Application Delivery Network (ADN) Market Size, Share, Growth & Industry Analysis, By Component (Application Controllers, Application Security Equipment, Application Accelerators) By Deployment Mode (On-Premises, Cloud, Hybrid) By Organization Size (SMEs, Large Enterprises) By Industry Vertical (BFSI, IT & Telecom, Healthcare, Retail, Media & Entertainment, Government), and Regional Analysis, 2024-2031

Application Delivery Network (ADN) Market: Global Share and Growth Trajectory

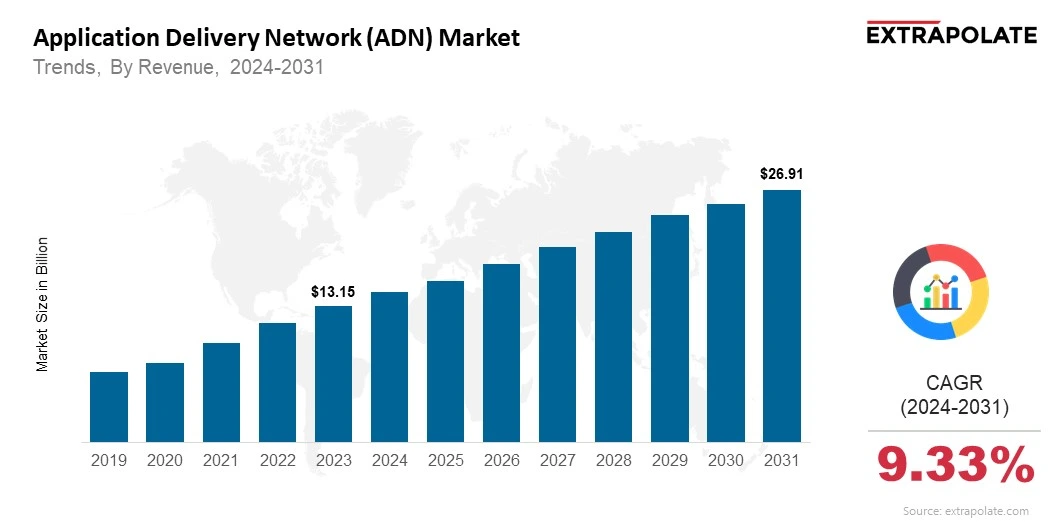

Global Application Delivery Network (ADN) Market size was recorded at USD 13.15 billion in 2023, which is estimated to be valued at USD 14.41 billion in 2024 and reach USD 26.91 billion by 2031, growing at a CAGR of 9.33% during the forecast period.

The global Application Delivery Network (ADN) market is growing fast. This growth is driven by the rising need for quick, secure, and scalable application delivery. As digital services continue to expand, users expect smoother and faster experiences. To meet these expectations, businesses are turning to strong ADN solutions.

These tools help boost application performance by speeding up content delivery, improving network strength, and balancing application loads. A major reason for this growth is the digital transformation happening across industries. Many companies are moving to cloud-based systems and using hybrid environments.

This shift has made managing performance and security more complex. As a result, smarter delivery systems are needed to handle changing demands and offer a steady user experience across locations and devices. ADN solutions help by combining features like WAN optimization, load balancing, and application acceleration. This helps reduce delays, manage bandwidth, and improve reliability.

North America leads the ADN market. This is due to its strong tech presence, heavy cloud adoption, and early use of digital tools. But the Asia-Pacific region is catching up quickly. Countries like China, India, and those in Southeast Asia are investing heavily in cloud infrastructure and building more data centers. Digital usage is also rising fast in this region, making it the fastest-growing ADN market.

Key Trends Driving the Adoption of Application Delivery Networks

Key Trends Driving the Adoption of Application Delivery Networks

Rising Demand for High-Performance Applications

Cloud-native apps and digital services are now widely used. This puts pressure on businesses to deliver high-speed, reliable performance. Customers expect fast response times at all times. ADNs help by managing traffic, balancing loads, and caching content. This keeps applications running smoothly.

Growth in Cloud Computing and SaaS

Cloud services and SaaS platforms are becoming more common. But they also make networks more complex. To handle this, companies are turning to ADN solutions. These tools help manage apps across hybrid and multi-cloud setups. They ensure smooth delivery, whether apps are on-premise, in the cloud, or across data centers.

