Avanafil Market Size, Share, Growth & Industry Analysis, By Product Type (Branded Avanafil, Generic Avanafil), By Application (Erectile Dysfunction, Pulmonary Hypertension (Off-label)), By End-User (Hospitals, Clinics, Online Pharmacies, Telemedicine Providers), and Regional Analysis, 2024-2031

Avanafil Market: Global Share and Growth Trajectory

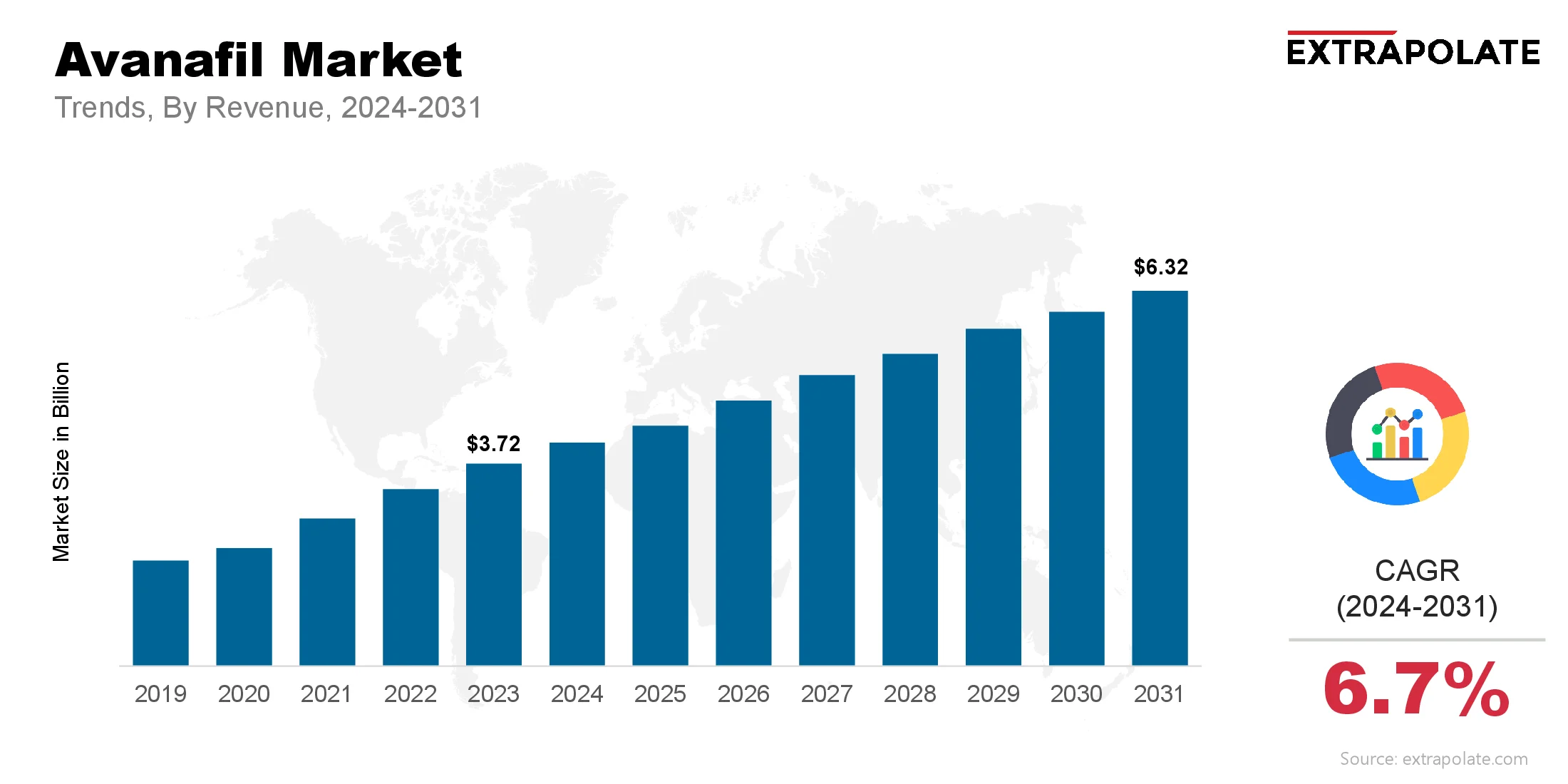

The global Avanafil market size was valued at USD 3.72 billion in 2023 and is projected to grow from USD 4 billion in 2024 to USD 6.32 billion by 2031, exhibiting a CAGR of 6.7% during the forecast period.

