Pre-Workout Supplements Market Size, Share, Growth & Industry Analysis, By Product Type (Stimulant-Based, Non-Stimulant, Thermogenic, Nootropic), By Form (Powder, Capsule/Tablets, Liquid, Gummies), By End User (Athletes, Bodybuilders, Recreational Users, Women, General Fitness Enthusiasts), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online, Pharmacies), and Regional Analysis, 2024-2031

Pre-Workout Supplements Market: Global Share and Growth Trajectory

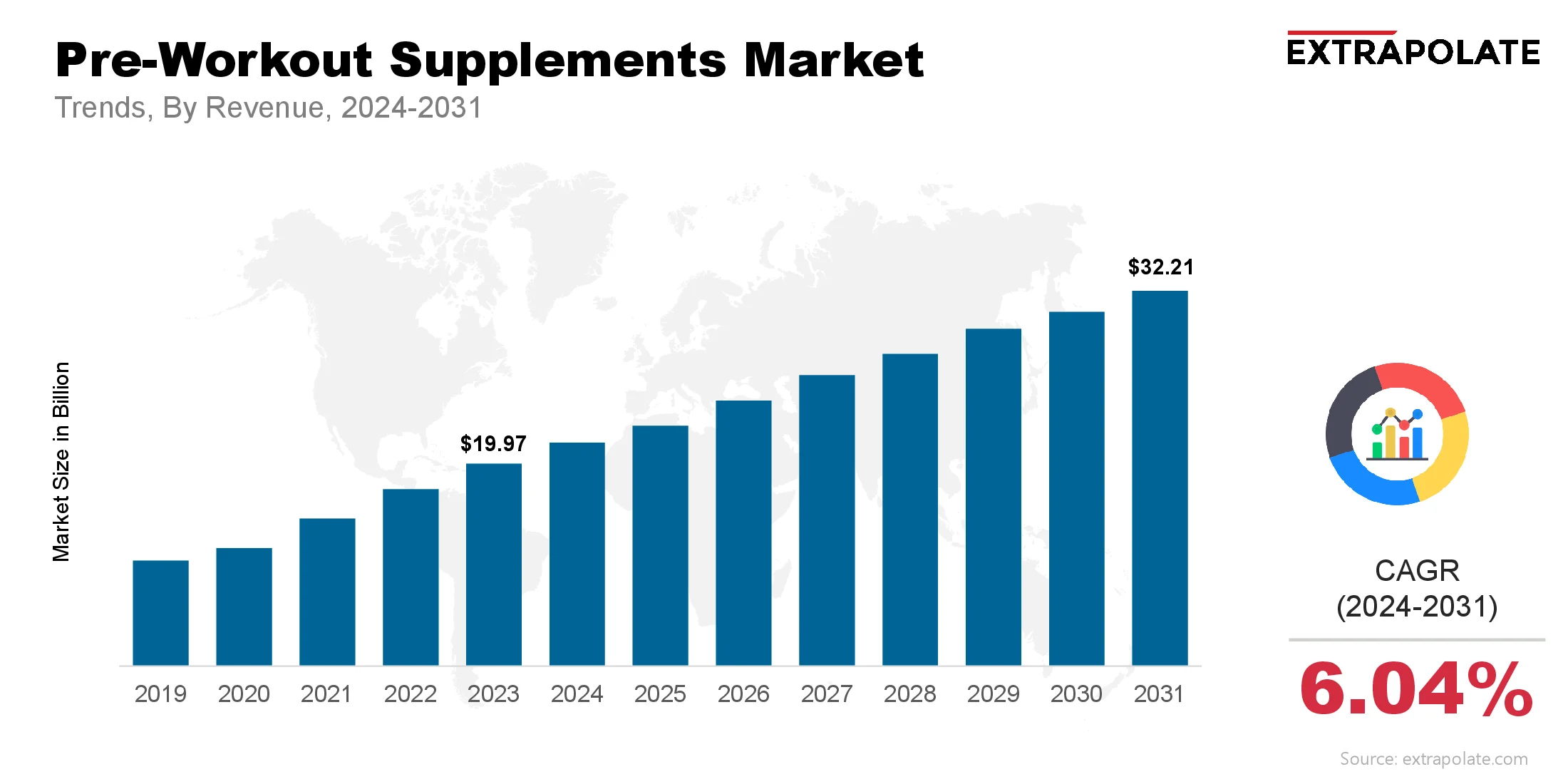

The global Pre-Workout Supplements Market size was valued at USD 19.97 billion in 2023 and is projected to grow from USD 21.35 billion in 2024 to USD 32.2 billion by 2031, exhibiting a CAGR of 6.04% during the forecast period.

The pre-workout supplements market is growing and here’s why: increased health awareness, growing fitness culture and demand for performance enhancing products. Pre-workout supplements are designed to be taken before physical activity, giving you energy, endurance, mental focus and physical performance. These products are formulated with a combination of ingredients like caffeine, beta-alanine, creatine, branched-chain amino acids (BCAAs) and nitric oxide boosters that work together to help you get the most out of your workouts.

One of the main drivers of this market is the huge growth in gym memberships and participation in structured fitness programs worldwide. The popularity of high-intensity interval training (HIIT), CrossFit, strength training and other intense fitness routines has increased demand for products that can help you perform at your best. And the growing interest in bodybuilding and physical aesthetics especially among younger consumers has led to a surge in pre-workout supplement use as people want faster and more visible results.

Digital marketing and social media has also played a big role in the growth of the pre-workout supplements market. Fitness influencers, online coaches and health-conscious communities are promoting these products and driving awareness and credibility. And the growing e-commerce sector has made it easier for consumers to access a wide range of pre-workout supplements, compare brands and read reviews before buying.

Key Trends Driving Adoption

Millennials and Gen Z Fitness Awareness:

