Global Green Hydrogen Market Size, Share, Growth & Industry Analysis, By Production Method (Alkaline Electrolysis, Proton Exchange Membrane Electrolysis, Solid Oxide Electrolysis), By Application (Transportation, Industrial Processes, Power Generation, Energy Storage), By End-User (Industrial, Commercial, Residential), and Regional Analysis, 2024-2031

Green Hydrogen Market: Global Share and Growth Trajectory

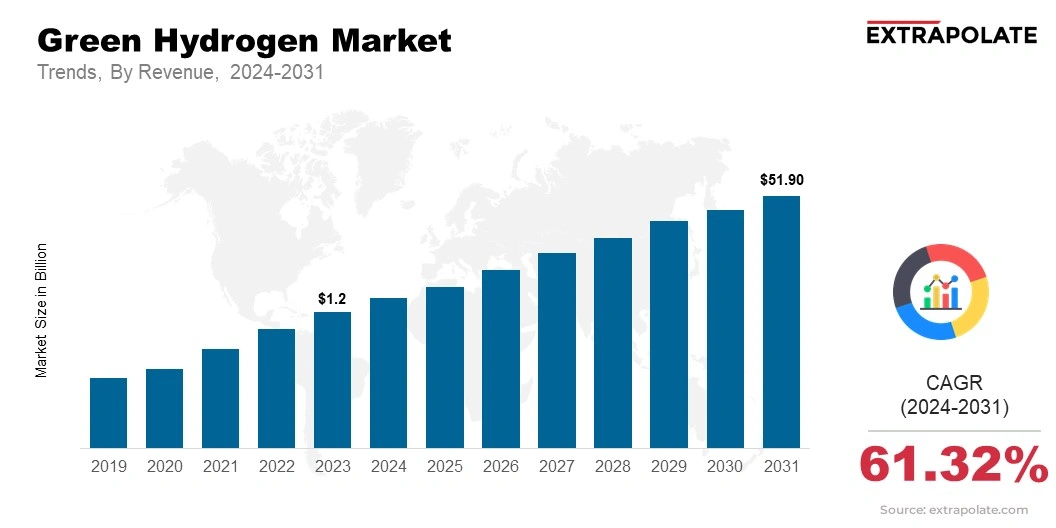

Global Green Hydrogen Market size was recorded at USD 1.12 billion in 2023, which is estimated to be valued at USD 1.83 billion in 2024 and reach USD 51.90 billion by 2031, growing at a CAGR of 61.32 % during the forecast period.

The green hydrogen market is observing rapid growth driven by increasing demand for clean energy solutions, progress in electrolysis technology, and favorable government policies. This market consists hydrogen which is produced using renewable energy sources such as wind, solar, and hydropower. As green hydrogen becomes a key component of the global energy transition, its uses across areas like transportation, power generation, and industrial processes gaining prominence.

Key Market Trends Driving Adoption

The green hydrogen market is portrayed by innovation, expanding applications, and regulatory support. Key trends that drive market growth are:

- Decarbonization of Industries: Green hydrogen is used to replace fossil fuels in energy-intensive industries such as steelmaking, chemicals, and refineries to an increasing extent.

- Advances in Electrolysis Technology: Innovations in electrolyzer efficiency and versatility are pulling down production costs, which, in turn, makes green hydrogen accessible.

- Integration with Renewable Energy: Surplus renewable energy is being used for hydrogen production, boosting grid stability and storage capacity.

- Expansion of Hydrogen Mobility: Hydrogen fuel cells are gaining support in transportation for passenger cars, buses, trains, and aviation applications.

- Supportive Policies and Investments: Governments all over the world are applying strategies to improve green hydrogen production and infrastructure through subsidies, tax incentives, and national hydrogen roadmaps.

Major Players and their Competitive Positioning

The green hydrogen market features major players like Air Liquide, Linde, Siemens Energy, and ITM Power, besides other upcoming companies that are driving innovation. These firms focus on partnerships, technology advancements, and expanding capacity of production to secure their competitive positions.

Consumer and Industry Behavior Analysis

Major factors driving the adoption of green hydrogen are:

- Clean Energy Transition: Governments and businesses are making green hydrogen a priority to meet carbon neutrality targets.

- Energy Security: Countries are investing in green hydrogen to reduce reliance on fossil fuel imports.

- Sustainability Goals: Companies are using green hydrogen in their operations for enhancing sustainability and fulfil basic operational requirements.

- Cost Reductions: As production costs are declining, green hydrogen is becoming available for widespread use.

Pricing Trends

Pricing trends in the green hydrogen market are determined by production methods, energy costs, and government incentives. While recent costs are higher compared to conventional hydrogen, economies of scale and technological advancements are most likely to drive significant deductions in prices over the next decade.

According to industry projections, the global green hydrogen market is expected to grow at an estimated Compound Annual Growth Rate (CAGR) of 61.32% between 2024 and 2031, with the market size forecasted to surpass $51.90 billion by 2031.

Regional Growth Analysis

The green hydrogen market is seeing global expansion, with noticeable growth in Europe, North America, and Asia-Pacific. Europe leads the way with support from government, while Asia-Pacific is coming through as a huge market because of its growing industrial base and renewable energy potential.