The global Avanafil market is growing steadily. More people are aware of erectile dysfunction (ED) treatments, and healthcare access is improving worldwide. Avanafil is a selective phosphodiesterase type 5 (PDE5) inhibitor. It mainly treats ED, a condition affecting millions of men. It stands out from other ED drugs because it works faster and has fewer side effects.

As sexual health stigma decreases and consumerization increases, demand for effective treatments like Avanafil for ED is increasing. The market is likely to observe even more growth because of rising lifestyle disorders, aging populations, and the availability of generic Avanafil versions in emerging economies.

Produced in brand names like Stendra (USA) and Spedra (EU), Avanafil is making inroads as an effective substitute for sildenafil and tadalafil. With its quick onset of action, better safety profile, and convenience for patients, the market for Avanafil has the potential for significant growth in both developed and emerging economies.

Key Market Trends Driving Product Adoption

A number of factors are driving the increased Avanafil adoption:

- Increasing Cases of Erectile Dysfunction: Erectile dysfunction (ED) is a prevalent condition nowadays, particularly in men aged 40 and above. Diabetes, heart disease, obesity, smoking, and alcoholism increase the likelihood of ED. This growing trend increases the need for efficient drugs like Avanafil.

- Preference for Fast-Acting Medications: Avanafil works quickly, usually within 15 minutes. This fast response makes it a popular choice among consumers. Older ED medications can take 30 minutes to an hour to work. Patients prefer Avanafil for its spontaneity.

- Positive Sentiment Toward Therapeutics: There is increased awareness of men's sexual health in the past decade. There are more men willing to discuss ED with physicians. Direct-to-consumer marketing, Internet pharmacies, and telemedicine services make Avanafil more accessible. This reduces the stigma associated with ED treatment.

- Generic Drug Availability: Patents for Avanafil are expiring in some areas, leading to generic options. These cost-effective alternatives will improve affordability and access, especially in price-sensitive markets. This change will likely expand the consumer base.

Major Players and Their Competitive Positioning

The Avanafil market is moderately consolidated, with a few dominant players and several emerging pharmaceutical firms. Companies with strong R&D capabilities, distribution networks, and regulatory expertise maintain competitive advantages. Key players in the global Avanafil market include Vivus, Inc. (original developer of Avanafil),Metuchen Pharmaceuticals, LLC (U.S. rights holder for Stendra), Menarini Group (European rights holder for Spedra), Teva Pharmaceutical Industries Ltd.,Cipla Limited,Zydus Lifesciences Ltd., Torrent Pharmaceuticals,Hetero Labs Ltd., Apotex Inc., Lupin Pharmaceuticals

These companies are investing in market expansion, clinical research, and partnerships with telemedicine platforms to strengthen their positions. Some are focusing on developing generic Avanafil versions or combination therapies to widen their portfolio and target a broader patient demographic.

Consumer Behavior Analysis

The adoption of Avanafil is influenced by several factors related to patient needs, affordability, and access:

- Convenience and Discretion: Patients value convenience and privacy in ED treatment. Avanafil is fast-acting and has fewer food interactions, offering greater flexibility. Its availability through telemedicine and discreet delivery boosts consumer confidence and adoption.

- Efficacy and Side Effects: Customers prefer drugs with low side effects and high effectiveness. Avanafil is low in side effects of visual impairment and muscle pain, which are associated with previous PDE5 inhibitors. Clinical trials demonstrate that Avanafil offers effective erections with fewer adverse events.

- Cost Sensitivity: Cost is a major barrier, especially where insurance does not cover ED drugs. The arrival of generic Avanafil makes it more appealing to price-sensitive consumers in emerging markets.

- Digital Health and Online Pharmacies: Online pharmacy growth and app-based consultations have enhanced access to Avanafil. U.S., UK, and Indian consumers can now purchase prescription ED drugs online without having to endure face-to-face consultations that some find repellent.

Pricing Trends

Prices for Avanafil differ based on brand, region, and type. Branded Avanafil products such as Stendra and Spedra tend to be more expensive than generics, which are now stocked in most regions.

In the United States, Stendra is priced at $70 to $80 per tablet but can be lower through insurance and discount cards. In developing economies, generics cost between $1 and $3 per dose.

Prices are likely to fall as more generics become available. In wealthier regions, cost-containment strategies may also lower prices. Additionally, bundling Avanafil with telehealth services is emerging as a new pricing model.

Growth Factors

Key drivers for Avanafil's market expansion include:

- Increasing Geriatric Population: As life expectancy rises, elder men are experiencing ED. This demographic shift boosts market demand.

- Changing Attitudes Toward Sexual Health: Greater acceptance of sexual health issues encourages men to seek treatment for ED. Awareness campaigns are fostering a more open market.

- Improved Diagnosis and Prescription Rates: Healthcare providers are now better at screening for ED and recommending treatments. Avanafil’s strong safety profile makes it a top choice for first-line therapy.

