Contact Center Software Market Size, Share, Growth & Industry Analysis, By Deployment Type (Cloud-based, On-premise), By Application (Customer Support, Sales & Marketing, IT Support, Others), and Regional Analysis, 2024-2031

Contact Center Software Market: Global Share and Growth Trajectory

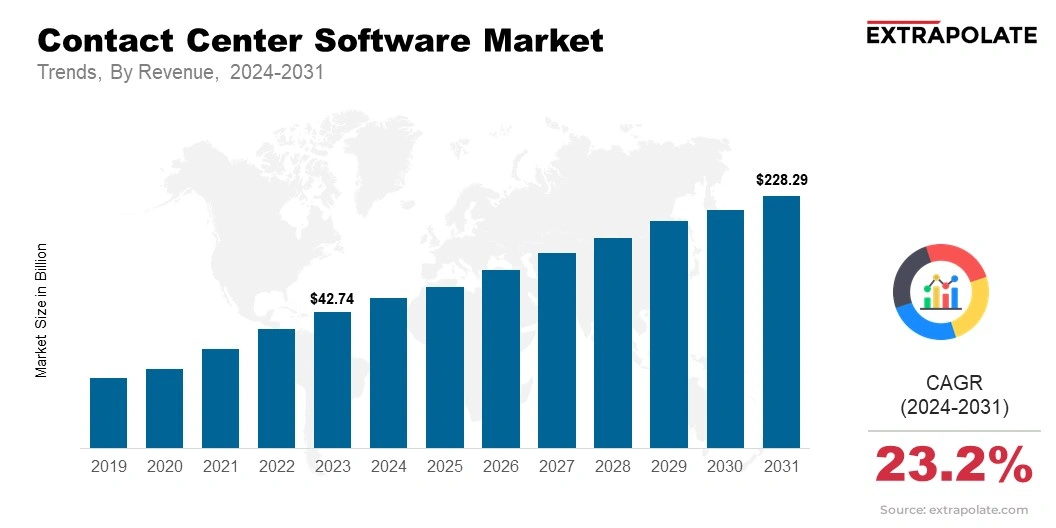

The global Contact Center Software Market size was valued at USD 42.74 billion in 2023 and is projected to grow from USD 53.08 billion in 2024 to USD 228.29 billion by 2031, exhibiting a CAGR of 23.2% during the forecast period.

The global market is growing rapidly, due to the increasing demand for improved customer experiences, advancements in cloud technologies, and growing need for businesses to enhance operational efficiency.

This market encompasses a wide range of software solutions, including cloud-based platforms, omnichannel solutions, workforce optimization tools, and analytics software.

As businesses across industries recognize the importance of delivering seamless and personalized customer interactions, contact center software is becoming an integral part of customer service operations.

Technological innovations in artificial intelligence (AI), Machine Learning (ML), and automation are playing a major role in transforming contact center software.

These advancements enable companies to offer more efficient, responsive, and personalized services by automating routine tasks, optimizing workforce management, and analyzing customer data to predict and meet customer needs.

Additionally, the shift to cloud-based solutions is allowing businesses to scale their contact center operations more easily, enhance data security, and reduce operational costs.

The market is further benefiting from the increasing use of multichannel and omnichannel strategies, allowing businesses to engage with customers across various touchpoints, including voice, email, chat, social media, and more.

The demand for these solutions is particularly strong among sectors such as retail, telecommunications, and banking, where high volumes of customer interactions are common.

Furthermore, the rising importance of customer satisfaction and loyalty is driving businesses to invest in cutting-edge contact center software that enhances the overall customer experience.

As the market continues to evolve, the increasing adoption of AI-driven features, real-time analytics, and the integration of Internet of Things (IoT) devices are expected to further accelerate growth in the contact center software sector.

The market is poised to expand significantly in the coming years, with both established businesses and new entrants recognizing the value of advanced contact center solutions in maintaining competitive advantage and meeting the growing demands of today’s tech-savvy consumers.

Key Market Trends Driving Product Adoption

The contact center software market is witnessing key trends that are accelerating product adoption:

- Cloud-based Solutions: The shift to cloud-based contact center software is growing rapidly, offering businesses increased scalability, flexibility, and cost efficiency. Cloud adoption enables businesses to deploy contact centers without heavy upfront investments and improve operational agility.

- AI-powered Automation: AI and ML are becoming integral parts of contact center software. Automated chatbots, speech analytics, and predictive dialing systems are reducing human intervention and increasing productivity.

- Omnichannel Integration: Businesses want to give customers a smooth experience. This occurs across various ways to talk, like calls, messages, letters next to social media. The need for complete contact center tools rises - companies target communication that works as one.

