Cloud Native Application Protection Platform (CNAPP) Market Size, Share, Growth & Industry Analysis, By Component (Platform, Services) By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud) By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises) By End User (BFSI, Healthcare, Retail, IT & Telecom, Government, Others), and Regional Analysis, 2024-2031

Cloud Native Application Protection Platform (CNAPP) Market: Global Share and Growth Trajectory

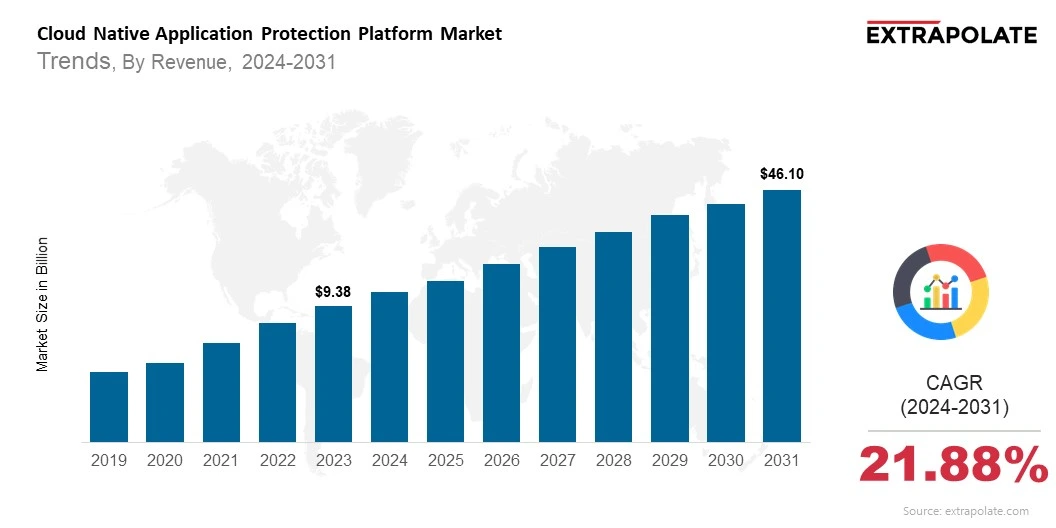

The global Cloud Native Application Protection Platform (CNAPP) Market size was valued at USD 9.38 billion in 2023 and is projected to grow from USD 11.53 billion in 2024 to USD 46.10 billion by 2031, exhibiting a CAGR of 21.88% during the forecast period.

The global Cloud Native Application Protection Platform (CNAPP) market is undergoing substantial growth as enterprises worldwide adopt cloud-native technologies at an unprecedented pace. CNAPP solutions, which combine a suite of security capabilities into a unified platform, are quickly becoming essential tools for protecting modern cloud-native applications.

These platforms integrate key functions such as vulnerability management, workload protection, compliance monitoring, and runtime threat detection across containers, microservices, Kubernetes environments, and serverless architectures.

The primary driver of the CNAPP market’s growth is the increasing shift toward digital transformation and cloud-native development. Organizations are increasingly leveraging containers, microservices, and DevOps practices to accelerate software delivery and improve scalability.

However, these innovations also introduce new security complexities that traditional security tools are not equipped to handle. CNAPP platforms are designed to address these challenges by providing a centralized, scalable, and context-aware approach to securing applications across the entire software development lifecycle.

Cybersecurity threats have also evolved alongside the cloud landscape. The rising incidence of misconfigurations, software vulnerabilities, identity-based attacks, and supply chain risks in cloud environments has highlighted the critical need for integrated security solutions.

CNAPP solutions offer continuous risk assessment and real-time protection capabilities, enabling organizations to detect, prioritize, and remediate threats before they impact business operations. Furthermore, CNAPP platforms support compliance with regulatory frameworks such as GDPR, HIPAA, and PCI-DSS, making them vital for organizations in highly regulated sectors.

Another significant factor contributing to the market’s expansion is the growing complexity of multi-cloud and hybrid cloud environments. Enterprises are increasingly deploying workloads across multiple public and private clouds, which introduces visibility and control challenges.

CNAPP solutions address these pain points by delivering consistent security policies and unified visibility across heterogeneous infrastructure, thereby reducing operational friction and improving incident response times.

