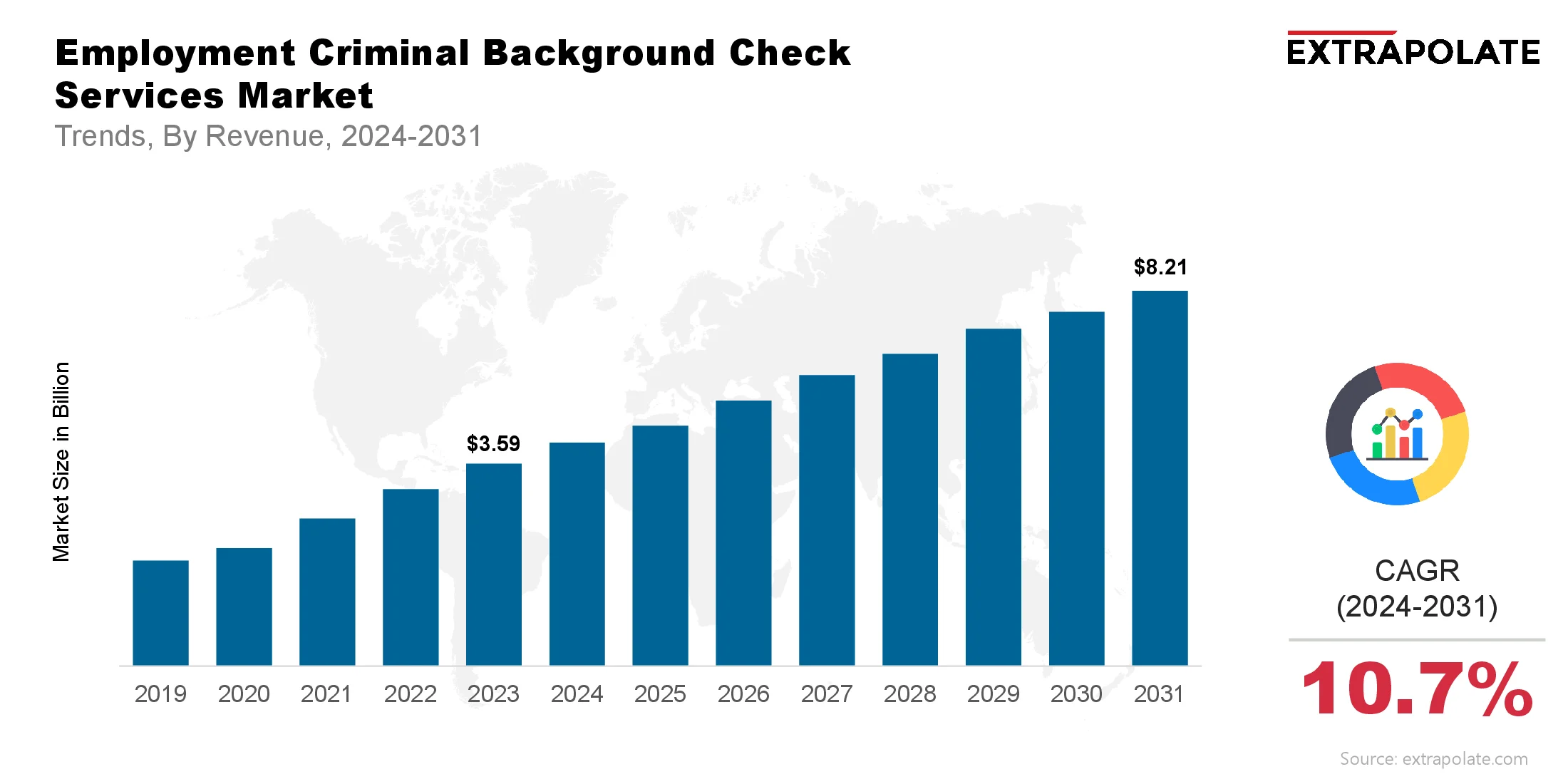

The global employment criminal background check services market size was valued at USD 3.59 billion in 2023 and is projected to grow from USD 4.01 billion in 2026 to USD 8.21 billion by 2033, exhibiting a CAGR of 10.7% during the forecast period.

The global market is experiencing a steady rise, driven by growing concerns over workplace safety, compliance requirements, and the need for trustworthy talent. As companies expand their operations and embrace remote and hybrid work models, ensuring the integrity of prospective hires has become more critical than ever. These services offer valuable insights into a candidate’s criminal history, helping employers mitigate potential risks and make informed hiring decisions.

Employers across industries are increasingly investing in comprehensive background screening tools to maintain ethical hiring standards and safeguard their workforce. The integration of advanced technologies like artificial intelligence (AI), automation, and secure cloud-based platforms has improved the speed, accuracy, and scalability of background checks. As businesses continue to prioritize data-driven hiring processes, the demand for employment criminal background check services is projected to surge significantly in the coming years.

Criminal background checks are especially important in industries with high trust requirements—such as healthcare, education, finance, and transportation. These sectors rely heavily on detailed reports to prevent potential threats, minimize legal liabilities, and uphold organizational reputation. With rising regulatory scrutiny and social responsibility becoming a boardroom priority, these services are evolving from a compliance measure into a strategic asset in talent management.

