Pharmaceutical Filtration Market Size, Share, Growth & Industry Analysis, By Product Type (Membrane Filters, Depth Filters, Air Filters, Cartridge Filters, Others), By Application (Biopharmaceutical Production, Vaccine Production, Sterile Filtration, Water Purification, Others), By End User (Pharmaceutical Companies, Biotechnology Companies, Contract Manufacturing Organizations (CMOs), Others) and Regional Analysis, 2024-2031

Pharmaceutical Filtration Market: Global Share and Growth Trajectory

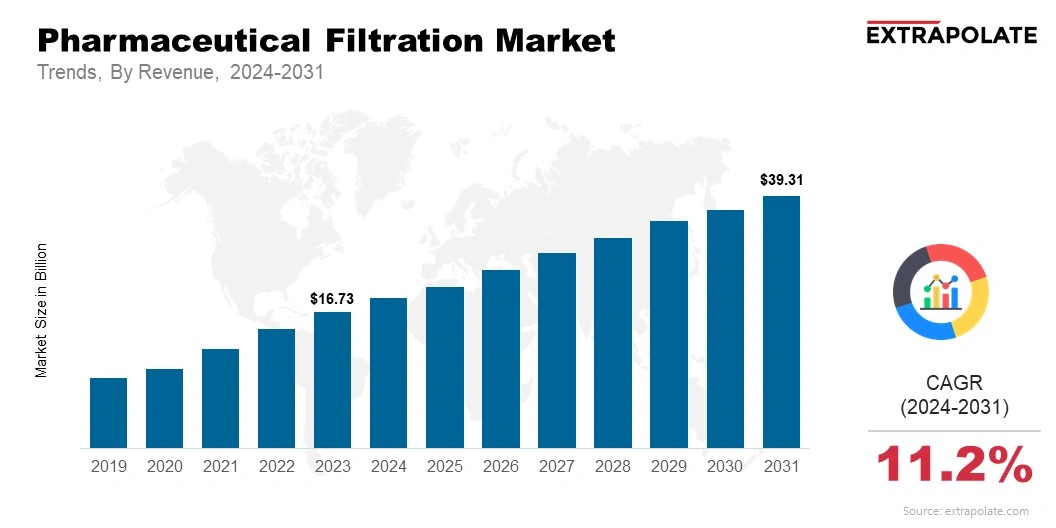

Global Pharmaceutical Filtration Market size was recorded at USD 16.73 billion in 2023, which is estimated to be valued at USD 18.75 billion in 2024 and reach USD 39.31 billion by 2031, growing at a CAGR of 11.2% during the forecast period.

The global market is experiencing robust growth, driven by increasing demands for high-quality pharmaceutical products, advancements in filtration technology, and growing regulatory standards within the pharmaceutical industry.

This market includes a wide range of filtration solutions such as membrane filters, cartridge filters, depth filters, and capsule filters, which are crucial in various stages of drug production, from raw material processing to the final product.

Filtration plays a pivotal role in removing contaminants, bacteria, viruses, and particles, ensuring that drugs meet the highest quality standards for safety and efficacy.

As the pharmaceutical industry continues to expand, particularly with the increasing demand for biologics, vaccines, and large-molecule drugs, the need for effective filtration solutions has grown substantially.

The market is essential for ensuring sterility, purifying drug ingredients, and preventing contamination during the manufacturing process. The growing prevalence of chronic diseases, along with advances in biotechnology and personalized medicine, is further fueling the demand for innovative filtration systems.

Technological advancements such as the development of more efficient membrane filters, ultrafiltration, and nanofiltration technologies are significantly enhancing filtration performance and product purity.

Additionally, the adoption of single-use filtration systems is transforming the industry by offering increased flexibility, reducing contamination risks, and improving operational efficiency. Automation in filtration systems is also reducing the need for manual intervention, which increases consistency and reduces human error.

The pharmaceutical filtration industry is further supported by increasing regulatory pressures to meet stringent safety standards imposed by health authorities worldwide. As the pharmaceutical industry expands and new drugs continue to be developed, the market for pharmaceutical filtration is expected to grow steadily.

This trend, combined with continuous innovations in filtration technologies, will ensure that the industry can meet the evolving demands for high-quality pharmaceutical products in the global healthcare landscape.

Key Market Trends Driving Product Adoption

The pharmaceutical filtration market is growing rapidly due to several key trends:

- Rising Demand for Biopharmaceuticals: A rise occurs in the output of biopharmaceuticals. This covers monoclonal antibodies, vaccines along with gene therapies. This increase boosts the need for sophisticated filtration methods.

- Strict Regulatory Standards: Stricter quality rules in pharma manufacturing push firms to use advanced filtration solutions.

- Technological Advancements: New filtration materials and membrane tech improve efficiency. They boost the performance of pharmaceutical filtration systems.

- Sterility and Safety Requirements: Increased demand for sterile pharmaceutical items fuels the need for filtration systems. These systems must eliminate bacteria, viruses next to particles from pharmaceutical liquids.

Competitive Landscape and Key Players

The pharmaceutical filtration market is highly competitive, with key players such as Merck Group (MilliporeSigma), Sartorius AG, 3M Company, Pall Corporation, and Thermo Fisher Scientific. These companies are continually expanding their product portfolios and investing in new technologies to offer advanced filtration solutions.

Additionally, several regional players are making significant inroads into the market by offering cost-effective and customized filtration solutions for pharmaceutical companies.

