Edge Security Market Size, Share, Growth & Industry Analysis, By Solution Type (Endpoint Security, Network Security, Cloud Security, and Others), By Deployment Mode (On-premise, Cloud-based, and Hybrid), By End User (Enterprises, Government Agencies, Managed Service Providers (MSPs), and Others), and Regional Analysis, 2024-2031

Edge Security Market: Global Share and Growth Trajectory

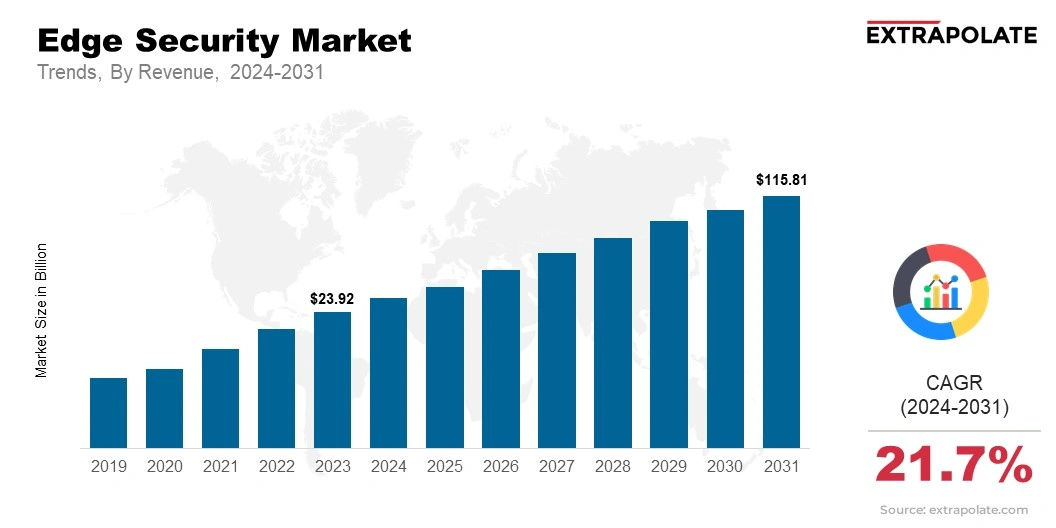

The global Edge Security Market size was valued at USD 23.92 billion in 2023 and is projected to grow from USD 29.34 billion in 2024 to USD 115.81 billion by 2031, exhibiting a CAGR of 21.7% during the forecast period.

The global market is experiencing robust growth, driven by the increasing adoption of edge computing, the rising number of connected devices, and growing cybersecurity concerns. Edge security solutions are designed to safeguard devices and data processed at the network edge, ensuring that critical infrastructure remains protected from threats.

As businesses and consumers increasingly rely on IoT devices, remote work, and cloud-based services, the demand for edge security solutions to protect decentralized networks and data is rapidly expanding.

Key Market Trends Driving Product Adoption

The edge security market is characterized by rapid innovation and the evolution of cybersecurity strategies. Key trends driving market growth include:

- Increasing Cybersecurity Threats: Cyberattacks are rising, including ransomware, data breaches, and IoT vulnerabilities. This is fuelling the demand for edge security solutions. These solutions safeguard sensitive data at the edge.

- Growth of IoT and Connected Devices: IoT devices and sensors are growing in many industries. This creates new attack surfaces. It leads to an increasing need for security at the network edge.

- Shift to Remote Work and Cloud Services: The surge in remote work and cloud computing has accelerated the need for decentralized security solutions. These protect both data and endpoint from cyber threats.

- Artificial Intelligence and Machine Learning: AI and machine learning plays a crucial role in identifying threats. They enhance the effectiveness of edge security solutions, enabling real-time threat detection and automated response.

- 5G and Edge Computing Integration: The rollout of 5G networks is accelerating the adoption of edge computing. This is further driving the need for advanced security solution to protect edge devices and data.

Major Players and Their Competitive Positioning

The market is highly competitive, with several key players focusing on technological innovation. Strategic partnerships and acquisitions strengthen their market position. Major companies such as Cisco, Palo Alto Networks, Fortinet, and Check Point Software Technologies are leading the market. These players are continuously investing in R&D to offer next-generation edge security solution.

Consumer Behavior Analysis

Consumers and businesses are increasingly seeking edge security solutions, This includes:

- Enhanced Protection: Advanced security technologies offers stronger protection for devices. And data processed at the edge of the network.

- Real-Time Threat Detection: Businesses need security solutions that can detect and respond to threats in real-time. Especially for distributed networks and IoT device.

- Cost-Efficiency: Edge security solutions help cut costs by enabling localized threat mitigation. It reduces the need for centralized infrastructure and minimizes the impact of cyberattacks.

- Regulatory Compliance: With stricter data protection rules, businesses choose edge security solutions. It ensures compliance with data privacy laws and cybersecurity rules.

