Functional Non-Meat Ingredients Market Size, Share, Growth & Industry Analysis, By Ingredient Type (Binders, Fillers, Extenders, Preservatives, Emulsifiers, Flavor Enhancers) By Source (Animal-Based, Plant-Based, Synthetic) By Application (Processed Meat, Plant-Based Meat, Ready-to-Eat Products, Frozen Meat) By End User (Meat Processors, Food Service Providers, Retail Manufacturers), and Regional Analysis, 2024-2031

Functional Non-Meat Ingredients Market: Global Share and Growth Trajectory

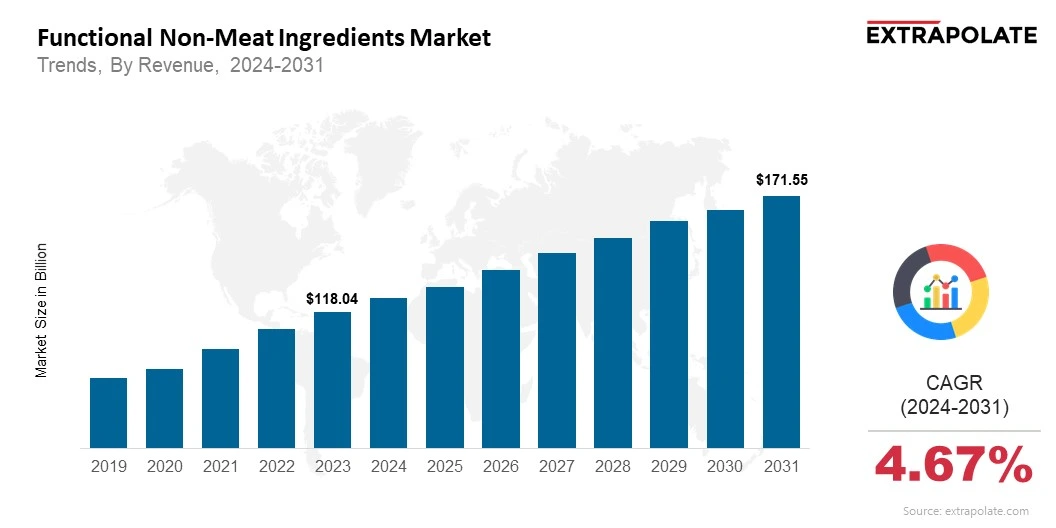

The global Functional Non-Meat Ingredients Market size was valued at USD 118.04 billion in 2023 and is projected to grow from USD 124.60 billion in 2024 to USD 171.55 billion by 2031, exhibiting a CAGR of 4.67% during the forecast period.

The global functional non-meat ingredients market is witnessing significant momentum, driven by rising health awareness, increasing demand for processed meat alternatives, and advancements in food technology. This market includes a wide range of ingredients such as binders, extenders, fillers, coloring agents, flavor enhancers, preservatives, and texturizing agents, all of which are crucial in enhancing the quality, shelf life, appearance, and nutritional profile of processed meat products.

These functional ingredients are designed to meet evolving consumer expectations for cleaner labels, healthier options, and better-tasting meat alternatives.As global dietary preferences shift toward plant-based and flexitarian diets, food manufacturers are exploring innovative ingredient solutions to improve the texture and taste of meat analogs. Functional non-meat ingredients are playing a critical role in this transition, helping replicate the organoleptic properties of traditional meat.

Moreover, the increasing consumption of processed meat across emerging economies, coupled with the growing popularity of ready-to-eat meals, has led to a surge in demand for functional additives that can enhance processing efficiency and product appeal.

Technology is also acting as a catalyst for market expansion, with the development of novel formulations and ingredient blends that optimize both cost and functionality. In addition, food safety regulations and consumer concerns about additives are encouraging the use of natural and clean-label ingredients. This shift is prompting key players to invest heavily in research and development to create functional ingredients derived from natural sources without compromising on quality or performance.