Key Market Trends Driving Product Adoption

Several major trends are influencing the adoption of employment criminal background check services:

- Remote and Hybrid Work Models: The COVID-19 pandemic has permanently altered the employment landscape, accelerating the shift toward remote and hybrid work. As companies onboard employees virtually, ensuring accurate background checks has become imperative. Employers now rely on digital platforms that can deliver fast and reliable checks, regardless of geographical boundaries.

- Integration with HR Tech and Applicant Tracking Systems (ATS): Background screening is becoming more seamless with the integration of check services into HR technology platforms. Many providers now offer API integrations with leading ATS tools, allowing companies to initiate checks directly within their recruiting workflow. This reduces friction, minimizes delays, and ensures that screening becomes a standardized part of the hiring cycle.

- AI and Automation in Screening Processes: The adoption of AI and automation has enhanced the speed and precision of background check processes. AI-powered tools can rapidly scan criminal databases, flag inconsistencies, and ensure real-time alerts. Automation also reduces manual errors and helps organizations handle large volumes of checks effortlessly.

- Demand for Real-Time and Continuous Screening: Employers are moving beyond one-time checks. Real-time and continuous criminal background monitoring is gaining popularity, especially in roles involving sensitive data or direct client interaction. This proactive approach helps identify issues as they arise, fostering safer workplaces.

- Compliance with Global Data Protection Laws: As data privacy becomes a global concern, background check services are evolving to comply with laws like the GDPR in Europe, FCRA in the United States, and similar frameworks worldwide. These regulations shape how data is collected, stored, and shared, influencing service design and delivery models.

Major Players and their Competitive Positioning

The employment criminal background check services industry is competitive, with several established and emerging companies providing a wide range of services. Leading vendors differentiate themselves through technological innovation, compliance expertise, geographic reach, and customer service excellence. Key players in the market include Sterling Check Corp., First Advantage Corporation, HireRight Holdings Corporation, Checkr Inc., GoodHire (Inflection), ADP LLC, Insperity Inc., Accurate Background Inc., Intellicorp Records Inc., Employment Screening Resources (ESR) and others.

These players are actively expanding their capabilities through mergers, acquisitions, and partnerships with global HR tech platforms. Their goal is to offer end-to-end background screening solutions that are fast, compliant, and scalable.

Consumer Behavior Analysis

Understanding consumer behavior in the reveals insights into evolving employer preferences and expectations:

- Emphasis on Candidate Experience: Employers recognize that background checks affect candidate perception. Lengthy processes can damage their employer brand. Thus, providers are building user-friendly, transparent platforms to maintain candidate trust.

- Focus on Speed and Turnaround Time: In a competitive job market, hiring delays are costly. Employers need faster, accurate background checks. Providers are using cloud tech, real-time data, and AI to quickly deliver reports.

- Preference for Customized Screening Packages: Different industries need different levels of screening. Employers are choosing customized packages that fit job roles, regulations, and company policies. This allows for flexible pricing and personalized service.

- Rising Awareness About Legal Risks: Legal compliance strongly drives background checks. Employers are more aware of negligent hiring's legal risks. This boosts demand for reliable, comprehensive, and legally compliant criminal background screening.

Pricing Trends

Pricing for employment criminal background check services depends on factors such as the depth of the screening, the number of jurisdictions searched, turnaround time, and value-added features like continuous monitoring or AI-enhanced analysis.

Typical cost structures include:

- Per-check pricing for individual candidates, ranging from $20 to $100 per criminal background check depending on complexity.

- Subscription or bundled pricing for large-scale or enterprise clients.

- Customized pricing for industry-specific or international screening needs.

Recent trends suggest growing interest in value-based pricing, where companies pay for results rather than the number of checks. Meanwhile, integration fees, support costs, and compliance consultancy services may be offered as part of premium packages.

Growth Factors

The market is expected to expand rapidly due to several powerful growth drivers:

- Heightened Risk Management Priorities: Companies across the globe are investing more in risk mitigation. Criminal background checks help reduce exposure to workplace violence, theft, fraud, and reputational damage, driving widespread adoption.

- Globalization of Workforce: As talent becomes borderless, companies are hiring across geographies. Global hiring requires checks that cover international databases, requiring advanced tools that can manage multi-jurisdictional compliance with ease.

- Increasing Government Regulations: Governments and industry bodies are mandating background checks, particularly in sectors like education, finance, aviation, and healthcare. Regulatory enforcement is strengthening the case for thorough and repeatable background verification.

- Expansion of the Gig and Freelance Economy: Background check services are extending beyond full-time roles. With more workers joining gig platforms and freelancing marketplaces, background verification is becoming a key differentiator for platforms that prioritize safety and customer trust.

- Rising Adoption by SMEs: Background check services are no longer confined to large enterprises. Cloud-based solutions and API-ready platforms have lowered the entry barrier for small and medium-sized businesses, enabling them to conduct checks affordably and efficiently.