Pricing Trends

Pricing trends in the edge security market are influenced by factors such as the complexity of security solutions, the scope of deployment, and the scale of edge computing environments.

Advanced solutions that incorporate AI, machine learning, and threat intelligence are priced higher due to their sophistication, while more basic edge security products remain accessible to a wider range of users. As competition intensifies and adoption increases, there is potential for pricing to become more competitive, particularly in emerging markets.

Growth Factors

Several factors are driving the growth of the edge security market:

- Increasing Cybersecurity Awareness: Businesses are becoming more aware of the risks from unsecured devices and networks. This is driving them to invest in edge security solutions.

- IoT and Edge Computing Expansion: The rapid growth of IoT devices and edge computing is creating new opportunities. Edge security providers can capitalize on this expanding market.

- Regulatory Pressure: Stricter data security and privacy regulations pushing organizations to adopt edge security. This helps them avoid penalties and stay compliant.

- Digital Transformation: As businesses embrace digital transformation, edge security is gaining importance. It plays a key role in protecting decentralized networks and data.

Regulatory Landscape

The regulatory landscape for edge security solutions varies across regions, with governments around the world implementing stricter data protection and cybersecurity regulations. Compliance with these regulations is essential for organizations deploying edge security technologies.

Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are influencing the development and adoption of edge security solutions, ensuring that organizations maintain high standards of data protection.

Recent Developments

The edge security market continues to evolve, with new products and technologies being introduced regularly. Recent developments include:

- AI-Driven Security Solutions: AI and machine learning are enhancing edge security. These technologies improve threat detection and response speed.

- Zero Trust Security Models: Zero trust models are becoming more popular in edge security. No device or user is trusted by default, enhancing protection.

- 5G Security Solutions: Security solutions designed for 5G networks are opening new possibilities. Businesses need them to safeguard 5G-enabled devices and applications.

Current and Potential Growth Implications

a. Demand-Supply Analysis

The demand for edge security solutions is expected to progress uniformly as the number of connected devices increases and cyber threats become more sophisticated. However, challenges such as the complexity of edge security deployments and the lack of skilled cybersecurity professionals may impact the market’s growth.

b. Gap Analysis

While the market is growing, there are areas where improvement is needed:

- Skilled Workforce Shortage: A lack of skilled experts makes edge security implementation difficult. Managing advanced solutions is also a challenge.

- Complexity of Integration: The integration of edge security with existing IT infrastructure can be complex, particularly for organizations with legacy systems.

- Awareness and Education: Many organizations are unaware of edge computing risks. This lack of awareness slows down edge security adoption.

Top Companies in the Edge Security Market

- Cisco

- Palo Alto Networks

- Check Point Software Technologies

- CrowdStrike

- Zscaler

- Akamai Technologies

- Fortinet

- Trend Micro

- Cloudflare

Edge Security Market: Report Snapshot

Segmentation | Details |

By Solution Type | Endpoint Security, Network Security, Cloud Security, and Others |

By Deployment Mode | On-premise, Cloud-based, and Hybrid |

By End User | Enterprises, Government Agencies, Managed Service Providers (MSPs), and Others |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segments

The following market segments are expected to experience significant growth:

- Cloud-based Security: More organizations are shifting to cloud services. This is driving higher demand for cloud-based edge security solutions.

- Endpoint Security: The growing number of IoT devices is increasing security risks. Protecting endpoints is now a crucial part of edge security strategies.

- Zero Trust Security: The rise of zero trust security models is fueling expansion in the market. Industries handling sensitive data are adopting these measures at a faster pace.

Major Innovations

Innovation is driving the edge security market, with the latest developments including:

- AI-Powered Threat Detection: Artificial intelligence and machine learning is being used to predict and detect security threats. These technologies help mitigate risks at the edge of the network.

- 5G-Specific Security Solutions: Specialized security solutions are being developed for the 5G network environment. These solutions ensure secure communication and data exchange at the edge.

Potential Growth Opportunities

Companies in the market are facing challenges, including:

- Rapidly Evolving Threats: Edge security solutions must constantly evolve to counter new cyber threats. Continuous innovation and adaptation are essential to stay ahead of emerging risks.

- Integration Complexity: Integrating edge security solutions with existing IT infrastructure is complex. Many companies face challenges in achieving seamless compatibility.

- Cost of Implementation: Small and medium-sized enterprises may struggle with high implementation costs. This could slow market growth in some regions.

- Geographical Barriers: Bringing edge security solutions to emerging markets is still difficult. Limited infrastructure and cost barriers slow adoption.

Kings Research says:

The global edge security market is seeing immense growth. This is because of the mass uptake of edge computing. Moreover, the rapid spread of IoT devices is also a factor. Companies that solve integration issues, workforce gaps, and emerging threats will gain a strong market position. Their efforts will help secure the network edge.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Edge Security Market Size

- February-2025

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021