The market is further bolstered by the expanding foodservice industry and increased investments in packaged food innovations. Regional trends also play a significant role; while North America and Europe remain leading markets due to mature food processing sectors, Asia-Pacific is emerging as a high-growth region thanks to rising disposable incomes, urbanization, and a rapidly evolving consumer base.

As manufacturers strive to meet the dual challenge of delivering taste and nutrition while ensuring cost-effectiveness, the functional non-meat ingredients market is expected to maintain a strong growth trajectory. The integration of these ingredients into both meat and meat-free product lines is shaping the future of food innovation globally. With growing consumer interest in healthier and more sustainable food choices, this market stands at the intersection of culinary tradition and scientific advancement.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

The functional non-meat ingredients market is evolving rapidly with innovation, sustainability efforts, and health consciousness shaping the landscape. Key trends boosting market adoption include:

• Clean Label Demand: Consumers are seeking meat products with clear labeling. They want fewer artificial additives, which is driving the use of natural functional ingredients.

• Plant-Based Innovation: The surge in plant-based meat alternatives is driving demand. Ingredients that mimic the texture, flavor, and juiciness of real meat are needed.

• Enhanced Processing Efficiency: Functional ingredients improve water retention, emulsification, and binding in processed meats. They enhance overall product quality.

• Health-Conscious Formulations: Functional ingredients help manufacturers reduce sodium, fat, and allergens. This is done without compromising product quality.

• Global Food Security: Meat alternatives are growing in popularity. Functional ingredients help make sustainable protein sources.

Major Players and their Competitive Positioning

The functional non-meat ingredients market features a mix of global food ingredient giants and specialized players, including Kerry Group, Ingredion Incorporated, DuPont Nutrition & Biosciences, and Archer Daniels Midland Company (ADM). These companies are investing in R&D to develop innovative, multifunctional solutions for both traditional meat and plant-based segments.

Consumer Behavior Analysis

Consumer preferences are evolving due to several key factors:

• Health and Wellness: Shoppers are opting for products with enhanced nutritional profiles and minimal additives.

• Sustainability Awareness: Consumers care about the environment. They are choosing meat alternatives.

• Ethical Choices: Animal welfare concerns are growing. This is pushing people toward plant-based meat.

• Convenience: Ready-to-eat and frozen meat products are growing in popularity. They are enriched with functional ingredients.

Pricing Trends

Prices of functional non-meat ingredients vary depending on their type, source (natural vs synthetic), and application. While premium natural ingredients often command higher prices, economies of scale and technological advances are improving affordability, especially in emerging markets. Plant-based ingredients, such as soy proteins and natural binders, are seeing growing demand and cost competitiveness.

Growth Factors

Several core drivers are propelling market expansion:

• Innovation in Meat Alternatives: Rising demand for meat substitutes is increasing. Functional ingredients are needed to improve product structure and appeal.

• Regulatory Push for Clean Labeling: Governments and industry bodies are promoting less chemical use. This is creating demand for natural alternatives.

• Increased Processed Meat Consumption: Functional ingredients are key in processed meats. They help maintain shelf life, flavor, and safety.

• Rising Middle-Class Demand: In developing countries, incomes are rising. Urbanization is also driving demand for ready-to-cook and packaged meats.

Regulatory Landscape

The functional non-meat ingredients industry operates within stringent food safety and labeling regulations. Different countries have varying approvals for additives, preservatives, and processing aids. Clean-label compliance and transparency are becoming critical for global players.

Recent Developments

Recent innovations and strategic moves in the market include:

• Introduction of Natural Preservatives: Rosemary extract innovations are increasing. Vinegar preservatives and fermented ingredients are improving as well.

• Expansion into Plant-Based Meat: Major players are launching new functional blends. These are designed specifically for vegan products.

• Collaborations and Acquisitions: Companies are forming partnerships. This helps expand their ingredient portfolios and global presence.

• Smart Ingredient Delivery Systems: Encapsulation technologies are improving ingredient performance. Controlled-release technologies are also helping.