Security Integration with Application Delivery

Modern ADNs come with built-in security features. These include Web Application Firewalls (WAFs), SSL offloading, and DDoS protection. As cyber threats grow more advanced, security becomes a top priority. ADNs not only improve app performance but also protect systems from attacks.

Automation and AI-Driven Optimization

AI and automation are changing the way apps are delivered. ADN solutions now use smart algorithms to manage traffic in real time. They can spot bottlenecks and adjust quickly. This leads to better network performance and efficiency.

Major Players and Their Competitive Positioning

The ADN market is highly competitive, with major players introducing cutting-edge innovations to stay ahead. These companies offer a broad range of solutions tailored for different enterprise needs, focusing on performance, scalability, and security.

Key players in this market include: Cisco Systems Inc., F5, Inc., Citrix Systems, Inc., A10 Networks, Inc., Radware Ltd., Array Networks, Inc., Akamai Technologies, Inc., Cloudflare, Inc., Barracuda Networks, Inc., and Fortinet, Inc.

These companies invest heavily in R&D, partnerships, and acquisitions to enhance their technological capabilities and expand their global reach. Many are focusing on integrating AI and automation to strengthen their product offerings. At BDC Shanghai 2025, Huawei introduced its new AI ultra-broadband (UBB) solution. It includes four parts—AI FAN, AI OTN, AI WAN, and ADN. The ADN part focuses on improving network performance from end to end. It adds intelligence directly into network devices. This helps carriers offer better experiences for AI-based applications. With faster data transfer, smarter networks, and stronger infrastructure, it supports computing interconnection. The launch is part of Huawei’s bigger All Intelligence strategy to rebuild networks for the AI era.

Consumer Behavior Analysis

Consumer behavior in the ADN market is driven by performance, scalability and security:

User Experience

Organizations are putting application performance first to satisfy their customers. Bad user experiences can cost revenue so ADN tools are essential to ensure consistent high quality digital interactions. These tools reduce latency, optimize bandwidth and availability during peak traffic.

Cost vs Performance

Deploying ADN solutions can be expensive upfront but the long term benefits such as reduced downtime, increased productivity, and better resource utilization justify the spend. Many businesses now see ADN as a strategic necessity rather than an optional upgrade.

Scalability

Modern businesses need scalable ADN platforms that can adapt to changing demand. Consumers want vendors that offer flexible deployment models, including on-premise, cloud or hybrid, and modular licensing, to manage costs.

Security

Consumers are getting more security conscious and regulatory compliant. ADN platforms with built-in security are seen as a dual solution, which are performance optimization and cyber threat protection.

Pricing Trends

ADN solutions vary in cost based on deployment size, functionality, vendor and licensing model. Enterprise grade solutions with features like global load balancing, integrated WAF and AI based analytics can be expensive. But the total cost of ownership is offset by operational efficiency, customer retention and reduced downtime.

Cloud based ADN solutions are gaining popularity with subscription based pricing that reduces capital expenditure. Some vendors also offer tiered pricing and bundled services making ADN accessible to small and medium sized businesses.

Growth Factors

Several factors are driving the growth of the ADN market:

Industry Digitalization

Companies in finance, retail, healthcare and manufacturing are digitizing fast. This requires robust, scalable and secure application delivery frameworks which is a major boost to the ADN market.

Web and Mobile Applications Explosion

With mobile first and web based platforms, organizations need to manage heavy traffic and application performance. ADN solutions route traffic and prevent congestion to give a smooth user experience.

Hybrid Work and Remote Access

With the shift to remote and hybrid work, the need for secure and high performing application access from distributed locations has increased. ADN tools give reliable performance, optimized bandwidth and secure tunneling for remote users.

Edge Computing

As organizations process more data at the edge, ADN is evolving to support edge nodes and micro data centers. This improves latency and performance for real-time applications like video conferencing and IoT.

Regulatory Landscape

While ADN solutions are not regulated in the same way as medical or financial devices, they must comply with various data security and privacy laws. Key considerations include:

- GDPR (General Data Protection Regulation) in the European Union

- CCPA (California Consumer Privacy Act) in the U.S.

