Magnetite Iron Ore Market Size, Share, Growth & Industry Analysis, By Product Type (High-Grade Magnetite Ore, Low-Grade Magnetite Ore), By Application (Steel Production, Construction, Energy, Other Industrial Applications), By End User (Steel Manufacturers, Construction Companies, Energy Providers, Industrial Processors), and Regional Analysis, 2024-2031

Magnetite Iron Ore Market: Global Share and Growth Trajectory

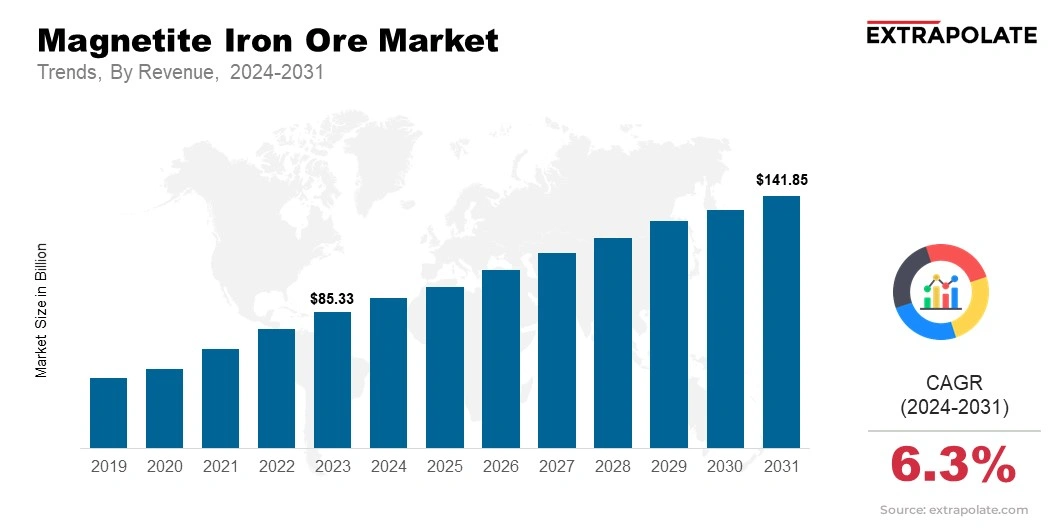

The global Magnetite Iron Ore Market size was valued at USD 85.33 billion in 2023 and is projected to grow from USD 92.20 billion in 2024 to USD 141.85 billion by 2031, exhibiting a CAGR of 6.3% during the forecast period.

The global market is experiencing rapid progress, driven by the upsurge in demand from the steel industry, infrastructure development, and the rising need for premium iron ore. Magnetite iron ore, which is known for its increased iron levels and effectiveness in steel production, is undergoing substantial growth in mining operations all over the world.

With the increase in urbanization and industrialization in emerging regions, the demand for steel, one of the most important end products of magnetite iron ore, is anticipated to maintain its growth.

Technological developments in extraction of magnetite, processing, and utilization are also driving market expansion. Opting for effective mining methods, such as advanced beneficiation and dry processing methods, is aiding in cutting production costs, improving the attractiveness of magnetite iron ore to market players.

The innovation of cleaner and more eco-friendly mining practices is also gaining prominence as environmental issues become more significant.

Additionally, the market is reaping benefits from increase in the need for steel in several sectors like automotive, construction, and manufacturing. With the expansion of infrastructure projects in both developed and developing markets, the demand for premium iron ore such as magnetite is steadily increasing.

Countries rich in magnetite reserves, like Australia, Brazil, and Russia, are playing a crucial role in the supply chain worldwide, as they accelerate production to meet international needs.

To conclude, the market is demonstrating a strong growth pattern, propelled by technological advancements, the growth in demand for high-quality iron ore, and the worldwide increase in infrastructure development. As these trends progress, the market is positioned for strong growth, offering new opportunities to influential players in the sector.

Key Market Trends Driving Product Adoption

The magnetite iron ore market is shaped by significant trends contributing to its development:

- High Iron Content and Efficiency: Magnetite iron ore contains more iron than hematite, making it more attractive for steel production.

- Sustainability and Environmental Focus: Due to rising environmental concerns, magnetite iron ore is becoming more popular in industries, as it requires reduced energy and water for processing.

- Technological Advancements in Mining: Advancements in mining techniques are enabling more efficient extraction, reducing costs, and increasing output.

- Increasing Demand from Emerging Economies: The rapid growth of industries and cities in emerging economies, particularly in the Asia-Pacific region, is a major factor behind the increased demand for magnetite iron ore.

Major Players and their Competitive Positioning

The market is driven by key players in the industry like Rio Tinto, BHP, Vale S.A., and Fortescue Metals Group. These companies have built a dominant position with extensive mining operations and streamlined production processes. Smaller market participants are gaining ground, targeting regional demand and specific niches for magnetite-based goods.

Consumer Behavior Analysis

Consumers in the magnetite iron ore market comprise large steel manufacturers, industrial processors, and construction companies. The market's expansion is fueled by the following factors:

- Steel Production: The high iron content of magnetite makes it well-suited for steel production, which is the main consumer of iron ore.

- Infrastructure Development: As global infrastructure’s progress continues, the need for iron ore to support construction activities continues to grow.

- Energy and Cost Efficiency: Companies prefer magnetite iron ore due to its economical extraction process and low environmental footprint.

