Ostomy Bags Market Size, Share, Growth & Industry Analysis, By Type (One-Piece System, Two-Piece System, Others) By End-User (Hospitals, Home Care, Clinics, Others, and Regional Analysis, 2024-2031

Ostomy Bags Market: Global Trends, Growth Opportunities, and Forecasts

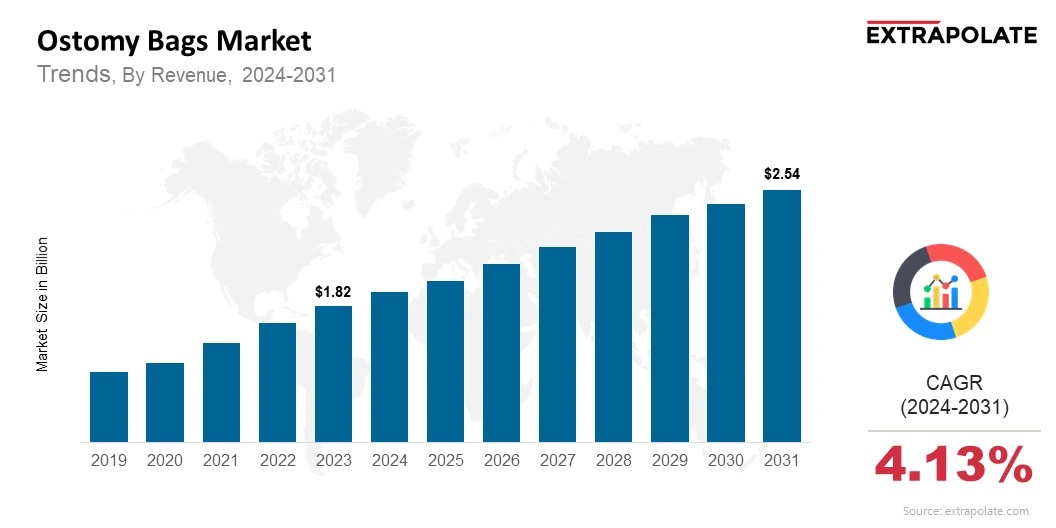

The global Ostomy Bags Market size was valued at USD 1.82 billion in 2023 and is projected to grow from USD 1.91 billion in 2024 to USD 2.54 billion by 2031, exhibiting a CAGR of 4.13% during the forecast period.

The global ostomy bags market is growing steadily. This growth comes from more chronic diseases. Colorectal cancer and inflammatory bowel disease (IBD) are key examples. These conditions often require ostomy procedures. Ostomy bags are vital for those who have had ostomy surgery, as they safely collect waste from the body. Healthcare systems around the world want to improve care for patients with ostomies. So, the demand for these products will probably rise. This rise will contribute to the market's expansion.

The advent of new methodologies has resulted in the latest innovation in ostomy bags. Better designs are offering ease of use, breathable fabrics, odor-proof functionality, and a comfortable fit. This is improving everyday geriatric care and making more consumers inclined to opt for ostomy bags. Customization options have also changed the adoption rate drastically. Now patients can get tailored options as per their requirements. Another important factor is its leak-proof and irritation-free design. All these factors are expected to add to the market growth of ostomy bags over the forecast period.

Ostomy care is booming due to awareness. Patients want to live life fully. In emerging markets, rising incomes mean better healthcare access. As a result, demand for essential bags is up. The elderly population and chronic illnesses are driving the need for ostomy procedures, fueling global demand for innovative solutions.

The market for ostomy bags is changing fast. Manufacturers are working to make their products more comfortable and discreet. They are also focused on sustainability and eco-friendly materials. These efforts will support the market's continued growth.

The market's future depends on three main areas:

- Creating new products.

- Educating patients.

- Expanding healthcare systems globally.

Key Market Trends Driving Ostomy Bags Adoption

Key Market Trends Driving Ostomy Bags Adoption

Several key trends are shaping the adoption of ostomy bags across various regions:

- Rising Prevalence of Chronic Diseases: Chronic conditions like colorectal cancer, inflammatory bowel diseases (IBD), and diverticulitis are raising the need for ostomy surgeries. This increase drives demand for ostomy bags. More surgeries mean a growing market for ostomy care products, including bags.

- Aging Population: The number of aged adults in the world is constantly increasing due to many demographic factors. This is leading to a higher prevalence of widespread diseases. The demand for ostomy bags is increasing due to heightened need for ostomy surgeries.

- Product Advancements: Ostomy bags are being designed with a number of innovations to improve the comfort they offer, along with their odor control and durability. Use of new and improved adhesive formulations along in the new one-piece and two-piece systems is also making users satisfied, which is driving product demand.

- Awareness and Support: More people now know and want to learn about ostomy care and options. Communities and healthcare workers are coming together in the form of support groups, campaigns, and dedicated programs to spread awareness and break preconceived notions. This is leading to a higher adoption of ostomy bags.

Competitive Landscape and Key Players

The ostomy bag market is very competitive. Many global and regional players are fighting for market share. Coloplast, Hollister, ConvaTec, B. Braun Melsungen, and Smith & Nephew offer various products to meet different customer needs. They focus on innovation to stay ahead. They keep improving the comfort, functionality, and quality of their ostomy bags.

