Gas Pipeline Infrastructure Market Size, Share, Growth & Industry Analysis, By Application (Transmission, Distribution, Storage), By Type (Onshore Pipelines, Offshore Pipelines), and Regional Analysis, 2024-2031

Gas Pipeline Infrastructure Market: Global Share and Growth Trajectory

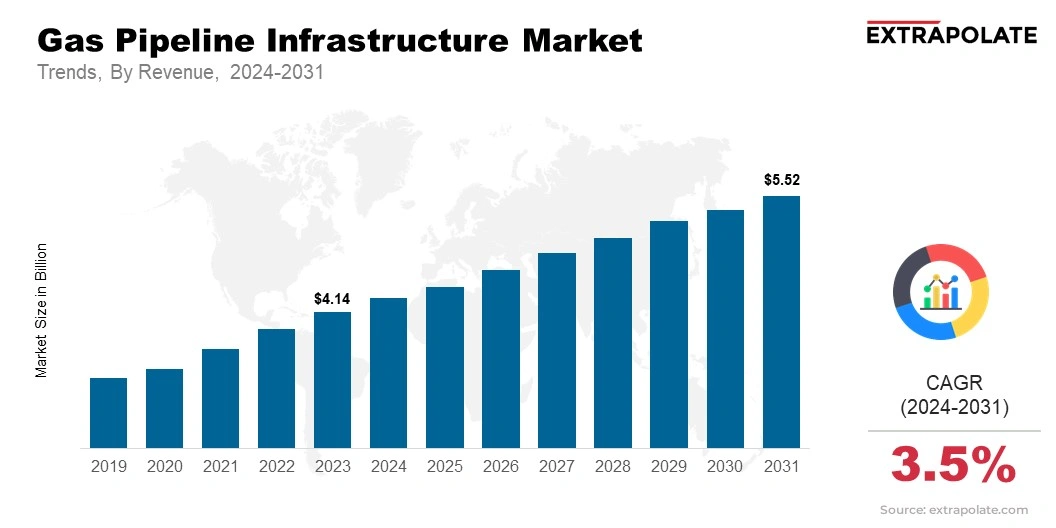

The global Gas Pipeline Infrastructure Market size was valued at USD 4.14 billion in 2023 and is projected to grow from USD 4.32 billion in 2024 to USD 5.52 billion by 2031, exhibiting a CAGR of 3.5% during the forecast period.

The global market is witnessing significant growth, driven by the increasing demand for natural gas, the expansion of energy networks, and the ongoing shift toward cleaner energy sources.

Gas pipeline infrastructure plays a critical role in the transmission and distribution of natural gas, connecting production fields with end-users in residential, industrial, and commercial sectors.

As countries around the world continue to prioritize energy security and reduce reliance on coal and oil, the demand for natural gas infrastructure is poised for substantial growth, contributing to the expansion of the global market.

Technological advancements in pipeline construction, materials, and monitoring systems are significantly enhancing the efficiency, safety, and capacity of gas pipelines.

Innovations in smart pipeline technologies, such as real-time monitoring and predictive maintenance, are improving operational reliability while reducing risks associated with leaks and pipeline failures.

Additionally, the shift toward LNG (Liquefied Natural Gas) infrastructure, as well as the development of cross-border pipelines, is opening up new growth opportunities, particularly in emerging economies seeking to diversify their energy sources.

The market is also benefiting from the increasing investments in pipeline expansion projects, especially in regions such as North America, Europe, and Asia-Pacific. In North America, for example, the shale gas revolution has led to a surge in natural gas production, resulting in increased infrastructure development to transport gas efficiently.

Similarly, growing demand for natural gas in countries like China and India is driving the need for extensive pipeline networks to ensure reliable energy supply.

As governments implement stricter environmental regulations and encourage the adoption of low-emission energy sources, the market is evolving to meet these demands with sustainable and efficient solutions.

With the ongoing development of renewable energy projects and the integration of natural gas into the energy mix, the market for gas pipeline infrastructure is expected to experience sustained growth. The market’s trajectory will be shaped by advancements in technology, regional energy demands, and the need for energy security across the globe.

Key Market Trends Driving Product Adoption

Several key trends are driving the demand for gas pipeline infrastructure:

- Rising Demand for Natural Gas: As the world seeks cleaner energy alternatives to coal and oil, natural gas is becoming a preferred choice for power generation and industrial applications, which is driving the demand for gas pipeline infrastructure.

- Expansion of Energy Networks: The expansion of natural gas networks in both developed and emerging economies, especially in Asia Pacific and the Middle East, is creating a significant need for the construction and upgrade of gas pipeline systems.

- Technological Advancements in Pipeline Construction: Advances in pipeline construction technology, such as advanced welding techniques, smart pipeline monitoring systems, and improved materials, are making gas pipelines more efficient, durable, and cost-effective.

- Focus on Energy Security and Supply Diversification: Countries are diversifying their energy sources and ensuring energy security by building new pipeline networks that connect domestic gas supplies to international markets.

Major Players and their Competitive Positioning

The gas pipeline infrastructure market is highly competitive, with a number of key players controlling significant market shares. Companies like Enbridge Inc., Kinder Morgan, TransCanada Corporation, and Gazprom are at the forefront, with large-scale infrastructure projects spanning across continents. These companies lead the market through strategic investments in pipeline construction, network expansion, and technological innovation. Additionally, many regional players are investing in expanding their pipeline systems to meet growing domestic and international energy demands.