Pricing Trends

The pricing trends in the magnetite iron ore industry differ on the basis of factors like worldwide demand for steel, production costs, and trade policies. High-end prices are commonly linked to high-grade magnetite ore, as it ensures improved efficiency in steel production. Furthermore, changes in prices are shaped by supply chain dynamics, geopolitical factors, and worldwide economic trends.

Growth Factors

Several influences are driving the progress of the market:

- Steel Industry Demand: The increase in global steel production is one of the main forces behind the rising demand for magnetite iron ore.

- Mining Technology Advancements: Advancements in ore processing and extraction techniques are producing higher-quality products while minimizing environmental impact.

- Industrialization in Developing Nations: Countries like China, India, and Brazil are ramping up their industrial capacities, which in turn, is fueling the demand for iron ore, including magnetite.

- Infrastructure Growth: The worldwide increase in infrastructure development, particularly in emerging economies, drives higher demand for raw materials such as iron ore.

Regulatory Landscape

The magnetite iron ore market is controlled by a range of regulations which concern mining operations, ecological impact, and trade policies. Stricter regulations are being implemented by governments to reduce the environmental impact of mining, shaping production methods and costs for businesses.

Recent Developments

Several major shifts have taken place in the magnetite iron ore market:

- Sustainability Initiatives: Various mining companies have opted for sustainable methods in their operations, reducing environmental footprint while improving production efficiency.

- New Mining Projects: New exploration and mining initiatives have been introduced, especially in nations with unexplored magnetite iron ore reserves, driving market expansion.

- Technological Innovation: Ongoing innovations in ore processing and beneficiation technologies have boosted both the quality and supply of magnetite ore, making it more desirable to purchasers.

Current and Potential Growth Implications

a. Demand Supply Analysis

The demand for magnetite iron ore is advancing at a steady pace, with supply lagging in some regions. The increase in demand from top steel-producing countries and the need for high-quality iron ore is prompting companies to boost exploration and production operations.

b. Gap Analysis

- Supply Chain Constraints: Global supply chain disruptions, including issues with transportation and logistics, can hinder on-time delivery of ores to end customers.

- Investment in Mining Projects: With the growing demand, additional exploration and development of untapped magnetite iron ore reserves will require more investment.

- Sustainability Compliance: Organizations must contend with the challenge of maintaining high production efficiency while complying with stringent environmental guidelines.

Top Companies in the Magnetite Iron Ore Market

- Rio Tinto

- BHP

- Vale S.A.

- Fortescue Metals Group

- Anglo American

- China Shenhua Energy Company

- ArcelorMittal

- NSL Consolidated Ltd.

- Champion Iron

- CITIC Pacific Mining

Magnetite Iron Ore Market: Report Snapshot

Segmentation | Details |

By Product Type | High-Grade Magnetite Ore, Low-Grade Magnetite Ore |

By Application | Steel Production, Construction, Energy, Other Industrial Applications |

By End User | Steel Manufacturers, Construction Companies, Energy Providers, Industrial Processors |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segments

The following market sectors are anticipated to witness considerable expansion:

- Steel Production: A central driver behind magnetite iron ore demand, fueled by the continuous rise in steel production.

- Energy Sector: Increased demand for magnetite ore due to its role in energy-driven industrial applications.

Major Innovations

Innovation is a driving force in the magnetite iron ore market, with the developments listed below influencing the industry's future:

- Advanced Ore Processing Technologies: New practices to maximize the efficiency of magnetite ore mining and processing.

- Sustainability Practices: Application of sustainable and eco-friendly techniques in mining operations.

- Automation and Digitalization: Cutting-edge technologies in mining, such as automation and digital systems, enhancing production efficiency and lowering costs.

Potential Growth Opportunities

Companies operating in the magnetite iron ore market encounter various challenges and prospects for growth:

- Intense Competition: Challenge from other iron ore manufacturers and emerging mining players.

- Technological Advancements: Staying informed about emerging innovations in ore processing and extraction techniques.

- Regulatory Compliance: Safeguarding compliance with environmental and operational protocols.

- Sustainability: Managing production efficiency alongside environmental considerations.

Kings Research says:

The global magnetite iron ore market is projected for sustained growth, propelled by higher demand for premium ore, increased steel production, and ongoing tech advancements. Companies that stay in tune with market trends and address obstacles will be well-equipped to capture opportunities in this growing sector.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Magnetite Iron Ore Market Size

- February-2025

- 149

- Global

- energy-and-power

Related Research

Organic Rankine Cycle Market Size, Share, Growth & Industry Analysis, By Application (Solar Thermal

February-2023

Air Electrode Battery Market Size, Share, Growth & Industry Analysis, By Product (Zinc-Air Batteries

September-2024

Battery Recycling Market Size, Share, Growth & Industry Analysis, By Battery Chemistry (Lead-Acid, L

August-2025

Biodiesel Market By Feedstock (Soybean, Rapeseed, Palm, Palm, Poultry, Tallow, White Grease, and Oth

January-2023

Biomass Boiler Market Size, Share, Growth & Industry Analysis, By Product Type (Fully Automated Boil

August-2025

Biomass Power Generation Market Size, Share, Growth & Industry Analysis, By Feedstock (Woody Biomass

August-2025

Biomethane Market by Application (Automotive, Power Generation, and Others), Production Method (Ferm

February-2023

Cable Entry Systems and Components Market Size, Share, Growth & Industry Analysis, By Product Type (

February-2025

Carbon Capture and Storage Market Size, Share, and COVID-19 Impact Analysis, By Capture Source (Chem

August-2025

Diesel Market Size, Share, Growth & Industry Analysis, By Application (Transportation (On-road, Off-

April-2025