Digital Advertising Market Size, Share, Growth & Industry Analysis, By Format (Display Ads, Search Ads, Social Media Ads, Video Ads, Email Marketing, Native Advertising, Audio Ads), By Platform (Mobile, Desktop, Tablets, Connected TVs), By Industry Vertical (Retail & E-commerce, BFSI, Healthcare, Media & Entertainment, Automotive, Education, Travel & Hospitality, Others), By End-User (SMEs, Large Enterprises), and Regional Analysis, 2024-2031

Digital Advertising Market: Global Share and Growth Trajectory

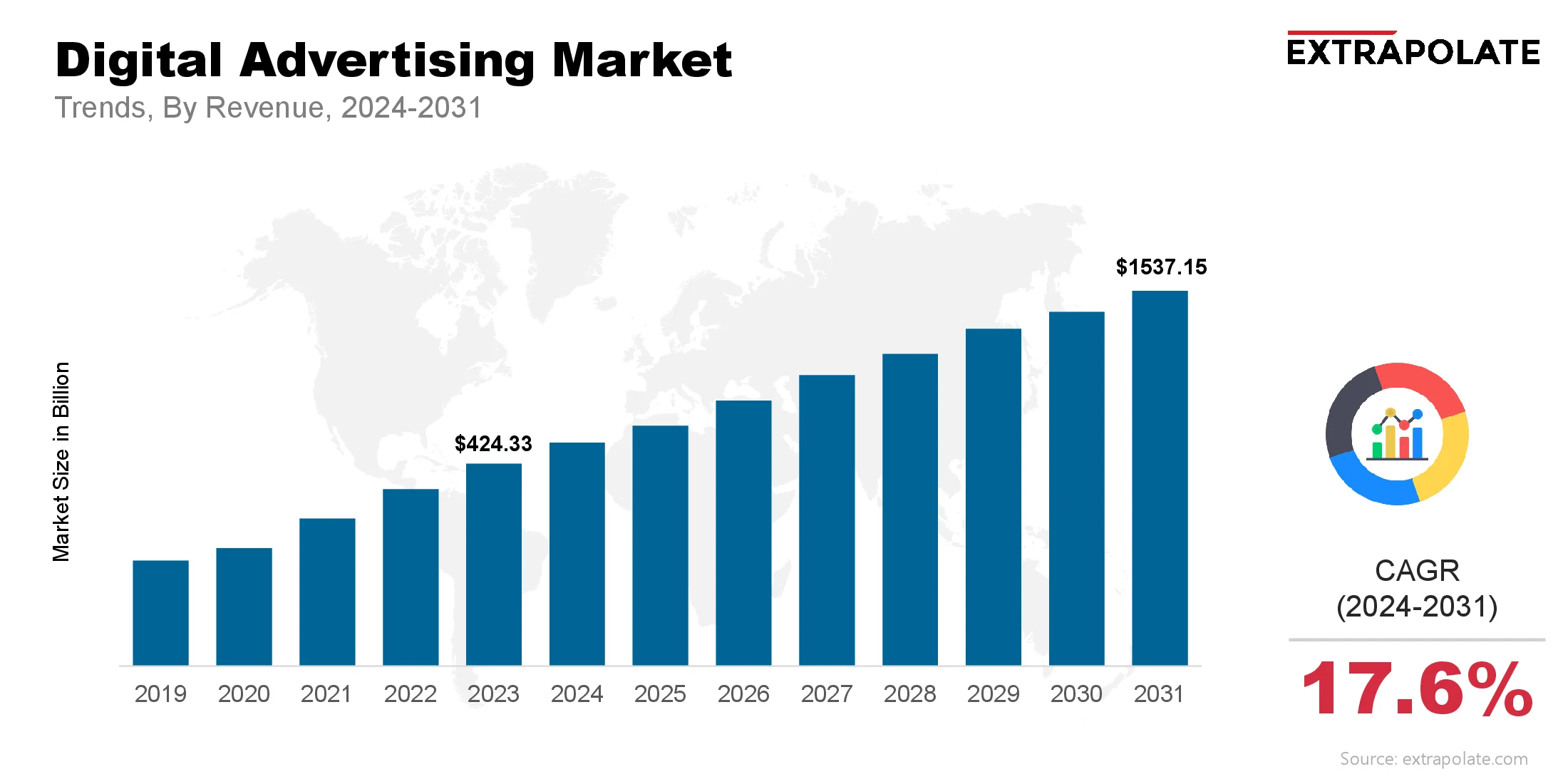

The global Digital Advertising Market size was valued at USD 424.33 billion in 2023 and is projected to grow from USD 493.44 billion in 2024 to USD 1537.15 billion by 2031, exhibiting a CAGR of 17.6 % during the forecast period.

The global market is booming as businesses change how they engage with their audience. With more internet connected devices, businesses across industries are relying on digital platforms to promote their products and services. Digital advertising encompasses search engines, social media, websites, mobile apps, email and more to deliver personalized and targeted messages.

