Medical Beds Market Size, Share, Growth & Industry Analysis, By Product Type (Hospital Beds, Long-Term Care Beds, Bariatric Beds, ICU Beds, Other Medical Beds) By Application (Healthcare Facilities, Home Care, Long-Term Care, Rehabilitation) By End User (Hospitals, Clinics, Nursing Homes, Home Care Providers), and Regional Analysis, 2024-2031

Medical Beds Market: Global Share and Growth Trajectory

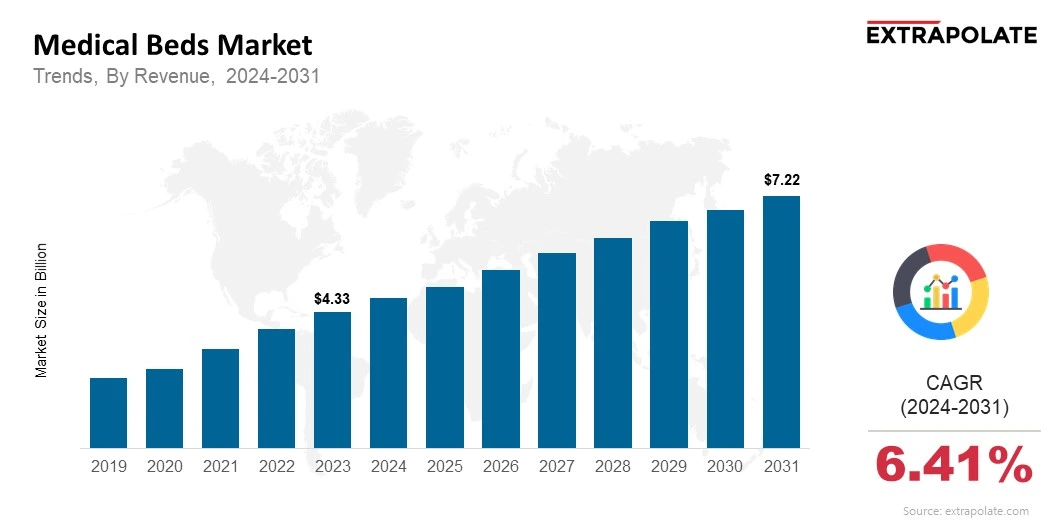

The global Medical Beds Market size was valued at USD 4.33 Billion in 2023 and is projected to grow from USD 4.67 Billion in 2024 to USD 7.22 Billion by 2031, exhibiting a CAGR of 6.41% during the forecast period.

The global medical beds market is experiencing considerable growth, driven by the increase in demand for healthcare services, rising patient population, and advancements in medical technology. Medical beds, which play a critical role in patient care in hospitals, nursing homes, and home care settings, are evolving rapidly with features made for improving patient comfort, safety, and treatment outcomes.

These beds are equipped with several innovations, like adjustable height, position controls, and integrated monitoring systems that cater to the diverse needs of patients and healthcare providers.

The market is propelled by an aging global population, which requires more long-term healthcare solutions and places greater emphasis on patient care during hospitalization. The growth of chronic diseases, such as cardiovascular conditions, diabetes, and respiratory disorders, further contributes to the growing demand for medical beds, as these patients often require extended hospital stays or specialized home care.

In addition to this, the rise in surgeries and medical procedures worldwide necessitates the widespread use of advanced medical beds equipped with features that aid in post-operative recovery and intensive care management.

Technological innovations are playing a crucial role in shaping the medical beds market. Smart medical beds, which are integrated with sensors and monitoring systems, allow healthcare providers to track patients' vital signs, mobility, and positioning in real-time. These advancements enable a more personalized approach to patient care, enhance operational efficiency, and reduce the risk of complications such as pressure ulcers.

Furthermore, the integration of wireless communication capabilities and telemedicine functionalities in modern medical beds allows for remote monitoring and management of patient health, enhancing the overall quality of care.

In addition to these technological advancements, the growth of the trend of home healthcare is also positively influencing the market. As patients increasingly prefer receiving medical care in the comfort of their homes, demand for homecare medical beds, which are designed for at-home use, is on the rise.

These beds are equipped with features that ensure patient comfort, ease of use for caregivers, and safety, further driving market growth. Geographically, North America dominates the medical beds market, owing to the region’s advanced healthcare infrastructure, high healthcare expenditure, and the rising elderly population.

However, the Asia-Pacific region is expected to experience the highest growth rate in the years to come, fueled by advancements in healthcare facilities, rising healthcare awareness, and a large population.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

The medical beds market is changing fast. This is due to new ideas, more healthcare funds, and patient needs. Key trends are driving growth:

• Technological Advancements: Smart tech is being added to medical beds. These include adjustable settings, patient monitors, and auto features. They help improve patient care.

• Ergonomic Design: People want medical beds with more comfort and adjustability. These beds also help lower pressure ulcers and boost patient movement.

• Infection Control: Infection-resistant materials are on the rise. Easy-to-clean bed designs help cut down hospital infections.

• Patient-Centric Features: Materials that resist infection are growing in use. Beds are made easy to clean to lower infections in hospitals.

• Healthcare Facility Upgrades: More infection-resistant materials are being used. Beds have simple designs to stop hospital infections.

Major Players and their Competitive Positioning

The medical beds market is controlled by leading players, which include Stryker Corporation, Hill-Rom Holdings, Inc., Invacare Corporation, and Arjo. These companies continue to make advancements and expand their product range to meet the evolving needs of healthcare providers and patients. Smaller players are also emerging, offering tailored solutions for niche applications in the market.

Consumer Behavior Analysis

Healthcare facilities are buying more advanced medical beds. This is due to many important reasons:

• Patient Comfort and Recovery: Advanced beds help patients feel more comfortable. They also improve movement and support during recovery.

