Liquefied Petroleum Gas Market Size, Share, Growth & Industry Analysis, By Source (Refinery, Associated Gas, Non-Associated Gas), By Application (Residential, Commercial, Industrial, Transportation, Others), By Distribution (Cylinder, Bulk, Autogas), and Regional Analysis, 2024-2031

Liquefied Petroleum Gas Market: Global Share and Growth Trajectory

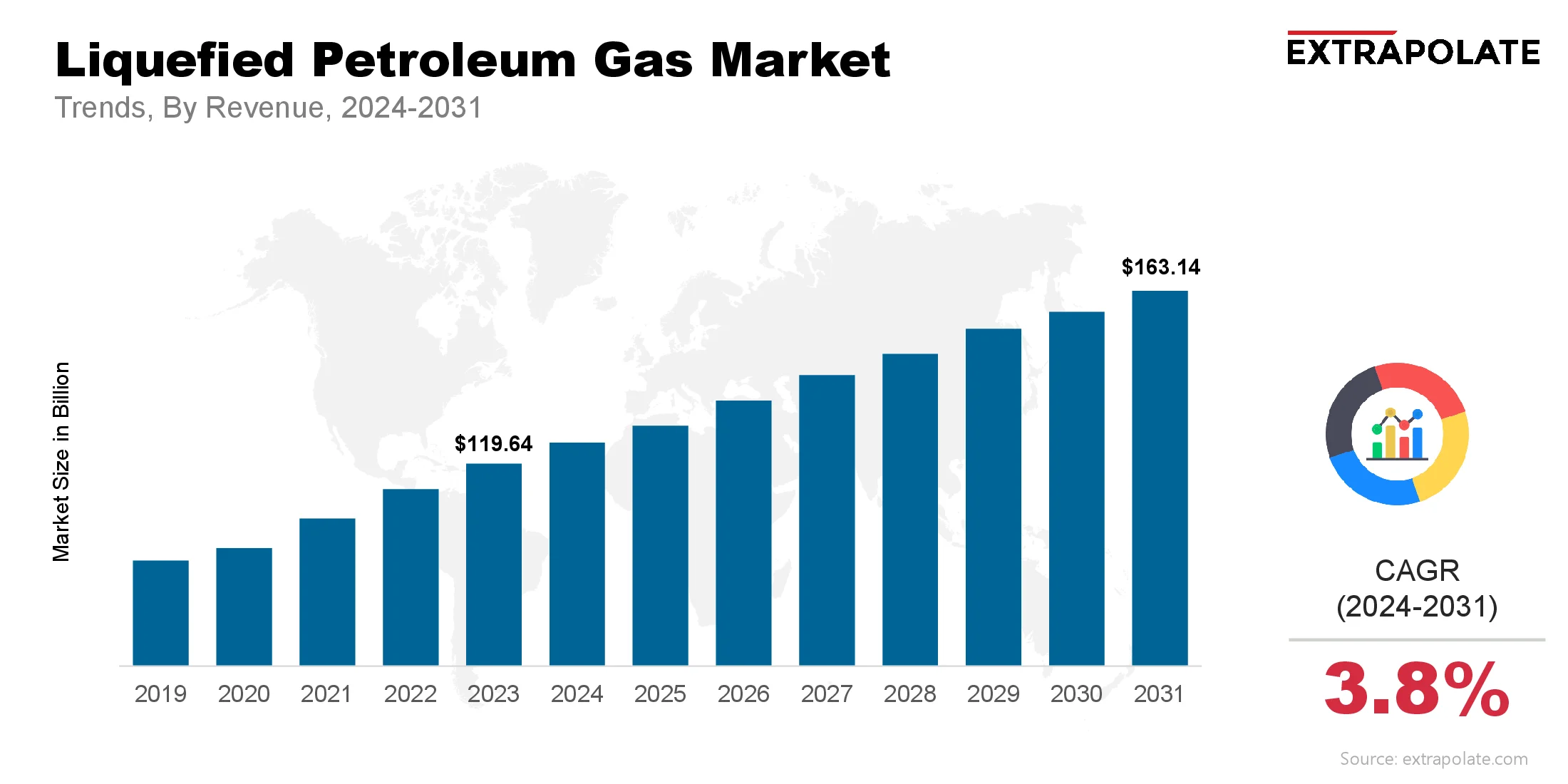

The global Liquefied Petroleum Gas market size was valued at USD 119.64 billion in 2023 and is projected to grow from USD 125.28 billion in 2024 to USD 163.14 billion by 2031, exhibiting a CAGR of 3.8% during the forecast period.