Consumer Behavior Analysis

Pharmaceutical companies are increasingly adopting filtration solutions due to several factors:

- Cost Efficiency: Pharmaceutical firms employ filtration systems to lessen pollution threats and to boost output. These actions generate financial benefits that last.

- Product Quality and Compliance: Top-tier filtration ensures compliance and product safety. This drives pharma firms to invest in reliable solutions.

- Flexibility and Customization: Filtration systems, customized to meet the specific demands of drug production, gain wider acceptance.

- Technological Integration: Filtration systems linking with chromatography and aseptic processing grow popular. They offer efficiency and cost savings.

Pricing Trends

The pharmaceutical filtration industry exhibits cost variances based on technology type, process difficulty next to operational size. Sophisticated filtration methods, chiefly those using membrane methods alongside reusable solutions, usually possess higher price tags. But as rivalries grow, in conjunction with expanded output, price drops for specific equipment should occur. This would enable greater access for smaller pharmaceutical producers.

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2023 to 2031, fueled by the increasing demand for filtration solutions in drug production, particularly for biologics, vaccines, and sterile products.

Growth Factors

Several factors are driving the growth of the pharmaceutical filtration market:

- Growth of the Biopharmaceutical Industry: Rising biologics, vaccine, and gene therapy production drives demand for advanced filtration tech .

- Technological Advancements: Better filtration membranes and automation tech improve the filtration process.

- Regulatory Compliance: Drug manufacturers use filtration systems. They do so to adhere to strict rules. These rules concern product safety and quality.

- Global Health Challenges: The constant vaccine need, heightened by COVID-19, speeds up demand for pharma filtration solutions.

Regulatory Landscape

Stringent rules govern the pharmaceutical filtration market. The aim is to assure product safety and top quality. Several control groups, "U.S. FDA, European Medicines Agency (EMA) and World Health Organization (WHO)," specified rigid directives about filtration used for drug goods. Manufacturers must follow these rules. This is to guarantee product safety, especially for sterile goods like vaccines plus biologics.

Recent Developments

The pharmaceutical filtration market has witnessed several notable developments:

- Innovation in Filtration Materials: New filter stuff, like hollow fiber membranes, boost filtering power, mainly in big production runs.

- Growth in Biologics and Vaccine Production: More focus on biologics and vaccines boosts demand for top-notch filters, especially for sterile use.

- Advancements in Process Integration: Filter systems offer easier connection to manufacturing methods like chromatography and sterile work. These systems increase in appeal because they work better.

- Sustainability Initiatives: Some filtration firms are creating greener solutions, like reusable filters and energy-saving tech.

Current and Potential Growth Implications

- Demand-Supply Analysis: Predictions show a continued rise in the demand for pharmaceutical filtration systems. This increase stems from larger biopharmaceutical manufacturing and the necessity for sterile items of great quality. Supply chain problems involving raw materials as well as production capabilities could introduce short-term restrictions on market expansion.

- Gap Analysis: The market continues to encounter hurdles. These involve the design of economical filtration systems suitable for smaller pharmaceutical producers. It must satisfy the increased demand for tailored treatments. This state allows for fresh ideas in filtration methods. Such ideas should target those specific areas.

Top Companies in the Pharmaceutical Filtration Market

- Merck Group (MilliporeSigma)

- Sartorius AG

- 3M Company

- Pall Corporation

- Thermo Fisher Scientific

- GE Healthcare Life Sciences

- Danaher Corporation

- Alfa Laval

- Graver Technologies

- Porvair Filtration Group

Report Snapshot

Segmentation | Details |

By Product Type | Membrane Filters, Depth Filters, Air Filters, Cartridge Filters, Others |

By Application | Biopharmaceutical Production, Vaccine Production, Sterile Filtration, Water Purification, Others |

By End User | Pharmaceutical Companies, Biotechnology Companies, Contract Manufacturing Organizations (CMOs), Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are expected to experience significant growth:

- Biopharmaceutical Production: With the rise of biologics and vaccines, this segment is witnessing a strong demand for filtration technologies.

- Sterile Filtration: The need for germ-free goods, notably in areas of vaccines plus biological medicines, supports expansion within that area.

- Cartridge and Membrane Filters: These advanced filters are gaining popularity due to their efficiency and ease of use in high-volume production environments.

Major Innovations

The pharmaceutical filtration market is characterized by several innovations, including:

- Next-Generation Filtration Materials: The development of more efficient and durable filtration materials, such as advanced membranes, is enhancing filtration performance.

- Automation in Filtration Systems: Automated systems also incorporation into manufacturing procedures boost the effectiveness and precision of filtration setups.

- Sustainable Filtration Solutions: New filtration technologies are being designed to reduce waste and energy consumption, aligning with sustainability goals.

Potential Growth Opportunities

Despite significant growth, the pharmaceutical filtration market faces challenges:

- Regulatory Compliance: Manufacturers face difficulties as they meet changing rules. These regulations span various geographic areas.

- Technological Complexity: The increasing complexity of filtration technologies requires pharmaceutical companies to continually invest in training and system upgrades.

- Cost Concerns: For smaller pharmaceutical companies, purchasing expensive, top-tier filtration systems can prove problematic. This situation allows a market entry for less pricey, easily expanded solutions.

Extrapolate Research says:

Worldwide sales of pharmaceutical filters are rising, a trend propelled by more biologics and vaccines, rigorous rules along with demand for better filtration. Since filtration methods change, drug firms that implement modern, economical along with durable filtration benefit versus competitors.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Pharmaceutical Filtration Market Size

- April-2025

- 148

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021