As consumer behavior evolves with digital, advertisers are using tools powered by artificial intelligence (AI), machine learning (ML) and big data analytics to refine their strategy. The global digital advertising landscape is automating, personalizing and measuring. With continuous innovation in formats and tools the digital advertising market is on an upswing and offers great growth opportunities for all stakeholders across industries.

Key Market Trends Driving Product Adoption

Programmatic Advertising and Real Time Bidding (RTB)

Programmatic advertising is the key to efficiency and scalability in digital. RTB allows advertisers to buy digital ads in real time using algorithms to target the right user at the right time. This means optimal ad placement and ROI so brands can allocate their ad budgets more effectively. The use of demand side platforms (DSPs) and supply side platforms (SSPs) has made media buying and selling more efficient and has driven rapid adoption across industries.

Personalization and Hyper Targeting

Consumers expect relevant and customized experiences. This has pushed advertisers to hyper target using data driven insights. Using consumer behavior, browsing history and demographic data digital advertising tools deliver personalized content and better engagement and higher conversion rates. Personalized video ads, dynamic creatives and location based targeting are becoming the norm.

Mobile First Advertising

With mobile devices accounting for a large chunk of internet usage, mobile first is key to digital advertising. Mobile apps, games and mobile optimized web experiences are the channels. In app advertising, mobile video ads and location based promotions are the most effective way to reach on the go consumers. This mobile first approach is changing content creation, ad format design and campaign management.

Influencer Marketing and Social CommerceInfluencer marketing is a key tool in digital advertising especially on platforms like Instagram, TikTok and YouTube. Brands partner with influencers who have niche audiences and deliver authenticity and trust. With the rise of social commerce where consumers can buy products directly through social media platforms, influencer driven campaigns are impacting buying decisions and conversion rates.

Major Players and Their Positioning

The digital advertising landscape is competitive with tech giants, specialized agencies and innovative startups. Market leaders are continuously upgrading their platforms and ad services to offer seamless, data driven and omnichannel solutions. Key players are Google LLC (Alphabet Inc.), Meta Platforms, Inc. (Facebook, Instagram, WhatsApp), Amazon.com, Inc., Microsoft Corporation (LinkedIn, Bing), Apple Inc., Twitter Inc. (now X), ByteDance Ltd. (TikTok), Adobe Inc., The Trade Desk, Inc., Baidu, Inc. and others.

These companies are investing in artificial intelligence, augmented reality (AR), and machine learning to smarten up their advertising. Collaborations, acquisitions and product innovations are key to their competitive edge.

Consumer Behaviour Analysis

- More Screen Time: Consumers are spending more time on digital devices—streaming content, browsing social media or shopping online. More screen time means more touchpoints to connect with audiences. Consumer trust in digital and e-commerce has grown so they are more receptive to relevant and engaging ads.

- Authenticity: Modern consumers especially Gen Z and millennials value authenticity in brand communication. They are more likely to engage with brands that offer transparent messaging and relatable content. This has made influencer marketing, user-generated content and storytelling ads more appealing.

- Privacy Awareness and Data Sensitivity: With growing awareness of data privacy, consumers are more cautious about how their personal info is used. This has led to a shift towards more ethical advertising and consent-driven data collection. Marketers are adapting by prioritising first-party data and contextual targeting.

- On-Demand Culture: Consumers expect instant gratification and real-time responses. Ads must be engaging and relevant and timely. This has made short-form video ads, shoppable posts and interactive content that directs users to action popular.

Pricing Trends

Digital advertising pricing is influenced by ad format, channel, targeting depth and market demand. Models like cost-per-click (CPC), cost-per-impression (CPM) and cost-per-acquisition (CPA) dominate the landscape. Programmatic advertising uses real-time bidding to determine ad cost so pricing is dynamic and performance-oriented.

Video and influencer ads tend to command higher rates due to reach and engagement. Standard display and search ads are more cost-effective for many businesses. SMEs also benefit from self-serve ad platforms offered by Google, Meta and others that allow tight budget control and flexible pricing.

Growth Factors

- Digital Platforms Explosion: Streaming services, gaming platforms and social media networks have created new ad opportunities. Brands are testing ads on OTT, podcasts and virtual events. These formats have highly engaged audiences and measurable performance metrics.

- Analytics and AI Advancements: AI powered analytics tools allow advertisers to see campaign performance in real time and make data driven decisions. Predictive analytics helps identify high potential audience segments, natural language processing and image recognition enables contextual ad placement. These innovations increase targeting and ad relevance.

- Shift from Traditional to Digital Media: Global ad budgets are moving away from traditional media (TV, print, radio) to digital channels. This trend is driven by better ROI, performance tracking and engagement of digital. COVID-19 has accelerated this shift as brands needed to stay visible during physical restrictions.

- Ecommerce and D2C Growth: Online shopping and D2C brands are investing more in digital ads. These businesses rely heavily on targeted digital marketing to reach their niche audience, retarget abandoned carts and drive conversions.