The global market continues to chart a strong growth trajectory, fueled by a confluence of demographic, economic, and environmental factors. With an increasing global population and rising urbanization, the demand for cleaner and more efficient energy sources has intensified, positioning LPG as a favorable option.

As a byproduct of natural gas processing and petroleum refining, LPG is widely used in residential heating and cooking, industrial processing, transportation, and agriculture. Its relative cleanliness compared to conventional fuels like coal and biomass makes it an attractive alternative, particularly in developing countries where access to piped natural gas remains limited.

In residential applications, LPG is predominantly used for cooking and space heating, especially in regions with inadequate access to electricity or gas grids. Governments in Asia, Africa, and Latin America have been proactively promoting LPG adoption through targeted subsidies, public distribution schemes, and infrastructure investments. For example, the Pradhan Mantri Ujjwala Yojana (PMUY) initiative in India has significantly expanded household access to LPG, contributing to both environmental improvements and health benefits by reducing indoor air pollution from biomass burning.

From a regional perspective, Asia-Pacific leads the global LPG market in terms of consumption and growth potential, followed by North America and Europe. The Middle East, a major producer of LPG, continues to play a crucial role in global supply dynamics. As the global energy landscape evolves, LPG’s flexibility, scalability, and relatively low carbon footprint make it a vital component of the ongoing transition toward more sustainable and inclusive energy systems.

Key Market Trends Driving Product Adoption

Growing Demand from Residential Sector

The residential sector represents one of the largest consumers of LPG globally. In many developing countries, LPG is the primary fuel for cooking and heating, replacing firewood, coal, and kerosene. This transition is being encouraged by government subsidies, awareness campaigns, and enhanced distribution networks. In countries like India and Indonesia, large-scale initiatives such as Pradhan Mantri Ujjwala Yojana (PMUY) have provided millions of households with access to LPG, significantly boosting market penetration.

Environmental and Health Benefits

LPG produces lower carbon dioxide emissions than other conventional fossil fuels, making it a cleaner energy source. Its high combustion efficiency and reduced particulate emissions are critical advantages in urban environments suffering from poor air quality. These environmental benefits, coupled with health advantages such as reduced indoor air pollution, are driving wider acceptance, especially in densely populated regions.

Rise in Industrial Applications

LPG is widely used in the industrial sector for processes including metal cutting, heating, drying, and powering industrial furnaces. It is also a vital feedstock in petrochemical manufacturing. Industries are adopting LPG for its consistent energy output, cleaner combustion, and lower maintenance costs. As manufacturing activities expand in emerging markets, the demand for industrial-grade LPG is expected to grow significantly.

Adoption in the Automotive Sector

The use of LPG as an automotive fuel (autogas) is gaining traction due to its lower emissions and cost-effectiveness compared to gasoline and diesel. Countries such as Turkey, South Korea, Poland, and Italy are leading adopters of autogas, supported by tax incentives and favorable policies. With increasing focus on reducing vehicular emissions, the adoption of autogas vehicles is expected to rise steadily in the coming years.

Major Players and Their Competitive Positioning

The global LPG industry is competitive and fragmented, with several key players operating across the supply chain—from production to distribution and retail. These companies are focusing on technological advancements, mergers, acquisitions, and strategic alliances to strengthen their market positions. Leading companies include are Royal Dutch Shell plc, BP plc, TotalEnergies SE, Chevron Corporation, ExxonMobil Corporation, China Petroleum & Chemical Corporation (Sinopec), Reliance Industries Limited, Saudi Arabian Oil Co. (Saudi Aramco), SHV Energy N.V., UGI Corporation and others.

These companies are investing in infrastructure, expanding storage and distribution networks and developing new applications for LPG to tap into emerging market opportunities and meet growing global demand.

In May 2025, Islands Energy Group launched its first BioLPG gas trial, supplying renewable LPG to businesses in Jersey and Guernsey. This pilot initiative introduces bioLPG derived from renewable feedstocks, a cleaner, “drop-in” fuel alternative compatible with existing LPG assets and appliances.