Regulatory Landscape

The regulatory framework surrounding employment criminal background checks varies by country, but the overarching goal remains consistent: protect candidate rights while ensuring organizational safety.

Key regulations shaping the market include:

- Fair Credit Reporting Act (FCRA): In the U.S., FCRA sets strict guidelines for employers and screening agencies, requiring candidate consent, adverse action notifications, and data accuracy.

- General Data Protection Regulation (GDPR): In Europe, GDPR mandates strict data privacy and protection standards. Employers must have lawful reasons for background checks and ensure minimal data collection.

- Ban the Box Legislation: Several jurisdictions now prohibit asking about criminal history early in the hiring process. These laws require employers to assess candidates based on qualifications first, then conduct checks later in the process.

- Equal Employment Opportunity Commission (EEOC) Guidelines: EEOC provides guidelines to prevent discrimination in hiring practices, specifically concerning criminal records.

Screening providers must stay updated on evolving legislation to help employers remain compliant across jurisdictions.

Recent Developments

Recent advancements and developments in the market include:

- Checkr’s AI-Driven Screening Platform: Checkr has launched an AI-powered platform. This platform uses real-time data and contextual insights. It assesses candidate risk with greater accuracy and transparency.

- Sterling and Workday Integration: Sterling's integration with Workday simplifies background screening. It offers a faster and more reliable workflow within the HR system.

- First Advantage’s Expansion into APAC: First Advantage is growing in the Asia-Pacific region. They are launching new verification services. These services are specifically designed to meet the unique legal and regulatory needs of each country

- Rise in Continuous Screening Adoption: Employers in finance and healthcare are using continuous criminal monitoring. This helps ensure their staff stay compliant after being hired.

- Blockchain for Background Verification: New startups are exploring blockchain solutions for identity and background checks. This technology promises better data security and transparency.

Current and Potential Growth Implications

a. Demand-Supply Analysis: Demand for employment criminal background checks is high, especially where digital infrastructure is weak. Companies are expanding globally to meet this need and serve neglected markets.

b. Gap Analysis: A big gap in the market is accessibility for small businesses and emerging markets. Many vendors are now creating modular and cost-effective solutions to make high-quality background checks more widely available.

Another gap lies in real-time criminal data aggregation, particularly in countries with fragmented legal systems. Solutions that offer comprehensive, up-to-date records are gaining a competitive edge.

Top Companies in the Employment Criminal Background Check Services Market

Leading companies in this market include:

- Sterling Check Corp.

- First Advantage Corporation

- HireRight Holdings Corporation

- Checkr Inc.

- GoodHire (Inflection)

- Accurate Background Inc.

- ADP LLC

- Intellicorp Records Inc.

- Insperity Inc.

- Employment Screening Resources (ESR)

Employment Criminal Background Check Services Market: Report Snapshot

Segmentation | Details |

By Service Type | Criminal Background Checks, Identity Verification, Continuous Monitoring, International Checks, Drug Screening |

By End-User | BFSI, Healthcare, IT & Telecom, Retail, Transportation, Government, Education, Others |

By Organization Size | Small & Medium Enterprises (SMEs), Large Enterprises |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are expected to witness strong growth:

- Continuous Criminal Monitoring: Driven by increased risk awareness and trust-based roles.

- Healthcare and Financial Services: Regulatory scrutiny in these sectors requires comprehensive checks.

- SME Segment: Cost-effective cloud platforms are enabling widespread adoption among small businesses.

Major Innovations

Innovations driving growth include:

- AI-Driven Risk Assessment Engines: Using contextual analytics to improve decision-making.

- Cloud-Based Verification Platforms: Supporting global screening at scale.

- Blockchain Technology: Securing candidate data and ensuring transparency.

Potential Growth Opportunities

Key growth opportunities in the market include:

- Expansion into Emerging Markets: Developing regions with growing formal employment offer significant potential.

- Integration with Talent Intelligence Platforms: Creating predictive models for hiring success.

- Specialized Screening for Gig Workers: Meeting the needs of an evolving workforce.

- Enhanced Mobile Platforms: Improving candidate engagement and faster check completion.

Kings Research says

The Employment Criminal Background Check Services Market is witnessing robust growth driven by the increasing emphasis on workplace safety, regulatory compliance, and talent risk mitigation across diverse sectors. As organizations become more aware of the potential liabilities associated with negligent hiring, the demand for comprehensive background screening solutions is rising globally. Technological advancements, including AI-driven automation and real-time data analytics, are transforming traditional screening methods, enhancing both accuracy and turnaround time.

North America continues to dominate due to stringent employment laws and high adoption of pre-employment screening services, while Asia-Pacific is emerging as a promising frontier driven by rapid digital transformation and expanding corporate ecosystems. Startups and established players alike are leveraging integrations with applicant tracking systems and cloud-based platforms to offer seamless and scalable screening services. Amid this dynamic landscape, service providers that focus on global compliance, data privacy, and industry-specific customization will be well-positioned to lead. Clients looking to invest or expand in this market should align with partners offering not just accuracy and speed, but also strategic value through risk intelligence and global operational reach.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Employment Criminal Background Check Services Market

- June-2025

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021