The CNAPP market is also benefitting from technological advancements such as artificial intelligence (AI), machine learning (ML), and automation. These technologies enhance the capabilities of CNAPP platforms by enabling advanced threat detection, anomaly identification, and predictive analytics.

As a result, organizations can proactively secure their applications and infrastructure with minimal manual intervention, reducing the burden on IT and security teams.

From a regional perspective, North America currently dominates the CNAPP market, driven by the presence of major cloud service providers, rapid digital transformation initiatives, and strong cybersecurity regulations.

However, the Asia-Pacific region is anticipated to witness the highest growth rate over the forecast period due to increasing cloud adoption, the emergence of digital-first economies, and growing awareness of cloud security best practices.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

The CNAPP market is shaped by dynamic trends, innovative technologies, and evolving security challenges. Key trends driving growth in this market include:

- Cloud-First Strategies: Enterprises are increasingly adopting cloud-first approaches, necessitating security solutions tailored to native cloud environments.

- Integrated Security Functions: CNAPPs combine multiple security features—such as Cloud Security Posture Management (CSPM), Cloud Workload Protection Platform (CWPP), Kubernetes security, and CI/CD pipeline security—into a single platform.

- Shift-Left Security: The movement toward embedding security early in the development lifecycle is encouraging the use of CNAPPs for proactive vulnerability detection.

- DevSecOps Adoption: The growing emphasis on integrating security into DevOps workflows is propelling the demand for tools like CNAPP that enable automation and real-time protection.

- Zero Trust Architectures: CNAPP platforms are increasingly aligning with zero trust principles, ensuring continuous verification and micro segmentation.

Major Players and their Competitive Positioning

The CNAPP market is led by a mix of established cybersecurity vendors and innovative start-ups. Key players such as Palo Alto Networks, Wiz, Orca Security, Microsoft, and Trend Micro are driving advancements and market penetration. These companies are actively expanding their platforms to offer end-to-end cloud-native security solutions. Emerging firms are also gaining traction by offering specialized features or ease of deployment for specific use cases.

Consumer Behavior Analysis

Businesses across various sectors are adopting CNAPP solutions to address multiple security and compliance concerns:

- Security Assurance: Ensuring the protection of applications, workloads, and data in public, private, and hybrid cloud environments.

- Operational Efficiency: Streamlining security operations through automation, centralized visibility, and actionable insights.

- Regulatory Compliance: Meeting standards such as GDPR, HIPAA, and ISO 27001 by continuously monitoring cloud configurations and access control.

- Innovation Enablement: Empowering development teams to build and deploy applications quickly without compromising security.

Pricing Trends

Pricing for CNAPP solutions typically varies based on deployment size, number of cloud accounts, and feature sets. Vendors offer flexible pricing models, including subscription-based, usage-based, and per-workload pricing. While enterprise-grade solutions may carry a premium, many vendors also offer scalable entry-level options for SMEs looking to enhance their cloud security posture.

Growth Factors

Several factors are fueling the growth of the CNAPP market:

- Rising Cloud Adoption: As cloud-native development becomes the norm, the demand for integrated security solutions grows. Notably, in 2023, 45.2% of EU enterprises purchased cloud computing services, marking a 4.2 percentage point increase from 2021. This trend underscores the accelerating shift towards cloud technologies among European businesses.

- Increasing Cyber Threats: Complex and evolving threats targeting cloud infrastructures are pushing organizations toward advanced protection platforms. The European Union Agency for Cybersecurity (ENISA) reported in its 2023 Threat Landscape report that supply chain attacks have become a significant concern. These attacks exploit vulnerabilities in third-party services and software, thus pose substantial risks to cloud infrastructures.

- Need for Unified Platforms: Fragmented security tools are being replaced by consolidated CNAPP platforms to reduce complexity and costs.

- Automation and AI Integration: CNAPPs are leveraging AI and machine learning to deliver predictive threat detection and automated remediation. For instance, in April 2024, the Department of Homeland Security (DHS) and the Cybersecurity and Infrastructure Security Agency (CISA) issued AI safety guidelines for critical infrastructure, highlighting automation’s role in strengthening cyber defenses.