Some companies have developed products featuring advanced odor-filtering systems or skin-friendly materials. Others offer discreet and compact designs. These companies grow through smart acquisitions and partnerships. This helps them reach more customers and stay competitive. This helps them adapt fast to changing customer needs. Their products stay relevant and effective.

Consumer Behavior and Adoption Drivers

Several driving factors are contributing to the rise of ostomy bag adoption:

- Innovative Product Features: Today's ostomy bags are becoming increasingly sophisticated. Users now enjoy leak-proof designs, effective odor control, and flexible materials. These advancements elevate comfort and ease, significantly boosting market growth.

- Customized Comfort: Consumers strive to settle for products that are more comfortable and customizable. Therefore, there is a higher demand for ostomy bags with adhesives that are skin friendly and fabric that is breathable. Modern patients also look for ease of use as a functionality which makes has made these products increasingly apt for daily use.

- Robust Support Systems: The availability of comprehensive support services enhances the lives of ostomy patients. Access to educational resources and counseling instills confidence and ease of use. These supportive offerings encourage greater acceptance and adoption of ostomy bags.

Pricing Trends

The cost of ostomy bags depends on several important factors. The type of bag, whether it's one-piece or two-piece, is a major consideration. The material used also matters, as it affects both quality and comfort. Also, odor control features can raise the price. High-quality ostomy bags with extra features may cost more. However, many manufacturers are determined to enhance affordability. They are using competitive pricing strategies in emerging markets. This helps them meet patients' needs better.

Growth Factors and Opportunities

Several factors are fueling the growth of the ostomy bags market:

- Tech Advances: New bag designs offer improved comfort, skin protection, and odor control. These features help boost the market. These new technologies also reduce complications from ostomy surgeries, making patients more willing to use ostomy bags regularly.

- Growing Healthcare Infrastructure: More healthcare facilities in emerging markets help people access medical products and ostomy care services. This increased access is expected to drive demand for ostomy bags in regions where they were previously hard to find.

- Rising Awareness: Public campaigns on ostomy procedures and care products have reduced stigma and boosted product use.

Regulatory Landscape

In the U.S., manufacturers must follow the International Organization for Standardization (ISO). They also need to meet strict guidelines from the Centers for Medicare & Medicaid Services (CMS). This ensures their products are safe and high quality. These authorities check quality, documentation, and supplier requirements. This helps guarantee the product's safety and effectiveness.

Recent Developments in the Market

The ostomy bags market is driving growth through three significant advancements:

Manufacturers are revolutionizing ostomy care with innovative products that improve functionality and comfort. New bags now come odor-proof, leak-resistant, and hypoallergenic. These features offer users more convenience and improve well-being.

Companies are grabbing chances in emerging markets, like Asia-Pacific and Latin America. More people can access healthcare there, and awareness is rising. This is boosting demand for ostomy care products.

Manufacturers are responding to consumer demand for sustainable products. They are now making eco-friendly ostomy bags from biodegradable materials. This shift meets the rising environmental awareness among consumers.

Growth Projections and Market Outlook

The ostomy bags market is expected to keep growing due to the rising number of diseases, improvements in product design, and better access to healthcare worldwide. As the population ages and more people become aware of ostomy care, the market is likely to see significant growth during the forecast period.

Top Companies in the Ostomy Bags Market

- Coloplast

- Hollister

- ConvaTec

- B. Braun Melsungen

- Smith & Nephew

- Medtronic

- Fresenius Kabi

- C. R. Bard

- Asid Bonz

Ostomy Bags Market: Snapshot of Market Segmentation

Segmentation | Details |

By Type | One-Piece System, Two-Piece System, Others |

By End-User | Hospitals, Home Care, Clinics, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High-Growth Segments in the Ostomy Bags Market

Several segments within the ostomy bags market are projected to experience high growth:

- One-Piece Systems: Their simplicity, ease of use, and comfort are making these systems increasingly popular. They are especially beneficial for patients who prefer a hassle-free and easy-to-maintain solution.

- Home Care: As more patients opt for in-home care options after surgery, the home care segment is expected to see a surge in demand, driven by the convenience and comfort it offers.

Major Innovations in the Market

- Smart Ostomy Bags: Some companies are working on developing ostomy bags with built-in features like leak detection and output measurement. This means added convenience and peace of mind for patients.

- Skin-Friendly Materials: Manufacturers are constantly improving ostomy bag materials to make them more comfortable and reduce skin irritation for patients with sensitive skin.

- Ostomy Bags Market: Potential Growth Opportunities

The ostomy bags market presents several growth opportunities, including:

- Rising Demand from Emerging Markets: Healthcare systems are improving in emerging markets. This opens up great chances for market growth in areas like Asia-Pacific and Latin America. Access to ostomy care products is on the rise there.

- Elderly Population Growth: The aging population in developed countries is growing. This will increase the demand for ostomy care products, creating big opportunities for market players.

Extrapolate Research Says:

Our analysis suggests that the ostomy bags market is expected to experience steady growth. The growth will majorly be a result of rapid product innovations, growing awareness regarding the medical benefits of the product, and further growth in geriatric population. Manufacturers who focus on making their offerings more comfortable, functional, and sustainable will be in a good position gain maximum from the rising global demand for ostomy bags.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Ostomy Bags Market Size

- May-2025

- 148

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021