- Growing Demand from Emerging Economies: As healthcare systems improve in countries like China, India, and Brazil, more patients can access prescription medications. This creates opportunities for both branded and generic Avanafil.

Regulatory Landscape

Avanafil regulation involves strict testing and compliance to ensure safety and efficacy. Key regulatory bodies include:

- S. Food and Drug Administration (FDA): Avanafil (Stendra) was approved by the FDA in 2012. Generic drug equivalents must submit Abbreviated New Drug Applications (ANDAs) and demonstrate bioequivalence.

- European Medicines Agency (EMA): Avanafil (Spedra) received marketing authorization from the EMA in 2013. EU law emphasizes safety and correct labelling.

- Indian Central Drugs Standard Control Organization (CDSCO): Avanafil can be sold and exported, subject to adhering to national standards.

- WHO Directives and GMP Certification: Global suppliers have to adhere to WHO directives and GMP certification.

As more generics come into effect, regulatory oversight of quality control and counterfeiting should take up a vital role.

Recent Developments

The Avanafil market has seen several important developments:

Current and Potential Growth Implications

- Patent Expire and Generic Entry: Vivus's patent has already expired in many countries, opening the way for generics.

- Telemedicine Collaborations: Firms such as Hims & Hers and Roman are collaborating with pharmacies to make Avanafil available on digital channels.

- New Forms: Oradispersible and sublingual forms of Avanafil are being researched, potentially enhancing convenience and accessibility in the market.

- Expansion in Regional Markets: Pharmaceutical companies are receiving regulatory clearances in Latin America and Asia-Pacific to launch branded and generic Avanafil, aiding overall growth worldwide.

a. Demand-Supply Analysis: Worldwide demand for Avanafil is expanding as a result of increased diagnoses of ED and an aging male population. Supply should accommodate this demand while maintaining quality and compliance.

b. Gap Analysis: With growing demand, awareness and availability are still short in rural and poor populations. Market players need to address educational gaps and invest in outreach to maximize market potential.

Top Companies in the Avanafil Market

Key companies contributing to the Avanafil market include:

- Vivus, Inc.

- Metuchen Pharmaceuticals, LLC

- Menarini Group

- Teva Pharmaceutical Industries Ltd.

- Cipla Limited

- Torrent Pharmaceuticals

- Zydus Lifesciences Ltd.

- Hetero Labs Ltd.

- Apotex Inc.

- Lupin Pharmaceuticals

These players are leveraging R&D capabilities, expanding to underserved markets, and adopting digital health channels to strengthen their presence.

Avanafil Market: Report Snapshot

Segmentation | Details |

By Product Type | Branded Avanafil, Generic Avanafil |

By Application | Erectile Dysfunction, Pulmonary Hypertension (Off-label) |

By End-User | Hospitals, Clinics, Online Pharmacies, Telemedicine Providers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Generic Avanafil: With patents expiring in many countries, generic versions are set to grow rapidly. This is especially true in cost-sensitive markets.

- Online Pharmacies and Telemedicine: These options are becoming popular for buying and consulting, particularly among younger consumers who want discreet access to ED treatments.

Major Innovations

- Fast-Dissolving Tablets: Research focuses on new delivery methods, like tablets that dissolve quickly without water.

- Combination Therapies: New formulations are being tested that combine Avanafil with other agents, such as testosterone.

- AI-Integrated Digital Prescriptions: Some platforms use AI to suggest dosages and support adherence, linking with Avanafil distribution.

Potential Growth Opportunities

- Southeast Asian, African, and South American Market Penetration: Large opportunities exist in Southeast Asia, Africa, and South America where awareness and access to healthcare are increasing.

- Women's Sexual Health Expansion: Although targeting men, PDE5 inhibitors such as Avanafil are researched for potential applications in sexual dysfunction among women.

- Formulation Breakthroughs: Novel drug delivery systems such as sprays, gels, and sublingual films may form new market niches and enhance compliance.

Kings Research says:

The Avanafil market is set for significant growth in the coming years. This is due to the rising global rates of erectile dysfunction, changing social attitudes, and the greater availability of affordable generics. With its quick action, strong safety profile, and fit with telemedicine, Avanafil can become a top choice among PDE5 inhibitors. As digital health platforms and new markets create more access, stakeholders in pharma and healthcare should prepare for a more competitive, patient-focused landscape. Innovation in formulations and targeted outreach will be key to capturing market share in both developed and developing areas. Overall, the Avanafil market presents strong growth potential backed by changing healthcare dynamics, favorable demographics, and increasing consumer awareness.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Avanafil Market Size

- June-2025

- ���1���4���8

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021