Consumer Behavior Analysis

- Affordability and Accessibility: Consumers are choosing LPG because it’s cost effective especially in areas where there is no natural gas. Bulk purchasing options, cylinder delivery services and government subsidies in developing regions have made LPG more accessible and affordable to low income households. Convenience of use and fast cooking time are key drivers of household adoption.

- Environmental Awareness: More and more consumers are shifting to cleaner fuels due to growing awareness about climate change and health risks of traditional biomass or coal. This environmental consciousness is strong in urban areas where LPG is a practical and cleaner option.

- Portability and Flexibility: LPG is portable and can be used in various applications such as outdoor activities, small business operations and disaster relief scenarios. Consumers love the flexibility of LPG cylinders which can be transported and used without fixed infrastructure.

- Digitalization of Distribution: Technology is playing a bigger role in consumer engagement and satisfaction. Mobile apps and digital platforms are being used to book cylinder refills, track deliveries and ensure safe handling. This digital transformation is improving user experience and building brand loyalty.

Pricing Trends

LPG pricing is influenced by multiple global and regional factors such as crude oil prices, refining capacity, seasonal demand and geopolitical tensions. The price is generally more stable than other petroleum products because of diversified sources and long term contracts.

While prices can fluctuate with global oil markets, governments in many countries regulate retail LPG prices or provide subsidies to insulate consumers from volatility. In the industrial and commercial sectors, bulk LPG supply agreements and futures contracts are common to large consumers.

Technological innovations in distribution and storage such as composite LPG cylinders and advanced metering are also reducing operational costs and enhancing pricing transparency.

Growth Drivers

- Urbanization and Infrastructure Expansion: Urbanization in Asia, Africa and Latin America is driving demand for modern cooking fuels like LPG. Improved infrastructure and better logistics are making LPG more available in remote and underserved areas thus contributing to growth.

- Government Subsidies and Incentives: Government support has been key. Subsidized LPG connections for low income households, tax exemption for autogas and incentives for LPG bottling plants.

- Technological Advancements: New tech in extraction, transport, and storage is improving LPG use. These advances boost safety and efficiency. They help meet rising demand smoothly. Smart meters and leak alerts boost trust. Light cylinders add ease of use. Together, these features drive wider LPG adoption.

- Energy Transition Goals: As part of their broader climate goals, countries are promoting LPG as a transition fuel. LPG acts as a cleaner bridge fuel. It's useful where renewables aren't ready. It helps cut emissions while infrastructure grows.

Regulatory Landscape

The LPG market is subject to comprehensive regulations designed to ensure safety, quality, and environmental compliance. Key regulatory areas include:

- Safety Standards: Governments set strict LPG safety rules. These cover storage, transport, and use. Cylinder checks, valve safety, and fire systems are key parts.

- Licensing and Distribution: Governments require licenses for LPG distributors. They set supply limits and pricing rules. These steps protect consumers and ensure fair access.

- Environmental Compliance: Green rules push cleaner fuels. LPG gets support as a low-emission option. Incentives help boost its use.

- International Trade and Customs: Trade rules and customs shape LPG flows. Import and export duties affect prices. Transport laws also guide market movement.

Compliance with these frameworks is essential for market players to operate effectively and maintain consumer trust.

Recent Developments

Investment in Storage and Terminals: Firms like SHV Energy and UGI are expanding LPG storage. They invest in terminals and pipelines. This boosts supply safety and transport efficiency.

- Rise in Autogas Infrastructure: Autogas stations are growing fast in South Korea and Turkey. This supports more LPG vehicle use. Better access is driving adoption.

- LPG Blending with Renewable Gases: Research is exploring LPG mixed with renewable gases. BioLPG is one key option. This blend helps cut carbon and meet green goals.

- Digital Booking Platforms: Digital booking platforms are growing in India, Brazil, and Kenya. These mobile apps help with LPG refills and delivery. They serve rural and semi-urban users better.

- Strategic Partnerships: LPG suppliers are forming joint ventures with local firms. This helps grow market reach. It also supports infrastructure in emerging economies.