Regulatory Landscape

The CNAPP market is heavily influenced by regulatory and compliance requirements. Vendors must ensure their platforms can support governance standards, data residency regulations, and incident reporting mandates across different regions. Solutions that offer compliance reporting and continuous auditing are particularly attractive to highly regulated industries such as finance and healthcare.

Recent Developments

- Platform Convergence: Major vendors are unifying CSPM, CWPP, and CIEM (Cloud Infrastructure Entitlement Management) into cohesive CNAPP solutions. For instance, in September 2023, Check Point Software Technologies acquired Atmosec, a SaaS security startup, to enhance its CNAPP capabilities by integrating SaaS security features into its platform. Atmosec specializes in the rapid discovery and disconnection of malicious SaaS applications, prevention of risky third-party SaaS communications, and rectification of SaaS misconfigurations.

- Cloud-Native Security Innovation: Features like agentless scanning, runtime protection, and identity-based access controls are becoming standard.

- Strategic Acquisitions: Companies are acquiring niche security startups to enhance CNAPP capabilities and expand their customer base.

- AI-Powered Threat Detection: CNAPPs are increasingly incorporating machine learning for real-time anomaly detection and behavior-based risk scoring. For instance, in August 2024, SentinelOne introduced Purple AI to its Singularity platform, enhancing its CNAPP capabilities with AI-driven threat detection and response.

Current and Potential Growth Implications

Demand-Supply Analysis

With the rapid pace of cloud migration, the demand for CNAPPs is significantly outpacing supply in certain sectors. Shortages in skilled cybersecurity professionals further highlight the need for automated, self-service CNAPP solutions.

Gap Analysis

Despite its progress, the CNAPP market still has areas for improvement:

- Interoperability: Ensuring seamless integration with a wide range of cloud platforms and DevOps tools remains a challenge.

- User Education: Organizations need better awareness and training on how to effectively implement and manage CNAPP tools.

- Customization: Businesses often seek CNAPP solutions tailored to their specific cloud stack and threat profile.

- Scalability for SMEs: Solutions must be more accessible and scalable to cater to small and mid-sized enterprises.

Top Companies in the CNAPP Market

- Palo Alto Networks

- Wiz

- Orca Security

- Microsoft

- Check Point Software Technologies

- Trend Micro

- Lacework

- Aqua Security

- Sysdig

- CrowdStrike

CNAPP Market: Report Snapshot

Segmentation | Details |

By Component | Platform, Services |

By Deployment Mode | Public Cloud, Private Cloud, Hybrid Cloud |

By Enterprise Size | Small & Medium Enterprises (SMEs), Large Enterprises |

By End User | BFSI, Healthcare, Retail, IT & Telecom, Government, Others |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, Latin America |

CNAPP Market: High-Growth Segments

The following market segments are expected to see robust growth:

- Public Cloud Deployments: Driven by scalability and cost-efficiency.

- BFSI Sector: High need for regulatory compliance and data security.

- Large Enterprises: Early adopters of CNAPPs due to complex multi-cloud environments.

- DevSecOps Integration: Tools enabling real-time security within CI/CD pipelines.

Major Innovations

The CNAPP market is ripe with innovation aimed at improving security posture and usability:

- Agentless Scanning: Reducing operational overhead by eliminating the need for agents.

- Kubernetes Security: Providing visibility and policy enforcement in containerized environments.

- Behavioral Analytics: Detecting threats through anomaly detection and predictive modeling.

- Cloud Identity Protection: Managing entitlements and preventing privilege escalation.

CNAPP Market: Potential Growth Opportunities

Despite its promise, the CNAPP market faces several challenges:

- Evolving Threat Landscape: Keeping up with sophisticated cloud-native threats.

- Complex Integration: Ensuring CNAPPs work seamlessly with diverse cloud ecosystems.

- Talent Shortage: Limited cybersecurity expertise for cloud-native deployments.

- Vendor Lock-In: Balancing feature richness with multi-cloud support and openness.

Kings Research says:

The global Cloud Native Application Protection Platform market is poised for exponential growth, underpinned by the rising demand for holistic cloud security, regulatory compliance, and operational efficiency. Companies that can offer comprehensive, user-friendly, and scalable CNAPP solutions are expected to thrive in this rapidly evolving and highly competitive market landscape.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Cloud Native Application Protection Platform

- May-2025

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021