Younger generations are driving the healthy living movement. With social media driving fitness trends and body image awareness there’s a huge growth in gym memberships, home workouts and demand for fitness supplements. Pre-workout products that deliver quick and visible results are especially popular with millennials and Gen Z.

Endurance and High-Intensity Workouts:

Fitness routines such as HIIT (High-Intensity Interval Training), CrossFit, and functional training demand enhanced energy, stamina and muscular endurance. Pre-workout supplements provide the physical boost required for such demanding regimens. The surge in these workout formats has made pre-workout products a staple among fitness enthusiasts and athletes alike.

Clean Label and Natural Ingredients:

Consumers are more health conscious and ingredient aware. There is growing demand for pre-workout supplements made with plant based ingredients, free of artificial colors, flavors and banned substances. This is driving manufacturers to innovate with natural caffeine sources, adaptogens, herbal extracts and stimulant free alternatives.

E-Commerce and Direct-to-Consumer Channels:

Digital platforms have made products more accessible. Fitness focused consumers are buying supplements through online channels that offer detailed information, customer reviews and personalized recommendations. Subscription models and influencer marketing are further amplifying online visibility and trust.

Major Players and their Positioning

The pre-workout supplements market is highly competitive and fragmented with both global giants and emerging players vying for consumer attention. Key players are innovating with products, flavors, clean label certifications and targeted marketing to strengthen their position. Some of the major players in the space are Cellucor (Nutrabolt), MusclePharm, BSN (Bio-Engineered Supplements and Nutrition), Optimum Nutrition, GAT Sport, RSP Nutrition, EVLUTION Nutrition, Nutrex Research, Kaged Muscle, Redcon1 and others.

These companies are investing in R&D to create innovative formulas that perform while aligning with clean label trends. Strategic partnerships, celebrity endorsements and exclusive e-commerce collaborations are also part of their growth strategy.