- Focus on Customer Experience: Customer expectations shift, so businesses put money into modern programs. The purpose is to give services that are individual, effective next to quick. These options elevate customer happiness - they nurture devotion.

Major Players and their Competitive Positioning

The contact center software market is competitive. Established players such as Genesys, NICE Systems, Avaya, and 8x8 offer robust solutions tailored to different industry needs. These companies provide a wide range of products, including both cloud-based and on-premise contact center solutions. Smaller companies and startups are also emerging with specialized solutions that focus on specific functionalities, like AI or omnichannel capabilities, to cater to niche markets. Leading companies are increasingly integrating AI, analytics, and ML into their solutions to differentiate themselves in the competitive landscape.

Consumer Behavior Analysis

Key consumers of contact center software solutions include:

- Enterprises: Big companies in retail, healthcare, finance next to telecommunications use contact center software. This system helps them handle customer support more easily. It makes the service better for customers.

- BPO Providers: BPO companies use contact center software. They offer outsourced customer support across various industries.

Pricing Trends

Pricing models shift based on deployment type, features, and business size. Different setups mean different costs. Cloud-based solutions follow a subscription model. Businesses get flexibility with a pay-as-you-go approach. On-premise solutions come with higher upfront costs. Businesses gain more control over infrastructure. Subscription pricing models are becoming popular. They offer cost-effectiveness, appealing to SMBs seeking low initial investments.

Growth Factors

The growth of the contact center software market can be attributed to several factors:

- Technological Advancements: AI, NLP, and ML are making their way into contact center software. Automation is rising, customer support is improving, and costs are dropping.

- Omnichannel Demand: Businesses are turning to contact center software. It integrates voice, email, chat, and social media for smooth operations.

- Cost Efficiency: Cloud solutions reduce infrastructure needs. They cut maintenance costs, making contact center software more affordable.

- Rise of Remote Work: The shift toward remote work is boosting demand for cloud-based contact center solutions. These enable agents to work from any location, enhancing flexibility and efficiency.

Regulatory Landscape

Contact center software providers must follow data privacy regulations. GDPR in Europe and CCPA in the U.S. are key compliance requirements. These regulations safeguard customer data privacy and security. This concern is now critical in the contact center software market. Meeting industry-specific standards like HIPAA in healthcare is essential. Secure handling of sensitive data depends on compliance with such regulations.

Major Innovations:

Innovations in the contact center software market:

- AI-powered chatbots and automated workflows enhance response times. They also boost customer satisfaction.

- Software solutions support multiple communication channels. Voice, email, chat, and social media integration ensure a seamless customer experience.

- Cloud-based contact centers enable businesses to scale operations efficiently. Cost reduction and improved customer interactions are key benefits.

- Speech analytics in contact center solutions enhances customer insights. Optimizing agent performance and improving service quality are key benefits.

Current and Potential Growth Implications

- Demand-Supply Analysis: The demand for contact center software is likely to keep increasing. Businesses seek to engage with customers and make their operations more efficient. However, challenges in the supply chain like developing, deploying, and integrating the software exist.

- Gap Analysis: The market faces several key challenges. These involve concerns about data privacy, difficulties in connecting new solutions with existing IT systems, and the need for skilled workers to manage advanced software tools.

Top Companies in the Contact Center Software Market

- Genesys

- NICE Systems

- Cisco Systems

- 8x8, Inc.

- Avaya

- Five9

- Mitel Networks

- Talkdesk

- RingCentral

- Amazon Web Services (AWS)

Contact Center Software Market: Report Snapshot

Segmentation | Details |

By Deployment Type | Cloud-based, On-premise |

By Application | Customer Support, Sales & Marketing, IT Support, Others |

By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

High-Growth Segments

- Cloud-based Solutions: Flexibility, scalability, and cost-efficiency offered by cloud-based contact center software to boost cloud-based solutions.

- Omnichannel Communication: Need to engage customers across multiple platforms to increase the demand for omnichannel contact center solutions.

Growth Opportunities

Several growth opportunities exist in the contact center software market. The market may expand in developing regions like Asia Pacific and Latin America. This is mainly due to the gradual adoption of cloud technologies and AI solutions by businesses.

Additionally, advancements in AI, ML, and NLP will help businesses improve their customer service. SMBs are using contact center software more often, as cloud-based solutions are becoming cheaper and easier to access. This will help them engage better with customers and run their operations more efficiently.

Extrapolate Research says:

The contact center software market is set to grow, as companies want to improve how they interact with customers. Cloud-based tools, AI features, and communication options are important factors in this growth. Many businesses are adopting this software to boost customer satisfaction and reduce costs. The market will keep growing, especially in North America and Europe, while places like Asia Pacific offer several opportunities for expansion.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Contact Center Software Market Size

- April-2025

- 150

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021