Growth Factors

Factors driving the growth of the green hydrogen market are:

- Climate Policies: Increasing significance of net-zero emissions is speeding up green hydrogen adoption.

- Technological Innovations: Improvements in electrolyzer efficiency and renewable integration are powering feasibility.

- Infrastructure Development: Investments in hydrogen pipelines, storage, and refueling stations are helping create a more conducive ecosystem.

- International Collaboration: Countries are forming alliances for promoting cross-border trade and standardizing hydrogen production.

Regulatory Landscape

The regulatory framework for green hydrogen is changing, as different countries are setting up certifications and standards for its production, distribution, and use. Adhering to these regulations is essential for market participants to build trust with consumers and the government.

Recent Developments and Market Highlights

The green hydrogen market is experiencing rapid growth, with key advancements including:

- Large-Scale Production Plants: Developing gigawatt-scale electrolyzers for industrial use.

- Hydrogen Hubs: Building integrated hydrogen hubs to simplify production and distribution processes.

- Cross-Sector Applications: Increasing adoption of hydrogen for power storage, ammonia production, and fuel cell vehicles.

- International Investments: Collaborations and joint ventures aimed at advancing hydrogen infrastructure in various regions.

Current and Potential Growth Implications

Demand-Supply Analysis

The demand for green hydrogen is rapidly increasing as industries pursue decarbonization efforts. However, the supply is limited due to high production costs and insufficient infrastructure. This discrepancy creates more opportunities for innovation and investment.

Gap Analysis

Key areas that require development include:

- Cost Efficiency: Reducing the cost of hydrogen production.

- Infrastructure Expansion: Increasing the number of hydrogen pipelines and refueling stations.

- Storage Solutions: Creating innovative storage systems to guarantee reliability.

- End-User Awareness: Informing industries and consumers about the advantages of green hydrogen.

Top Companies in the Green Hydrogen Market

Prominent players operating in the green hydrogen market are:

- Air Liquide

- Linde

- Siemens Energy

- ITM Power

- Nel ASA

- Plug Power

- Ballard Power Systems

- Toshiba Energy Systems

- Cummins Inc.

- Air Products and Chemicals, Inc.

Green Hydrogen Market: Report Snapshot

Segmentation | Details |

By Production Method | Alkaline Electrolysis, Proton Exchange Membrane Electrolysis, Solid Oxide Electrolysis |

By Application | Transportation, Industrial Processes, Power Generation, Energy Storage |

By End-User | Industrial, Commercial, Residential |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

Green Hydrogen Market: High Growth Segments

- Alkaline Electrolysis: Well-established technology providing cost-effective production.

- Transportation: Growing use in fuel cell vehicles.

- Industrial Processes: Increasing adoption in the steel, cement, and ammonia sectors.

Major Innovations

Innovation is propelling the green hydrogen market with advancements such as:

- Modular Electrolyzers: Flexible solutions for varied energy needs.

- Hybrid Systems: Integrating solar and wind energy to ensure steady hydrogen production.

- Digitalization: Advanced monitoring systems to oversee efficient operations.

Green Hydrogen Market: Potential Growth Opportunities

Even with its promising growth prospects, businesses in the green hydrogen sector encounter several challenges, including:

- High Initial Costs: The investment required for production and infrastructure is still quite substantial.

- Supply Chain Limitations: Securing a steady supply of raw materials and components can be difficult.

- Regulatory Barriers: Dealing with policies and certification processes is a significant hurdle.

- Consumer Adoption: Overcoming hesitancy in adopting new energy solutions.

Extrapolate Research Says:

The global green hydrogen market is set for significant growth, fueled by climate objectives, technological advancements, and a expanding range of applications across various industries. Businesses that tackle these challenges and seize new opportunities will be in a strong position to lead this evolving market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Global Green Hydrogen Market Size

- January-2025

- 140

- Global

- energy-and-power

Related Research

Organic Rankine Cycle Market Size, Share, Growth & Industry Analysis, By Application (Solar Thermal

February-2023

Air Electrode Battery Market Size, Share, Growth & Industry Analysis, By Product (Zinc-Air Batteries

September-2024

Battery Recycling Market Size, Share, Growth & Industry Analysis, By Battery Chemistry (Lead-Acid, L

August-2025

Biodiesel Market By Feedstock (Soybean, Rapeseed, Palm, Palm, Poultry, Tallow, White Grease, and Oth

January-2023

Biomass Boiler Market Size, Share, Growth & Industry Analysis, By Product Type (Fully Automated Boil

August-2025

Biomass Power Generation Market Size, Share, Growth & Industry Analysis, By Feedstock (Woody Biomass

August-2025

Biomethane Market by Application (Automotive, Power Generation, and Others), Production Method (Ferm

February-2023

Cable Entry Systems and Components Market Size, Share, Growth & Industry Analysis, By Product Type (

February-2025

Carbon Capture and Storage Market Size, Share, and COVID-19 Impact Analysis, By Capture Source (Chem

August-2025

Diesel Market Size, Share, Growth & Industry Analysis, By Application (Transportation (On-road, Off-

April-2025