In June 2025, GNC (Beyond Raw brand) introduced its first-ever flavor- and color-changing LIT Pre‑workout. The unique dual-phase formula transforms colors and flavors mid-shake, and features performance-enhancing ingredients like caffeine (250 mg from standard and extended release), 3 g citrulline, 3.2 g beta-alanine, and 1.5 g creatine for energy, endurance, focus, and pumps.

In May 2025, Nutrabolt’s C4 brand launched C4 AlphaBomb, a next-generation pre-workout formulated with Deura9 (d9‑Caffeine) complex (336 mg), 8 g VELOX (arginine & citrulline), and 8 g CarnoSyn beta-alanine, engineered for elite-level intensity and explosive performance.

Consumer Behavior

Consumer behavior in the pre-workout supplements market is influenced by:

- Desire for Immediate Results: Consumers are looking for supplements that deliver fast results. Pre-workout products are prized for their ability to give energy and focus which translates to better workout and motivation.

- Personalization and Transparency: Buyers are more educated about ingredients and looking for products that are tailored to their fitness goals. Labels with transparent ingredient sourcing, allergen info and dosage breakdown are winning consumer trust.

- Social Media and Fitness Influencers: Fitness influencers play a big role in shaping buying behavior. Many users are introduced to pre-workout supplements through sponsored posts, workout videos and testimonials on platforms like Instagram, YouTube and TikTok.

- Cultural Shift to Holistic Wellness: As consumers adopt wellness as a lifestyle, pre-workout supplements are seen as part of daily health routine not just for muscle building but for mental alertness, mood enhancement and overall vitality.

Pricing

Pricing of pre-workout supplements vary based on formulation complexity, ingredient quality, brand value and quantity per serving. Products with special ingredients like patented blends, natural extracts or adaptogens are priced higher. Plant-based and stimulant-free variants are also premium.

While premium pre-workout supplements can range from USD 35 to USD 60 per container, mid-tier options are between USD 20 to USD 35. Budget conscious consumers look for bundle deals or trial packs and companies have responded with flexible pricing and loyalty programs.

Growth Drivers

Several key drivers are contributing to the growth of pre-workout supplements market:

- Booming Fitness Industry: The global fitness industry is growing. More and more fitness centers, boutique gyms and training studios are creating a steady demand for supplements that support active lifestyle.

- Rise of Preventive Healthcare: People are focused on disease prevention through lifestyle management. Supplements that enhance workout efficiency are seen as part of proactive approach to health, driving demand for products that support cardiovascular health, fat loss and metabolic balance.

- Product Expansion: Brands are expanding their product line to cater to different user needs like low-stim, non-stim, thermogenic, endurance focused and women specific pre-workout, to reach more consumers and attract new segments.

- More Women in Fitness: As more women do strength training and endurance sports, demand for pre-workout products that cater to their physiology and fitness goals is growing. Companies are creating formulas that focus on clean energy, mood balance and hormonal support.

Regulatory Landscape

The pre-workout supplements market is regulated by food safety and consumer protection authorities across different regions. These regulations govern permissible ingredients, health claims, labeling, and safety standards.

- United States (FDA): The FDA regulates pre-workouts as dietary supplements. They fall under the DSHEA rules. This law covers safety and labeling standards. Manufacturers must ensure products are safe and labels are correct. Pre-market approval isn't needed. But it's required if a new dietary ingredient is used.

- Europe (EFSA): In Europe, EFSA sets strict rules. Health claims and ingredient safety are tightly controlled. Products must follow EU supplement laws.

- Asia-Pacific: Rules differ by country. In India and China, local agencies handle supplement checks. They manage product approval and safety rules.

Global safety standards are getting more aligned. This is key for products sold online worldwide. It helps ensure trust and smoother cross-border trade. More companies now use third-party certifications. Labels like NSF and Informed-Sport build trust. They show the product meets quality and safety standards.

