Energy Drinks Market Size, Share, Growth & Industry Analysis, By Product Type (Carbonated Energy Drinks, Non-Carbonated Energy Drinks, Energy Shots), By Ingredient (Caffeine, Taurine, Sugars, Vitamins, Adaptogens), By Distribution Channel (Online, Offline (Supermarkets, Convenience Stores, Pharmacies)), and Regional Analysis, 2024-2031

Energy Drinks Market: Global Share and Growth Trajectory

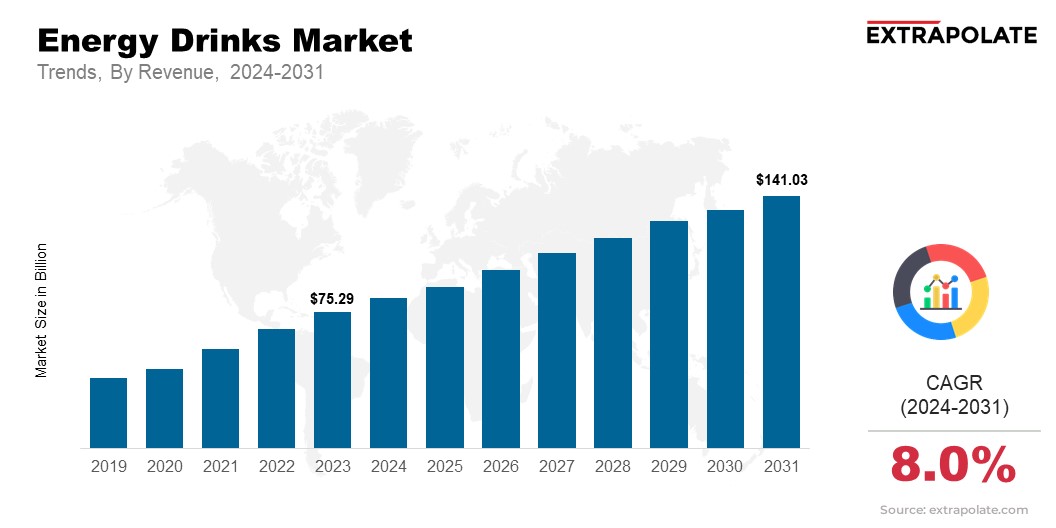

The global Energy Drinks Market size was valued at USD 75.29 billion in 2023 and is projected to grow from USD 82.03 billion in 2024 to USD 141.03 billion by 2031, exhibiting a CAGR of 8.0% during the forecast period.

The global energy drinks market is experiencing robust growth, fueled by rising demand for products that enhance physical performance, mental alertness, and overall energy levels.

As consumers increasingly seek convenient and effective solutions for combating fatigue and boosting productivity, the market for energy drinks continues to expand.

This market includes a diverse range of offerings such as carbonated drinks, non-carbonated beverages, and energy shots, with innovations in ingredients and formulations catering to evolving consumer preferences.

Key Market Trends Driving Product Adoption

The energy drinks market is characterized by strong competition and continuous innovation. Key trends fueling growth include:

- Health-Conscious Offerings: Low-sugar, natural energy drinks are reshaping the market. Consumers want healthy performance boosts.

- Functional Benefits: Energy drinks are now functional. They increase vitality and provide advantages including immunity, attention, and hydration.

- Innovative Flavors and Formulations: In order to satisfy a wide range of consumer preferences, brands are concentrating on developing new flavors and product variations. Additionally, plant-based, organic, and functional components like vitamins and adaptogens are becoming more and more popular.

- Sustainability Initiatives: In an effort to appeal to consumers who care about the environment, firms are putting more emphasis on sustainability by using eco-friendly packaging and sourcing sustainable products.

Major Players and their Competitive Positioning

The energy drinks market is dominated by a few major players such as Red Bull, Monster Beverage Corporation, PepsiCo (Rockstar), and Coca-Cola (Powerade). These brands innovate and expand to stay dominant.

Additionally, smaller companies are starting to appear, aiming to attract health-conscious customers and niche niches.

Consumer Behaviour Analysis

Consumers are increasingly drawn to energy drinks for various reasons, including:

- Energy Boost: Energy drinks are consumed by people who want more stamina and energy. They are particularly helpful to professionals, fitness lovers, and athletes.

- Mental Alertness: Customers require improved cognitive function and attentiveness. They use energy drinks, especially for studying or working.

- Convenience: Energy drinks quickly combat fatigue, making them popular with busy people.

- Flavours and Choices: Consumers seek healthy drinks with added benefits beyond energy.

Pricing Trends

Energy drink pricing varies by product type. Premium options, like sugar-free, organic, or functional drinks, command higher prices. The energy drink market has a budget-friendly segment.

This segment is experiencing significant growth, attracting cost-conscious consumers with affordable options. Energy drink companies are adapting to diverse consumer needs. They are introducing value packs and multi-serving options.

Growth Factors

Several factors are driving the growth of the energy drinks market:

- Increasing Demand for Functional Beverages: Energy is not the only thing that consumers desire. They also look for health advantages like stress reduction, immunity, and hydration.

- Rising Health Consciousness: Consumers prefer natural and organic energy drinks. This preference shifts them from sugary drinks to healthier options.