Consumer Behavior Analysis

The adoption of gas pipeline infrastructure is driven by various factors:

- Cost-Effectiveness: Natural gas pipelines transport large volumes of gas over long distances. They are cheaper than methods like LNG and CNG.

- Reliability and Safety: Gas pipelines are safe and reliable for transporting natural gas. Advanced monitoring systems help detect leaks and hazards.

- Environmental Benefits: Natural gas is cleaner than coal and oil. It produces fewer greenhouse gases, boosting the use of gas pipelines.

Pricing Trends

Pricing in the gas pipeline market depends on many factors. These include material costs, construction, regulatory compliance, and new technologies. Gas pipeline projects need a lot of money. Costs can change based on location, environment, and infrastructure complexity. Regulations and government policies affect the market. They can encourage or limit pipeline development.

Growth Factors

Several factors are contributing to the growth of the gas pipeline infrastructure market:

- Energy Transition: Countries want to reduce their carbon footprint. The shift to natural gas as a cleaner option is driving the growth of gas pipeline infrastructure.

- Regional and Global Energy Connectivity: The desire for better energy connectivity is growing. This is prompting the development of cross-border pipelines and large domestic gas systems.

- Government Initiatives: Governments are investing in energy infrastructure. This includes gas pipelines to meet growing energy needs, especially in developing regions.

Regulatory Landscape

The gas pipeline market has many rules. Governments set strict laws for building pipelines, safety, the environment, and pricing. Companies must follow these rules. It is crucial for building and running gas pipeline networks. Pipeline projects need government approval. This includes environmental checks, public talks, and safety rules.

Recent Developments

The gas pipeline infrastructure market has witnessed several important developments in recent years, including:

- Expansion of Cross-Border Pipelines: New cross-border pipelines like Nord Stream and TurkStream are being built. They connect major gas producers and consumers, improving energy security.

- Technological Innovations: Advanced materials like high-strength steel are being used. Smart monitoring systems are improving pipeline safety and operation.

- Government Support: Many countries are offering financial incentives. They are also creating rules to support gas pipeline growth.

Current and Potential Growth Implications

Demand-Supply Analysis:

The need for gas pipelines will stay strong. This is due to higher demand for natural gas and energy security efforts. Regulatory approvals, environmental issues, and financing can slow down projects. These factors may delay timelines.

Gap Analysis:

- Infrastructure Gaps: Some regions still lack pipeline infrastructure. Africa and Southeast Asia need gas systems to support growth.

- Technological Barriers: Solving tech challenges in pipeline safety is key. Leak prevention and monitoring will drive market growth.

Top Companies in the Gas Pipeline Infrastructure Market

- Enbridge Inc.

- Kinder Morgan

- TransCanada Corporation

- Gazprom

- Royal Dutch Shell

- Sempra Energy

- Williams Companies

- E.ON SE

Gas Pipeline Infrastructure Market: Report Snapshot

Segmentation | Details |

By Application | Transmission, Distribution, Storage |

By Type | Onshore Pipelines, Offshore Pipelines |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High-Growth Segments

Certain segments within the market are expected to experience high growth, including:

- Offshore Pipelines: New offshore oil and gas fields are being developed. Offshore pipelines are more important for moving gas to land-based facilities.

- Smart Pipelines: Combining refined surveillance and regulation frameworks within conduits allows for effectiveness, security next to spillage identification - these actions produce prospects for expansion in the sector.

Major Innovations

The market is witnessing several innovations:

- Pipeline Integrity Management Systems: New technologies are improving pipeline monitoring. They enhance safety and reduce operational risks in transportation.

- Hydrogen Integration: Hydrogen is gaining interest as a clean energy alternative. Some pipeline companies are exploring repurposing gas pipelines for hydrogen transport.

Potential Growth Opportunities

The market presents several growth opportunities, including:

- Emerging Markets: Energy demand is rising in developing countries. This creates opportunities for expanding gas pipeline infrastructure.

- Technological Advancements: Innovations in pipeline technology open new opportunities. Automated monitoring improves efficiency. Advanced materials enhance safety.

Kings Research Says:

The gas pipeline infrastructure market anticipates considerable expansion as natural gas demand grows, power networks broaden and administrations introduce programs. Firms that take up modern tech plus change to current rules gain a solid position. For example they benefit from the rising requirement for effective and safe natural gas movement systems.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Gas Pipeline Infrastructure Market Size

- April-2025

- 148

- Global

- energy-and-power

Related Research

Organic Rankine Cycle Market Size, Share, Growth & Industry Analysis, By Application (Solar Thermal

February-2023

Air Electrode Battery Market Size, Share, Growth & Industry Analysis, By Product (Zinc-Air Batteries

September-2024

Battery Recycling Market Size, Share, Growth & Industry Analysis, By Battery Chemistry (Lead-Acid, L

August-2025

Biodiesel Market By Feedstock (Soybean, Rapeseed, Palm, Palm, Poultry, Tallow, White Grease, and Oth

January-2023

Biomass Boiler Market Size, Share, Growth & Industry Analysis, By Product Type (Fully Automated Boil

August-2025

Biomass Power Generation Market Size, Share, Growth & Industry Analysis, By Feedstock (Woody Biomass

August-2025

Biomethane Market by Application (Automotive, Power Generation, and Others), Production Method (Ferm

February-2023

Cable Entry Systems and Components Market Size, Share, Growth & Industry Analysis, By Product Type (

February-2025

Carbon Capture and Storage Market Size, Share, and COVID-19 Impact Analysis, By Capture Source (Chem

August-2025

Diesel Market Size, Share, Growth & Industry Analysis, By Application (Transportation (On-road, Off-

April-2025