Refrigerant Market Size, Share, Growth & Industry Analysis, By Type (Hydrofluorocarbons (HFCs), Hydrofluoroolefins (HFOs), Natural Refrigerants (CO2, Ammonia, Propane), Others), By Application (Residential, Commercial, Industrial, Automotive, Others), By End-User Industry (HVACR, Food & Beverage, Pharmaceutical, Automotive, Others), and Regional Analysis, 2024-2031

Refrigerant Market: Global Share and Growth Trajectory

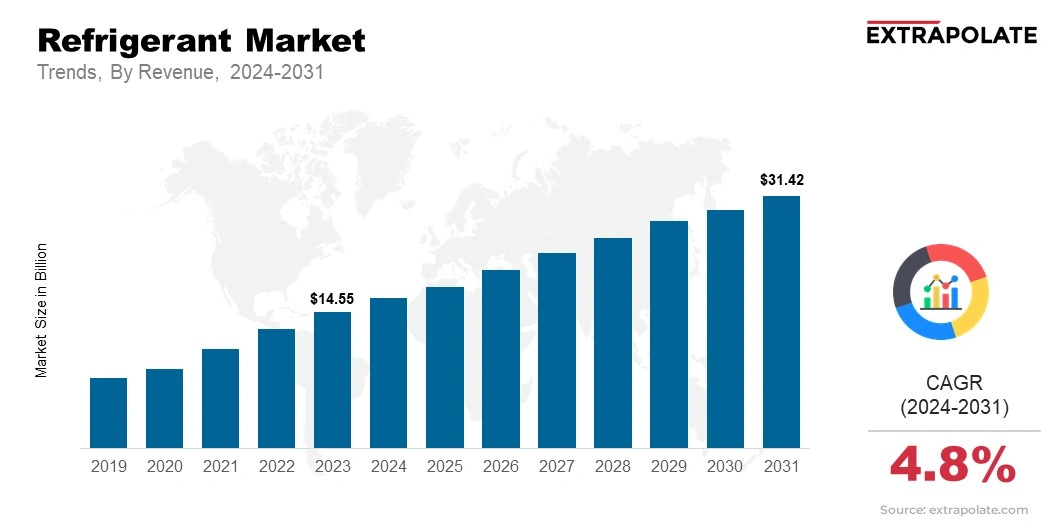

The global Refrigerant Market size was valued at USD 14.55 billion in 2023 and is projected to grow from USD 15.38 billion in 2024 to USD 21.42 billion by 2031, exhibiting a CAGR of 4.8% during the forecast period.

The global market is poised for substantial growth, driven by the increasing demand for refrigeration and air conditioning systems across various industries. Refrigerants play a crucial role in heat transfer processes within cooling systems, making them integral to numerous applications in sectors such as automotive, industrial, commercial, and residential cooling.

With growing concerns over environmental sustainability and global warming, the market is witnessing a shift towards more eco-friendly refrigerants.

Additionally, the phase-out of high-GWP (Global Warming Potential) refrigerants is propelling the demand for alternative solutions that offer lower environmental impact. The market is anticipated to grow significantly as technological advancements and stricter regulations continue to shape the demand for refrigerants.

Key Market Trends Driving Product Adoption

Several trends are influencing the growth of the refrigerant market, including:

- Shift to Low-GWP Refrigerants: With global efforts to reduce greenhouse gas emissions, there is a growing demand for refrigerants with lower GWP values. The phase-out of traditional refrigerants like R-22 and R-134a in favor of environmentally safer alternatives such as R-32, HFOs, and natural refrigerants is a key trend driving product adoption.

- Rising Demand for Air Conditioning Systems: The increasing need for air conditioning in residential, commercial, and industrial applications is driving the demand for refrigerants. As temperatures rise globally, there is a surge in the installation of cooling systems, which fuels refrigerant consumption.

- Technological Advancements in Refrigeration Systems: Continuous innovation in refrigeration technologies, including more efficient compressors and energy-saving solutions, is contributing to the adoption of new refrigerants that enhance system performance while reducing energy consumption.