- Expanding Consumer Base: The working population and active youth are growing. This fuels demand for energy products.

- Market Diversification: Energy drink companies offer new flavors, variants, and formats. This appeals to more consumers.

Regulatory Landscape

Energy drink regulations are evolving globally. Governments focus on labeling, health claims, and age restrictions. Companies must follow regional regulations for product safety and consumer trust.

Recent Developments

The energy drinks market is constantly evolving, with brands introducing new products and expanding into new markets. Recent developments include:

- Functional Energy Drinks: Energy drink companies are creating new offerings. These offerings include added benefits like electrolytes, antioxidants, and adaptogens.

- Sugar-Free and Low-Calorie Options: Health-conscious consumers are seeking healthier options. This is driving growing demand for energy drinks with no added sugars and fewer calories.

- Sustainability Initiatives: Consumers are increasingly environmentally conscious. As a result, brands are shifting towards recyclable packaging and sustainably sourced ingredients.

- Flavored Variations: New flavors are constantly emerging in the energy drink market. These new flavors cater to consumer taste preferences and diversify product offerings.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Demand for energy drinks is rising as a result of busy lives and health trends. However, supply chain issues pertaining to the production and sourcing of ingredients could affect some goods' availability.

b.Gap Analysis

Despite the market's remarkable expansion, there are still several areas that require improvement:

- Healthier Alternatives: Customers are requesting more healthful options. Consequently, more natural, sugar-free, and useful products are required.

- Packaging Innovation: Eco-friendly packaging and less environmental effect are still crucial areas for development.

- Transparency in Ingredient Sourcing: Transparency is valued by consumers. Their trust will grow if ingredient sourcing and benefits are made more transparent.

Top Companies in the Energy Drinks Market

- Red Bull

- Monster Beverage Corporation

- PepsiCo (Rockstar)

- Coca-Cola (Powerade)

- Celsius Holdings

- National Beverage Corp. (Fizzique)

- Vital Pharmaceuticals (VPX Sports)

- AriZona Beverages USA

- Keurig Dr Pepper, Inc

- Amway Corp

Energy Drinks Market: Report Snapshot

Segmentation | Details |

By Product Type | Carbonated Energy Drinks, Non-Carbonated Energy Drinks, Energy Shots |

By Ingredient | Caffeine, Taurine, Sugars, Vitamins, Adaptogens |

By Distribution Channel | Online, Offline (Supermarkets, Convenience Stores, Pharmacies) |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segments

The following market segments are expected to experience significant growth:

- Energy Shots: Consumers often need quick energy boosts. Compact and potent energy drink options meet this need.

- Sugar-Free and Low-Calorie Energy Drinks: Consumers are demanding healthier products. Energy drink companies are responding by offering lower-calorie options.

- Functional Energy Drinks: Energy drink products are evolving. They now offer added benefits such as hydration, immunity, or cognitive support.

Major Innovations

Innovation plays a crucial role in the growth of the energy drinks market. Some of the key innovations include:

- Natural and Organic Ingredients: Consumers are demanding transparency. Therefore, brands are shifting to cleaner and more transparent ingredient sourcing.

- Enhanced Formulations: Energy drink companies are developing new formulations. These formulations include added health benefits like electrolytes, vitamins, and antioxidants.

- Sustainable Packaging: Consumers are increasingly environmentally conscious. This is driving increased adoption of eco-friendly packaging solutions.

Potential Growth Opportunities

Companies in the energy drinks market face several challenges but also have multiple opportunities for growth:

- Health-Conscious Consumer Demand: Consumers increasingly prefer functional and natural ingredients. Energy drink companies are working to meet this preference.

- International Expansion: Emerging markets offer significant growth potential. Manufacturers are therefore expanding into these regions, notably Asia-Pacific and Latin America.

- Eco-Friendly Projects and Sustainability: Environmental responsibility is becoming progressively important to consumers. Energy drink companies are acknowledging this shift.

- Product Diversification: Energy drink companies are expanding their product lines. These expansions include sugar-free, organic, and functional options.

Extrapolate Research says:

It is anticipated that the global energy drinks market will expand considerably. The main cause of this rise is growing health consciousness. Another factor is the growing demand for functional beverages and the evolving consumer preferences. Businesses that can innovate and meet consumer demand for healthy products will hold a solid advantage. Taking advantage of market prospects will also depend on offering sustainable products.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Energy Drinks Market Size

- February-2025

- 140

- Global

- food-beverage

Related Research

Adaptogens Market Size, Share, Growth & Industry Analysis, By Source (Ashwagandha, Ginseng, Rhodiola

May-2025

Alginate Market By Product (Potassium Alginate, Calcium Alginate, Propylene Glycol Alginate, Sodium

March-2023

Artificial Sweetener Market By Type (Aspartame, Acesulfame-K, Monosodium Glutamate, Saccharin, and S

March-2023

B2B Food Market Size, Share, Growth & Industry Analysis, By Product Type (Fresh Produce, Dairy Produ

July-2025

Barbecue (BBQ) Sauce Market Insights Aircraft Air Brake Market Insights 2022, Global Analysis and Fo

July-2021

Beverage Cans Market Size, Share, Growth & Industry Analysis, By Material (Aluminium, Steel), By App

June-2025