Current and Potential Growth Implications

Demand-Supply Analysis

Demand is strong and rising steadily, especially in processed meat and alternative protein sectors. Supply chains are expanding, but raw material sourcing (especially natural and organic components) may present bottlenecks.

Gap Analysis

Despite the positive momentum, the market still faces challenges:

• Limited Functional Ingredient Options for Vegan Meats: There’s a need for improved binding and flavor-enhancing alternatives.

• Labeling Complexity: Some functional ingredients blur lines between food additives and natural components, causing regulatory uncertainty.

• Cost Constraints: High cost of premium ingredients can deter small and mid-sized food producers.

• Consumer Skepticism: Misunderstandings about ingredient functionality and origin persist.

Top Companies in the Functional Non-Meat Ingredients Market

• Kerry Group

• Ingredion Incorporated

• Corbion N.V.

• Archer Daniels Midland Company (ADM)

• DuPont Nutrition & Biosciences

• IFF (International Flavors & Fragrances)

• Givaudan

• Tate & Lyle PLC

• Sensient Technologies

• AiBiotech Ingredients

Functional Non-Meat Ingredients Market: Report Snapshot

Segmentation | Details |

By Ingredient Type | Binders, Fillers, Extenders, Preservatives, Emulsifiers, Flavor Enhancers |

By Source | Animal-Based, Plant-Based, Synthetic |

By Application | Processed Meat, Plant-Based Meat, Ready-to-Eat Products, Frozen Meat |

By End User | Meat Processors, Food Service Providers, Retail Manufacturers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Functional Non-Meat Ingredients Market: High-Growth Segments

Segments poised for strong growth include:

• Plant-Based Emulsifiers: Crucial for clean-label plant-based meat products.

• Natural Preservatives: Responding to clean-label and shelf-life demands.

• Texture Enhancers for Vegan Products: Addressing mouthfeel challenges in meat analogs.

Major Innovations

Ongoing innovations shaping the industry include:

• Microencapsulation: Firms are producing high-functionality proteins. These proteins are for meat alternatives.

• Precision Fermentation: Firms are making high-functionality proteins. These are used in meat alternatives.

• Smart Blends: Custom multi-functional ingredient solutions tailored for specific product types.

Functional Non-Meat Ingredients Market: Potential Growth Opportunities

Key challenges and opportunities include:

• Intensifying Competition: New entrants are joining the market. Startups are offering novel formulations.

• R&D for Plant-Based Innovation: A major opportunity lies in developing versatile ingredients. These should also be label-friendly.

• Regulatory and Labeling Complexity: Navigating regulations is still a challenge. Gaining consumer trust also remains tough.

• Sustainability and Ethical Sourcing: Players focused on traceable and eco-friendly sourcing will stay ahead. This builds trust and meets consumer demand.

Extrapolate Research says:

The functional non-meat ingredients market is growing fast. Tech advances, shifting preferences, and the plant-based trend are driving it. Firms offering natural, high-performance, and flexible ingredients will gain a strong edge. Demand for such solutions is rising.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Functional Non-Meat Ingredients Market Size

- May-2025

- 148

- Global

- food-beverage

Related Research

Adaptogens Market Size, Share, Growth & Industry Analysis, By Source (Ashwagandha, Ginseng, Rhodiola

May-2025

Alginate Market By Product (Potassium Alginate, Calcium Alginate, Propylene Glycol Alginate, Sodium

March-2023

Artificial Sweetener Market By Type (Aspartame, Acesulfame-K, Monosodium Glutamate, Saccharin, and S

March-2023

B2B Food Market Size, Share, Growth & Industry Analysis, By Product Type (Fresh Produce, Dairy Produ

July-2025

Barbecue (BBQ) Sauce Market Insights Aircraft Air Brake Market Insights 2022, Global Analysis and Fo

July-2021

Beverage Cans Market Size, Share, Growth & Industry Analysis, By Material (Aluminium, Steel), By App

June-2025