- Regulatory Push for Sustainable Solutions: Governments and environmental organizations are tightening regulations surrounding the use of refrigerants, particularly focusing on reducing the use of substances that contribute to ozone depletion and global warming. This regulatory pressure is accelerating the transition toward more sustainable refrigerants.

Major Players and their Competitive Positioning

Above all, the refrigerant industry is highly competitive, and the leading manufacturers are engaged in product innovations, environmental in line with the requirements, and market expanded with a global outlook. Principal market sources include Honeywell International, Chemours, Daikin Industries, Arkema, and Linde Group, and more.

At the cutting edge of these companies, these companies are exploring new refrigerants, such as hydrofluoroolefins (HFOs) and natural refrigerants (CO2 and ammonia), in an effort to deliver ever greater demand "green" solutions in a burgeoning market. Strategic alliances, mergers, and acquisitions are not uncommon in the market through the companies to increase their product portfolio as a result of being a more "hard" market players and thus increasing their market share.

Consumer Behavior Analysis

The demand for refrigerants is primarily driven by the following consumer behavior trends:

- Environmentally Conscious Consumers: With growing awareness of environmental issues, consumers are increasingly demanding cooling systems that use environmentally friendly refrigerants. The shift toward natural refrigerants and low-GWP alternatives is driven by consumer preferences for eco-conscious products.

- Energy Efficiency: Consumers are increasingly looking for refrigeration and air conditioning solutions that not only offer efficient cooling but also reduce energy consumption. The use of modern refrigerants that improve the energy efficiency of systems is a key driver of market growth.

- Regulatory Compliance: As governments and regulatory bodies enforce stricter rules on the use of refrigerants, consumers are increasingly choosing systems and refrigerants that comply with these regulations. This trend is particularly evident in commercial and industrial sectors where regulatory compliance is critical.

Pricing Trends

Events like raw material costs, environmental pressures, and technological developments affect the pricing of refrigerants. The cost of low GWP (Global warming potential) refrigerants, such as HFOs and natural refrigerants is often higher because they are costly to produce and scarce.

However, those refrigerants are likely to lose its price due to increasing demand and expanding production in the future. At the same time, other areas are placing regulatory-driven incentives and subsidies to assuage the cost burden of eco-friendly refrigerants towards consumers.

Unlike GWP refrigerants that are gradually phased out and replaced with greener alternatives, traditional refrigerants with higher GWP values are getting more and more expensive.

Market projections suggest that the refrigerant market will grow at a compound annual growth rate (CAGR) of approximately 7.5% from 2023 to 2031, driven by the growing adoption of energy-efficient and environmentally friendly refrigerants, as well as increasing demand for cooling systems worldwide.

Growth Factors

The refrigerant market is influenced by a number of key drivers:

- Progressive Adoption of Air Conditioning Systems: As global temperatures rise and urbanization increases, the demand for air conditioning systems in residential, commercial, and industrial sectors is fueling the demand for refrigerants.

- Rigorous Environmental Standards : The global transition to low-GWP refrigerants and the phase-out of ozone-depleting substances are major factors driving the growth of the market. Government regulations that mandate the use of environmentally friendly refrigerants are boosting market demand.

- Technological Developments: Innovations in refrigeration and air conditioning technologies, including more energy-efficient systems and next-generation refrigerants, are driving market growth by improving the performance and efficiency of cooling solutions.

Regulatory Landscape

In a very large part, the refrigerant market is impacted by regulatory regimes aimed at lowering the environmental footprint of refrigerating systems. Two key regulations to focus on, are the Montreal Protocol and Kigali Amendment. The European Union and the United States have also introduced strict laws to limit the use of harmful refrigerant chemicals and encourage low-GWP alternatives. Such regulations could lead to the rising demand for sustainable refrigerants which will assist in the market growth.

Recent Developments

Important trends shaping the market include:

- Rise in Demand for Eco-Friendly regrigerants: The market is seeing big growth in using eco-friendly refrigerants, like HFOs, CO2, and ammonia, because they have less environmental impact. Companies are focusing more on making these refrigerants to meet tough rules.