Recent Developments

Several recent developments in the pre-workout supplements market highlight its evolving nature:

- Launch of Clean-Label Products: Legion Athletics and Naked Nutrition lead the way. They offer non-GMO, allergen-free, and vegan pre-workouts. These meet the growing demand for clean and clear products.

- Growth in Subscription-Based Sales: Brands now offer custom monthly supplement plans. These boost customer loyalty. They also add ease and convenience for users. This model has gained popularity during and after the COVID-19 pandemic.

- Brand Collaborations and Endorsements: Sports stars and fitness influencers now team up with supplement brands. They co-create signature pre-workout blends. This leads to branded and limited edition products.

- Focus on Mental Performance: New blends add nootropics like L-theanine, tyrosine, and Rhodiola. These help with focus and reduce workout stress. They also boost mental clarity for wider appeal.

Current and Potential Growth Implications

Demand-Supply Analysis:

Global demand is outpacing supply for innovative and niche formulations. Manufacturers are boosting output to meet demand. They are also choosing eco-friendly ingredients. This supports both growth and sustainability.

Gap Analysis:

A noticeable gap exists between urban and rural access to pre-workout supplements. While urban areas benefit from high brand penetration and product variety, rural markets often remain underserved. This opens up opportunities for distribution expansion.

Top Companies in the Pre-Workout Supplements Market

- Cellucor (C4 Series)

- BSN (N.O.-Xplode)

- Optimum Nutrition (Gold Standard Pre-Workout)

- MuscleTech (VaporX5)

- JYM Supplement Science (Pre JYM)

- Redcon1 (Total War)

- Kaged Muscle (Pre-Kaged)

- Legion Athletics (Pulse)

- RSP Nutrition (AminoLean)

- Naked Nutrition (Naked Energy)

Pre-Workout Supplements Market: Report Snapshot

Segmentation | Details |

By Product Type | Stimulant-Based, Non-Stimulant, Thermogenic, Nootropic |

By Form | Powder, Capsule/Tablets, Liquid, Gummies |

By End User | Athletes, Bodybuilders, Recreational Users, Women, General Fitness Enthusiasts |

By Distribution Channel | Supermarkets/Hypermarkets, Specialty Stores, Online, Pharmacies |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Stimulant-Free Pre-Workouts: Stimulant-free pre-workouts are becoming popular. Users want options for late workouts or sensitivity issues. These products offer clean energy without harsh effects.

- Plant-Based and Vegan Options: Plant-based and vegan supplements are on the rise. Health-focused and ethical buyers prefer them. Demand keeps growing in this space.

- Nootropic Blends: Nootropic blends are gaining popularity. They boost both body and brain performance. Many users now prefer this dual benefit .

Major Innovations

- Smart Supplements: Smart supplements use wearable data and AI. They adjust doses and blends to match fitness needs. This makes pre-workouts more personal and effective.

- Water-Enhancer Pre-Workouts: Water-enhancer pre-workouts are rising in demand. They come as drops or sachets. Easy to carry and use anytime.

- Adaptogen-Enriched Blends: Adaptogen blends are gaining use. Ingredients like ashwagandha and ginseng reduce stress. They help manage pre-workout anxiety naturally.

Potential Growth Opportunities

- Expansion into Emerging Economies: Emerging economies are seeing fast growth. Incomes and urban living are rising. Asia, Latin America, and Africa offer big market chances.

- Innovation in Delivery Formats: New supplement formats are trending. Gummies, energy shots, and RTD pre-workouts are popular. These forms boost ease and appeal for users.

- Integration with Personalized Fitness Apps: Supplements now link with fitness apps. This offers tailored support based on user data. It opens new paths for personalized performance.

Extrapolate says:

The pre-workout supplements market will continue to grow. Health, wellness and performance is redefining the space. Innovation, personalization and digital marketing will keep fitness focused consumers and brand differentiation. Clarity and science will further build consumer trust and propel the market forward.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Pre-Workout Supplements Market Size

- August-2025

- 148

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021