Regulatory Landscape

The digital advertising market is under evolving regulatory scrutiny especially around user privacy, data protection and ad transparency.

- GDPR in Europe requires clear consent mechanisms and user control over personal data.

- CCPA in the US gives consumers the right to opt-out of data collection and access collected data.

- DSA and DMA in the EU will regulate online platforms and ad transparency.

Advertisers need to adopt privacy centric solutions like contextual advertising, first party data strategies and privacy compliant data partnerships.

Recent Developments

- Google’s Phase-Out of Third-Party Cookies: Google’s plan to deprecate third-party cookies in Chrome has big implications for digital advertisers. This is driving the industry to first party data, contextual targeting and privacy preserving tracking technologies like FLoC and Google Topics.

- Retail Media Networks: Retailers like Amazon, Walmart and Target are becoming ad platforms, using their customer data to offer targeted ads. Retail media networks are gaining momentum as brands want to reach high intent audiences close to the point of purchase.

- Video and OTT Advertising Surge: Short form video (YouTube Shorts, TikTok, Instagram Reels) and long form content on OTT are seeing huge ad spend growth. Video ads have higher engagement and is the preferred format for storytelling and product demos.

- AI-Powered Creative Optimization: Creative automation tools are enabling brands to generate multiple ad variants, test them in real-time, and optimize based on performance. This ensures more relevant messaging, increased efficiency, and faster time to market.

In May 2025, FOX Advertising launched OneFOX, a converged AI-enabled media platform. Built on AdRise technology, OneFOX integrates audience targeting, contextual signals, and campaign analytics across FOX’s Entertainment, Sports, News, and Tubi properties— enabling advertisers to orchestrate more personalized and measurable campaigns across multiple channels.

In May 2025, PubMatic unveiled its upgraded AI-powered media‑buying platform for buyers. This enhanced suite uses generative AI to streamline media planning, inventory discovery, forecasting, activation, and performance optimization—markedly improving efficiency in programmatic advertising workflows.

Current and Future Growth

a. Demand-Supply Analysis

As demand for digital ad inventory increases, publishers and platforms are adding more ad formats and audience segments. But the supply of premium ad inventory is limited, so costs are rising in competitive categories like finance, travel and healthcare.

b. Gap Analysis

Despite the growth, there’s still a problem – especially for small businesses trying to navigate the complex ad landscape. There’s an opportunity for solutions that simplify campaign management, improve attribution and democratize access to high quality ad tools.

Top Companies in Digital Advertising

- Google LLC

- Meta Platforms, Inc.

- Amazon.com, Inc

- Microsoft Corporation

- TikTok (ByteDance Ltd.)

- Twitter Inc. (X)

- Snap Inc.

- The Trade Desk

- Adobe Inc.

- Verizon Media/Yahoo Advertising

Digital Advertising Market: Report Snapshot

Segmentation | Details |

By Format | Display Ads, Search Ads, Social Media Ads, Video Ads, Email Marketing, Native Advertising, Audio Ads |

By Platform | Mobile, Desktop, Tablets, Connected TVs |

By Industry Vertical | Retail & E-commerce, BFSI, Healthcare, Media & Entertainment, Automotive, Education, Travel & Hospitality, Others |

By End-User | SMEs, Large Enterprises |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Video Advertising: Video ads are taking over the digital space because of high engagement and storytelling. YouTube, TikTok and Instagram Reels are seeing exponential growth in ad revenue.

- Social Media Advertising: With billions of users on Facebook, Instagram, LinkedIn and TikTok, social media advertising is a hot space. Innovations like live shopping, influencer collaborations and AR ads are opening up new possibilities.

Big Innovations

- Augmented Reality (AR) and Virtual Reality (VR): Immersive technologies like AR and VR are creating new opportunities for interactive ads. Brands can offer virtual try-ons, gamified promotions and virtual store experiences.

- AI Chatbots and Conversational Ads: AI powered chatbots in ads offer real time engagement. Conversational ads on Messenger and WhatsApp are enabling instant customer interactions.

Growth Opportunities

- Emerging Markets: As internet penetration deepens in emerging markets, digital advertising is going to explode. Countries in Asia-Pacific, Africa and Latin America are untapped for advertisers especially through mobile first strategies.

- 5G and IoT: Roll out of 5G and expansion of IoT devices will create high speed, connected environments for dynamic and responsive ads. Real time ads in smart cars, wearables and connected homes will open up new frontiers.

Extrapolate Research says:

The global digital advertising market will grow exponentially over the forecast period. The convergence of AI, big data and mobile is changing how brands talk to audiences. As new formats, platforms and technologies emerge, digital advertising will be more personal, measurable and interactive than ever before.

Consumer behaviour is changing fast and regulatory frameworks are evolving, the industry must innovate and be ethical. Companies that put user experience, transparency and technological agility at the top of the agenda will lead the next phase of digital advertising evolution.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Digital Advertising Market Size

- July-2025

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021