- Growth of The Natural Refrigerants Market: Natural refrigerants like CO2, ammonia, and hydrocarbons are getting popular because they are good for the environment and efficient. These are especially liked in commercial refrigeration and industrial uses.

- Technological Innovations: Advances in refrigeration tech, like better systems, are driving the need for advanced refrigerants that perform better while cutting energy use and environmental harm.

Current and Potential Growth Implications

Demand-Supply Analysis

The refrigerant market is composed for a heavy demand, driven by the increasing need for refrigeration and air conditioning in a range of fields. However, the availability of environmentally friendly refrigerants could encounter restrictions. These restrictions are derived from constraints in production and the need for newly developed infrastructure. The new infrastructure is a necessity for the extensive use of eco-friendly options. Hence, the constant development production facilities and supply chains for low-GWP refrigerants is essential for satisfying forthcoming trends in the market.

Gap Analysis

Even with the market's rapid expansion, a few obstacles still exist:

- Inflated Production Costs for Low-GWP Refrigerants: Higher production costs tied to low-GWP refrigerants can affect their growth. This is true especially in markets focused on cost.

- Regulatory Compliance Challenges: Companies in refrigeration and air conditioning face stricter rules. These rules are slowly being put in place. To make sure they comply, these companies are making big advancements. This includes new tech and using more ecofriendly refrigerants.

Top Companies in the Refrigerant Market

- Honeywell International

- Chemours

- Daikin Industries

- Arkema

- Linde Group

- Airgas

- Mexichem Fluor

- Refrigerant Recovery Solutions

- Sinochem International

- China National Petroleum Corporation (CNPC)

Refrigerant Market: Report Snapshot

Segmentation | Details |

By Type | Hydrofluorocarbons (HFCs), Hydrofluoroolefins (HFOs), Natural Refrigerants (CO2, Ammonia, Propane), Others |

By Application | Residential, Commercial, Industrial, Automotive, Others |

By End-User Industry | HVACR, Food & Beverage, Pharmaceutical, Automotive, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The segments listed below are anticipated to achieve considerable growth:

- HFOs: Hydrofluoroolefins (HFOs) are getting more demand in the refrigerant market. They are low-GWP and give ecological benefits compared to old HFCs.

- Natural Refrigerants: Natural refrigerants like CO2, ammonia, and hydrocarbons are getting more popular. They have a smaller environmental footprint and work well in refrigeration systems.

Major Innovations

Innovations in the market emphasize on the advancements made in eco-friendly solutions, like:

- Low-GWP Substitutes: Current research and innovations are centered on low-GWO refrigerants. This is the leading factor in innovation within the market. Companies are prioritizing refrigerants that help in reducing environmental impact and consistently deliver top results.

- Systems with High-Efficiency: Refrigeration and air conditioning technologies are consistently progressing with enhancements in innovations. These innovations are substantially expanding energy efficiency of cooling systems. As a result, there is a considerable reduction in the consumption of energy and the overall effect that these systems have.

Potential Growth Opportunities

The refrigerant market can unlock new avenues for market players in the following areas:

- Sustainable Refrigerants: There is a sudden growth in the uptake of low-GWP (Global Warming Potential) refrigerants. This trend is generating major opportunities for companies that specialize in the development of sustainable refrigerants. Companies that supply sustainable alternatives have profited from the same.

- Growth in Developing Economies: Developing economies are undergoing an escalation demand for cooling systems. Simultaneously, there is an increasing pressure to minimize emissions in these regions. These factors altogether present a major potential for growth for refrigerant suppliers that are operating in developing economies.

Extrapolate Research says:

The refrigerant market is projected to grow substantially. This growth is essentially due to the rise in demand for cooling systems. A global shift toward eco-friendly refrigerants is further propelling this growth. Companies that are focusing on innovations in the development of refrigerators, and easily accommodate with the progressing standards will stay ahead of the curve. Making way into emerging markets will also companies to gain the ideal placement and reap benefits from the growth of the refrigerant market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Refrigerant Market Size

- March-2025

- 148

- Global

- chemicals-and-advanced-materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021