• Hospital Efficiency: These beds ease the work of healthcare staff. They have built-in monitoring and easy adjustment features.

• Long-Term Care: These beds are designed to support the growing elderly population. They provide long-term care and help with mobility assistance.

• Safety and Hygiene: Healthcare facilities prefer beds made from materials that lower infection risks. These beds are also easy to clean and maintain.

Pricing Trends

Pricing trends in the medical beds market vary widely based on features, material quality, and the type of bed. Premium models equipped with advanced technologies and enhanced features command higher prices, while basic models remain more affordable. As competition intensifies, there is a steady increase in affordable options targeting budget-conscious healthcare facilities, especially in emerging markets.

Global Market Growth

The medical beds market is expanding globally, with substantial growth observed in regions like North America, Europe, and Asia-Pacific. In particular, Asia-Pacific is emerging as a major market due to increasing healthcare investments, the aging population, and rising disposable incomes.

Growth Factors

Several factors are driving the growth of the medical beds market:

• Aging Population: The aging population is growing fast in developed countries. This increases demand for long-term care and specialized medical beds with features like easy access, safety rails, and comfort settings to meet elderly care needs.

• Technological Innovations: Advanced features are making medical beds smarter and more useful. Remote monitoring, auto adjustments, and AI systems help improve patient care and ease staff workload.

• Healthcare Infrastructure Expansion: Developing countries are investing more in healthcare systems. This is raising the demand for modern medical beds with better features and technology.

• Increased Focus on Patient Safety: Healthcare spending is rising in developing countries. This leads to higher demand for modern medical beds with smart features and improved design.

Regulatory Landscape

The medical beds market is controlled by multiple standards and certifications, which include those from the FDA and ISO, ensuring the safety, reliability, and hygiene of medical beds. Companies must comply to these rules for maintaining compliance and patient trust.

Recent Developments

The medical beds market is always changing. New innovations keep coming to improve patient care. Some recent developments are:

• Smart Medical Beds: Some beds now have IoT features for better care. They track vital signs and adjust positions on their own to help patients.

• Enhanced Ergonomics: New beds offer better adjustability for patient needs. They also have pressure systems and added comfort for long stays.

• Infection-Resistant Materials: Some beds now use antimicrobial coatings and materials. These help lower the risk of hospital infections and keep patients safer.

• Improved Mobility Features: New beds help patients move more easily, especially the elderly and bariatric. They support safer movement and reduce the need for extra help.

Current and Potential Growth Implications

Demand-Supply Analysis

The demand for medical beds is growing, driven by healthcare infrastructure developments, aging populations, and technological advancements. However, supply chain challenges and the rising cost of raw materials could affect the availability of beds in certain regions.

Gap Analysis

The medical beds market has made progress. However, some areas still need improvement:

• Standardization of Features: Many medical beds lack standard features and designs. This makes it hard for different models to work well together and slows down hospital operations.

• Affordability: Many medical beds lack standard features and designs. This causes problems with compatibility and makes hospital work less efficient. It also affects patient care quality.

• Customization: Many medical beds lack standard features and designs. This causes compatibility problems and slows hospital work. It can also lower the quality of patient care.

Top Companies in the Medical Beds Market

• Stryker Corporation

• Hill-Rom Holdings, Inc.

• Invacare Corporation

• Arjo

• Medtronic

• Linet Group

• Paramount Bed Holdings

• GF Health Products, Inc.

• Invacare Corporation

Medical Beds Market: Report Snapshot

Segmentation | Details |

By Product Type | Hospital Beds, Long-Term Care Beds, Bariatric Beds, ICU Beds, Other Medical Beds |

By Application | Healthcare Facilities, Home Care, Long-Term Care, Rehabilitation |

By End User | Hospitals, Clinics, Nursing Homes, Home Care Providers |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High-Growth Segments

Intensive care units use special beds. These beds adjust and have tools to help sick patients:

• ICU Beds: Special beds are made for intensive care units. They have adjustable settings and tools to help very sick patients.

• Long-Term Care Beds: Beds for elderly and long-term care patients offer safety and comfort. Nursing homes and assisted living places use them for special needs.

• Bariatric Beds: These beds keep elderly and long-term patients safe. They have easy adjustments and support special needs in care homes.

Major Innovations

Innovation is key in the medical beds market. New ideas and tools are shaping change:

• Smart Beds: IoT devices help track patient vitals in real time. They can also adjust bed settings automatically for better care.

• Robotic-Assisted Beds: Robotic technology is used to move patients safely. It helps reposition them with little manual work needed.

• Pressure Relief Technology: Beds have pressure relief systems to stop bedsores. They also make long-term patients more comfortable .

Potential Growth Opportunities

Companies in the medical beds market face a vast number of obstacles:

• Intense Competition: With many players in the market, firms must keep innovating to stay ahead. Constant product updates and new ideas help keep their edge strong.

• Technological Advancements: With many players in the market, companies must keep creating better products to stay competitive. Regular innovation and fresh solutions help them stand out and lead.

• Cost Control: Companies are working to offer advanced features while keeping costs low. This helps serve more healthcare providers, including those with tight budgets.

• Supply Chain Constraints: Companies must secure a steady flow of raw materials to keep up with rising demand for medical beds. This helps avoid delays and ensures smooth production.

Extrapolate Research says:

The global medical beds market is set to grow significantly in the coming years, driven by technological advancements, increasing healthcare investments, and the growing demand for patient-centric care. Companies that can innovate and adapt to evolving healthcare needs will be well-positioned to thrive in this expanding market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Medical Beds Market Size

- May-2025

- 148

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021