Current and Potential Growth Implications

Demand-Supply Analysis

There is a demand-supply imbalance in some regions. Demand is growing in Asia and Africa while supply is concentrated in the Middle East, US and Russia. This geographical mismatch requires international trade and long term contracts to ensure supply chain stability.

Gap Analysis

LPG adoption is growing but there are still gaps. In some regions, especially Sub-Saharan Africa and parts of Southeast Asia, affordability, limited infrastructure and weak distribution networks are hindering market penetration. Closing these gaps will require more investment in logistics, better financial support mechanisms and awareness campaigns.

Top Companies in the Liquefied Petroleum Gas Market

Some of the leading companies operating in the global LPG market include:

- Royal Dutch Shell plc

- BP plc

- Chevron Corporation

- TotalEnergies SE

- China Petroleum & Chemical Corporation (Sinopec)

- Reliance Industries Limited

- Saudi Aramco

- SHV Energy N.V.

- Petronas

- UGI Corporation

These companies are playing a central role in shaping the global LPG landscape through innovation, infrastructure development, and strategic market expansion.

Liquefied Petroleum Gas Market: Report Snapshot

Segmentation | Details |

By Source | Refinery, Associated Gas, Non-Associated Gas |

By Application | Residential, Commercial, Industrial, Transportation, Others |

By Distribution | Cylinder, Bulk, Autogas |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Residential Sector: Policy support and urban growth drive LPG use in homes. The residential sector is growing fast. This is most seen in developing countries.

- Transportation Sector: Autogas is gaining traction as a clean and economical fuel for vehicles. LPG use is high in Europe and parts of Asia. Strong government backing and good infrastructure help. These regions lead in adoption.

- Petrochemical Feedstock: LPG is key in making olefins and other chemicals. The petrochemical sector is growing fast. This will keep demand for LPG steady.

Major Innovations

- Composite LPG Cylinders: Modern LPG cylinders are light and rust-free. They give better safety. Both developed and developing markets are adopting them fast.

- BioLPG Development: Firms are making bioLPG from renewable sources. They use vegetable oils and animal fats. This supports global decarbonization goals.

- Smart Monitoring Systems: IoT meters and smart cylinders are in use. They track gas use and spot leaks. This boosts both safety and efficiency.

Potential Growth Opportunities

- Expansion into Underserved Regions: Africa and rural Asia have big LPG growth potential. Custom delivery models are in use. Community programs help improve access and reach.

- Integration with Renewable Energy: LPG supports solar and wind as backup power. It works well when renewables are down. Hybrid setups are now popular in off-grid regions.

Extrapolate says:

The Liquefied Petroleum Gas Market will continue to grow in the coming years driven by increasing residential consumption, industrial and transportation demand and government support. Technological innovation, autogas infrastructure expansion and cleaner fuel policies will add to the growth momentum.

As the world is going through an energy transition, LPG is proving to be a robust and flexible solution. With continued investments and regulatory backing it will be a transitional and long term energy option across various applications and geographies.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Liquefied Petroleum Gas Market Size

- August-2025

- 148

- Global

- energy-and-power

Related Research

Organic Rankine Cycle Market Size, Share, Growth & Industry Analysis, By Application (Solar Thermal

February-2023

Air Electrode Battery Market Size, Share, Growth & Industry Analysis, By Product (Zinc-Air Batteries

September-2024

Battery Recycling Market Size, Share, Growth & Industry Analysis, By Battery Chemistry (Lead-Acid, L

August-2025

Biodiesel Market By Feedstock (Soybean, Rapeseed, Palm, Palm, Poultry, Tallow, White Grease, and Oth

January-2023

Biomass Boiler Market Size, Share, Growth & Industry Analysis, By Product Type (Fully Automated Boil

August-2025

Biomass Power Generation Market Size, Share, Growth & Industry Analysis, By Feedstock (Woody Biomass

August-2025

Biomethane Market by Application (Automotive, Power Generation, and Others), Production Method (Ferm

February-2023

Cable Entry Systems and Components Market Size, Share, Growth & Industry Analysis, By Product Type (

February-2025

Carbon Capture and Storage Market Size, Share, and COVID-19 Impact Analysis, By Capture Source (Chem

August-2025

Diesel Market Size, Share, Growth & Industry Analysis, By Application (Transportation (On-road, Off-

April-2025