- HIPAA Compliance in healthcare sectors using ADN for application delivery

- ISO/IEC 27001 Certification for data management and information security

Vendors must ensure that their platforms enable customers to remain compliant, especially when dealing with sensitive or personally identifiable information (PII).

Recent Developments

Here are the latest developments in the ADN space:

- AI-Driven ADN: Vendors are launching intelligent ADN platforms that use machine learning to automate traffic management, fault detection and optimal delivery paths.

- Cloud-Based ADN Services: F5 and Citrix are expanding their cloud-native ADN offerings so you can manage application delivery across multi-cloud environments.

- Strategic Partnerships and Acquisitions: Big players are acquiring small startups and forming alliances to broaden their service portfolios. Cisco’s acquisition of ThousandEyes added observability and performance optimization to their portfolio.

- SD-WAN and ADN: ADN is being integrated with Software-Defined Wide Area Networks (SD-WAN) to enable centralized control, traffic steering and better performance across branches and remote offices.

Current and Potential Growth Implications

Demand-Supply Analysis

As digital systems grow more complex, the demand for ADN solutions is increasing. Vendors are expanding their infrastructure to keep up. They’re also offering more flexible solutions to match different customer needs. However, there’s still a lack of skilled professionals in network management and security. This makes it harder to deploy ADN solutions on a larger scale.

Gap Analysis

ADN solutions have the power to transform networks. But high costs and complex implementation make it tough for small businesses and developing countries to adopt them. To bridge this gap, simpler deployment models and managed service options are needed. These can help make ADN technology more accessible.

Top Companies in the ADN Market

- Cisco Systems Inc.

- F5, Inc.

- Citrix Systems, Inc.

- A10 Networks, Inc.

- Radware Ltd.

- Array Networks, Inc.

- Akamai Technologies, Inc.

- Cloudflare, Inc.

- Barracuda Networks, Inc.

- Fortinet, Inc.

Application Delivery Network Market: Report Snapshot

Segmentation | Details |

By Component | Application Controllers, Application Security Equipment, Application Accelerators |

By Deployment Mode | On-Premises, Cloud, Hybrid |

By Organization Size | SMEs, Large Enterprises |

By Industry Vertical | BFSI, IT & Telecom, Healthcare, Retail, Media & Entertainment, Government |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

ADN Market: High-Growth Areas

These are the areas of high growth:

Cloud-Based ADN

As businesses move to the cloud, cloud-based ADN is in high demand. These solutions offer agility, lower costs and scalability for dynamic workloads.

Security-Integrated ADN

With cyber threats on the rise, security-integrated ADN solutions, including firewalls, DDoS mitigation and access control, are gaining popularity across all sizes of enterprises.

Innovations

Innovation is the key differentiator in ADN market. Key developments:

- AI-Powered Traffic Management: Using machine learning to predict congestion and route traffic dynamically.

- Zero Trust Network Access (ZTNA): Integrating ADN with Zero Trust principles to enhance access control and reduce vulnerabilities.

- Global Server Load Balancing (GSLB): Advanced load balancing across geographically distributed data centers to improve performance and reliability.

ADN Market: Growth Opportunities

Growth opportunities in ADN market:

Emerging Markets

With increasing internet penetration and digital transformation initiatives, emerging markets are huge growth areas. Vendors offering cost-effective and scalable ADN solutions will gain big.

5G and IoT

Deployment of 5G networks and expansion of IoT will create new use cases for ADN. Low latency and high bandwidth of 5G will complement ADN to deliver high speed applications.

AI-Driven Network Observability

Convergence of ADN with observability tools will give enterprises deep insights into application performance, network health and user experience to optimize proactively.

Extrapolate Says:

Global Application Delivery Network market will grow rapidly over the forecast period. As digital transformation accelerates, ADN solutions are moving from optional add-ons to mission critical infrastructure. AI, security and cloud-native architecture is redefining application delivery and network performance.

With businesses prioritizing speed, scalability and security, demand for advanced ADN solutions will skyrocket. Vendors offering flexible, intelligent and cost-effective solutions will be at the forefront of this digital revolution.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Application Delivery Network

- August-2025

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021